Most mutual fund traders get misplaced on the earth of varied fairness fund classes like Massive cap, Flexi-cap, midcap, small-cap, targeted funds, multi-cap, and whatnot.

Do traders preserve questioning which class will present one of the best returns over the long run? And in actual life I’ve additionally seen many of the traders out of their ignorance evaluate the fund return with the Sensex or nifty as thats probably the most simply benchmark to check (instance – market double ho gaya, however mera fund to utna accha nahi efficiency kar raha)

So here’s what I did

I downloaded 9 fairness classes mutual funds from advisorkhoj.com and sorted them on the premise of the final 10 yrs’ returns and discovered how a lot a one-time funding of Rs 10 lacs grew to become in worth phrases. On this interval Sensex went from 17700 ranges to 60,000 (this journey is only a single knowledge level from nineteenth Aug 2012 to nineteenth Aug 2022, which I do know is a biased knowledge level, however that’s when I’m writing the article, so no matter is the state of affairs,I’m doing it). This turned out to be approx 12.98% CAGR return and Rs 10 lacs grew to become 33.94 lacs.

Earlier than I am going into charts and knowledge, let me admit that this isn’t the “proper” evaluation as such and with some flaws. Nonetheless, it displays what number of novice traders take a look at knowledge. Some necessary disclaimer and necessary factors I have to share earlier than you e-lynch me within the feedback part for my stupidity.

Disclaimer and Vital Factors

- This put up is solely the information presentation of the information and never some evaluation of which is the higher or unhealthy funds.

- The article merely tells you about what has occurred up to now and doesn’t predict something in regards to the future.

- Mutual fund SEBI categorization was accomplished on October 6, 2017, however the fund efficiency knowledge was taken earlier than that, so numerous funds aren’t in true sense the midcap, or giant and midcap, and so on, however we’re merely taking them as it’s, as a result of that’s the present state of affairs.

- Not all funds classes have been fastened from begin. some funds exchanged fingers from one class to a different and their mandate was additionally modified. However we’ll let or not it’s for creating the charts

- Some very well-known funds aren’t a part of this evaluation as they haven’t accomplished 10 yrs.

- Whereas the fund benchmark is totally different for every class, I’m merely making a easy comparability of which funds have a minimum of created extra wealth than Sensex.

Funds Class thought-about

- Massive Cap Funds

- Massive and Midcap Funds

- Midcap Funds

- Small Cap Funds

- Multicap Funds

- Centered Funds

- ELSS Funds

- Flexicap Funds

- Index Funds

Class #1: Massive Cap Funds

There have been 25 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 48.3 lacs for the funding of 10 lacs and the worst did return 27.4 lacs. Right here is the information within the chart.

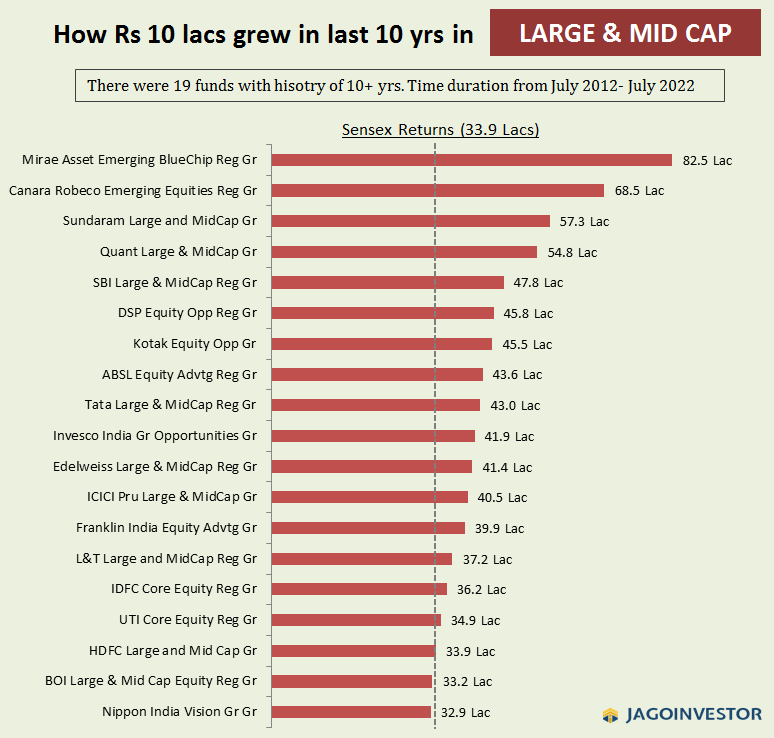

Class #2: Massive and Mid Cap Funds

There have been 20 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 82.5 lacs for the funding of 10 lacs and the worst did return 32.9 lacs. Right here is the information within the chart.

