Interarch Constructing Merchandise is a well known identify within the Pre-Engineered Buildings (PEB) enterprise in India, with over 30 years of experience. It has the second-largest mixture put in capability (161,000 MTPA) amongst built-in PEB companies within the nation and ranks third within the trade. With a market share of 6.5%, the corporate efficiently executed 677 PEB contracts between FY15 and FY24.

(A) About

Interarch is a distinguished supplier of turnkey pre-engineered metal development options in India. Interarch specializes within the set up and erection of pre-engineered metal buildings (PEBs) and has complete capabilities that embody design, engineering, manufacture, and on-site undertaking administration.

Its PEB options are custom-designed, engineered, and fabricated to serve clients in industrial, infrastructure, and constructing purposes and residential, industrial, and non-commercial initiatives. Interarch has accomplished initiatives in numerous industries, from multi-level warehouses for e-commerce purchasers to manufacturing services for paint, FMCG, and cement. Moreover, In addition they present large-span PEBs for indoor stadiums and different infrastructure wants.

The corporate’s marquee of consumers embody Ampin Photo voltaic, Pepsi Craftsman, Indospace, Welspun, Godrej, and loads of different nicely established manufacturers. The corporate works as an infrastrasture and capital expenditure adjoining participant.

Conventional RCC vs Pre-Engineered Buildings

The Pre Engineered Buildings have a definite options that may present important advantages over the normal RCC(Concrete Constructing):

