Final Up to date on Feb 20, 2025 by vanessa sequeira

The semiconductor trade has come into the limelight in recent times. That is very true for the reason that semiconductor trade has come into the highlight just lately. This spike in curiosity was owed to the arrival of the pandemic – when the demand for semiconductors elevated immensely, however provide constraints resulted in a worldwide scarcity. Nevertheless, due to their essential software in digital units, listed semiconductor manufacturing corporations in India proceed to take pleasure in recognition. On this article, let’s check out the trade overview, semiconductor shares in India, and why the sector is prone to be a profitable funding possibility.

Greatest Semiconductor Shares in India

Here’s a listing of the very best semiconductor shares in India sorted in response to market cap:

| Title | Sub-Sector | Market Cap | Shut Worth (Rs.) | PE Ratio |

| HCL Applied sciences Ltd | IT Providers & Consulting | 4,67,656.97 | 1,712.30 | 29.78 |

| Vedanta Ltd | Metals – Diversified | 1,63,349.57 | 423.50 | 38.53 |

| Dixon Applied sciences (India) Ltd | House Electronics & Home equipment | 84,139.96 | 14,088.30 | 228.80 |

| Tata Elxsi Ltd | Software program Providers | 37,977.11 | 6,017.60 | 47.94 |

| Moschip Applied sciences Ltd | Plastic Merchandise | 3,690.68 | 169.82 | 373.93 |

| RIR Energy Electronics Ltd | Digital Equipments | 1,383.19 | 1,712.40 | 197.04 |

| MIC Electronics Ltd | Electrical Parts & Equipments | 1,369.43 | 59.66 | 22.15 |

| ASM Applied sciences Ltd | IT Providers & Consulting | 1,265.26 | 1,145.00 | -295.62 |

| Solex Vitality Ltd | Industrial Equipment | 897.52 | 840.60 | 102.81 |

| SPEL Semiconductor Ltd | Digital Equipments | 524.59 | 123.00 | -31.26 |

| Surana Telecom and Energy Ltd | Cables | 258.08 | 19.43 | 32.02 |

Notice: The listing of Indian semiconductor corporations is derived from Tickertape Inventory Screener. The data offered right here is as of nineteenth February, 2025 and relies on market capitalisation.

🚀 Professional Tip: Utilise Tickertape’s Market Temper Index to gauge market sentiment and make knowledgeable funding choices primarily based on real-time market information and traits.

Overview of the Prime 10 Semiconductor Shares in India

Listed below are transient overviews of the highest 10 semiconductor corporations in India, together with the highest 5 semiconductor shares in India:

HCL Applied sciences Ltd

Based in 1976 and one of many NSE-listed semiconductor corporations in India, HCL Applied sciences is a multinational IT and consulting firm. It gives varied software program growth companies, enterprise course of outsourcing companies, and knowledge expertise infrastructure companies.

Vedanta Ltd

Based in 1965, Vedanta is a worldwide diversified pure useful resource firm working throughout segments: aluminium, copper, energy, iron ore, lead, silver, zinc, oil, fuel, and many others. The corporate has finalised a expertise partnership with Taiwanese agency Innolux and can be near finalising a partnership for semiconductor manufacturing. This makes it probably the greatest semiconductor shares for traders wanting on the semiconductor share listing in India.

Dixon Applied sciences (India) Ltd

Dixon Applied sciences is a multinational contract producer of electronics like washing machines, televisions, smartphones, LED bulbs, and many others. The corporate was based in 1993 as Weston Utilities Ltd. It is usually a key participant within the semiconductor share listing of India.

Tata Elxsi Ltd

Based in 1989, Tata Elxsi is concerned within the design and growth of pc software program and {hardware}. The corporate operates in two segments: system integration and help and software program growth and companies.

Moschip Applied sciences Ltd

Based in 1999, Moschip Applied sciences is a semiconductor and system design companies firm which focuses on mixed-signal IP, Turnkey ASICs, IoT options, semiconductor and product engineering catering to a number of sectors like automotive, medical, networking and telecommunications, client electronics, aerospace and defence.

ASM Applied sciences Ltd

Based in 1992, ASM Applied sciences gives enterprise and expertise consulting, software upkeep, enterprise options, product help, and many others.

