(A) In regards to the DSP Multi Cap Fund

The scheme goals to attain long-term capital appreciation by investing in a diversified portfolio of fairness and equity-related securities throughout large-cap, mid-cap, in addition to small-cap segments. Moreover, As an open-ended fairness fund, it presents flexibility in market capitalization publicity. Nevertheless, there isn’t any assure that the funding goal might be achieved.

(B) Fundamental Particulars of Dsp Multi Cap Fund

| Fund Home | DSP Asset Managers Pvt. Ltd. |

| Class | Fairness: Multi cap |

| Launch & Begin Date | 30-January-2024 |

| Kind | Open-ended |

| AUM | ₹1,869.45 Cr (As on 30 Nov 2024) |

| Obtainable at NAV of | ₹12.18 (As on 19 Dec 2024) |

(C) Classification Portfolio of the fund

(i) Portfolio Combine by Market Cap Dimension

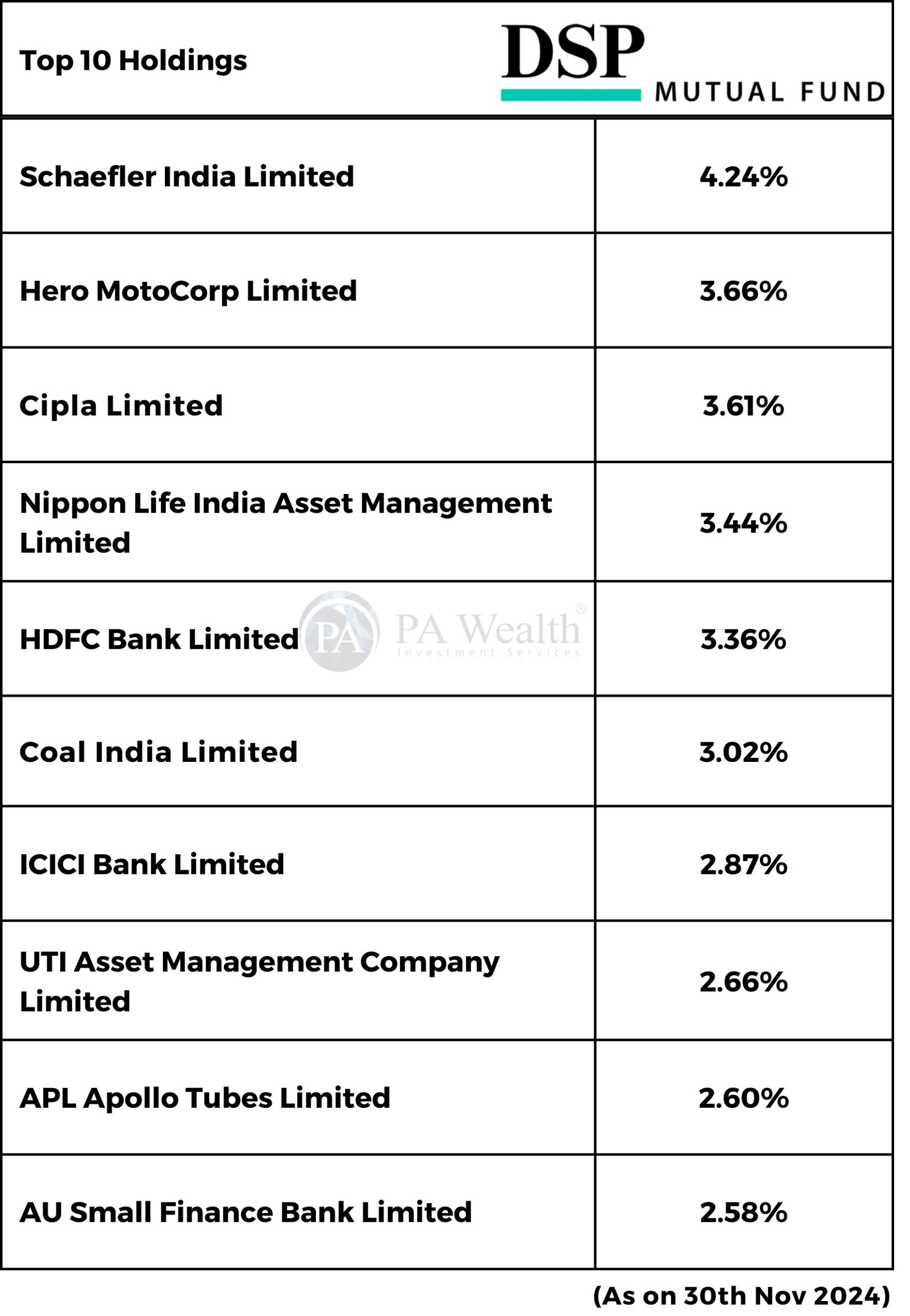

(ii) High 10 Holdings of the fund

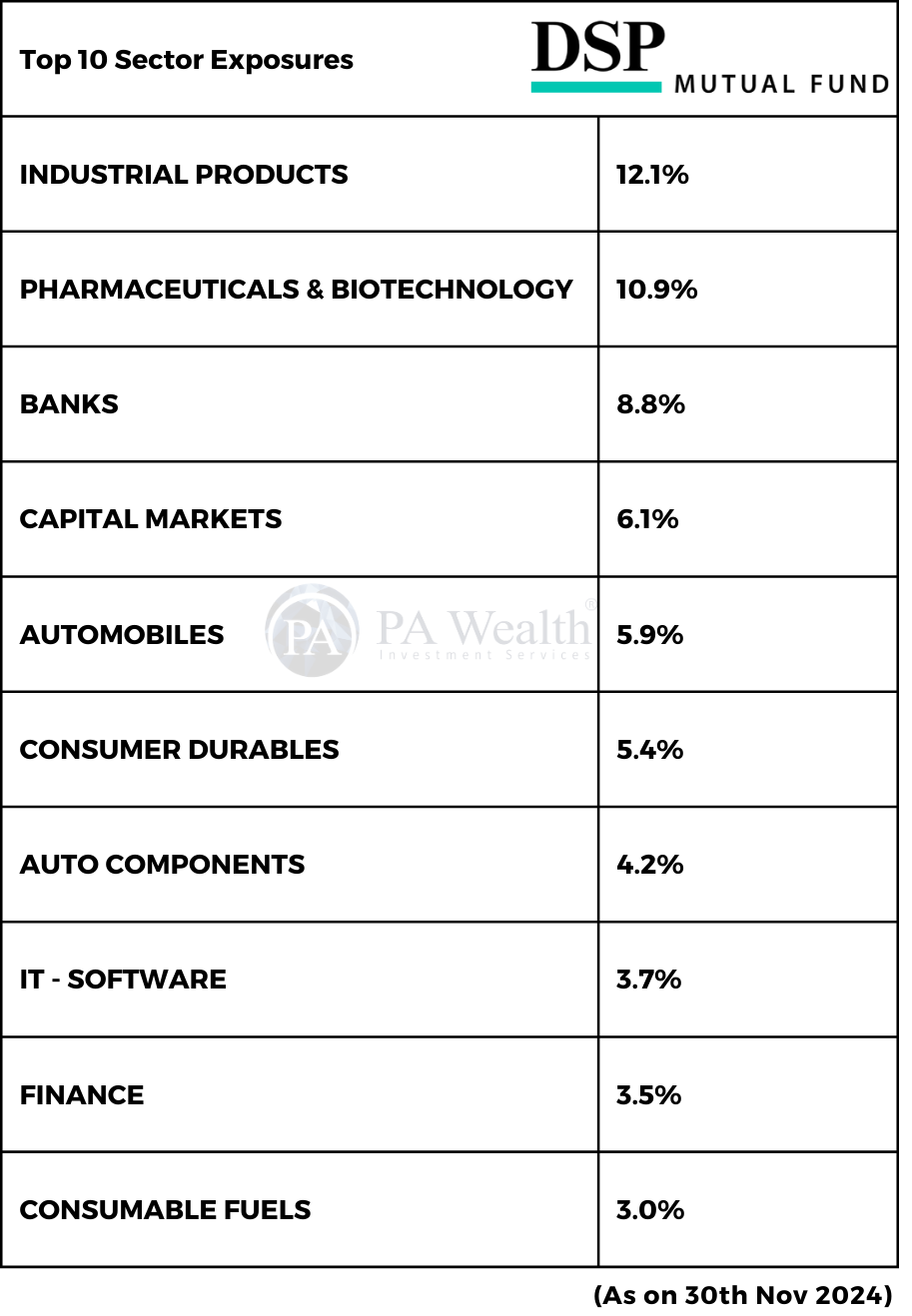

(iii) High 10 Sectors Exposures

(D) Fund Managers & Tenure of managing the Scheme

(E) Fund – Funding Particulars

| Dsp Multi cap Fund | |

|---|---|

| Utility Quantity for recent Subscription (Lumpsum) | ₹100 |

| Min Extra Funding (SIP) | ₹100 |

| Exit load | 1%* |

| Lock In | No |

| Expense Ratio | 2.04% (As on 31 Oct 2024) |

(F) Returns Generated By The Fund

(G) Danger Elements