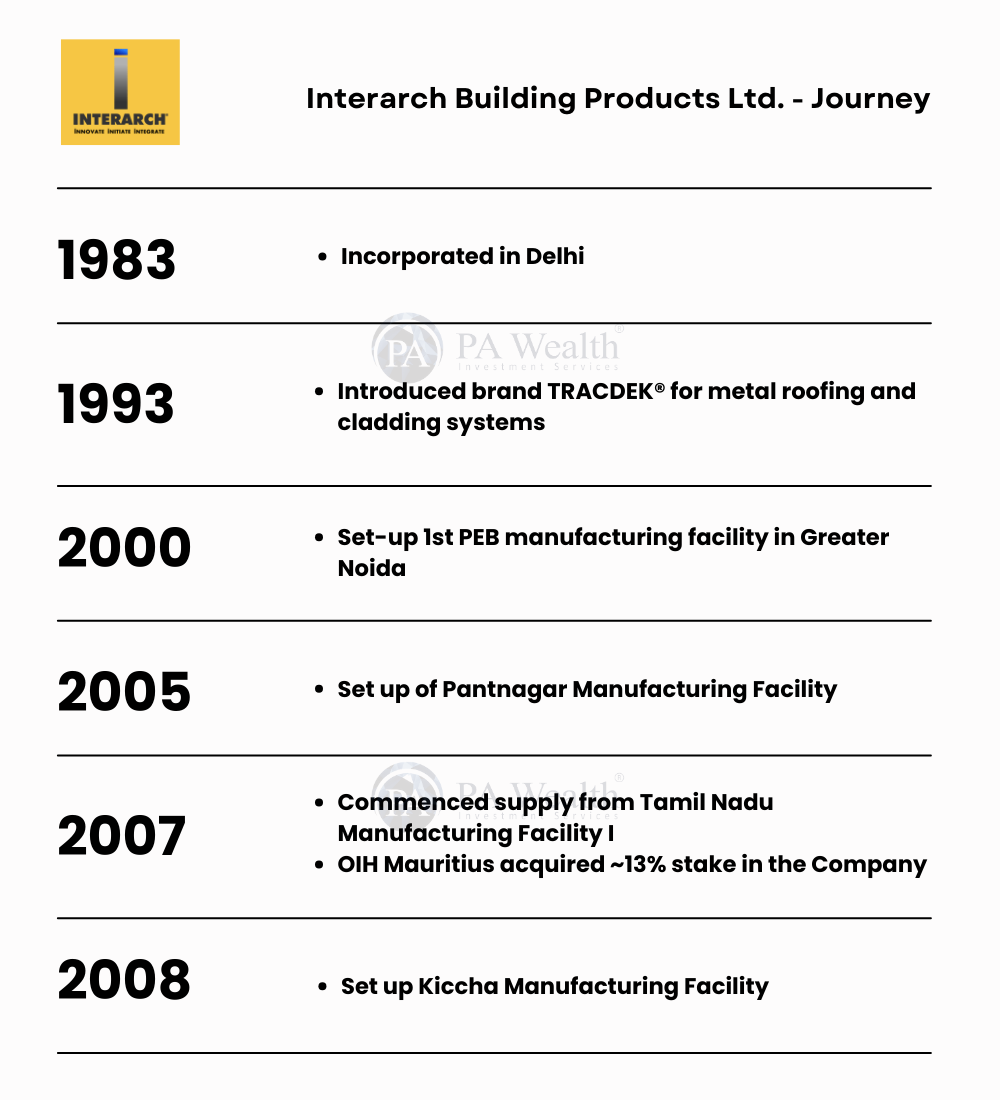

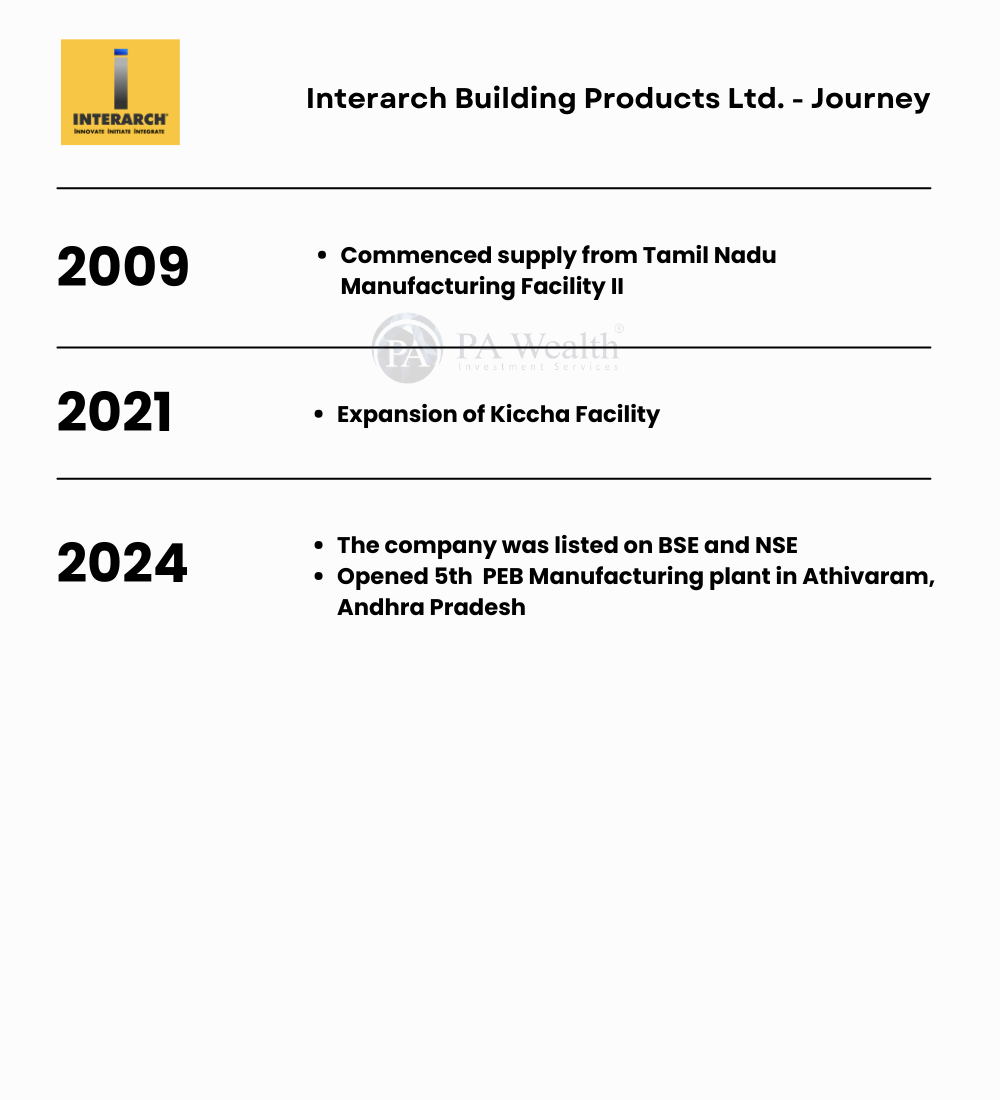

(B) Journey of Interarch Constructing Merchandise

(C) Business Overview

Industrial Sector

Building spends inside industrial or manufacturing rose by 6% to eight%. It’s anticipated to stay fixed over the subsequent few years. Govt. insurance policies corresponding to Atamnirbhar Bharat, PLI(Efficiency Linked Incentive) Scheme and so on. has been useful in driving these spends particularly in sectors like renewable energy, {hardware} manufacturing, auto parts and so on.

Metal Business India

The metal trade’s manufacturing capability which was 91 MT in FY18 elevated to 120 MT in FY24 and is predicted to additional develop signicantly over the subsequent decade. Additionally, Govt. Insurance policies corresponding to Pradhan Mantri Awas Yojana and PLI Scheme have main affect on enlargement drive. India is predicted to make further capital expenditure of 10 Lakh Crores and electrical energy provide of 27 GW to accomodate the capex.

Pre-Engineered Buildings Business

Market dimension of pre-engineered metal buildings in India:

- The trade grew at a CAGR of round 8.5% between 2019 and 2023, from ₹ 130 billion in 2019 to ₹ 180 billion in 2023. Market dimension will attain ₹195-200 billion in FY24. Moreover, The trade is predicted to develop at a CAGR of 10.5-11.5% between 2023-2028, reaching ₹ 295-310 billion. Furthermore, Investments in industrial and infrastructure sectors, together with warehouses, logistics, and expressways with facilities and toll plazas will additional speed up the expansion.

