Synopsis: The Indian actual property market is booming, creating a possibility for the NRIs, which is being pushed by financial development, transparency, and excessive demand throughout main cities in India. From Bengaluru’s IT-driven housing demand to Mumbai’s monetary powerhouse. With such all kinds of choices NRIs can efficiently profit from robust rental yields, capital appreciation, and even have the ability to obtain safe long-term investments in India.

The 12 months 2025 has made the Indian actual property market shine as essentially the most dynamic and promising business for Non-Resident Indians (NRIs), people who need to put money into their homeland. Pushed by sturdy financial development, enhanced transparency, elevated infrastructure, and excessive demand, India’s actual property area is now able to offering quite a lot of options for each capital appreciation in addition to rental yields. On this article, we’re going to take you thru the method of discovering the perfect Indian cities the place NRIs can take advantage of out of their actual property investments.

Why would NRIs put money into Indian Realty?

There are a number of causes for responding to this query as to why NRIs are interested in funding in property in India:

- Being near your roots

- Comparatively extra profitable returns in comparison with the abroad market

- Useful rules and guidelines.

- Rising demand for high-end housing

- Safety feeling if you possess a bodily asset in a secure market

Main Developments for NRI Funding in 2025

- Premium Phase Growth: The NRIs from the US, UK, GCC, and Southeast Asia, have been choosing the posh properties in India with worldwide customary facilities. Moreover, this sector is prone to broaden by 20% in 2025, with tier 2 cities becoming a member of in as nicely.

- Growth of Built-in Townships: Up to date gated communities with wellness zones, parks, and sensible know-how are gaining reputation.

- Rental Returns: City cities offering constant rental returns, notably alongside IT and enterprise corridors, are the primary desire for buyers contemplating their funding as a passive revenue supply.

High Indian Cities to Make investments for NRIs

1. Bengaluru

Providing careers in organisations inside the IT and startup ecosystem, Bengaluru has enticed professionals and companies from throughout the globe. This metropolis characteristic fashionable amenities, worldwide connectivity, and a gradual housing demand. Knight Frank’s Prime International Cities Index 2025 even positioned it in 4th place on the record of high international prime residential markets.

- Micro-market Hotspot: Whitefield, HSR Format, Indiranagar, Koramangala

- Rental Yield: 3.5-5%

- Why Make investments Right here: Excessive rental yields, quick worth appreciation, cosmopolitan type of residing, and great NRI inhabitants.

2. Hyderabad

This place is accompanied by inexpensive property costs, outstanding development within the tech, pharma business, and in addition has a fame for high-return investments. Hyderabad was at all times an NRI favorite.

- Hotspot Micro-markets: HITEC Metropolis, Gachibowli, Monetary District

- Rental Yields: 4- 5.5%

- Why to Make investments: Fairly priced luxurious, robust infrastructure, and investor-friendly insurance policies.

3. Pune

With instructional institutes, manufacturing items, and IT parks aspect by aspect, pune boasts its pretty productive infrastructure. Pune is counted among the many cities that’s preferrred each for actual property funding and for residing.

- Main Micro-markets: Baner, Hinjewadi, Magarpatta, Kharadi

- Rental Yields Vary: 3-4% (even as much as 5% in some micro-markets)

- Causes to Make investments Right here: This can be a mixture of that gives secure returns in addition to long-term appreciation for preferrred household and retirement residing.

Additionally learn: High 10 States in India with Finest Public Transport Amenities in 2025