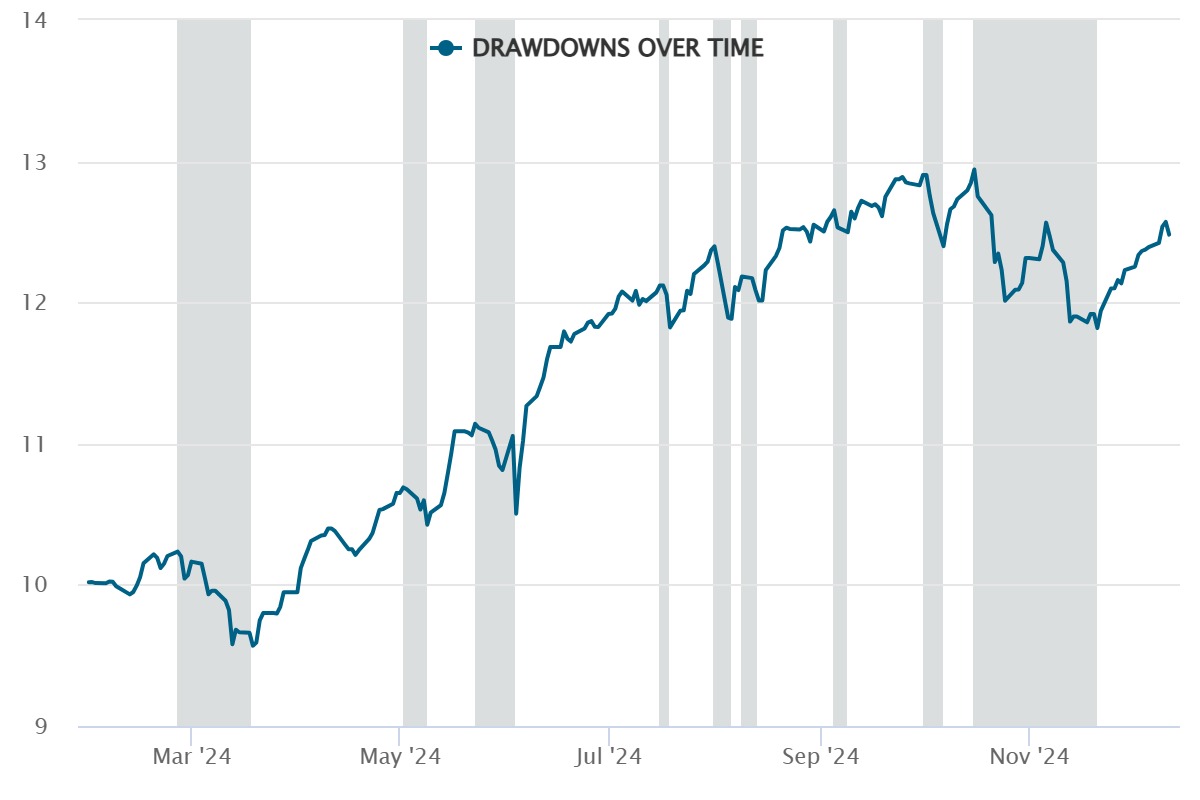

(i) High Drawdowns

This chart illustrates the fluctuations in a mutual fund’s worth from January 30, 2024, to the current in addition to its efficiency. A drawdown happens when the fund’s worth declines from a peak, reaches a brand new excessive, after which corrects once more. Additionally, The shaded space represents the period the fund remained in a drawdown part.

This chart, consequently, helps buyers perceive how the fund has reacted to huge occasions within the economic system.

(H) Funding Philosophy

- This scheme is appropriate for people targeted on constructing wealth over an prolonged interval which may vary from 5 to 10 years.

- Consequently, the fund invests in fairness and equity-related securities of large-cap, mid-cap, and small-cap firms.

(I) Taxability on earnings

Taxation

Capital Good points Taxation

- When you promote the mutual fund models after 1 yr of funding, you’ll be able to exempt good points as much as Rs 1.25 lakh in a monetary yr from tax. Nevertheless, good points exceeding Rs 1.25 lakh might be taxed at 12.5%.

- If the mutual fund models are offered inside 1 yr from the date of funding, total quantity of acquire is taxed on the price of 20%.

- No tax is to be paid so long as you proceed to carry the models.

Dividend Taxation

- Dividends are included within the revenue of buyers and it is usually taxed based mostly on their respective tax slabs. Additional, if an investor’s dividend revenue exceeds Rs. 5,000 in a monetary yr, the fund home additionally deducts a TDS of 10% earlier than distributing the dividend.

Drop us your question at – information@pawealth.in or Go to pawealth.in

References: valueresearchonline.com, Trade’s Publications, Information Publications, Mutual Fund Firm.

Disclaimer: The report solely represents private opinions and views of the writer. No a part of the report ought to be thought-about as advice for purchasing/promoting any inventory. Thus, the report & references talked about are just for the knowledge of the readers in regards to the trade acknowledged.

Most profitable inventory advisors in India | Ludhiana Inventory Market Suggestions | Inventory Market Specialists in Ludhiana | High inventory advisors in India | Finest Inventory Advisors in Gurugram | Funding Consultants in Ludhiana | High Inventory Brokers in Gurugram | Finest inventory advisors in India | Ludhiana Inventory Advisors SEBI | Inventory Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | High inventory advisors in India | High inventory advisory companies in India | Finest Inventory Advisors in Bangalore