- Structural metal use circumstances embody metro station, airport, telecommunications, broadcasting, floodlight, and energy transmission towers, driving enlargement in India’s pre-engineered metal constructing sector. The Indian authorities’s concentrate on infrastructure spending will improve demand for metal development buildings.

Pre-engineered metal buildings trade segmentation by finish person:

- Pre-engineered metal development is turning into more and more frequent in industrial, infrastructure, and industrial sectors, together with cars, cement, paper, workplaces, airplane hangars, warehouses, and information facilities. Firms usually use pre-engineered items to hurry up the development course of whereas sustaining high quality.

- Pre-engineered development eliminates uncontrollable exterior components like climate, leading to improved high quality management by way of standardised operations and streamlined processes.

- Pre-engineering reduces development time for industrial complexes, hospitals, workplace buildings, and high-rise initiatives whereas sustaining high quality. Pre-engineered metal buildings are generally utilized in colleges, exposition halls, hospitals, theaters, auditoriums, gymnasiums, and indoor sports activities courts.

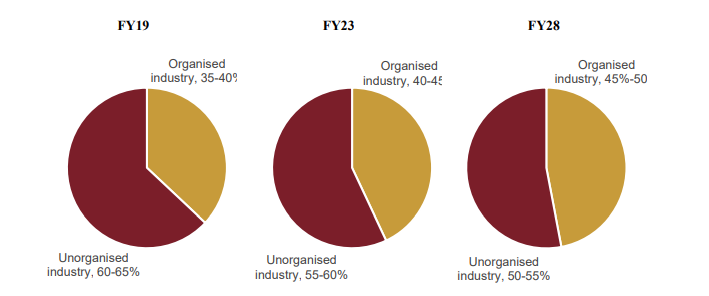

PEB market stays aggressive with an enormous unorganized gamers:

- As of FY23, the organized trade had a 40-45% income market share of the full trade. Interarch Constructing Merchandise Restricted and Kirby Constructing Methods held 40-50% of the market share within the organized trade.

