Immediately I wish to do the overview of the CRED app. I’ve been utilizing it for the final 12 months already.

CRED is an app, which provides you rewards on well timed funds of your bank card cost. If you’re not utilizing this app, chances are you’ll be making bank card funds anyhow by different on-line strategies. All you need to do is to make funds utilizing the CRED app, that’s all.

It’s that straightforward to make use of!

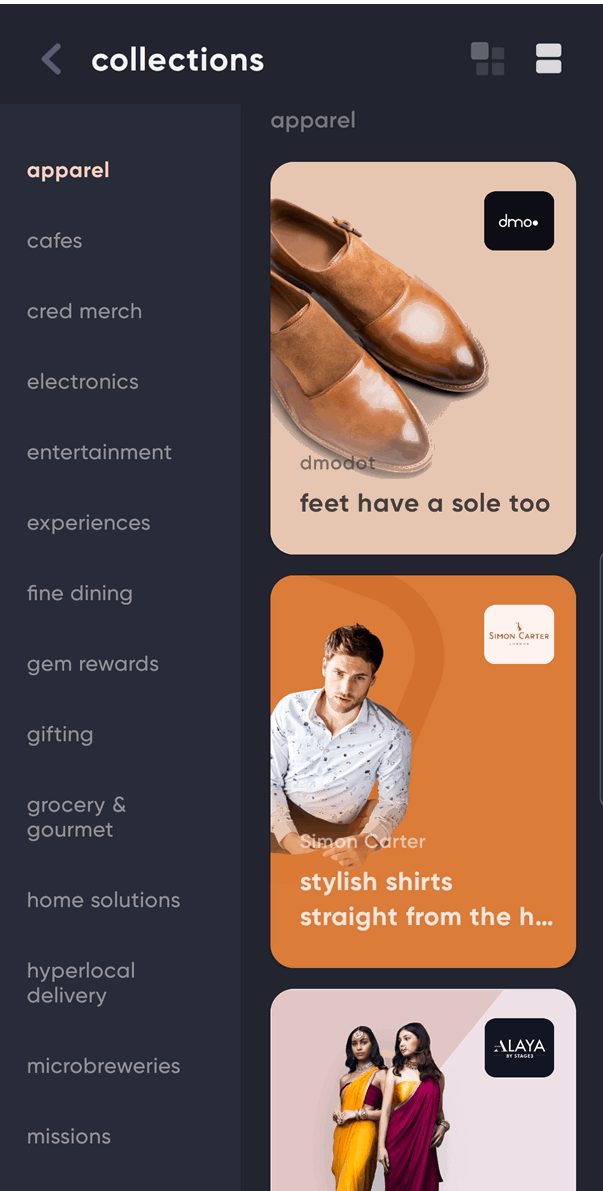

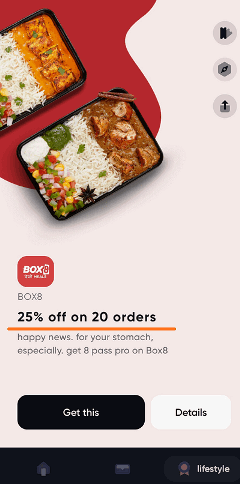

There are numerous model gives and coupons from classes like eating out, meals supply apps, flight tickets, and even buying? Right here is one occasion.

We get totally different sorts of rewards for utilizing or elevating the bank card invoice quantity. Like, in my case, I’ve a PVR bank card of Kotak financial institution, for each Rs. 15,000 bank card invoice, I get factors to redeem towards 2 PVR tickets (max. Rs. 400 for 1 ticket). Due to this, I get influenced to pay my payments principally by bank card to succeed in Rs.15,000 of a invoice each month.

