Priya, a 43-year-old working skilled, is sitting down together with her monetary advisor to plan her investments. She has two objectives in thoughts: saving for her daughter’s faculty admission in a single 12 months and buying a household automotive in three years. Whereas Priya has been diligently investing in fairness mutual funds, she is worried about market volatility affecting her short-term monetary wants.

These are the traits her monetary advisor observes in her:

- Danger-averse: Prefers secure investments over the volatility of fairness funds.

- Portfolio diversification: Goals to stability her fairness holdings with debt devices.

Her advisor suggests a balanced strategy: aligning every objective with an funding technique tailor-made to the timeline and danger concerned. For her daughter’s faculty admission in a single 12 months, he recommends a Brief Period Fund, making certain capital stability. For buying a automotive in three years, he suggests a Medium Period Fund, providing reasonable mutual fund return whereas protecting danger inside acceptable limits.

This story highlights the significance of goal-based planning, selecting investments that align with particular monetary milestones. Whether or not you’re saving for a serious expense, a long-term dedication, or searching for stability in your portfolio, debt mutual funds present constant returns whereas minimising danger. This text explores easy methods to discover essentially the most appropriate debt-based mutual fund on your monetary objectives.

Debt Mutual Funds Defined

Debt mutual fund returns are typically extra secure in comparison with fairness funds, making them superb for conservative buyers. They allocate cash into bonds and cash market securities similar to authorities bonds, company bonds, and treasury payments. Whereas they may not make headlines like their fairness counterparts, they provide one thing equally useful: stability and constant mutual fund return.

Mutual funds India laws, ruled by SEBI, be sure that buyers have entry to clear and well-regulated monetary merchandise for wealth creation. Whereas their every day Internet Asset Worth (NAV) could fluctuate, these actions are typically smoother in comparison with the volatility of fairness markets. For buyers who search capital safety over excessive mutual fund return, debt funds supply a much less nerve-racking funding expertise.

Advantages of Debt Mutual Funds

Debt mutual funds supply a number of benefits:

- Stability – Much less risky than fairness funds, making them safer funding choices.

- Liquidity – Present fast entry to funds with out vital penalties.

- Diversification – Entry to a broad vary of debt devices, decreasing total danger.

Aligning Targets Primarily based on Tenure

Upon getting decided your monetary timeline, the subsequent step is figuring out the kind of debt fund that finest aligns together with your objectives. When choosing a fund, it’s essential to match mutual fund returns throughout totally different classes to make sure they align together with your monetary objectives.

1. Brief-term objectives (1-3 years)

For instant wants like faculty charges, or emergency financial savings, Brief Period Funds supply low danger with cheap mutual fund return.

2. Medium-term objectives (3-5 years)

For commitments like a house renovation or a toddler’s increased schooling fund, Medium Period Funds strike a stability between danger and return.

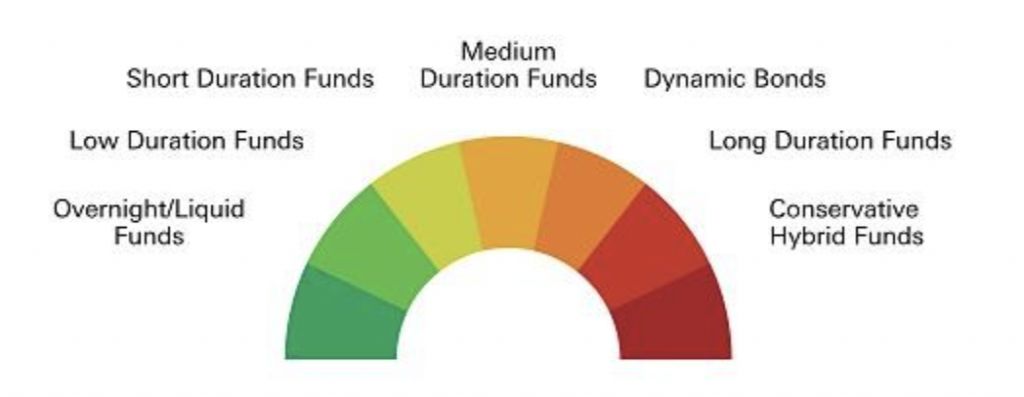

Sorts of Debt Funds

Buyers typically search mutual fund returns that outperform conventional financial savings accounts and stuck deposits. Debt-based mutual funds India supply a sexy various, offering liquidity and catering to totally different investor wants and funding horizons:

- Liquid Funds – Very best for very short-term parking of funds (lower than one 12 months).

