Are you one of many NRI’s who needs to know in case you ought to make investments your cash in India and methods to do it? Then this text is an efficient place to begin with.

There are shut to three crores NRI’s and PIO from India in numerous components of the world, nonetheless, this put up is especially for these NRI buyers who exit of India for 2-10 yrs and can principally return again after few years of labor.

Usually, there’s a notion that NRI’s make some huge cash exterior India as they’re paid in {Dollars} and Dirhams! Whereas that is true on the whole, one can’t deny that their bills are additionally excessive and their life out of India is difficult because it’s a distinct metropolis, tradition, and surroundings general.

NRI’s earn properly, spend properly and most often additionally “save” an honest sum of money each month. Even when one some is saving $2,000 in USA it’s near 1.5 lacs a month in any case. So the primary problem is to “save” cash if you are NRI and the second is to take a position it correctly and handle it properly, particularly in case you are have restricted time in your arms as an NRI.

What an individual can save in India in 5 yrs, many NRIs can try this in simply 1 yr – which implies that if an NRI plans properly – he/she will be able to do financially very properly in 8-10 yrs and are available again to India semi-retired or absolutely retired.

On this article, we’re simply going to do some dialog relating to the assorted choices accessible to NRI’s for investments and why they need to select India for his or her funding function. I cannot cowl too many technical guidelines or facets associated to investments on this article and can hold it fairly too the purpose.

Which checking account to make use of – NRE or NRO?

Lots of NRI’s hold utilizing their saving checking account for a few years, with out realizing that it’s unlawful. The second you turn out to be an NRI, one must convert their financial savings checking account to NRE or an NRO account. Or one can open a brand new NRE/NRO account if wanted.

NRE account is a checking account the place the cash is full repatriable – which implies that it is possible for you to to take out all the cash again from the NRE account and use it in a rustic the place you might be residing. It’s an account the place you may deposit each your international and Indian earnings.

Alternatively, the NRO checking account is barely partially repatriable and you’ll solely deposit your Indian earnings on this account.

So relying in your scenario and earnings sort, you’ll want to open these accounts. One can have any variety of NRE/NRO accounts if required. There are too many facets you’ll want to take into account between NRE / NRO account, which is defined within the desk beneath

[su_table responsive=”yes”]

| Comparability | NRE Account | NRO Account |

| Revenue will be Deposited | Overseas earnings and Indian Earnings | Solely Indian Earnings |

| That means | Tax-Free | Taxable |

| Repatriability | Absolutely Repatriable | Partial (curiosity absolutely and precept inside set limits) |

| Joint Account | Will be opened by 2 NRI’s | Will be opened by an NRI together with one other resident or NRI’s |

| Deposits and Withdrawals | Can deposit in international forex, and withdraw in Indian forex | Can deposit in international in addition to Indian forex, and withdraw in Indian forex |

[/su_table]

Click on right here to be taught extra about NRI funding companies by Jagoinvestor

4 the explanation why NRI’s ought to spend money on India?

Must you be investing your cash within the nation the place you might be residing or in India? Does it make sense to earn and keep within the US or the Center East, however make investments all that cash in India? Many NRIs are confused about this, so I’ll simply offer you 4 small factors which you have to be aware of.

Purpose #1 – India is one the quickest rising and a steady Economic system

Word that India is likely one of the quickest main economic system and fairly a steady nation in comparison with many others the place NRI’s reside. It’s vital to make it possible for your cash is invested within the nation which is steady sufficient. On prime of that, you additionally assist in rising the international change of your nation.

Purpose #2 – Excessive-Curiosity Charges

In comparison with many developed economies, the rates of interest or “returns” you will get in India is kind of good. Japan has destructive rates of interest and the US has no more than 2-3%. Many NRI buyers make the error of holding an excessive amount of cash within the financial institution accounts exterior India and earn little or no rates of interest.

Purpose #3 – Since you perceive the investments in India

There’s a excessive likelihood that you simply already perceive varied Indian investments choices and monetary merchandise. Additionally, you’ll by no means worry what occurs to your cash as a result of there’s a sense of familiarity with India’s markets and monetary ecosystem.

Purpose #4 – Largely you may be again to India

A overwhelming majority of NRIs return again to India after working for a couple of years exterior and eventually use all their investments again in India. That’s one sturdy purpose why you must make investments a serious a part of your cash in India itself.

