S&P 500 (ES)

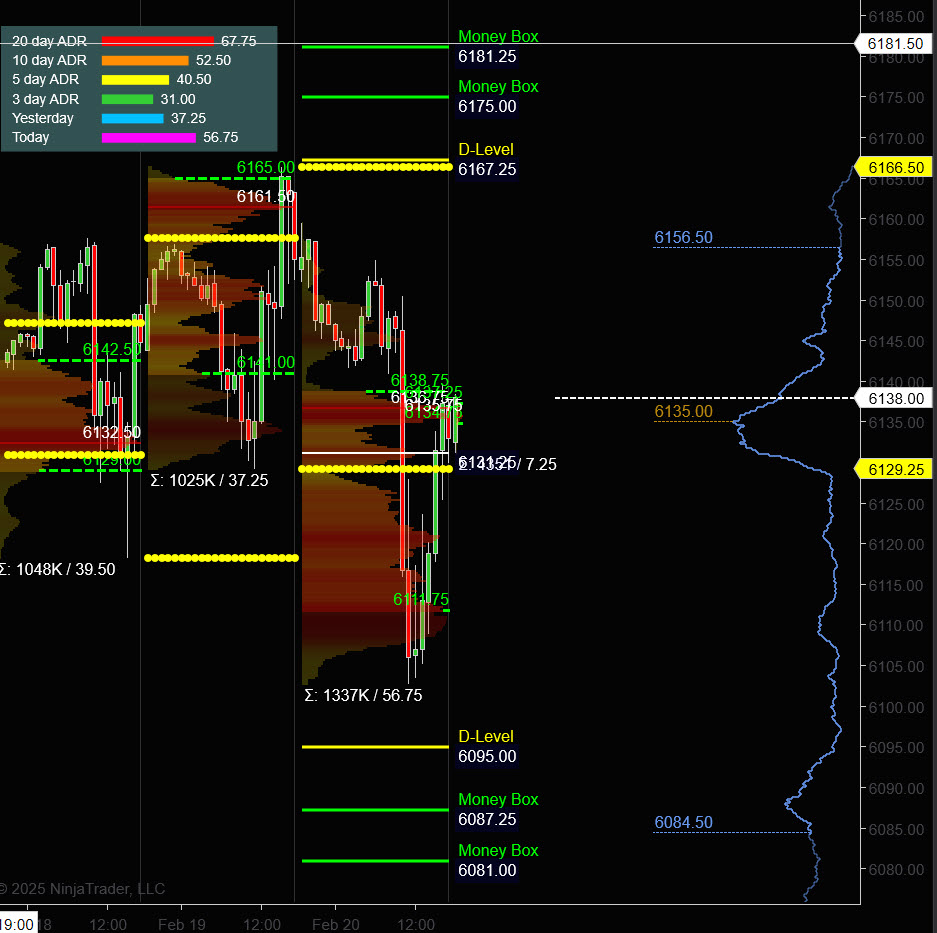

Prior Session was Cycle Day 1: Textbook Cycle Day 1 as value declined to the projected 6103 decrease goal as which period discovered responsive consumers. Following a pullback retest, securing the low, this cycle’s rally started, rebounding to shut at 6133. Vary for this session was 56 handles on 1.337M contracts exchanged.

FREE TRIAL hyperlink to PTG/Taylor Three Day Cycle

For a extra detailed recap of the buying and selling session, click on on this hyperlink: Buying and selling Room RECAP 2.18.25

…Transition from Cycle Day 1 to Cycle Day 2

…Transition from Cycle Day 1 to Cycle Day 2

Transition into Cycle Day 2: A part of this cycle’s rally is in-place, so we ought to be searching for some two-way consolidation to soak up the prior session’s “dip n rip.”

Given the character of latest rangebound exercise, we shouldn’t be shocked if value dips once more for an additional check, or proceed to rally to subsequent targets. Backside line is to stay versatile as Friday is “Gravy Day!”