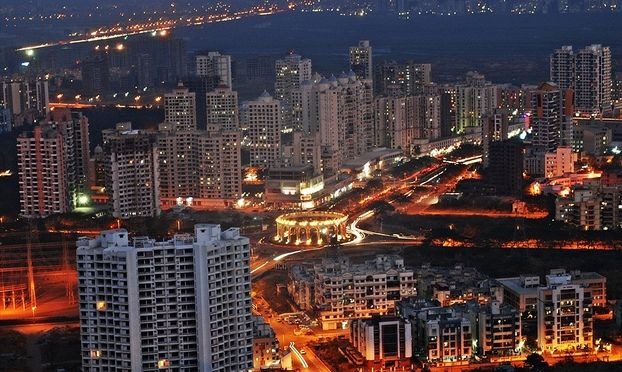

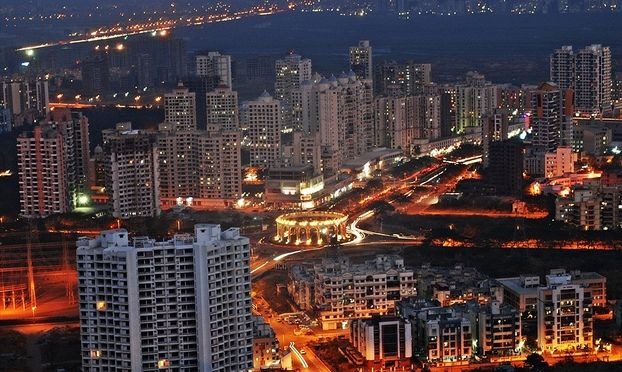

4. Mumbai Metropolitan Area (MMR)

Being the finance capital of India, Mumbai holds immense significance and is thought all around the nation because the monetary powerhouse. Actual property there has at all times been in nice demand. Satellite tv for pc cities and new suburbs similar to Thane and Navi Mumbai present a wider vary of choices for NRIs to contemplate for funding.

- Main Micro-markets: Mulund, Goregaon, Kandivali, Navi Mumbai, Thane

- Rental Yields: 2- 2.5% (central), 5% (suburban)

- Why to Make investments right here: Excessive capital appreciation, finest luxurious tasks, conducive worldwide enterprise surroundings.

5. Gurgaon

Gurgaon has been synonymous with its enterprise growth, cosmopolitan tradition, and quick tempo of urbanization. NRIs are attracted right here due to its luxurious built-in townships and the regular rising property tendencies skilled by town.

- Hotspots Micro-markets: DLF- Golf Course Street, New Gurugram, Dwarka Expressway

- Rental Yields: 2.5- 4%

- Why Make investments right here: Excessive rental demand, Fast capital appreciation, and a secure regulatory surroundings.

6. Chennai

Chennai has its modern manufacturing hub, in addition to its logistics business and early adoption of infrastructure tasks, which have put its actual property market on the upswing.

- Hotspots: Previous Mahabalipuram Street, Guindy, Porur, Tambaram

- Rental Yields: 3.5%- 4% (even as much as 6% in sure zones)

- Why to Make investments: Secure costs, NRI-friendly communities, balanced rental and appreciation potential.

Additionally learn: High 10 Indian States Contributing the Most to GST Income 2025

7. Ahmedabad

The important thing options of this metropolis are the Good metropolis tasks, higher infrastructure, and budget-friendly entry factors into the actual property markets, because of which Ahmedabad has emerged as a rising funding selection for NRIs for his or her investments.

- Areas: SG Freeway, Bopal, Satellite tv for pc, Prahlad Nagar

- Rental Yields: 3.9- 4.1%

- Why Make investments: Diverse property sorts, easy investor entry, long-term appreciation.