- In FY23, six essential corporations management 80-85% of the organized trade, which accounts for 35-40% of the full market. The six necessary gamers are Interarch, Kirby, Pennar, Phenix / M&B Engineering, Everest Industries, and Zamil, in no explicit order. The rest is a fragmented, unorganized sector.

- Unorganized industries make up 55-60% of the market on account of their low capital funding entry obstacles. The organized sector outperforms the unorganized sector when it comes to reliability, provide chain expertise, and high quality engineering companies, resulting in an rising shift in the direction of it.

(D) Board of Administrators | Interarch Constructing Merchandise Evaluation

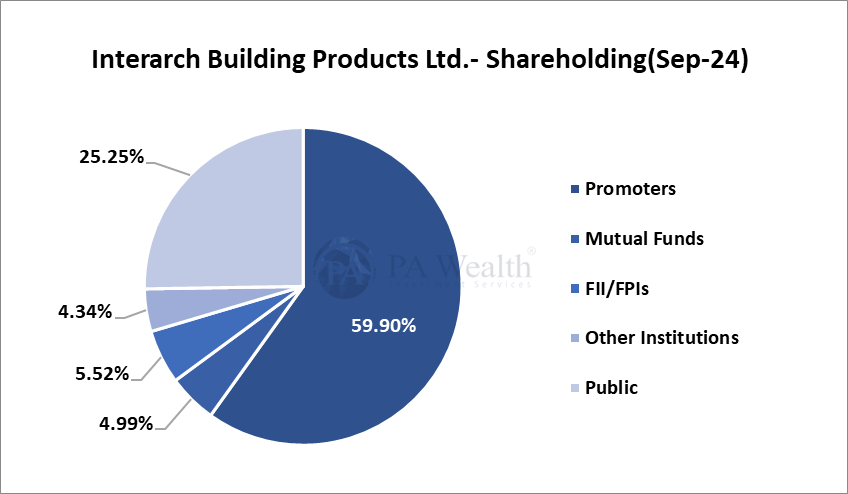

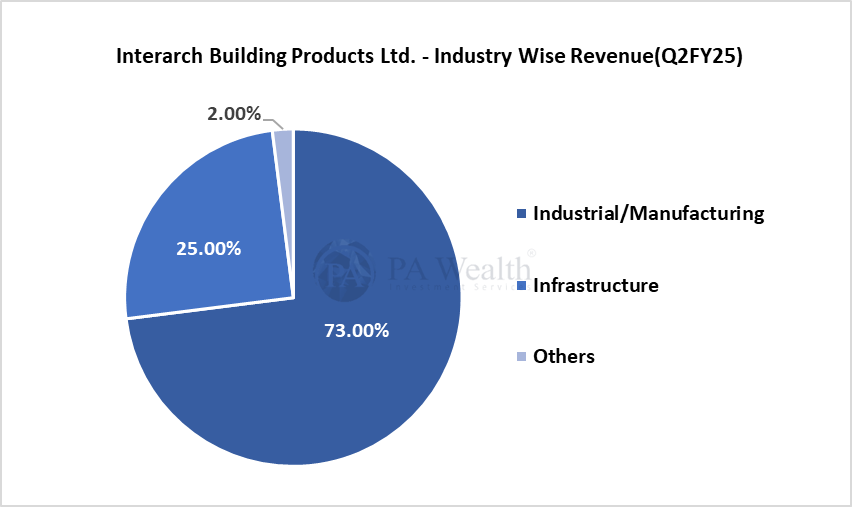

(E) Shareholding Sample | Interarch Constructing Merchandise Evaluation

(F) Product Segments | Interarch Constructing Merchandise Evaluation

Interarch Constructing Merchandise’ product segments are divided into three essential classes:

1. Steel ceilings and roofing:

- TRAC® Steel Suspended Ceiling Methods are developed to supply environment friendly ceiling options.