- Extremely Brief Period Funds – Barely increased returns than liquid funds, appropriate for as much as six months.

- Brief Period Funds – Balances danger and return for investments between one and three years.

- Medium Period Funds – Affords reasonable returns for investments between three and 5 years with some rate of interest danger.

- Lengthy Period Funds – Appropriate for buyers with a time horizon of over 5 years.

- Dynamic Bond Funds – Actively handle bond length primarily based on market circumstances for versatile returns.

- Credit score Danger Funds – Goal increased returns by investing in lower-rated bonds however carry better credit score danger.

Selecting the Proper Debt Fund

Investing in mutual funds India requires cautious consideration of things similar to danger urge for food, funding horizon, and fund efficiency. When choosing a debt fund, evaluating key metrics ensures it aligns together with your objectives and danger tolerance. Brief-term debt funds could supply decrease volatility, however their mutual fund returns are usually decrease than longer-duration funds.

1. Purpose Alignment and Analysis

- Select classes primarily based in your monetary timeline.

- Examine the fund supervisor’s observe report and experience.

2. Danger Components to Take into account

(a) Curiosity Fee Danger

Rate of interest danger occurs when market rates of interest change, affecting bond costs. When charges rise, new bonds supply higher returns, making older ones much less useful. When charges fall, present bonds with increased returns develop into extra engaging, rising their worth. This impacts the Internet Asset Worth (NAV) of debt mutual funds.

(b) Credit score Danger

Credit score danger is the prospect that an organization fails to repay the cash borrowed via bonds. Companies like CRISIL charge bonds primarily based on security, from AAA (very protected) to BBB (dangerous). If an organization defaults, the mutual fund’s worth could drop.

(c) Liquidity Danger

Liquidity danger happens when a mutual fund can’t promote its bonds simply resulting from low demand. If compelled to promote at a cheaper price, the fund’s worth drops, decreasing investor returns.

3. Key Fund Metrics

(a) Complete Expense Ratio (TER)

Decrease TER means extra of your returns stick with you. Evaluate TER throughout comparable funds to seek out cost-effective choices.

(b) Yield to Maturity (YTM)

YTM signifies the debt mutual fund return you possibly can count on if the fund is held to maturity. Guarantee increased YTM aligns with acceptable danger ranges.

(c) Common Maturity

Funds with shorter common maturities carry decrease danger however supply modest returns. Longer maturities could supply increased returns however are delicate to rate of interest fluctuations.

(d) Fund Allocation

Diversification reduces danger. Keep away from funds overly concentrated in high-risk securities like company bonds except you’re snug with the added credit score danger.

Tax Implications

Understanding the taxation guidelines for debt mutual funds India might help buyers make smarter selections when planning their investments. As of April 1, 2023, all capital features from debt mutual funds are taxed on the investor’s revenue tax slab charge, whatever the holding interval.

SIPs in Debt Mutual Funds

Systematic Funding Plans (SIPs) are usually not only for fairness funds. Constant investments via SIPs might help easy out market fluctuations and enhance mutual fund returns over the long term. SIPs are notably helpful for:

- Brief-term objectives (1-3 years) through Brief Period Funds.

- Medium-term objectives (3-5 years) through Medium Period Funds.

SIPs allow disciplined investing in debt mutual funds. Common contributions might help mitigate market dangers and guarantee constant wealth accumulation.

Wrapping Up

Within the evolving funding panorama, debt mutual funds India present a structured and controlled method for buyers to develop their wealth whereas balancing danger and returns. Discovering the appropriate debt mutual fund is about matching it together with your monetary timeline and danger tolerance. Whether or not you a’re planning for a purchase order in a 12 months or accumulating funds for a serious expense in 5 years, there’s a debt fund suited to your wants.

Like Priya, aligning investments together with your objectives can guarantee your cash is on the market whenever you want it most, quite than merely chasing the very best returns.

All in favour of how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Buyers