MIC Electronics Ltd

Based in 1988, MIC Electronics is a producer of electrical lighting tools. The market capitalisation of the corporate is Rs. 2,244.69 cr.

Ruttonsha Worldwide Rectifier Ltd

Based in 1969, Ruttonsha Worldwide Rectifier is a producer of energy semiconductors and has over 5 a long time of affiliation with Worldwide Rectifier, USA.

Solex Vitality Ltd

Based in 1998, Solex Vitality manufactures photo voltaic panels, photo voltaic lighting techniques, photo voltaic water pumping merchandise and water heater merchandise.

SPEL Semiconductor Ltd

Based in 1984, SPEL Semiconductors is India’s first Semiconductor IC meeting and check facility supplier.

Find out how to Spend money on the Greatest Semiconductor Shares with smallcase?

smallcases are portfolios of thematic shares created and managed by SEBI-registered analysts. A smallcase permits an investor to diversify their portfolio within the sector. Amongst quite a few smallcases, the semiconductor smallcases are as follows –

Notice: The smallcases are talked about just for academic functions and will not be meant to be recommendatory. Buyers should conduct their very own analysis and seek the advice of a monetary skilled earlier than making any funding choices.

Related Union Funds 2025-26 Implications on the Semiconductor Trade in India

The Union Funds 2025–26 underscores the Authorities of India’s continued dedication to bolstering home semiconductor capabilities via enhanced funding and supportive insurance policies. Under are the important thing takeaways and implications of the Union Funds 2025-26 for the semiconductor sector in India:

- The federal government has earmarked Rs. 7,000 cr. for the semiconductor sector. This earmarked corpus goals to cowl varied segments of semiconductor manufacturing—starting from fabrication and packaging items to analysis, growth, and design initiatives. The outlay, as a part of the broader Manufacturing Linked Incentive (PLI) and allied incentive schemes, marks a notable growth within the authorities’s dedication to high-tech electronics manufacturing.

- Past pure manufacturing incentives, the Funds prioritises capability constructing, encouraging the institution of native fabless design startups and the event of superior testing and packaging infrastructure.This built-in strategy is meant to draw international semiconductor companies whereas concurrently fostering an indigenous ecosystem—masking the complete worth chain from chip design to fabrication.

- Reflecting India’s aspiration to change into a hub for semiconductor innovation, the federal government has launched focused packages for analysis and growth in chip design. Collaborations with academia and international expertise leaders are envisaged to expedite the coaching of specialized expertise, underscoring the Funds’s emphasis on skilling and upskilling in superior electronics.

What’s a Semiconductor?

A semiconductor is a tiny chip that offers life to digital units. It manages the circulate of electrical energy in digital merchandise like smartphones, computer systems, electrical autos, medical tools and gaming {hardware}. Semiconductors are utilized in client electronics like ACs, rice cookers, CPUs, and industrial units similar to ATMs, trains, and different infrastructures.

These are additionally utilized in Electrical Autos (EVs). And you needn’t one, however a whole bunch of chips to make an ordinary EV. The developments in synthetic intelligence (AI), the Web of Issues (IoT), and different types of expertise have shot semiconductor demand worldwide. Nevertheless, the provision chain constraints and international scarcity have put the semiconductor trade beneath immense stress these days.

What are Semiconductor Shares?

Semiconductor-related shares in India characterize shares in corporations that design, manufacture, and distribute semiconductors or chips. Shares of chip manufacturing corporations in India are integral to the electronics trade, producing tiny chips that energy a variety of units, from smartphones and computer systems to electrical autos and medical tools.

Investing in semiconductor shares permits people to take part within the development and developments of the expertise sector. Notable semiconductor corporations listed in India embody Intel, AMD, NVIDIA, and Qualcomm. Buyers usually monitor semiconductor shares listed in India to gauge traits in expertise and the general well being of the electronics market.

Influence of Semiconductor Scarcity

Provide chain constraints and a worldwide scarcity have made the semiconductor market fairly risky for 2 years now. The provision chain disruptions within the semiconductor area have impacted over 169 industries throughout international locations, together with India. As per Deloitte, the chip scarcity over the past two years has resulted in a income lack of over $500 bn.

