Are you a brand new investor in mutual funds ? If sure, you then may be having these questions in thoughts.

- What’s KYC ?

- What do I must do to register my KYC?

- Whom ought to I strategy?

- Do I must do my KYC each time earlier than investing into mutual funds?

So, on this article you’ll get the reply of all such queries.

What’s KYC ?

KYC i.e. Know Your Consumer is a course of required by RBI norms which must be accomplished earlier than beginning any investments. It’s used as an eligibility take a look at of an investor to stop unlawful actions like cash laundering. So, if you’re planning to start out investing in mutual funds, you want to register your KYC first.

Do I must do my KYC each time earlier than investing into mutual funds ?

No, as KYC is one time train (central course of) must be completed earlier than investing. As soon as your KYC is registered you needn’t to bear similar course of once more whereas investing with completely different mutual fund homes.

How can I register my KYC ?

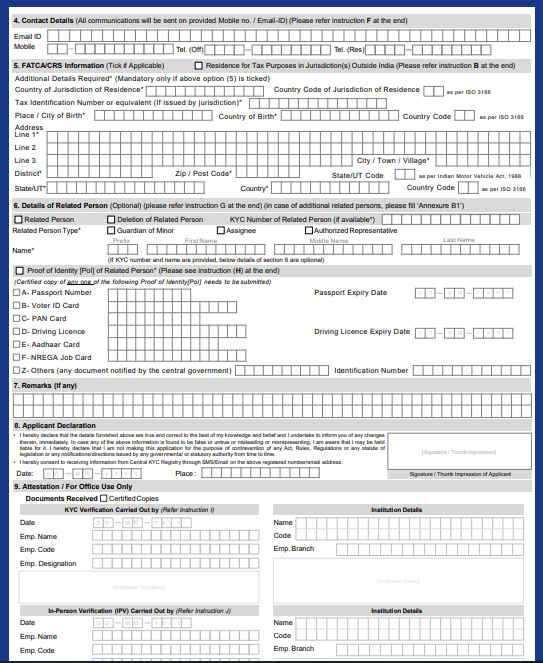

For KYC registration, KYC kind must be stuffed with all the small print and must be submitted together with self attested copies of required paperwork (as mentioned under).

Additionally word, that if you wish to put money into mutual funds (Resident or NRI), Click on right here to find out about Jagoinvestor mutual fund companies. We additionally allow you to in getting your KYC completed

From the place can I get the KYC kind ?

You get get the KYC kind by way of 3 sources:

- For this you want to go to the web site of CAMS KRA, Karvy or different registrars.

- Or you may also go to the web site of the fund home the place you wish to begin your investments.

- Or you’ll be able to attain an Impartial Monetary Advisor.

What paperwork are required to be hooked up with KYC kind ?

[su_table responsive=”yes” alternate=”no”]

For Resident Indian following paperwork are required :

| For Non-Resident People(NRIs) following paperwork are required :

|

[/su_table]

Vital Factors:

- POI card wanted for POI

- In case your abroad deal with shouldn’t be in English, you want to get it translated by a translator in your metropolis and get their stamp

- In case you don’t want to journey to India only for making investments, you’ll be able to all the time give POA to somebody trusted who can do the method for you.

- In particular person verification is necessary for true identification verification. So, Fund homes or registrars does IPV by way of video calls.

The place can I verify my KYC standing?

As soon as your KYC kind together with required paperwork is submitted to the registrars(CAMS, Karvy, Sundaram and so forth.) It would take 4 to five days in registration. As soon as it’s registered you can begin investing into mutual funds. You’re going to get the alert concerning the registration by way of mail or SMS. Nevertheless, if you need you’ll be able to verify standing of your KYC by coming into your PAN in both of the hyperlinks under:

https://kra.ndml.in/

https://camskra.com/

https://www.karvykra.com

https://www.cvlkra.com/

https://www.nsekra.com/

You can even refer these hyperlinks for downloading KYC software kind.

Conclusion :

For KYC you needn’t to go anyplace, it may be completed from your private home. So, if you’re planning to start out investing in Mutual Funds, KYC is step one to it. And if you’re having any hassle in KYC or whereas investing, do tell us within the remark part.