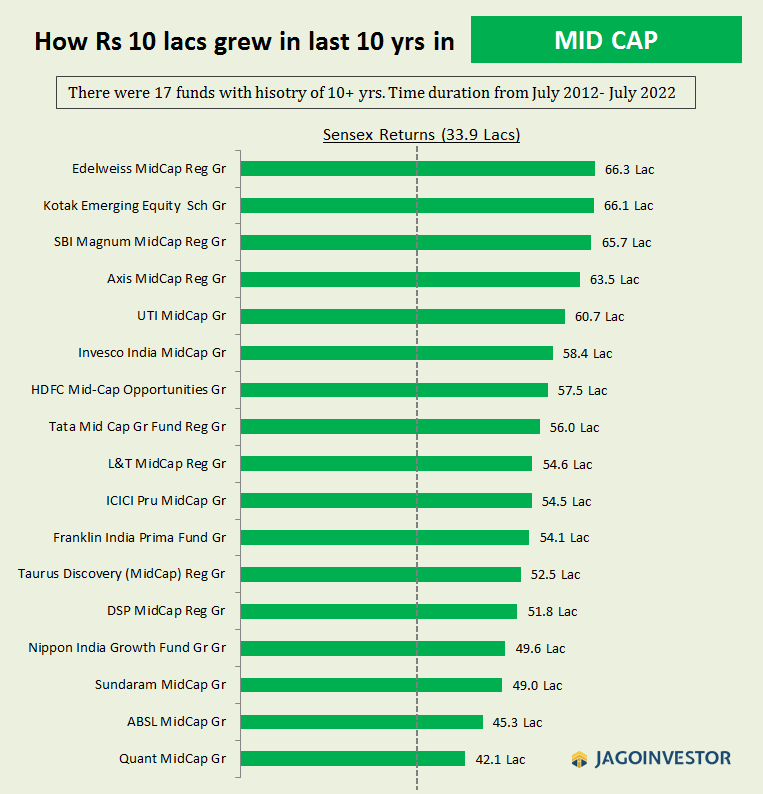

Class #3: Mid Cap Funds

There have been 17 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 66.3 lacs for the funding of 10 lacs and the worst did return 42.1 lacs. Right here is the information within the chart.

