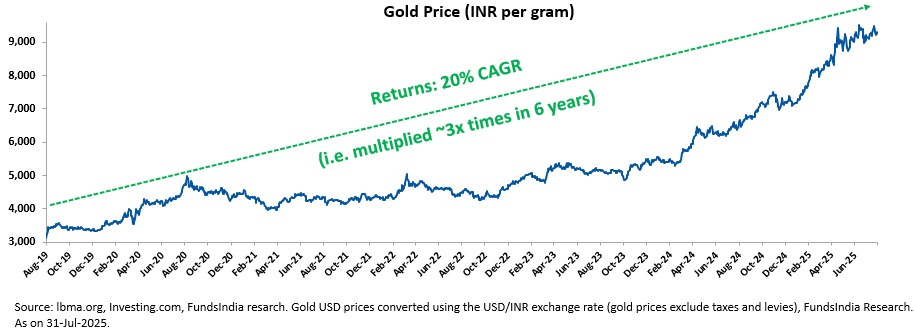

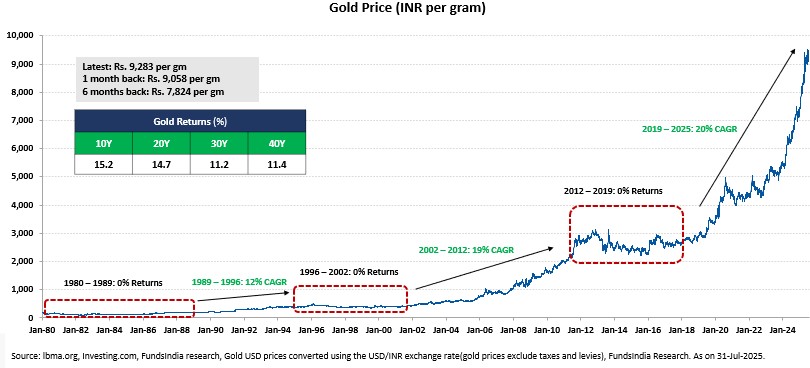

Gold has witnessed a pointy rally during the last 6 years (2019-2025), gaining ~20% yearly and almost tripling!

However right here’s the catch!

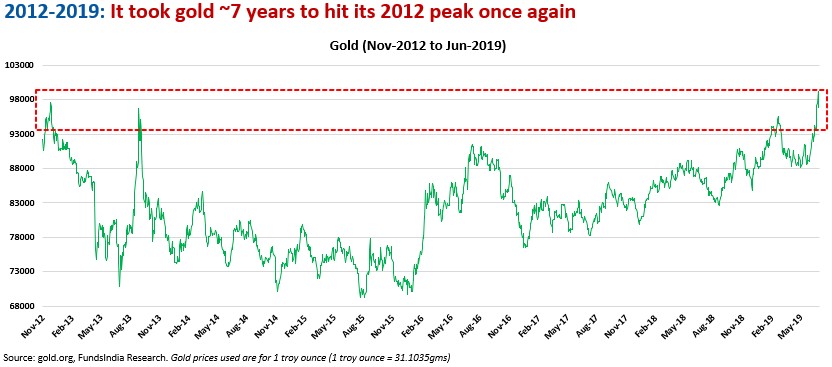

Regardless of Gold’s current stellar efficiency, historical past reminds us that gold is a cyclical asset. Intervals of fast good points had been usually adopted by lengthy, flat stretches.

For eg- From 2012 to 2019, Gold costs barely moved, giving nearly no returns.

From 1980 to 1989, gold stayed flat for almost a decade.

Oops!

Making an attempt to guess what gold will do subsequent based mostly on current efficiency is tempting. But it surely’s additionally unhelpful.

A extra helpful query is: The place are we within the cycle? And much more importantly: What ought to a wise investor do about it?

The objective is to not get the timing good. It by no means is. The objective is to remain considerate, balanced, and anchored to first ideas.