What explains the worldwide semiconductor scarcity?

As per S&P World Engineering Options, semiconductor scarcity shouldn’t be new. It’s cyclical. Traditionally, the intervals of shortages have lasted six months to a yr, however the present one has deviated from that development. A couple of causes for this are:

Unexpected occasions earlier than and through the pandemic

In early 2019, a hearth in Ukraine impacted the manufacturing of semiconductor packaging materials. In March 2021, a hearth in Japan’s Renesas fabrication (fabs) facility pressured the microcontroller manufacturing to go offline for 3 months. Most of its chips supported the automotive trade. On the identical time, a cargo ship caught within the Suez Canal blocked the passage for over every week, impacting the chip supply in transit.

In October 2021, staffing shortages resulted in 77 ships getting bottlenecked exterior the Los Angeles and Lengthy Seashore docks. In February of the next yr, an ice storm in Texas resulted in an influence outage and compelled Samsung, NXP, and Infineon fabs to halt manufacturing.

These occasions cumulatively disrupted semiconductor corporations in India share costs and the worldwide provide chain.

The COVID pandemic

Challenges escalated in 2020 when pandemic-triggered lockdowns pressured semiconductor manufacturing corporations in India on the inventory market to cease manufacturing. The auto sector, which accounted for many of the demand, lower down its orders, anticipating a drastic fall in automotive gross sales.

Nevertheless, with companies present process digital transformation, the demand for chips has shot from newer merchandise like residence IT tools, smartphones, and leisure merchandise like PlayStations and VR headsets. This meant that the semiconductor market needed to transition from producing lower-cost automotive chips to costly processors for client items.

With an enormous hole in demand and provide, issues acquired messy. By the point economies began opening up, demand from the auto trade had added to the prevailing client items orders. Thus started the automotive chip scarcity.

Geopolitical points between the US and China

Southeast Asia, China, and Taiwan have been the hub for chip factories. Nevertheless, the geopolitics points and commerce battle between China and the US made issues onerous. China’s tech crackdown and its problem with Taiwan worsened issues.

New semiconductor manufacturing facility development

To bridge the immense hole in demand and provide of semiconductor chips, international locations throughout the globe commissioned new fab items. Upcoming semiconductor corporations in India and foundries have began planning for 29 new semiconductor factories throughout China, Taiwan, the US, Japan, and Korea. It takes ~3 years for fabs to change into operational. Whereas the trade expects 200 fabs to change into operational by 2026, the development of fabs has its personal challenges as a consequence of a scarcity of supplies and labour.

Overview of the Semiconductor Trade in India

At present, India imports 100% of its semiconductors, majorly from Taiwan, China, Korea, and Vietnam. This ends in an enormous import worth of ~$24 bn. The Ministry of Electronics and Data Know-how estimates that India’s semiconductor market will develop to $63 bn, 4 instances the present market, by 2026. And with the 5G rollout across the nook, the semiconductor demand could break the ceiling.

On January 18, 2024, the federal government accredited a deal between India and the European Union. The purpose is to collaborate on semiconductor analysis, innovation, and expertise growth. This partnership goals to make the semiconductor provide chain stronger in each India and the EU. It covers cooperation in broad areas, together with analysis and innovation, expertise growth, partnerships, and the alternate of market info.

How is India Planning to Deal with the World Semiconductor Scarcity?

The worldwide semiconductor scarcity and provide constraints have impacted varied sectors of the Indian financial system. The federal government has taken a number of measures, as mentioned under, to be higher ready to satisfy the demand for chips.

Funds sanctioned beneath the PLI scheme

The federal government has earmarked Rs. 76,000 cr. within the Manufacturing-linked Incentive (PLI) scheme for semiconductor and show manufacturing. Of the sanction quantity, Rs. 2.3 lakh cr. is reserved to encourage the home manufacturing of semiconductors. It will considerably profit Indian chip producers and bolster the semiconductor enterprise in India.