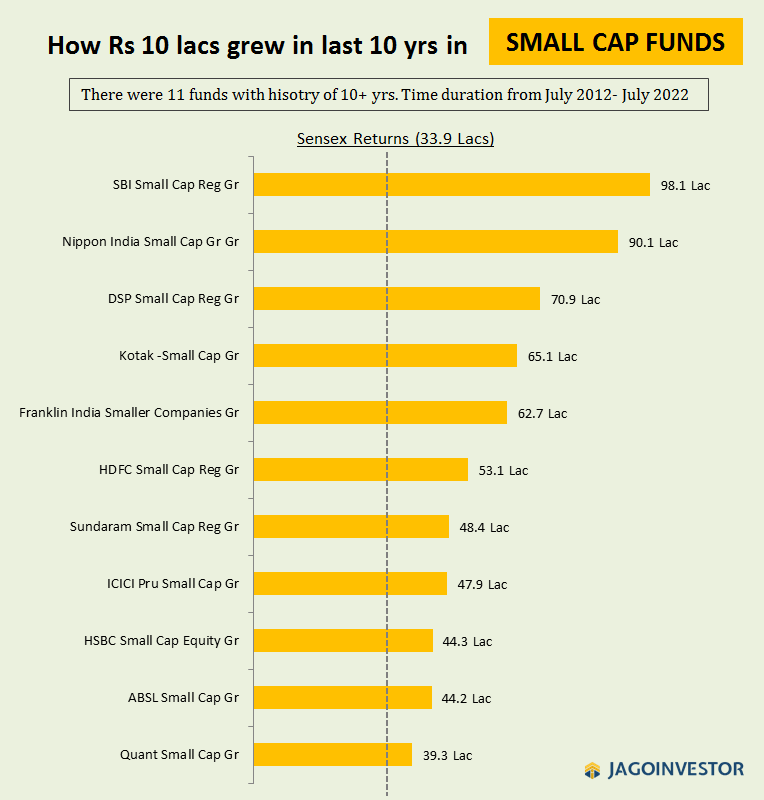

Class #4: Small Cap Funds

There have been 11 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 98.1 lacs for the funding of 10 lacs and the worst did return 39.3 lacs. Right here is the information within the chart.

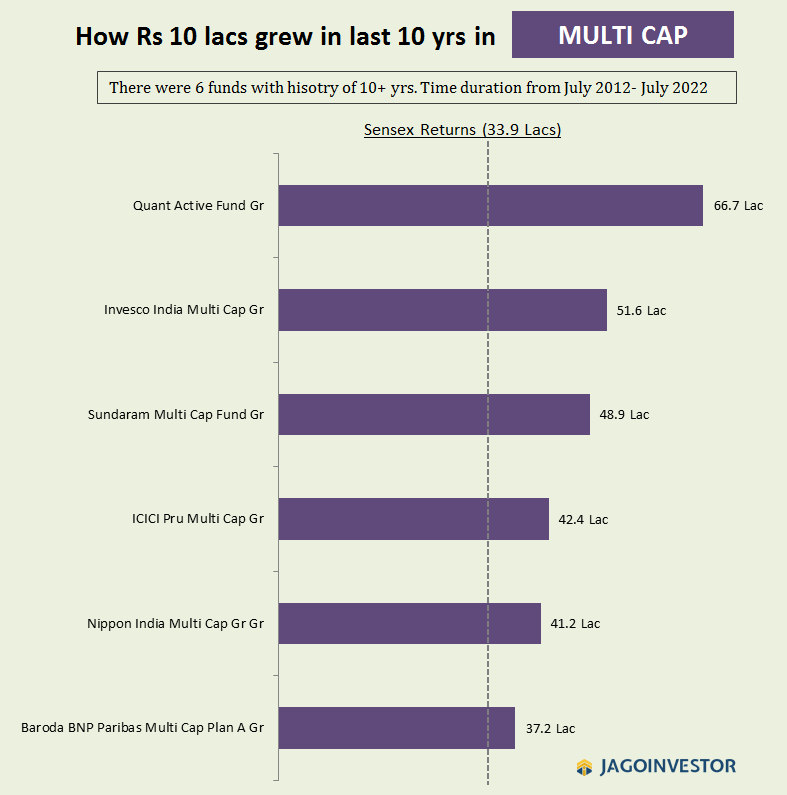

Class #5: Multicap Funds

There have been 6 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 66.7 lacs for the funding of 10 lacs and the worst did return 37.2 lacs. Right here is the information within the chart.