Let’s take a look at the place gold stands at this time – not by way of opinions, however by way of proof.

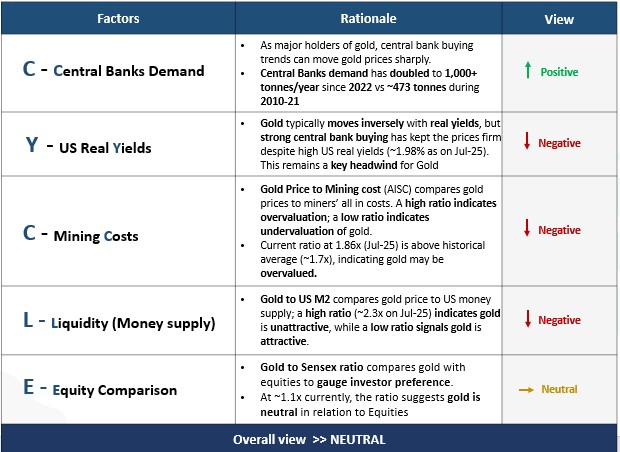

Introducing our Gold ‘C-Y-C-L-E’ Framework…

We break this down utilizing 5 key components to judge Gold at any cut-off date.

- C- Central Banks Demand

- Y- US Actual Yields

- C – Mining Prices

- L – Liquidity (US M2 Cash Provide)

- E – Fairness Comparability

1. C- Central Banks Demand

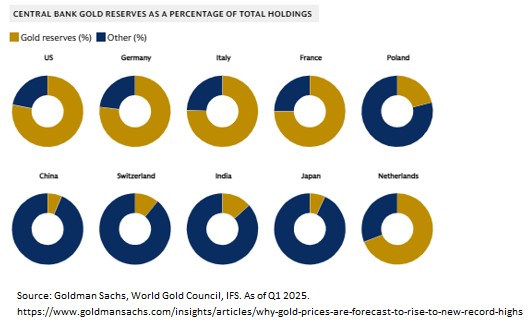

Central banks maintain a serious chunk of the world’s gold, giving them a robust affect on gold costs. Even small adjustments of their shopping for or promoting can transfer gold costs sharply.

Developed market central banks maintain ~75-80% of their reserves in gold, whereas Rising markets central banks maintain simply 5-10%.

However the tide is popping!

Rising markets at the moment are catching up and are rising their gold reserves to diversify and cut back reliance on the US greenback.

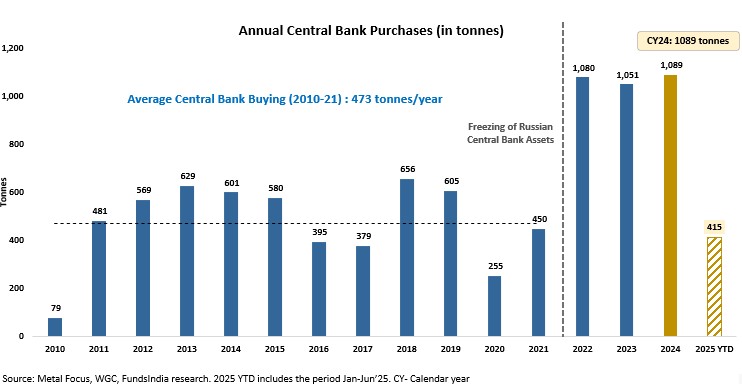

For eg – From 2010-2021, Central banks purchased ~473 tonnes of gold yearly (~10-11% of worldwide gold demand).

Since 2022, this annual demand has doubled to 1,000+ tonnes (~23% of worldwide gold demand), led by freezing of Russia’s forex reserves by the Western nations -> a wake-up name for international locations to shift in direction of gold.

Given the above context, Rising market central banks are prone to hold shopping for gold, with plans to develop their holdings from 5-10% to round 20% of whole reserves.

We imagine the present gold shopping for development by Central Banks is simply getting began as Rising market central banks nonetheless have important room to extend their gold reserves.