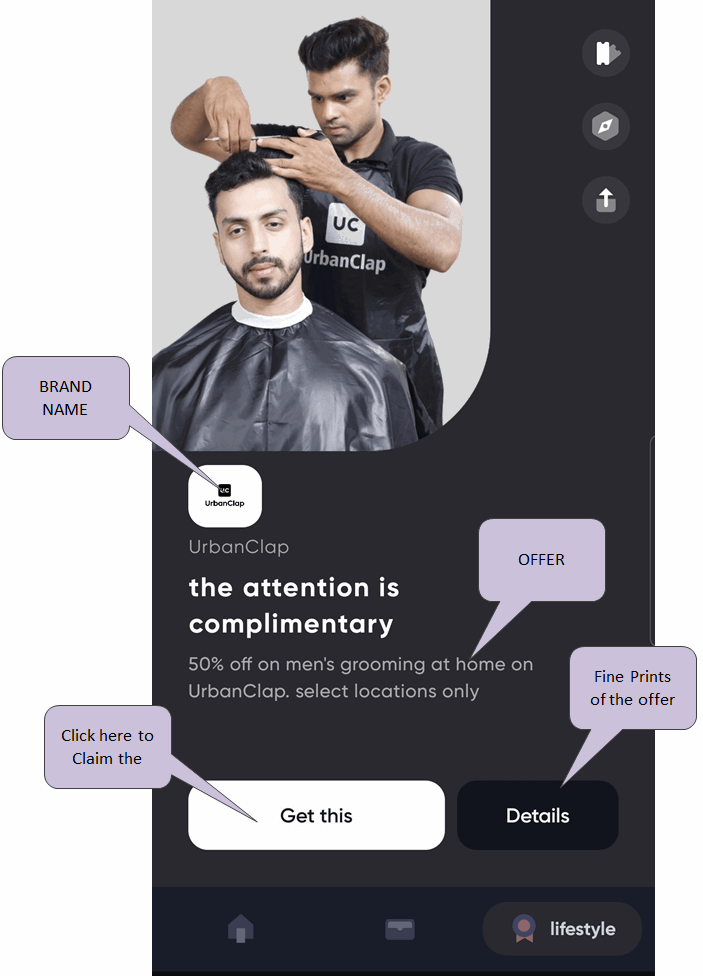

Right here is how a proposal seems like

That is how banks affect us to make use of a bank cards. However, once we pay payments of bank cards we by no means get any low cost or reward on that quantity?

Nevertheless, now it’s attainable with the assistance of the CRED app. This app offers you rewards for paying your bank card dues through this app.

What’s CRED App?

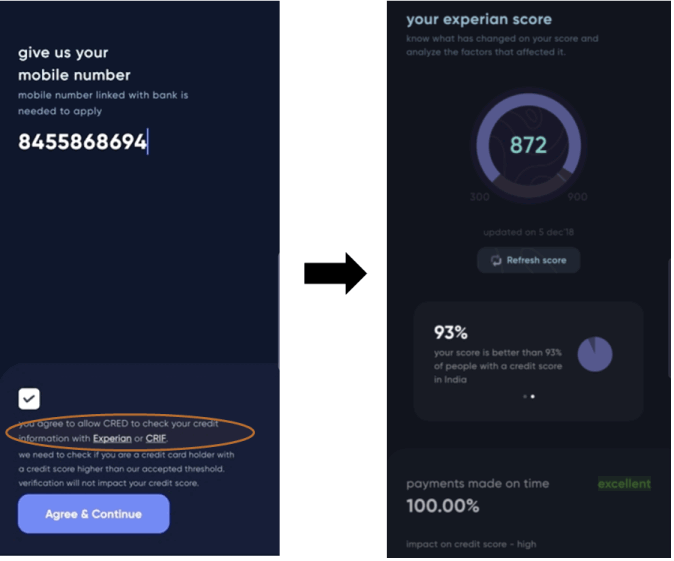

CRED is an app on which you add your a number of bank cards and make funds by the app itself, which will get credited to your financial institution in few hours. The app is solely for these individuals who have a great credit score rating (checked routinely from Experian or CRIF) and have some historical past of bank card cost. That is checked whenever you register for the app for the primary time.

Additionally it is outfitted with the cred to guard characteristic which is an AI (Synthetic Intelligence) backed system, that retains monitor of each single nuance of a bank card cost journey – proper from due date reminders, spending patterns and different card utilization statistics.

There are two issues you may earn on CRED App

Cash – You’ll earn cash equal to your bank card invoice quantity each time you pay the bank card invoice. So if you happen to pay the bank card invoice of Rs 40,000, you’re going to get 40,000 cash. The cash will maintain accumulating month after month. So you may maintain accumulating cash and later redeem it in any method. There are some gives and advantages which requires a really great amount of cash, so it’s helpful to gather numerous cash. I presently have round 3,50,000+ cash in my very own account.

Gems – You can even earn “gems” within the CRED app. These are totally different sorts of foreign money which are required by some gives. Proper now one earns 10 gems on every referral. So in case your referral indicators up on the CRED app, then you’ll earn 10 gems. When you like Jagoinvestor, please assist us earn some cash by registering on the CRED app utilizing this hyperlink.

