Picture supply: Getty Photos

For most individuals, 5 grand per thirty days in passive earnings would do very properly. Certainly, which will even be sufficient to surrender work, assuming one isn’t planning common luxurious spa breaks in The Bahamas.

Arguably one of the best ways to focus on dividend earnings is inside a Shares and Shares ISA. This account shields any returns from taxes, permitting wealth to construct sooner.

Over the previous 10 years, a Shares and Shares ISA monitoring the efficiency of the FTSE 100 index has simply outperformed a Money ISA. The common return is round 9% per yr and barely increased with the S&P 500 thrown into the combo.

In distinction, money has returned round 2% to 2.5%, even together with increased rates of interest since 2022. This means savers would have misplaced actual buying energy over this era, resulting from inflation.

Please be aware that tax remedy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Aiming for a £1m portfolio

The annual contribution restrict for an ISA is £20,000. This implies it’s going to take time to construct as much as the determine talked about within the headline.

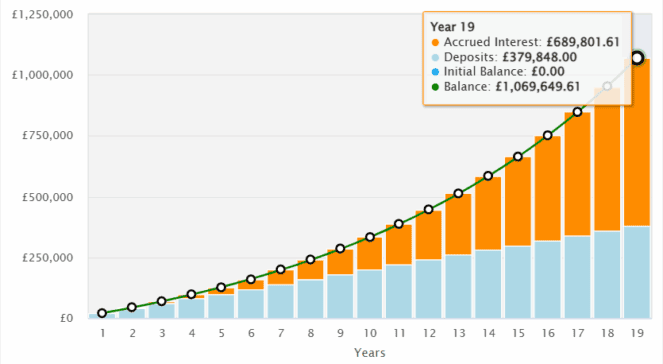

For instance, let’s say a portfolio yields 6% in future. To make a month-to-month earnings of £5,000, the Shares and Shares ISA will must be price £1m.

That’s clearly a big sum, and reaching it’d sound like a pipe dream, particularly when the annual ISA restrict is ‘solely’ £20,000.

Nevertheless, have been an investor to realize a mean 10% return, that seven-figure sum can be reached in just below 23 years. And the good information is that may be from investing £12,000 per yr (or £1,000 a month) slightly than £20,000.

But when the total ISA allowance was commonly invested, £1m can be achieved inside 19 years! And each of those examples contain somebody ranging from scratch.

Now, I ought to point out {that a} 10% return isn’t assured, whereas dividends might be suspended if a agency runs into hassle.

Nevertheless, the potential long-term rewards might be vital.

Prepared-made development portfolio

One strategy that might be used to intention for a ten% return is by investing in funding trusts. These are publicly listed firms that purchase a diversified portfolio of belongings, sometimes shares.

The Baillie Gifford US Progress Belief (LSE: USA) is one which I fee extremely. Among the many belief’s high holdings is Meta Platforms, whose earnings have simply blown previous Wall Steet’s expectations. AI is turbocharging advert efficiency throughout Fb and Instagram, delivering effectivity and higher returns.

In the meantime, gaming platform Roblox has executed one thing comparable. As I write at present (31 July), shares of Meta and Roblox are up 12% and 17%, respectively.

It appears to be like just like the belief’s managers have an eye fixed for excellent inventory picks (together with Nvidia).

One threat right here although is that the portfolio is closely tilted to US tech shares. Had been these to fall from grace, the belief would probably underperform. There’s additionally no geographic diversification (although most US tech companies are international these days).

The belief is presently buying and selling at a 7.5% low cost to web asset worth, which I discover engaging. I reckon it’s price contemplating, particularly as a solution to acquire portfolio publicity to the deepening AI revolution.

As soon as the ISA reaches the magic £1m mark, it might then be potential to focus fully on dividends shares. A 6%-yielding portfolio would then throw off the equal of £5,000 a month in tax-free passive earnings.