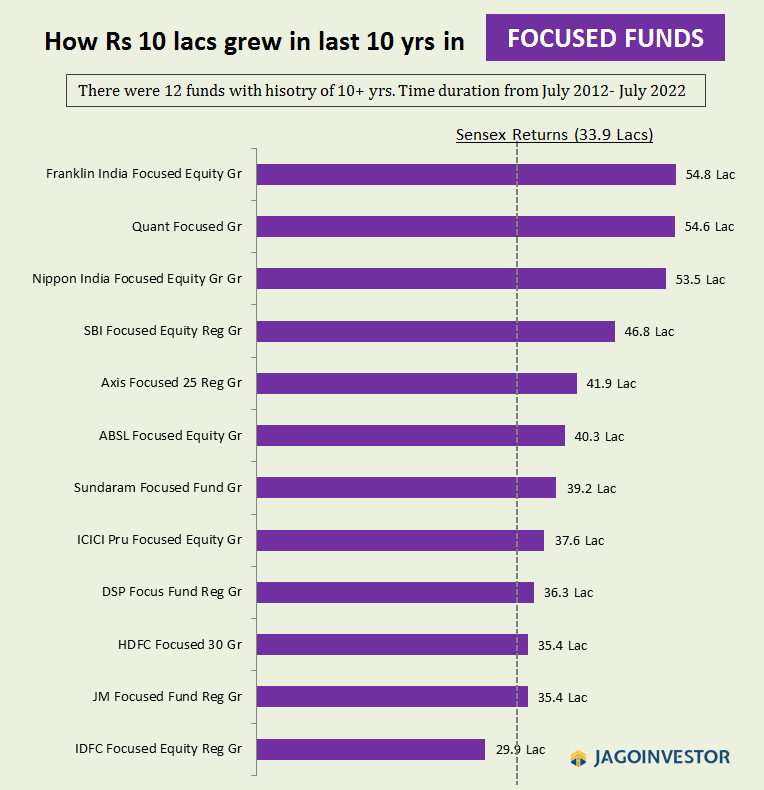

Class #6: Centered Funds

There have been 12 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 54.8 lacs for the funding of 10 lacs and the worst did return 29.9 lacs. Right here is the information within the chart.

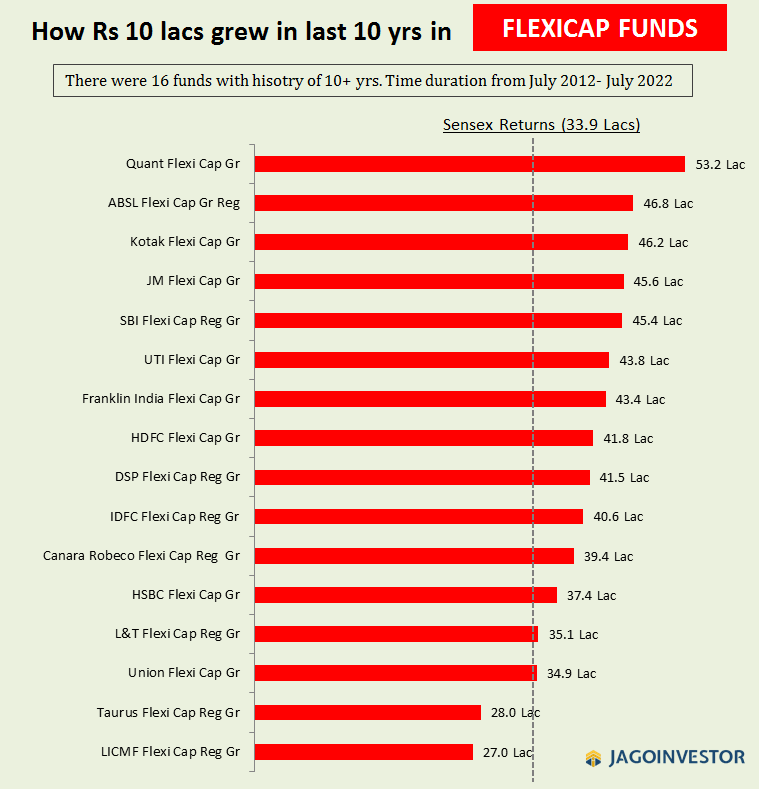

Class #7: Flexicap Funds

There have been 16 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 53.2 lacs for the funding of 10 lacs and the worst did return 27 lacs. Right here is the information within the chart.