The target is to assist create a semiconductor ecosystem in India. The scheme will possible help the opening of ~20 semiconductor manufacturing shares in India within the coming six years. Moreover, design, parts, and show fabs are anticipated to be began. The scheme can even supply much-needed monetary help to the very best semiconductor corporations in India. The subsidies will cut back microchip manufacturing corporations in India’s manufacturing prices, encouraging them to extend manufacturing and maximise earnings.

Aside from serving to the highest semiconductor corporations in India listed in NSE, the PLI scheme can be anticipated to create employment alternatives there. As per the federal government, ~35,000 specialised and 1 lakh oblique job alternatives might be created. Not solely this, however the scheme may additionally generate investments of ~Rs 1.7 lakh cr.

Semicon India Program

To scale back its import dependency and assist remedy the worldwide chip disaster, the Indian authorities additionally introduced a ‘Semicon India Program’ in December final yr. This system welcomes semiconductor corporations to construct and function their crops. The federal government has supplied monetary help of as much as 50% of a challenge’s price to eligible producers, selling the expansion of semiconductor corporations’ shares in India.

The federal government accepted proposals from worldwide chip producers, and chip manufacturing corporations in India like TSMC, Foxconn, Fujitsu, Intel, and AMD had proven curiosity. Tata Group, one of many key gamers in AI chip producers in India, had additionally introduced plans to speculate as much as US $300 mn in a semiconductor meeting and check unit in South India. In December final yr, Vedanta introduced to speculate ~US $15 bn on a semiconductor plant. And just lately, it cheered the market by saying progress on the entrance.

Why Spend money on Prime Semiconductor Shares in India?

The federal government has taken a number of measures, similar to sanctioning funds beneath the PLI scheme and saying the Semicon India Program. This goals to make India a distinguished hub for the manufacturing of semiconductors, thereby boosting the highest semiconductor shares in India. Non-public corporations, each home and worldwide, have responded positively to this. A number of the examples are:

- Multinational mining firm Vedanta introduced a three way partnership with Taiwanese-based Foxconn. It has additionally signed two Memorandum of Understanding (MoUs) with the Authorities of Gujarat to arrange semiconductor and associated amenities in Ahmedabad.

- Tata Motors and Tejas Networks Ltd joined fingers with Japan-based chipmaker Renesas Electronics Corp to design, develop, and manufacture Renesas’ semiconductor options for rising markets, together with India.

- Rajesh Exports is planning an funding of $3 bn to arrange India’s first digital show plant in Telangana. The corporate has additionally utilized for the PLI scheme.

- When the federal government invited bids for semiconductor fab items, Ruttonsha was the one entity registered to make compound semiconductors. The corporate was taken over by US-based Silicon Energy Company in 2005, opening up doorways to developmental and technological experience.

- SPEL Semiconductor was the one one registered for semiconductor packaging beneath the PLI scheme.

These initiatives and partnerships show that investing in semiconductor firm shares is a profitable possibility, offered that plans and partnerships are executed properly.

Issues to Take into account Earlier than Investing within the Greatest Semiconductor Shares in India

- You may be sure that the corporate has displayed a constant improve in its income development. Furthermore, it also needs to have the ability to translate gross sales into earnings. Solely then can it reinvest earnings into analysis and operations to develop the enterprise additional.

- Firms among the many chip shares in India should have robust financials. Scan its revenue assertion, stability sheet, money circulate assertion, annual report, and different necessary paperwork to analyse the corporate’s previous and present efficiency. This might point out its prospects and information you in making the precise funding determination.

- Watch out for the dangers and developments within the semiconductor trade and inside the firm.

- Though the federal government is placing a lot effort into making India a worldwide semiconductor hub, the ecosystem would wish time to kind, keep, and develop. Initially, the very best semiconductor corporations in India would spend immense assets on analysis and operations, which might improve their prices and restrict their earnings. So, it could be finest when you’ve got a long-term horizon in thoughts.

- Don’t comply with suggestions, ideas, and unsolicited recommendation blindly. Seek the advice of a monetary advisor if want be, however be sure that you make investments solely after completely analysing the semiconductor shares in India.

Find out how to Analyse a Semiconductor Inventory in India?