Here’s a pattern of a few of the gives on the CRED app

- iXigo flight bookings – Rs. 1000 off on utilizing 5,000 cash

- Flo Mattress – Rs. 5,000 off on utilizing 20,000 cash

- Swiggy – Free supply for 3 months on utilizing 5000 cash

- UrbanClap – Flat 50% off on man grooming utilizing 25000 cash

- Flea Bazaar cafe – Flat 20% off on complete invoice utilizing 5000 cash

- Cashback – Get Rs 1,000 cashback for 30 gems

- Flipkart – Rs 500 present card for 20 gems

There are numerous sorts of coupons and gives obtainable underneath the CRED app underneath totally different classes. Relying on what give you need, you may go into that class and discover the gives obtainable in your metropolis.

3 steps to register for CRED App

You’ll be able to avail of the advantages of this app provided that you meet the eligibility standards outlined by the app. Which is – to have a great credit score rating. Following is the step-by-step course of for this –

Step 1 – Obtain the Cred App from right here

Step 2 – Register to cred utilizing your cellphone quantity

- Login to cred utilizing your identify and cellphone quantity registered with a bank card.

- The app will immediate you to grant permission for cellphone entry to confirm the quantity and SMS (which is required to ship a reminder in your due bank card payments), simply grant the permissions.

- Cred will course of this knowledge and examine your eligibility, on the idea of your credit score historical past. Cred has a tie-up with credit score bureaus like Experian and CRIF.

- In case your credit score rating meets the requirements of cred then you’ll obtain an OTP to proceed additional

In case your membership is rejected, enhance your credit score rating and apply after a couple of months once more. It might additionally occur that you’re utilizing a number of cell numbers for banking, so attempt once more utilizing one other quantity. So, if in case you have simply obtained your bank card some weeks again, please await a few months earlier than you apply.

Step 3 – Add your bank cards

As soon as registration is profitable on the CRED app residence web page all of your Credit score Playing cards can be displayed. You simply have to confirm these playing cards by getting into the final 4 digits of the cardboard. To make sure the lively standing of those playing cards, cred will immediately deposit Rs. 1 to every of the playing cards.

You’ll not be requested to enter an expiry date or CVV of your playing cards which ensures the protection of this app.

As soon as efficiently getting your card verified, you may solely earn rewards and scratch playing cards on each invoice cost. Grasp card, American Specific, Diners Membership, and VISA playing cards are presently being dealt with by the CRED app.

5 advantages you get within the CRED app

Coming to the primary level of getting rewards and advantages from the CRED app, under are the next issues

- Cashbacks on paying payments

- Reductions

- Free presents and gives

- Spending Evaluation

- Credit score Rating monitoring

Let’s have a look at every of them

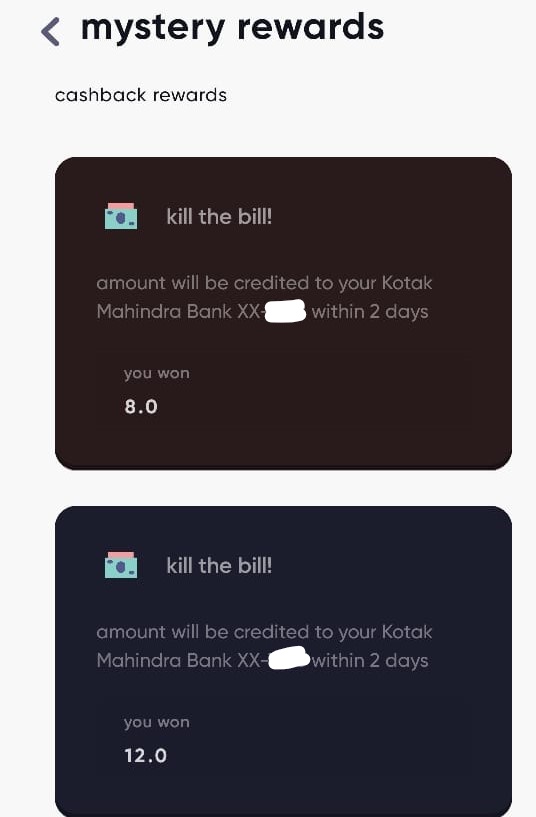

Profit #1 – Cashback on paying payments

You might earn money again (all known as #killthebill) on each transaction. On the time of cost of greater than Rs. 1000, chances are you’ll be notified that you’ve gained a scratch card and also you may earn some quantity which will likely be credited again to your bank card.