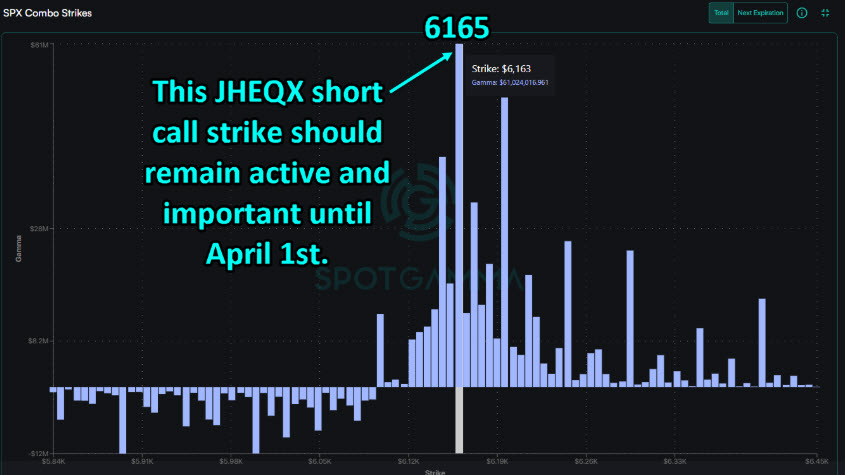

***Choices Expiration Be aware: In response to the “Gamma Guys” (spotgamma.com) 6165 SPX (6140 ES) is a distinguished strike for as we speak’s expiry. Quote: “6165 stays an important [positive gamma] strike. This isn’t robotically as a result of it’s the JHEQX (JPM Collar) quick name, however as a result of our instruments are measuring this fund’s name strike to be extremely impactful proper now. It additionally stands on the gateway of a snap melt-up to 6200, as the worth can simply and swiftly slice proper by way of that [red] damaging gamma.”

Moreover from the Gamma Guys: “to emphasise the sudden consideration on 6165, it’s dominating each the stay and static fashions, with the SPX-Combo mannequin discovering 6163 because the heaviest common gamma strike between them. The implication that this has for our buying and selling over the following 5 weeks is that it ought to produce a handful of repeatable pinning setups.”

After all, nothing adjustments for PTG…Merely comply with your plan. Take solely Triple A setups and handle the $danger. ALWAYS HAVE HARD STOP-LOSSES in-place on the change.

PTG’s Major Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, eventualities to think about for as we speak’s buying and selling.

Bull State of affairs: Value sustains a bid above 6135+-, initially targets 6150 – 6155 zone.

Bear State of affairs: Value sustains a suggestion under 6135+-, initially targets 6115 – 6110 zone.

PVA Excessive Edge = 6138 PVA Low Edge = 6112 Prior POC = 6137

ES (Profile)

Nasdaq (NQ)

