Well being Insurance coverage firms have not too long ago launched yet one more corona particular medical health insurance coverage referred to as as Corona Rakshak Coverage” as per the IRDAI tips.

It is a profit based mostly medical health insurance plan which pays you a lump sum quantity when you find yourself identified of covid-19 and are hospitalized for steady 72 hrs.

Options of Corona Rakshak Coverage

- This coverage might be bought solely on a person foundation.

- Sum Insured choices on this coverage vary between Rs 50,000 to Rs 2,50,000.

- There isn’t a pre-medical screening essential for this coverage.

- This coverage has a ready interval of 15 days.

- Adults aged between 18 yrs. to 65 yrs. can take this coverage.

- Tax profit on premium paid u/s 80D of Earnings Tax Act,1960.

- The coverage can’t be renewed nor it has a free look interval.

- Its a single premium coverage and the tenure have 3 choices of three.5 months (105 days), 6.5 months ( 195 days), and 9.5 months (285 days).

Advantages below this Coverage

If the insured particular person is identified with COVID +ve and is hospitalized of minimal 72 hours then the corona rakshak coverage pays the complete 100% sum assured to the policyholder. Observe that it’s not going to settle your payments, however make a single cost it doesn’t matter what are your bills.

To get the declare, it’s a must to give the analysis report of Covid-19 from a certified govt heart and the proof of hospitalization for at the very least 72 hrs.

The place can I buy this Coverage from?

Whereas IRDAI has directed all firms to launch this plan, in actuality its fairly difficult to seek out out the place to purchase this plan. It was reported on social media from many traders that they don’t seem to be in a position to get the net hyperlinks to purchase. However few additionally shared that they have been in a position to purchase it from the offline brokers.

#IRDAI, please instruct insurance coverage firms to promote Corona Kavach and Corona rakshak insurance policies on-line! At a time when social distancing is the important thing to combating COVID19, there is no such thing as a clear manner to purchase these insurance policies on-line!

— RAHUL (@trueIndiafan) July 16, 2020

So proper now it’s a bit difficult to purchase this plan.

Ideally following insurance coverage firms ought to provide you with their on-line hyperlinks for this coverage, as quickly as potential.

[su_table responsive=”yes”]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[/su_table]

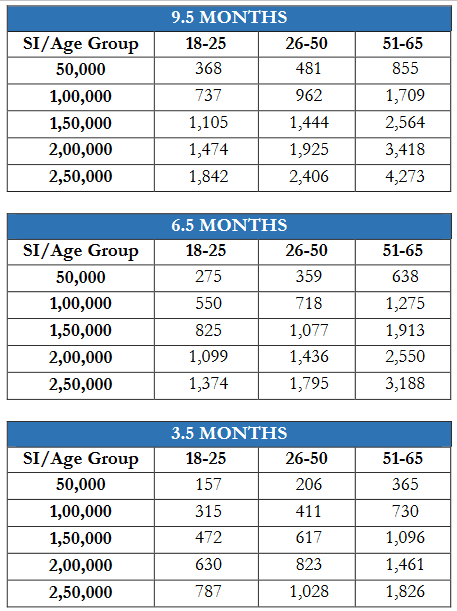

Premium For Corona Rakshak Coverage

Right here is the indicative premium chart we managed to seek out on-line.. however notice that these are nonetheless point out premiums and you’re going to get the actual numbers when you buy the coverage.

a) IFFCO TOKIO Basic Insurance coverage Co. Ltd –

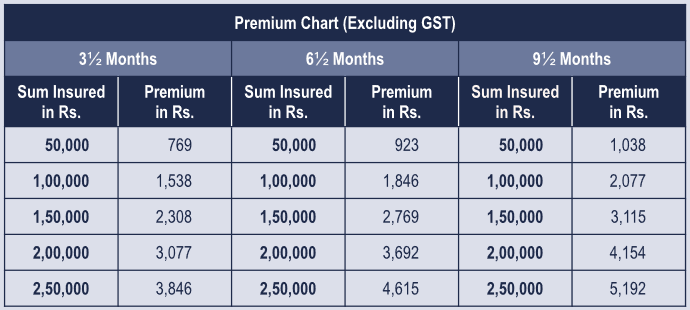

b) Star Well being & Allied Insurance coverage Co.Ltd. –

The beneath picture exhibits the premium particulars of the “Corona Rakshak Coverage” with all 3 tenures of the coverage.

Exclusion below this coverage

- If there are any diagnostic bills made which aren’t associated to COVID, then these bills won’t be lined on this coverage.

- If an individual is examined COVID +ve earlier than the beginning of the coverage, then this particular person can’t file a declare to the corporate.

- If an individual is getting testing achieved associated to COVID in diagnostic facilities that aren’t licensed by the federal government then the bills incurred won’t be lined below this coverage.

- If the insured particular person travels to any nation positioned below journey restriction by the federal government of India the insured particular person won’t get the profit below this coverage if the insured particular person checks +ve for COVID-19.

Must you take up this coverage?

If you’re too scared concerning the bills which could happen in case you get covid+, then you may absolutely go forward and take up this coverage because the premiums are usually not very huge quantity and anybody can handle it.

Nevertheless do notice that this coverage will solely pay if the hospitalization is there for 72+ hrs. You realize that the general public who’re getting corona don’t require hospitalization, which implies that the possibilities you getting corona together with hospitalization is sort of low.

Additionally that is going to solely offer you Rs 2.5 lacs, nevertheless the bills might be fairly excessive in case you get hospitalized for a 15-20 days in an excellent hospital. So deal with this coverage as only a small help system and never the alternative of the medical health insurance coverage in itself.

Conclusion

This was all that I needed to share on this article. Let me in case you have any queries within the feedback part.