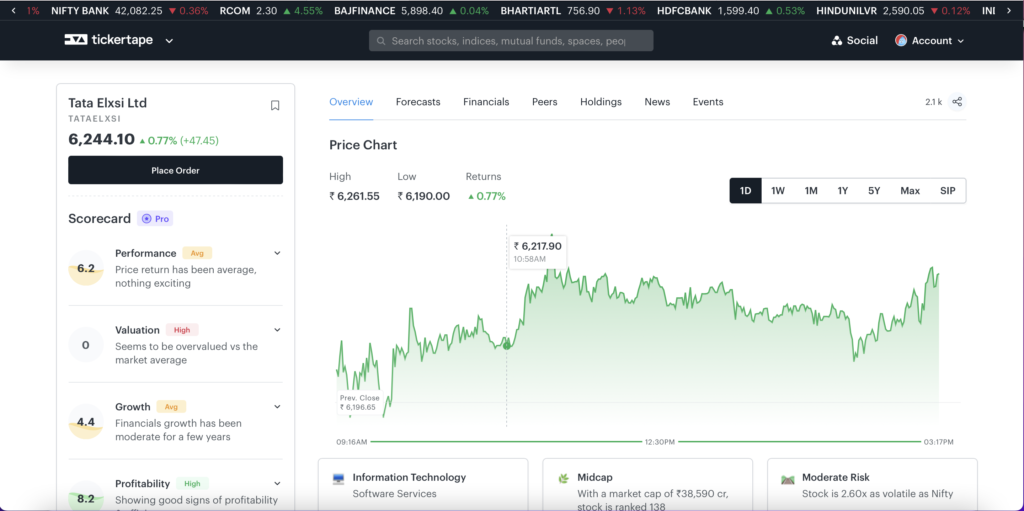

You need to use Tickertape to analyse any inventory within the NSE. Comply with the steps under to analyse a inventory on Tickertape.

- Log in Tickertape

- Enter the names of the semiconductor shares within the search bar

- You’ll get all the data relating to a inventory – its present worth, 1W returns, 3M returns, 1Y returns, and 5Y returns together with the important thing metrics of the inventory. Not simply that, you possibly can undergo the financials of the corporate within the ‘financials’ tab.

- You too can verify the Scorecard, which gives scores for efficiency, valuation, development and profitability of a inventory.

Regularly Requested Questions (FAQs) About Semiconductor Shares

1. What can substitute semiconductors?

Companies are consistently innovating to supply higher merchandise and improve their profitability. Subsequently, it’s no shock that semiconductor chips have an alternate. As of now, silicon carbide is claimed to be a key contender to chips. Nevertheless, such options would require years to exchange semiconductors as they’d require ample analysis earlier than manufacturing.

2. What’s the semiconductor shares listing?

Tata Elxsi Ltd, ASM Applied sciences Ltd, Dixon Applied sciences (India) Ltd, SPEL Semiconductor, and others are just a few semiconductor shares in India. Scroll to the highest to discover a longer semiconductor share listing in India.

3. What are the semiconductor shares in NSE?

At present, there are 11 semiconductor shares in NSE. They’re,

– Tata Elxsi Ltd

– ASM Applied sciences Ltd

– Dixon Applied sciences (India) Ltd

– SPEL Semiconductor Ltd

– Moschip Applied sciences Ltd

– Ruttonsha Worldwide Rectifier Ltd

– HCL Applied sciences Ltd

– MIC Electronics Ltd

– Surana Telecom and Energy Ltd

– Vedanta Ltd

– Solex Vitality Ltd

4. Who ought to put money into semiconductor shares in India?

Semiconductor shares in India swimsuit tech fans, long-term traders, and people within the expertise sector. Buyers with trade data and threat tolerance, monitoring international traits, can discover alternatives and think about semiconductor shares in India. Thorough analysis and session with a monetary advisor are important earlier than contemplating semiconductor shares in India.

5. What are the semiconductor penny shares in India?

With a detailed worth of Rs. 23.09, Surana Telecom and Energy Ltd is the one semiconductor penny inventory in India beneath Rs. 50.

6. What number of semiconductor corporations are there in India?

India has a rising semiconductor trade, primarily specializing in design, with corporations like Tata Elxsi, Wipro, and MosChip Applied sciences taking part in important roles.