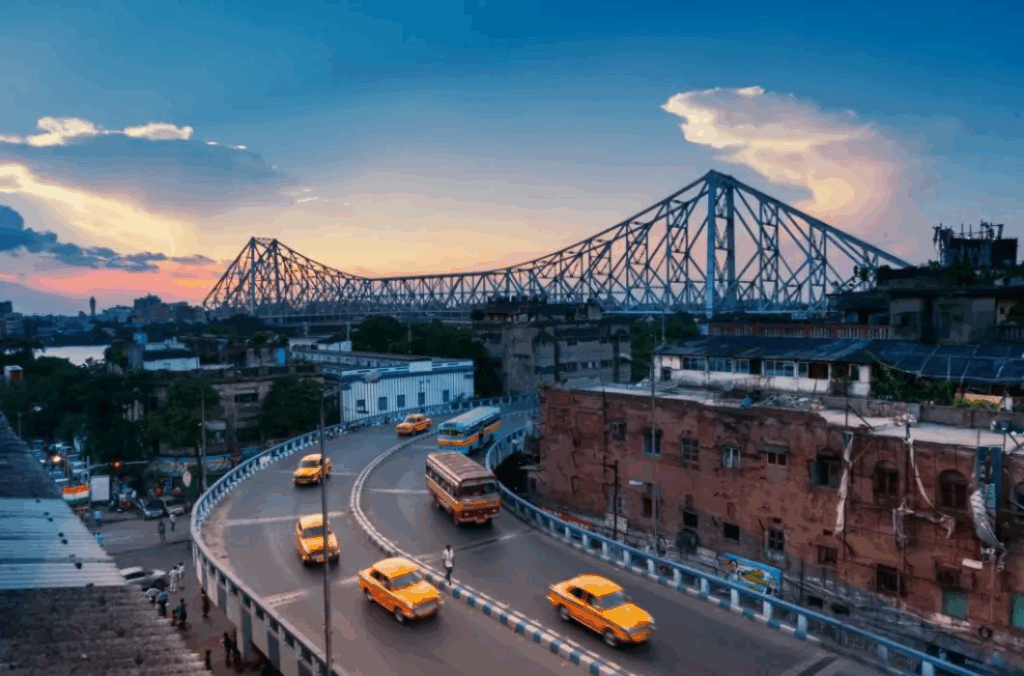

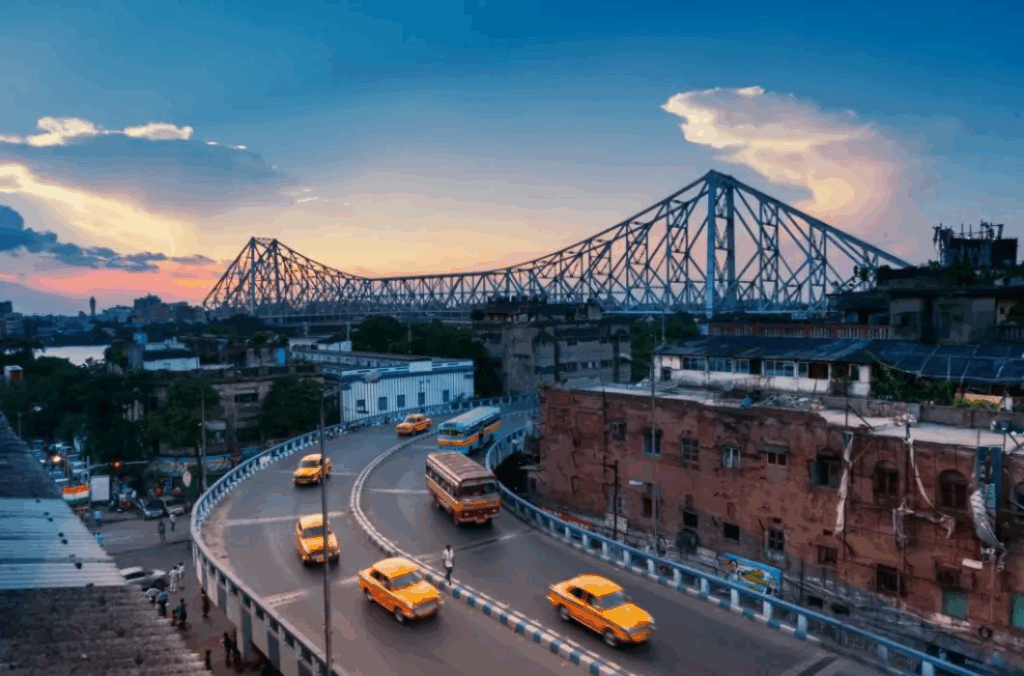

8. Kolkata

Kolkata, beforehand an rising market, is now ready to offer properties at affordable costs in addition to good appreciation alternatives, which is due to its quickly creating infrastructure.

- Hotspots Micro-markets: Rajarhat, Salt Lake Metropolis,New City

- Rental Yields: 3.5- 6.3%

- Why to Make investments right here: Lowered barrier to entry, excessive demand for residential housing, and rising business hubs.

What NRIs Ought to Search for in Actual Property Investments

- Location close to the IT and enterprise hubs: This supplies secure rental demand and future valuation of the property.

- Facilities Supplied: The property should be included with modern, inexperienced, and secure communities that tackle worldwide requirements.

- Clear title and builder fame: Make sure that the property is RERA permitted or that the challenge is being regulated by a regulatory authority, which can give a tangible observe file to instill investor confidence.

- Tax insurance policies: The latest reforms have enabled to implement smoother fund stream and streamlined tax compliance procedures.

Conclusion

The Indian actual property sector continues to be NRI-friendly. All of the cities mentioned right here have ranked constantly within the high positions for his or her security, funding return, life-style, and transparency of regulation. The rising digital improvements like digital excursions and AI-driven home discovering have made distant investments easy and safe. Since these industries are prone to continue to grow, NRIs investing at this time have the potential to profit from both- substantial monetary positive factors in addition to a long-term bond with India’s city future.

Written by Adithya Menon