Verdict – POSITIVE for Gold.

2. Y- US Actual Yields

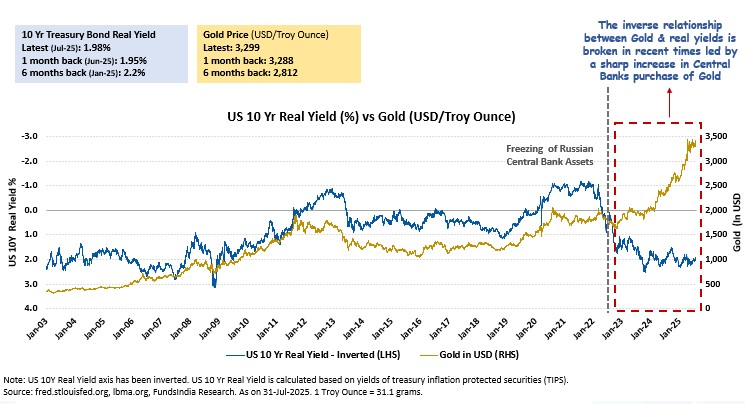

Traditionally, gold strikes inversely with actual yields:

Yields fall -> Gold rises

Yields rise -> Gold falls

It’s because world buyers sometimes select between US 10Y bonds and gold as safe-haven inflation hedge. Rising bond yields make gold unattractive and vice versa.

Nevertheless, this relationship has damaged down lately led by elevated central financial institution demand offsetting weaker investor inflows.

Gold due to this fact stays robust regardless of excessive actual yields (1.98% as on Jul-25).

If not for the central financial institution shopping for, the present Excessive US actual yield nonetheless stays a headwind for gold costs.

Verdict – NEGATIVE for Gold.

3. C – Mining Prices

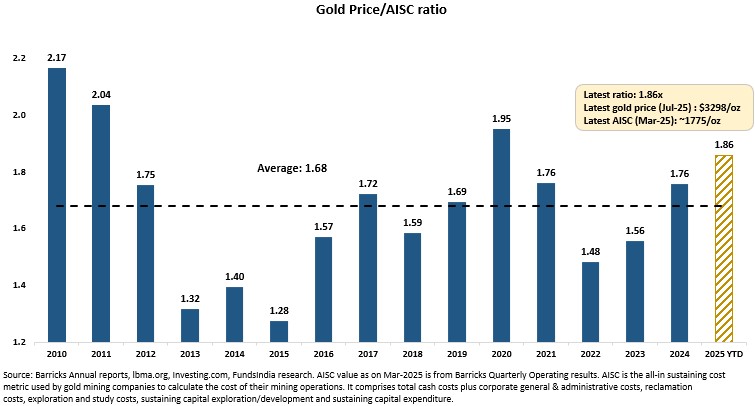

To guage this metric, we take into account the All in sustaining prices (AISC). AISC is the overall value per ounce for gold miners to maintain operations which incorporates:

- Direct mining prices – labor, power & supplies

- Administration, exploration, and environmental prices

- Sustaining capital – e.g., tools repairs and mine improvement.

In contrast to fundamental money prices, AISC offers a fuller image of a miner’s long-term value construction.

Evaluating gold worth to AISC exhibits how a lot revenue cushion miners have, and whether or not gold is overvalued or buying and selling close to its value.

- Excessive Gold Worth to AISC Ratio -> Sturdy miner margins -> Gold could also be overpriced

- Low Gold Worth to AISC Ratio -> Skinny/no margins -> Gold could also be undervalued

Presently, the ratio is at 1.85x (Jun-25), above historic averages of ~1.7x, indicating Gold is overvalued.

Verdict – NEGATIVE for Gold.

