OnRe, the onchain asset supervisor delivering institutional-grade yield to DeFi, at present launched OnRe Factors, a rewards program designed to incentivize significant participation within the ONyc ecosystem. In contrast to conventional liquidity mining, OnRe Factors reward real capital effectivity by monitoring how ONyc is actively deployed throughout DeFi protocols, strengthening its utility as Solana’s premier collateral asset.

OnRe factors mark a shift from passive token farming to energetic ecosystem constructing. By rewarding ONyc’s deployment throughout DeFi protocols, this system creates a direct hyperlink between person exercise and ecosystem development.

“OnRe was constructed on a easy precept: capital ought to work as effectively as attainable,” stated Dan Roberts, Co-Founder and CEO at OnRe. “ONyc is our basis – a steady, yielding asset backed by reinsurance premiums and collateral curiosity. With OnRe Factors, we’re rewarding customers who put that capital to work in ways in which reinforce all the ecosystem.“

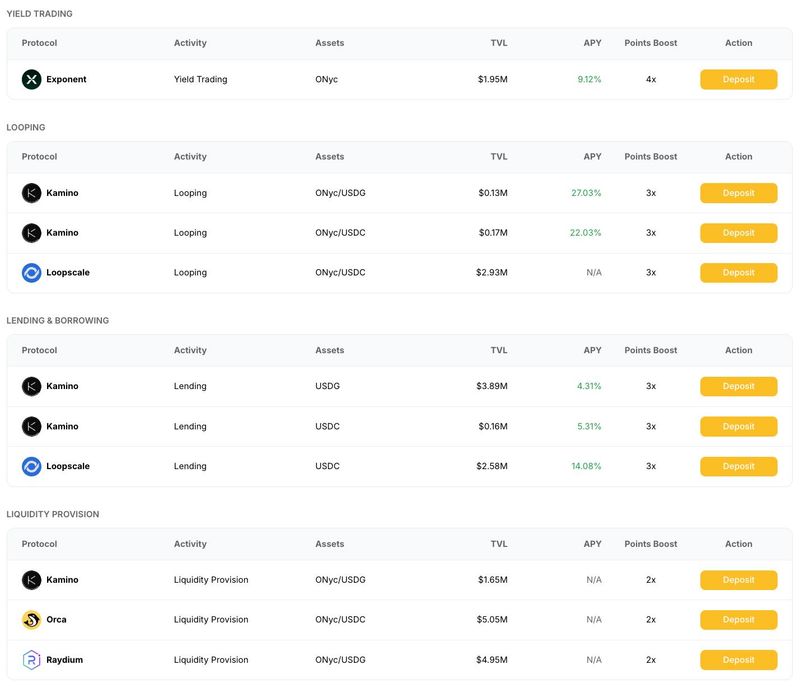

Factors accrue each day with strategic multipliers that reward DeFi participation:

Base Holding (1x): 1 level per ONyc per day for asset holders, offering baseline rewards whereas accessing real-world yield from reinsurance efficiency.

Liquidity Provision (2x): Double rewards for offering ONyc liquidity on main Solana DEXs together with Kamino, Orca, and Raydium. LPs assist deeper markets and tighter spreads, incomes each multipliers and buying and selling charges.

Lending and Borrowing (3x): Triple rewards for supplying ONyc as collateral to lending protocols like Kamino and Loopscale. Superior customers deploying looping methods obtain multipliers that scale with leverage, rewarding capital effectivity by recursive deposits that enhance yields whereas sustaining publicity to ONyc.

Yield Buying and selling (4x): Most rewards for offering liquidity and holding YT-ONyc on Exponent. YT (Yield Tokens) give LPs the flexibility to invest on the longer term yield of the underlying asset.

Bonus campaigns will add further rewards tied to social engagement, partnership launches, and group participation, giving customers extra methods to earn whereas driving deeper utility for ONyc.

“This is not about short-term incentives,” added Ayyan Rahman, Co-Founder and CGO at OnRe. “We’re constructing a framework that tracks and incentivizes capital deployment that genuinely strengthens ONyc. The extra customers put ONyc to work throughout DeFi, the stronger the ecosystem turns into, and the extra their rewards compound.”

This system’s clear construction permits customers to optimize methods whereas contributing to ONyc’s development. OnRe Factors exhibit how strategic capital deployment creates compounding advantages, making certain individuals who contribute most to ecosystem liquidity and utility are rewarded proportionally.

Speedy Availability

OnRe Factors are reside at present throughout all supported methods. Customers can start incomes instantly, with real-time monitoring within the OnRe app displaying ONyc positions, factors, and onchain exercise in a single place. Individuals can monitor their progress and alter methods as new alternatives emerge: https://app.onre.finance/.

This system underscores OnRe’s dedication to constructing sustainable DeFi infrastructure the place real utility drives long-term worth creation, making certain early adopters seize most profit from ONyc’s increasing ecosystem.

-ENDS-

About OnRe

OnRe is a number one onchain asset supervisor utilizing yield-bearing property to underwrite reinsurance, bringing steady, institutional-grade returns to DeFi. By connecting the $750B international reinsurance market with blockchain expertise, OnRe supplies buyers entry to structured merchandise designed to ship constant yield throughout market cycles, opening a market that has traditionally been out of attain. Its flagship product, ONyc, is a multi-collateral, yielding greenback asset backed by reinsurance premiums, a $1.2T market the group has underwritten for greater than a decade. Liquid, scalable, and absolutely composable, ONyc delivers resilient, uncorrelated returns and is positioned to turn out to be the popular collateral asset throughout all of DeFi.