I don’t imply to say that no funding merchandise exterior India are higher than Indian monetary merchandise. There’ll certainly be choices which will be checked out, please try this in case you’re feeling you need to.

What choices do NRI have for investments in India

Rapidly, let’s see what varied choices are the place NRI’s can put their cash for brief – long run. This isn’t a information which provides you with very detailed data, however a fast commentary of what the choice is all about.

#1 – Financial institution NRE Deposits

Financial institution NRE deposits are one of many great selections an NRI could make. The curiosity you earn on NRE deposits is tax-free and it’s a easy product that provides you first rate risk-free returns. You may select the NRE deposits for some a part of your investments in case you don’t need to complicate issues and are investing for lower than 5 yrs.

Many NRIs take a mortgage from the native banks at low-interest charges and spend money on NRE deposits and earn the margin. See if this can be a worthwhile factor to do in your case of not.

#2 – Actual Property

One the new favourite for NRIs is actual property in India. Actual property investments require big-ticket investments and lots of NRI’s have that. Even in case you are shopping for a flat or land on installments, it really works properly for NRI’s are they’ve a giant disposable earnings per 30 days. One in every of my shut pals additionally invested within the Hiranandani challenge in Bangalore by making a down fee as a result of they knew that the installments to be paid will probably be straightforward on the pocket with NRI earnings.

The one destructive facet is that many NRIs select actual property simply primarily based on the restricted data sitting exterior India or in a hurried method. So ensure you take your time in researching the property and take selections slowly. Because it’s a excessive ticket transaction, its extremely really useful to rent an actual property lawyer, pay them charges and get all of the work accomplished like title search, property inquiry. If wanted go along with an actual property dealer who can handle the whole lot for you!.

Yet one more factor NRI ought to know is that they’re allowed to solely purchase residential or industrial actual property, however not agricultural properties.

#3 – Insurance coverage Insurance policies

There are a lot of Insurance coverage insurance policies (which are literally funding polices) which can be marketed properly for NRIs. These, for my part, are to be rigorously chosen as many conventional merchandise can transform dud investments and a really unhealthy alternative of long run investments. Some ULIP’s out there have gotten reintroduced with decrease expenses and significantly better construction – so please select them after plenty of research and just for the long run.

I’d strictly advise in opposition to conventional funding possibility which doesn’t have publicity to fairness in them as a result of they aren’t higher than regular NRE deposits.

NRI’s can and can purchase the pure insurance coverage coverage (time period insurance coverage) in the event that they require it.

#4 – Direct Fairness

Direct fairness is an efficient alternative for NRI buyers, supplied they know the fairness sport and are capable of decide the fitting shares with correct analysis (both on their very own or on somebody’s recommendation). Be sure you don’t over diversify your inventory portfolio, as a result of with an excessive amount of cash you could go on a purchasing spree, which is able to make your portfolio very advanced and with unhealthy shares.

If you wish to do fairness and need to take excessive threat, you may also have a look at PMS. In order for you assist in PMS, our staff might help you out with that. Word that with the intention to spend money on fairness, an NRI wants a PIS permission (portfolio funding scheme). These are typically accomplished by your dealer or buying and selling account supplier and also you don’t have to fret about it.

#5 – Mutual Funds

Mutual funds are fairly sizzling lately amongst NRI’s and it certainly is likely one of the finest selections for investments, supplied you could have correct steering about it.

In Mutual funds, you could have two selections – Fairness mutual funds and Debt Mutual funds.

Fairness mutual funds are long run monetary merchandise that may ship extraordinarily good returns if managed properly. Those that are comfortable with volatility of their portfolio and wish very tax optimized inflation-beating returns for his or her long run targets, for these NRI’s mutual funds are an excellent alternative.

Even Debt mutual funds are an excellent alternative for these NRI’s who don’t need to get into fairness threat and wish options to financial institution deposits and bonds. Debt mutual funds are fairly a great possibility even taxation sensible in case you are prepared to take a position for greater than 3 yrs.