Profit #2 – Low cost Affords

Now, that is the main a part of the advantages. CRED app has related to varied manufacturers and it gives you some low cost (money low cost or share low cost) when spending a selected quantity.

For instance one of many gives is a “20% low cost on the subsequent 20 orders from BOX8”, so you may see that you’re going to get 20% on the Box8 for a very long time, however you continue to need to pay the remaining quantity. So even in case you are getting a reduction, it’s essential SPEND on it. So these low cost gives are really good solely if you find yourself anyhow going to spend cash on these manufacturers.

Typically, it might occur that these gives additionally provide you with an opportunity to expertise issues which you may not have completed with out a low cost, so technically it’s helpful in that method, however nonetheless, spending must be completed.

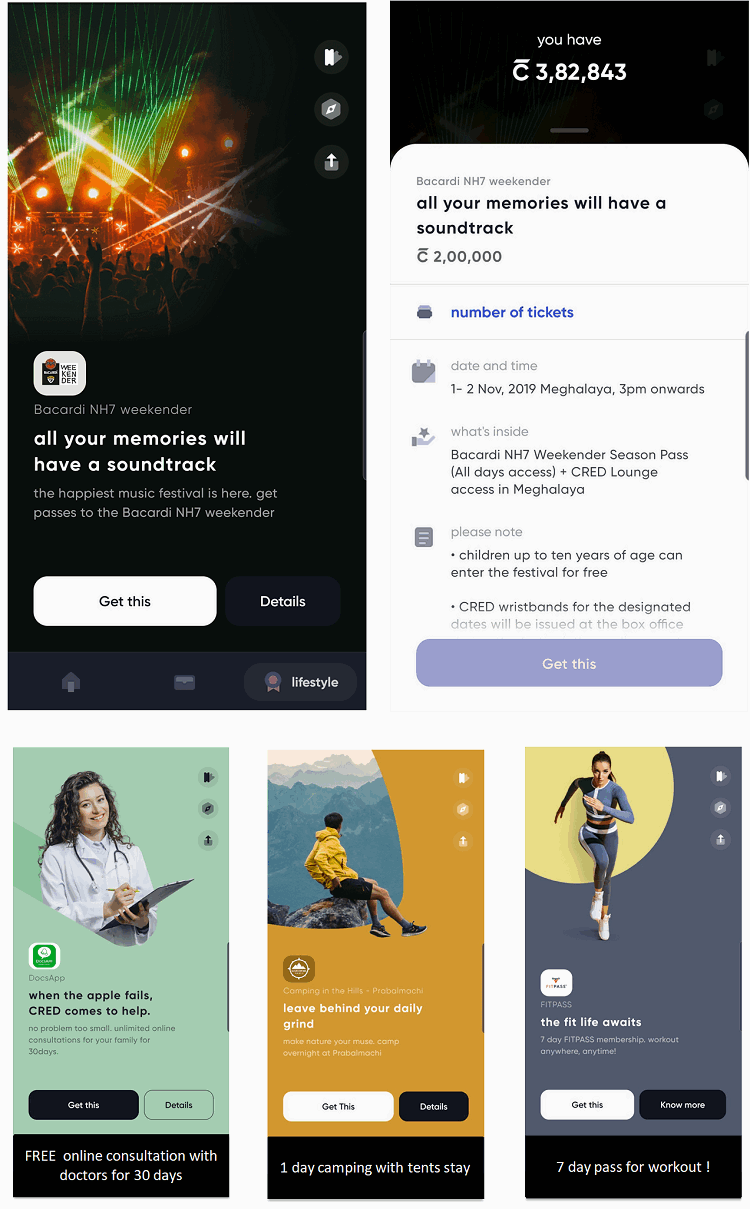

Profit #3 – Free Items and advantages

There are some rewards which are really free for you by burning some cash or gems. You don’t need to pay something to get the advantages. These I personally assume are the actual advantages in a means, as a result of you aren’t spending something out of pocket, however simply availing a proposal.

Beneath you may see an instance, the place you may burn 2,00,000 cash and get a go for two individuals Bacardi NH7 weekender occasion and even lounge entry. Other than that, I’ve proven 3 extra gives for complimentary advantages with out paying any additional from your individual pocket.

So you may maintain accumulating the cash and await the correct supply or reward to reach which is helpful for you.