- TRACDEK® Steel Roofing & Cladding Methods provides long-lasting roofing and cladding options.

- TRACDEK® Daring Rib is a everlasting metallic decking system used as a shuttering over metal framing that’s each structurally secure and straightforward to put in.

2. PEB (Pre-engineered Constructing) Metal buildings:

- Main framing programs embody parts corresponding to main load-bearing frames, end-wall frames, wind bracings, crane brackets, and mezzanine beams and joints to make sure structural integrity.

- Secondary framing programs embody roof purlins, wall girts, eave struts, and clips, which add structural help.

- Interarch Life gives whole PEB programs suited to specs for non-industrial buildings, that are put in with the help of third-party builders and erectors.

3. Mild Gauge Framing Methods:

This class combines main and secondary framing programs, in addition to metallic ceiling and corrugated roofing options, to supply light-weight and sturdy framing options.

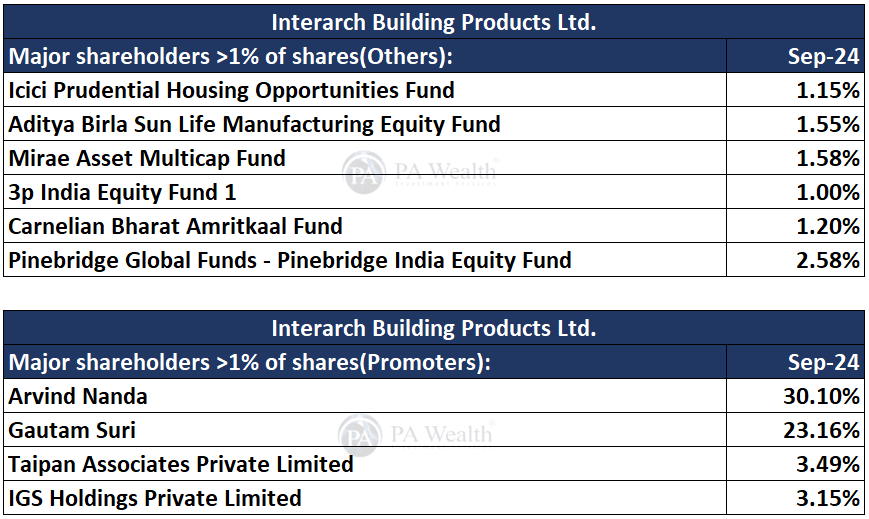

(G) Peer Comparability | Interarch Constructing Merchandise Evaluation

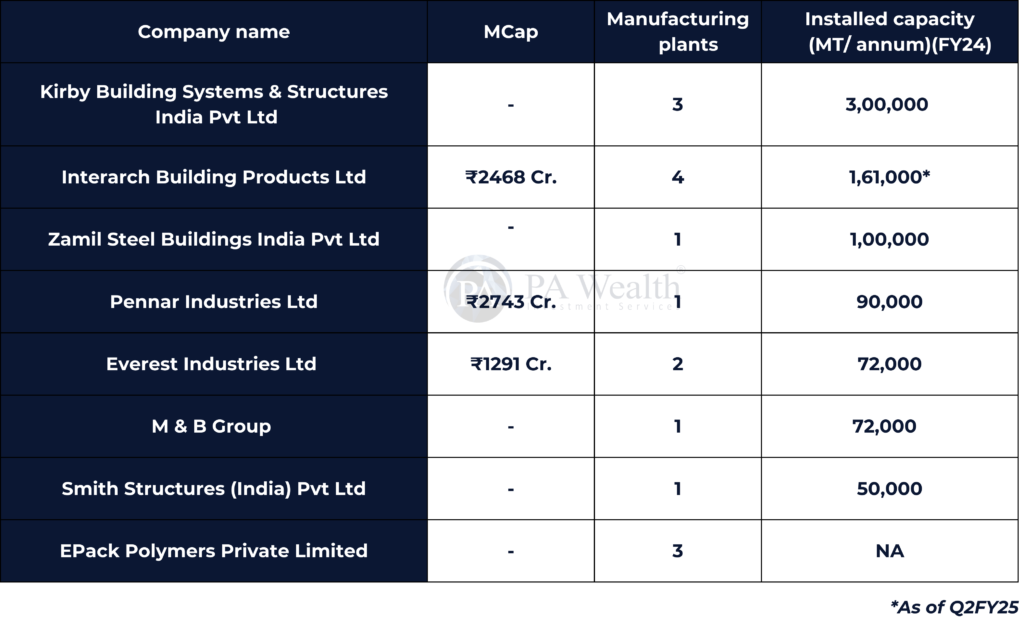

(H) Income Segments

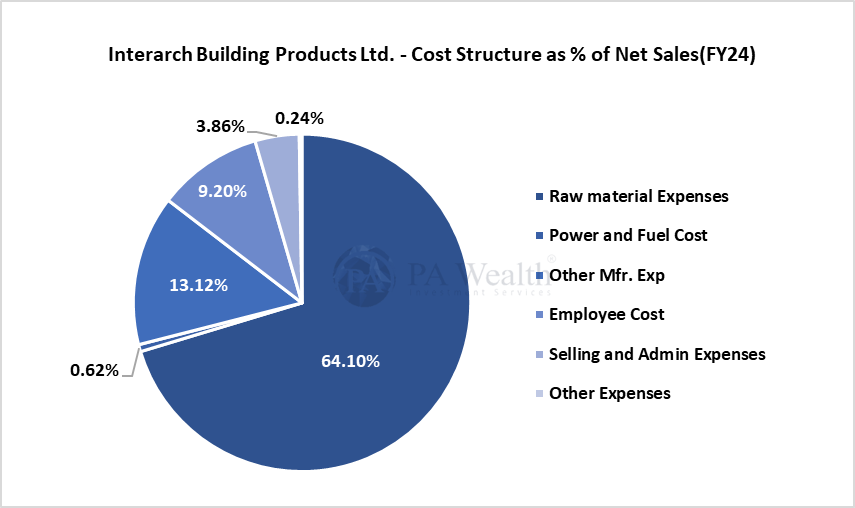

(I) Price Construction | Interarch Constructing Merchandise Evaluation