[su_table responsive=”yes” alternate=”no”]

| Taxation | Fairness Mutual funds | Debt Mutual funds |

| Brief Time period Capital Achieve (STCG) (Earlier than 1 yr) | Taxable @ 15% | Taxable as per Revenue tax slab price |

| Lengthy Time period Capital Achieve (LTCG) (After 1 yr) | Taxable @ 10% the place LTCG>1 lakh (No indexation profit) | Taxable @ 10% with out indexation or 20% with indexation |

[/su_table]

NRI’s from USA and Canada can even spend money on mutual funds, however solely with some restricted mutual fund homes attributable to FATCA compliance. Here’s a detailed information on NRI’s investments in mutual funds

We at Jagoinvestor handle greater than 140 NRI households’ investments in mutual funds. If you wish to discover what we’ve to supply, please do tell us by clicking right here and schedule a cellphone name with us.

#6 – Bonds and NCD

NRI’s can even spend money on varied bonds and NCD’s that are issued every now and then. These devices have fastened curiosity which you will get yearly credited in a checking account and also you get your precept on maturity. The liquidity must be compromised in these devices as getting out of those earlier than maturity turns into very powerful even when these are tradable within the secondary market.

#7 – PPF

PPF is a alternative for these NRI buyers who already had it opened whereas they have been in India as a result of an NRI can’t open a recent PPF account. Additionally, PPF goes to be a restricted time product as one can’t be prolonged past 15 yrs.

#8 – NPS

NPS is one other alternative to your long run investments if one needs fairness publicity of their portfolio, and pension advantages embedded into the product itself. Solely NRI’s who’re Indian residents can spend money on NPS. PIO and OCI should not eligible for opening the NPS account. In NPS, you get selections between fairness investments, govt securities, and different fixed-income devices.

Word that in NPS your financial savings get locked in until your retirement and solely after that you simply get a component in a lump sum and relaxation is used for a pension. So select NPS in case you are very clear that your retirement goes to be in India.

KYC compliance and taxation For NRI’s

Word that when you turn out to be an NRI, there are many compliance which must be adopted by you. There are limits on the place you may make investments and the place you may’t? Even the taxation for NRI’s is totally different and guidelines relating to TDS are totally different. We aren’t going into element on this article relating to this as its out of scope.

Tips on how to keep away from double taxation for NRI investments?

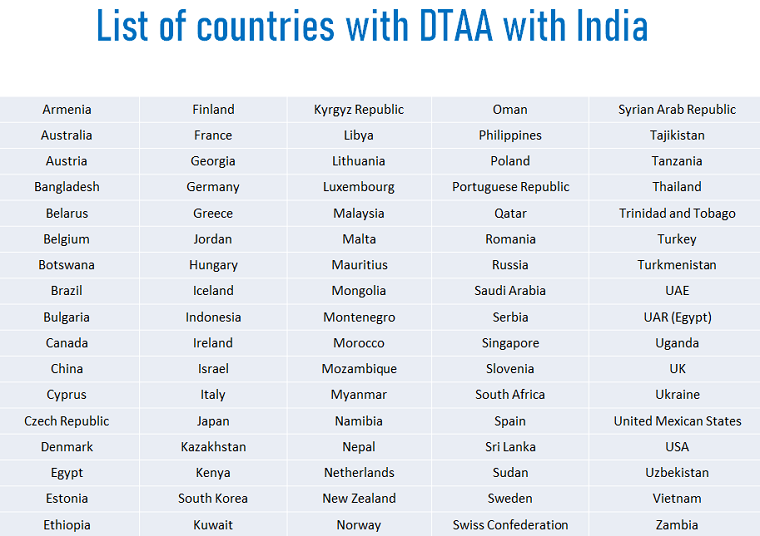

Lots of international locations have DTAA agreements (double taxation avoidance settlement with India. Within the case of NRIs – one can keep away from paying double taxes in nation of residence and India attributable to these agreements. You will get an equal deduction if DTAA exists between each international locations.

Let me offer you an instance – In USA, an individual has to pay the earnings tax on international earnings, so if an NRI has Rs 1 crore of FD in India they’ll pay the tax in India in addition to in USA, however due to DTAA they are going to be avoiding it. There may be paper work concerned right here, however you may certainly save the double taxes.

When ought to an NRI make investments exterior India?

Whereas India is a good place to take a position for NRI’s general, there could also be sure life conditions and a few circumstances the place investing within the nation the place you might be working could also be a good suggestion. There could also be sure international locations which may additionally offer related or higher rates of interest and returns in comparison with India. Nevertheless, makes certain you take into account the security and return of your capital if you are investing together with tax to be paid.

Do tell us if in case you have any extra questions associated to NRI’s investments in India? Share your questions within the feedback part.