4. L – Liquidity (US M2 Cash Provide)

M2 is a broad measure of cash provide. It exhibits how a lot cash is offered within the economic system for spending and saving, and contains:

- Bodily forex

- Demand deposits

- Financial savings accounts

- Time deposits

- Cash market mutual funds

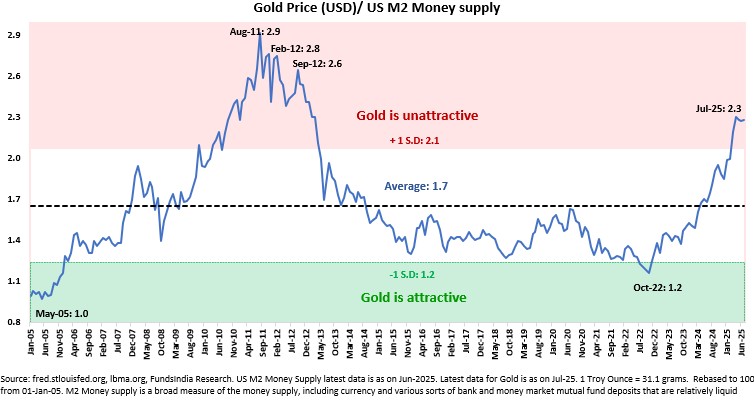

We use the Gold Worth to US M2 Cash provide ratio to judge if gold is maintaining with cash provide as gold has traditionally been inflation hedge.

- Excessive Gold to US M2 Ratio -> Gold is unattractive

- Low Gold to M2 Ratio -> Gold is enticing

Presently, the ratio is Excessive at ~2.3x -> Indicating gold is unattractive.

Verdict – NEGATIVE for Gold.

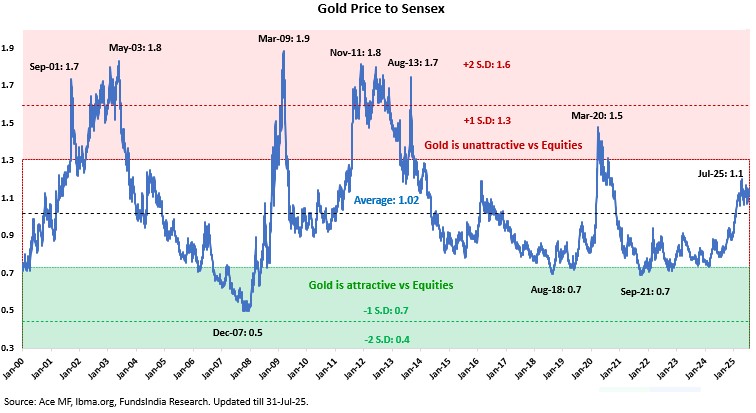

5. E – Fairness Comparability – Gold Worth to Sensex ratio

We evaluate gold with equities utilizing the Gold to Sensex ratio to evaluate investor’s choice.

- Excessive Gold to Fairness Ratio -> Gold is unattractive vs Equities

- Low Gold to Fairness Ratio -> Gold is enticing vs Equities

The present Gold to Sensex ratio is at ~1.1x, indicating Gold is impartial as in comparison with Equities – neither enticing nor unattractive.

Verdict – NEUTRAL for Gold.

Placing all of it collectively,

Our General view on Gold as per Gold C-Y-C-L-E Framework – NEUTRAL

Gold worth at ~$3,300/ounce – (1 Optimistic issue + 1 Impartial issue + 3 Unfavourable components)

Other than the above 5 components, gold costs are additionally influenced by Geopolitical and Financial uncertainties like Warfare, Pandemic, Market disaster and so on. These occasions are past our management and are arduous to foretell.

What must you do now?

- Stick along with your long run asset allocation to gold – Not the time to go Underweight / Obese

- Rebalance if it deviates by ±5% from the goal.

- New Lumpsum investments – Stagger over 3 months

- Eg- For a ₹1 crore portfolio with a goal allocation of Fairness 70% | Debt 15% | Gold 15%:

- Allocate ₹15 lakhs to gold by way of 3 month weekly STP

Different articles it’s possible you’ll like

Submit Views:

45