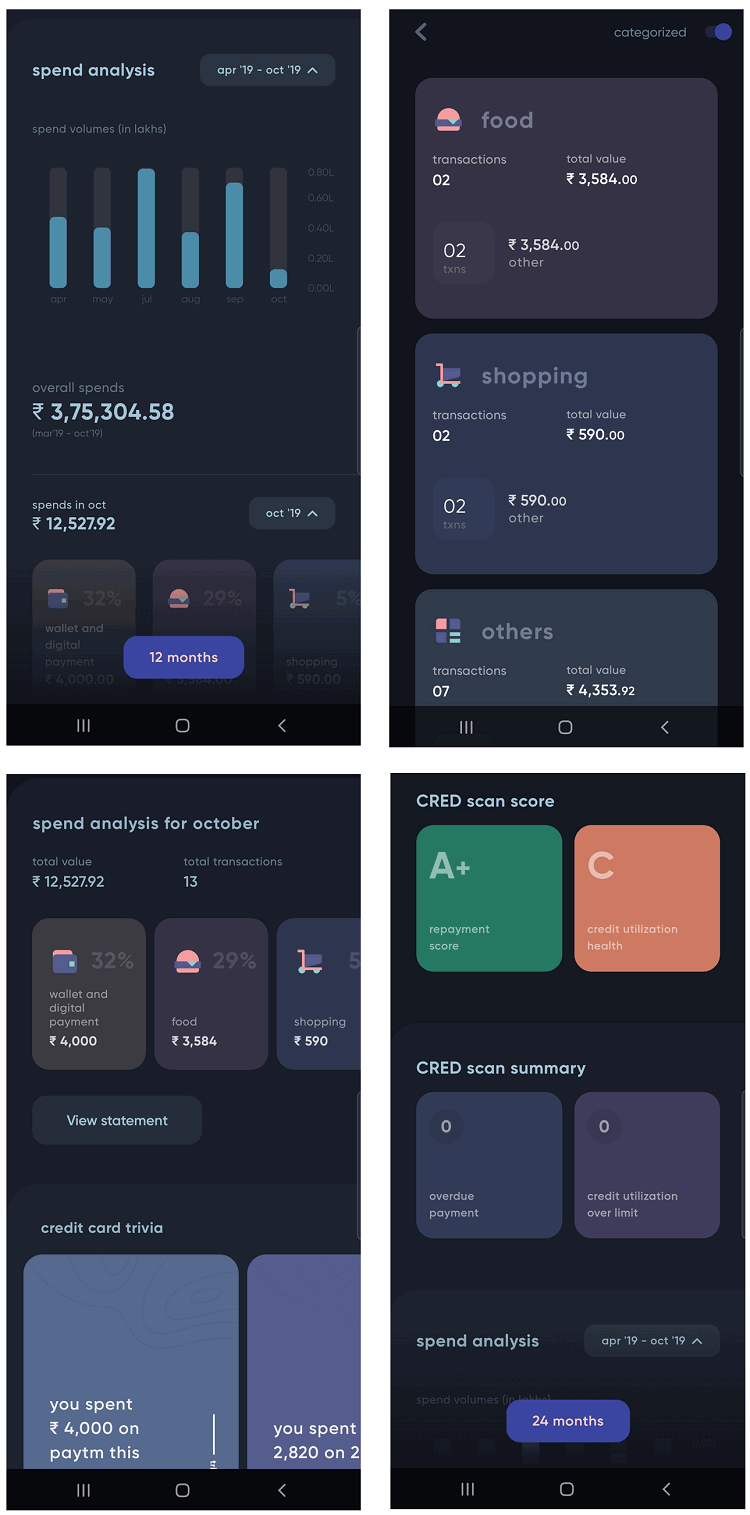

Profit #4 – Spending Evaluation

One small good thing about the CRED app is that you simply get some insights into your spending sample and the historical past of your bank card funds in a single single place. That is good for many who have a number of bank cards and wish some visibility on how their spending is going on.