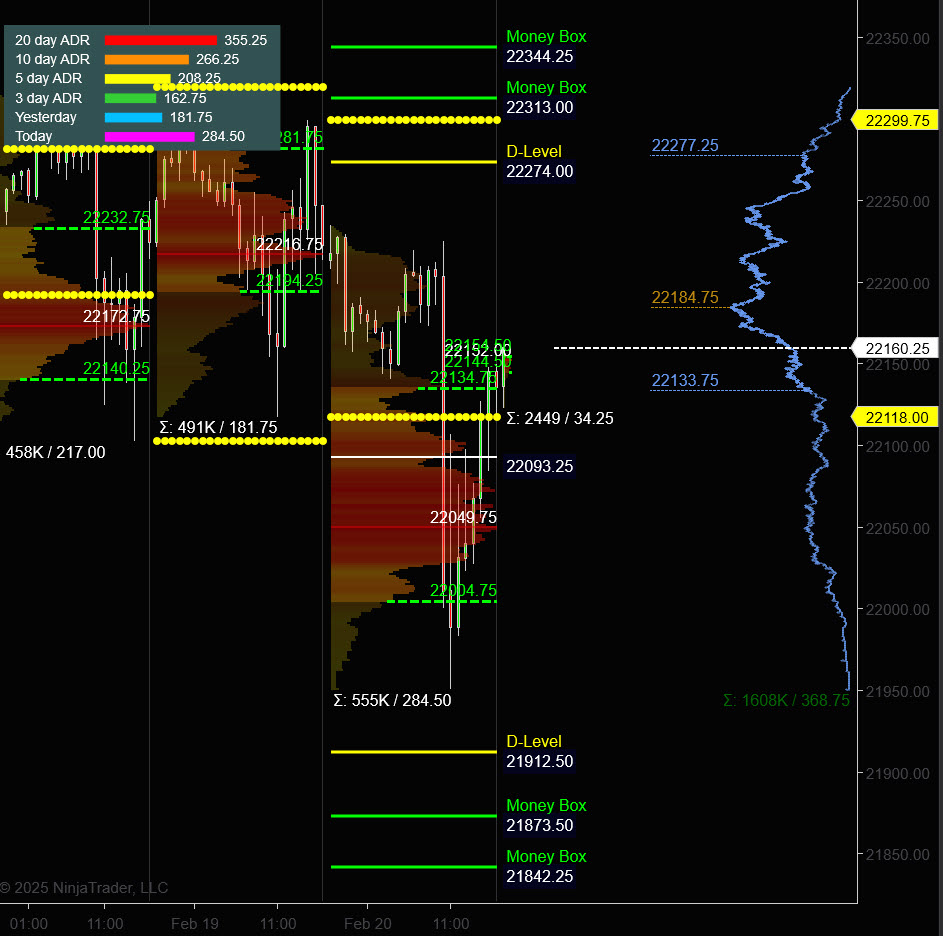

Prior Session was Cycle Day 1: Textbook Cycle Day 1 as value declined to the projected 21993 decrease goal as which period discovered responsive consumers. Following a pullback retest, securing the low, this cycle’s rally started, rebounding to shut at 22135.75. Vary for this session was 284 handles on 555k contracts exchanged.

…Transition from Cycle Day 1 to Cycle Day 2

Transition into Cycle Day 2: A part of this cycle’s rally is in-place, so we ought to be searching for some two-way consolidation to soak up the prior session’s “dip n rip.” Backside line is to stay versatile as Friday is “Gravy Day!”

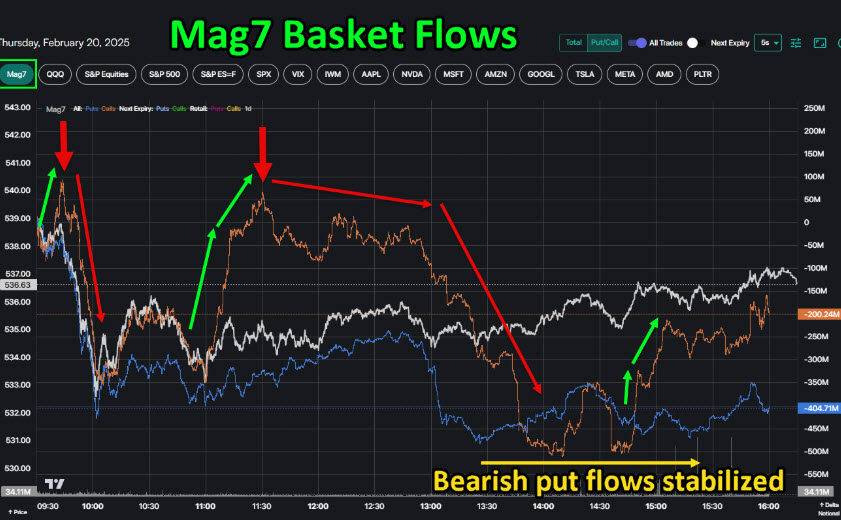

Right here is a few MAG7 Basket Flows from the “Gamma Guys” (spotgamma.com)

“There was a uncommon and heavy disparity between index and basket flows as we speak, however though with totally different shapes they have been each guiding costs towards the middle of the vary The opening sign was extraordinarily clear with basket flows, as calls peaked after which shortly dropped virtually vertically. The taller and pointier these indicators are, the stronger they’re at inferring immanent pivots.”