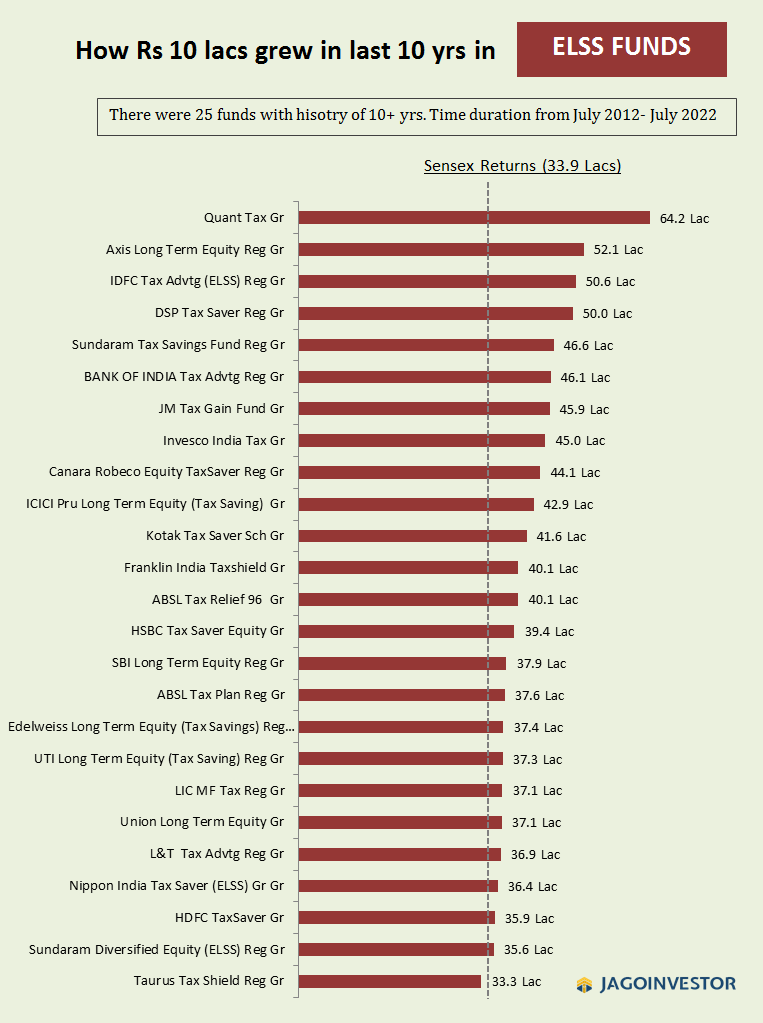

Class #8: ELSS / TaxSaver Funds

There have been 25 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 64.2 lacs for the funding of 10 lacs and the worst did return 33.3 lacs. Right here is the information within the chart.

Class #9: Index Funds

There have been 19 funds on this class with 10+ yrs of knowledge out there. The topmost fund returned 41.7 lacs for the funding of 10 lacs and the worst did return 30.6 lacs. Right here is the information within the chart.

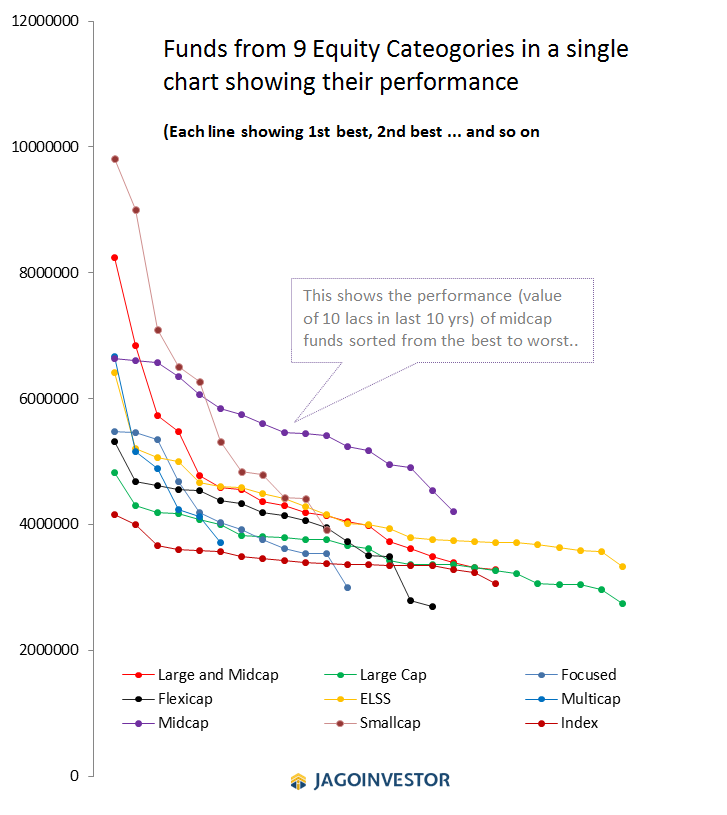

all of the funds in a single body

Allow us to put all of the funds into one single chart to see which class returns have been higher than others, worst than others, and their variation throughout the class.

There is no such thing as a conclusion I’m making from the information and chart on this article, as there are various points with the fund’s class. You might be free to make no matter inference you wish to make out of this knowledge.

Do depart a remark under with what has stunned and never stunned you in regards to the knowledge.