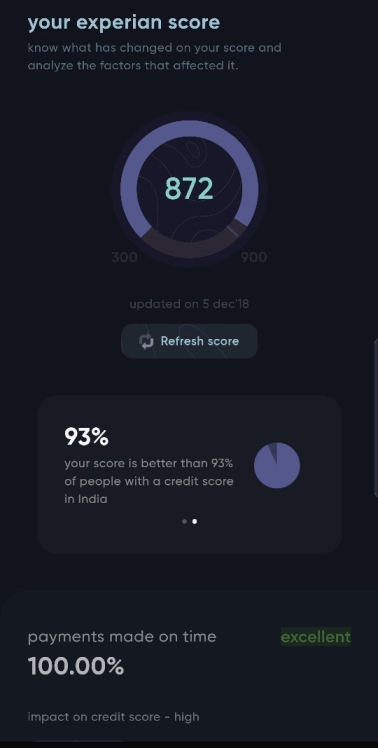

Profit #5 – Credit score Rating Monitoring

CRED app will maintain displaying your credit score rating once in a while, so this can enable you to remain motivated to make well timed bank card funds and you can too maintain a monitor of how your credit score rating is shifting over time. Proper now CRED has completed a tie-up with Experian and CRIF and pulls your credit score rating from each locations.

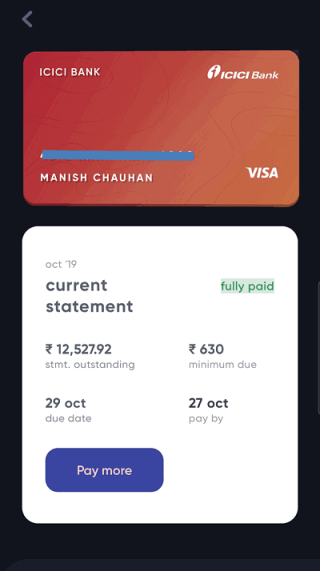

Tips on how to make cost within the Cred app?

Paying bank card payments through the CRED app could be very simple, simply click on on pay now, enter the quantity and click on proceed. These days the invoice quantity together with the minimal due quantity routinely will get pre-populated. You may make cost through debit card/internet banking (NEFT/IMPS) or UPI. It might take a while to mirror on the cash credited to your bank card account.

On Completion of Invoice Cost of your Credit score Card, you may be rewarded with CRED Cash and Kill Invoice Scratch Card which you’ll have to redeem.

Is the CRED app protected?

I’m positive that you simply should be having this query concerning the security of this app since you are placing your bank card particulars and authorizing the app with all particulars.

First, that is this app is based by Kunal Shah, the one that began Freecharge and the startup is closely funded. The previous document of the founder is undamaged so you may belief the corporate.

Subsequent level is that the CRED app by no means asks you to supply the date of expiry or CVV in your bank cards, therefore you aren’t giving any crucial info to this app.

Then, it’s best to know that whenever you set up some other app, these apps additionally get varied permissions like studying your SMS, making calls in your behalf, monitoring your exercise and so forth, and this app is nothing totally different from others.

In order for you, you may deny entry to emails and messages then you definately gained’t be capable to obtain a notification on due dates and likewise you gained’t get any expense evaluation.

Nothing is FREE on this world

Whereas it feels nice to get nice gives and advantages and freebies, do not forget that nothing is FREE on this world. Behind every thing which seems superb, there’s a enterprise mannequin and the explanation why you get these free rewards and gives.

You need to be conscious that CRED or some other coupon firm does varied tie-ups and associations with manufacturers and corporations and acts as a lead era firm. You’re nothing however a result in another firm and CRED helps in rising gross sales for the opposite social gathering.

They are going to principally get one thing again in return and that’s the enterprise mannequin. Nothing mistaken with it, however you as an investor ought to pay attention to what you might be moving into.

The reductions and superior advantages you get from CRED or some other related app are principally tempting you to spend on the pretext of a “nice deal”. When you spend on one thing which you initially didn’t intend to purchase then it’s an additional expense for you on the finish of the day. The coupons are pure rewards solely whenever you had been anyhow going to spend on one thing and if you happen to get a further low cost on the deal.

So, we should be aware whereas spending and getting reductions by utilizing CRED cash, it shouldn’t occur that you’re spending on some undesirable stuff to simply redeem Cred cash.

Let’s take my instance, I attended two reside concert events in Pune, VIP go of Rs. 5,000 every. Little question I simply paid Rs. 4,000 (Rs. 2,000 every) as a substitute of paying Rs. 10,000. However, if this reward wouldn’t be within the footage so, I’d have by no means gone to that live performance and saved Rs. 4,000.

Obtain the Cred App from right here

Who ought to use this app?

The app is extra appropriate for the below-given classes of bank card customers –

- Excessive bank card invoice payers

- Folks dwelling in metro cities/tier 1 or 2 cities (a lot of the rewards are eating out or reside concert events)

- Individuals who pay bank card payments earlier than the due date (no reward on late funds)

Do tell us if in case you have any feedback or questions concerning the app?