“As this occurred, shorts knew to attend for a cloth change in sample (or momentum) earlier than protecting. Calls tried to bounce once more, however HIRO shortly dismissed this as one other low-conviction surge, as calls rolled over into heavy exhaustion, which was stopping costs from climbing meaningfully. Put flows additionally stabilized early, which set the stage for an additional end-of-day ramp, which has been a frequent occasion currently.”

After all, nothing adjustments for PTG…Merely comply with your plan. Take solely Triple A setups and handle the $danger. ALWAYS HAVE HARD STOP-LOSSES in-place on the change.

PTG’s Major Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, eventualities to think about for as we speak’s buying and selling.

Bull State of affairs: Value sustains a bid above 22125+-, initially targets 22195 – 22225 zone.

Bear State of affairs: Value sustains a suggestion under 22125+-, initially targets 22050 – 22011 zone.

PVA Excessive Edge = 22135 PVA Low Edge = 22002 Prior POC = 22050

NQ (Profile)

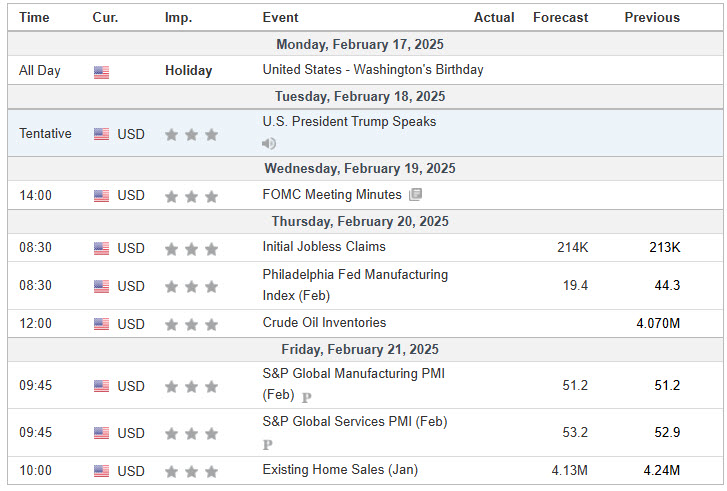

Financial Calendar

Commerce Technique: Our tactical commerce technique will merely stay unaltered…We’ll be versatile to commerce each lengthy and quick facet from Choice Pivot Ranges. Proceed to concentrate on Bull/Bear Stackers and Premium/Reductions. As all the time, remaining in alignment with dominant intra-day power will increase possibilities of manufacturing profitable trades.

Keep Targeted…Non-Biased…Disciplined ALWAYS USE STOPS!

Good Buying and selling…David

“Understanding isn’t sufficient, We should APPLY. Keen isn’t sufficient, We should DO.” –BR

*****This commerce technique report is disseminated for “schooling solely” and shouldn’t be considered in any approach as a suggestion to purchase or promote futures merchandise.”

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

IMPORTANT NOTICE! No illustration is being made that the usage of this technique or any system or buying and selling methodology will generate earnings. Previous efficiency isn’t essentially indicative of future outcomes. There’s substantial danger of loss related to buying and selling securities and choices on equities. Solely danger capital ought to be used to commerce. Buying and selling securities isn’t appropriate for everybody.

Disclaimer: Futures, Choices, and Forex buying and selling all have massive potential rewards, however additionally they have massive potential danger. You could concentrate on the dangers and be prepared to simply accept them as a way to put money into these markets. Don’t commerce with cash you possibly can’t afford to lose.

This web site is neither a solicitation nor a suggestion to Purchase/Promote futures, choices, or currencies. No illustration is being made that any account will or is prone to obtain earnings or losses just like these mentioned on this website. The previous efficiency of any buying and selling system or methodology isn’t essentially indicative of future outcomes.

CFTC RULE 4.41 –HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN