What has the gold value developments been over the past 3, 5 and 10 years?

Gold has lengthy been thought-about a safe-haven asset, particularly during times of market volatility and inflation. The efficiency of gold costs in India has mirrored international financial situations, together with geopolitical tensions, foreign money fluctuations and altering rates of interest. India is without doubt one of the largest customers of gold globally with a long-standing cultural affinity for the dear steel. For a lot of Indians, gold shouldn’t be solely seen as a logo of wealth but in addition as a safe and steady funding.

Whereas the value of gold has skilled fluctuations over time, its enchantment as a dependable funding choice has remained robust. Prior to now decade, the value of gold has predominantly trended upwards with durations of progress pushed by international financial situations, inflation issues and market uncertainty.

3-Yr Efficiency (2021-2024)

During the last three years, gold costs in India have seen notable volatility. The worth of gold spiked in 2020 because the pandemic precipitated uncertainty in international markets, reaching an all-time excessive of over ₹56,000 per 10 grams in August 2020. Since then, gold costs have fluctuated, and as of late 2024, gold is buying and selling round ₹56,000-₹59,000 per 10 grams, sustaining a gentle however barely downward pattern in current months as a result of market restoration and a stronger greenback.

- Worth vary: ₹46,000–₹59,000 per 10 grams.

- Annual returns: Assorted because of the pandemic and restoration phases.

5-Yr Efficiency (2019-2024)

During the last 5 years, gold costs in India have seen an general upward pattern, pushed by elements similar to international financial uncertainty, low-interest charges and inflation issues. Costs noticed a major rise beginning in 2019, peaking throughout the pandemic in 2020. Since 2021, the costs have been steady however have confronted downward stress as a result of restoration in fairness markets and international rate of interest hikes.

- Worth vary: ₹32,000–₹59,000 per 10 grams.

- Annual returns: Robust upward motion, particularly in 2020 and early 2021.

10-Yr Efficiency (2014-2024)

During the last decade, gold costs in India have risen considerably. In 2014, the value of gold was round ₹26,000 per 10 grams. The final 10 years have seen important progress, particularly with the value crossing ₹50,000 per 10 grams throughout international market uncertainties. The general value motion reveals a powerful upward trajectory, though it has been punctuated by short-term corrections.

- Worth vary: ₹26,000–₹59,000 per 10 grams.

- Annual returns: Excessive long-term progress with some volatility, notably throughout international financial crises.

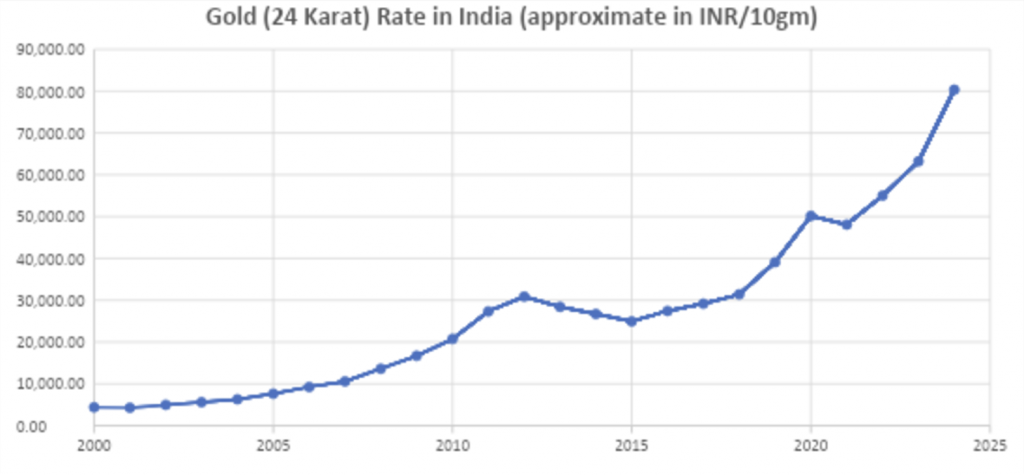

The under chart reveals the pattern of gold costs since 2000

Gold Index Efficiency in India

The Nifty Gold BeES and SBI Gold Fund are two examples of gold-focused indices in India. These funds monitor the value motion of gold within the home market and replicate the modifications in gold costs.

- 3-Yr Efficiency (2021-2024): The gold index funds carried out properly within the preliminary section of the pandemic in 2020 when gold costs surged. Nevertheless, the efficiency has stabilized since 2021 as fairness markets and rates of interest rebounded.

Return Vary: 10% to 12% yearly throughout the 2020-2021 surge, with a extra reasonable return in subsequent years.

- 5-Yr Efficiency (2019-2024): Gold index funds have mirrored the value progress of bodily gold over the previous 5 years. They’ve typically provided returns of 8%–12% per yr, particularly throughout financial uncertainties.

- 10-Yr Efficiency (2014-2024): The ten-year efficiency has been robust, with gold index funds providing regular returns consistent with the value improve in bodily gold, averaging 8%-10% yearly over the last decade.

Why Investing in Passive Funds Can Be a Higher Medium than Bodily Gold?

Whereas bodily gold has lengthy been a well-liked funding automobile in India as a result of its historic worth and cultural significance, passive funds that monitor gold costs or gold-related indices supply a number of benefits.

1. No Storage or Safety Considerations

Bodily gold requires secure storage, both in a locker or at residence, and poses the danger of theft or injury.

Passive gold funds, similar to gold ETFs and gold index funds are saved digitally, eliminating issues about bodily storage and safety.

2. Liquidity and Flexibility

Bodily gold will be cumbersome to promote, usually requiring you to go to a jeweller or seller. The costs may also range and the sale course of could take time.

Passive funds like gold ETFs are listed on the inventory alternate, providing excessive liquidity. You should buy and promote them anytime throughout market hours, offering way more flexibility in managing your funding.

3. Value-Effectiveness

Bodily gold comes with extra prices similar to making costs, taxes and storage charges. These prices can erode returns over time.

Passive gold funds typically have decrease prices and expense ratios. These funds replicate the efficiency of gold, so there are fewer related prices.

4. Diversification and Portfolio Administration

Passive funds let you put money into gold with out having to carry bodily gold. This lets you diversify your portfolio with minimal effort and threat as they’re usually a part of bigger, diversified monetary portfolios (shares, bonds and so on.).

Bodily gold will be a part of a restricted portfolio with out offering a lot diversification.

5. Tax Effectivity

Passive gold funds supply higher tax remedy in comparison with bodily gold. Gold ETFs are taxed below the long-term capital positive factors (LTCG) tax fee if held for greater than 3 years which is 20% with indexation advantages.

Bodily gold could entice larger taxes when bought and there are not any indexation advantages until held for a very long time.

6. Regulated and Clear Funding

Passive funds are extremely regulated by the Securities and Change Board of India (SEBI), providing a clear and safe funding choice.

Bodily gold, though a dependable asset doesn’t include the identical stage of regulatory oversight and shopping for can generally contain excessive seller margins.

Wrapping Up

In conclusion, whereas bodily gold has lengthy been a well-liked funding alternative in India, it comes with challenges similar to storage, safety issues and excessive transaction prices. Alternatively, passive funds similar to gold ETFs and gold index funds, supply a extra environment friendly and cost-effective different for gaining publicity to gold’s value actions. These funds present liquidity, ease of buying and selling and decrease administration prices in comparison with proudly owning bodily gold, all whereas monitoring the efficiency of the gold market. For buyers seeking to diversify their portfolios with gold, passive funds current a contemporary, hassle-free strategy to take part in gold’s long-term potential with out the complexities related to bodily possession.

Excited about how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Is UPI Killing the Toffee Enterprise?