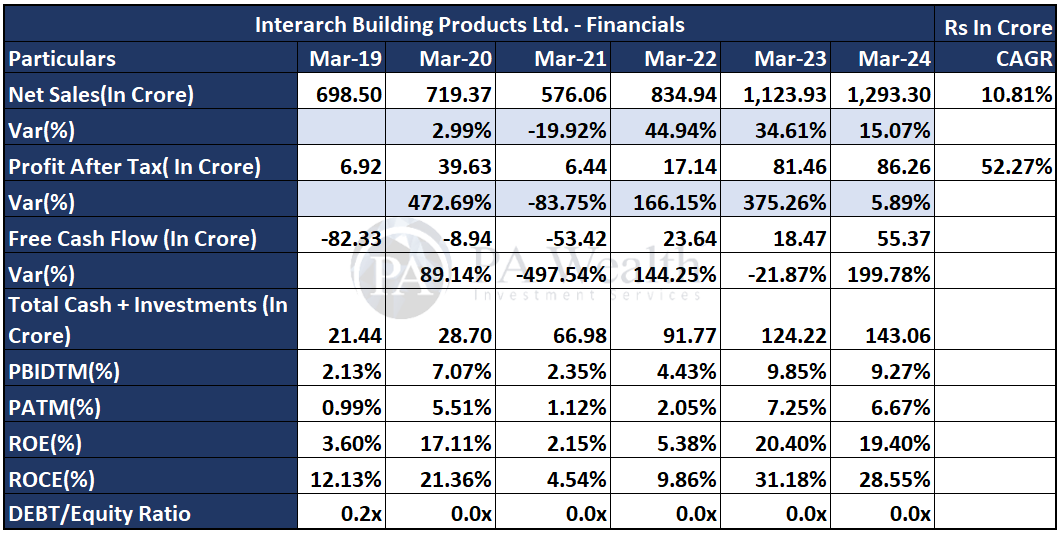

(J) Financials | Interarch Constructing Merchandise Evaluation

The corporate’s income has grown at a CAGR of 10.81% over the previous 6 years, rising from Rs 698.5 Cr. in FY19 to Rs 1293.3 Cr. in FY24. Subsequently, the corporate’s PAT has additionally proven progress, rising from Rs 6.92 Cr. in FY19 to Rs 86.26 Cr. in FY24 at a CAGR of 52.27%. Moreover, the corporate’s ROE has seen a lower from 3.6% in FY19 to 19.4% in FY24.

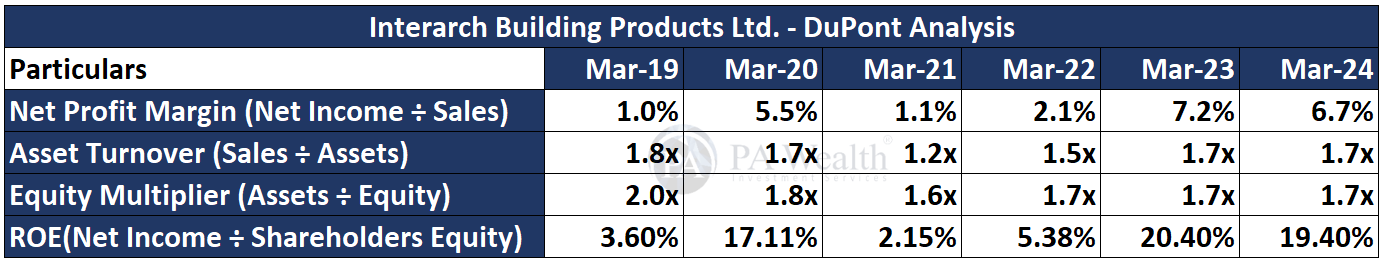

DuPont Evaluation

(Ok) Administration Dialogue

Concall Highlights | Interarch Constructing Merchandise Evaluation

- Q2FY25 income stood at 323 Cr., up 8.5% YoY whereas H1 income totaled 627 Cr., a 6% progress YoY. The corporate witnessed 17.6% YoY improve to 26,274 tons in Q2FY25 and for H1FY25 elevated by 10.1% YoY to 48,868 tons. Q2FY25 EBITDA margin was 7.8%, whereas H1FY25 at 8.3%.

- Present order ebook stands at ₹1,303 Cr., which interprets to 9-10 months of gross sales. Main initiatives embody battery crops, manufacturing services, and renewable vitality crops.

- The corporate holds approx. 15% of the organized pre-engineered constructing market whose worth is ₹8,000 crores.

- Interarch plans to determine a brand new facility in Kheda, Gujarat, which can have the identical capability of its present crops, aiming for a turnover of 500 crores yearly. Centered on information facilities as a progress space, with bids for initiatives in Chennai, Noida, and Mumbai reflecting renewed exercise within the sector.

- The corporate has excessive operational leverage, with increased turnover bettering margins. The corporate’s present targets embody attaining 9%-10% EBITDA margin over the subsequent fiscal 12 months.

- The corporate maintains shut involvement from undertaking conception to supply, positioning itself as a “capital items companion” relatively than only a contractor. It strictly adheres to cost phrases with clients, guaranteeing easy money move and constant turnover

- Interarch has witnessed progress in demand from industries like renewable vitality, battery manufacturing, and new-age sectors corresponding to microchip factories and photo voltaic panel manufacturing.

- The corporate avoids direct authorities contracts, preferring to work with non-public sector gamers to reduce dangers related to cost delays.

- Interarch designs its crops to run at close to full capability, with a threshold of 85%-90% utilization which triggers preparations for brand new services and capability additions. Its present manufacturing services have the flexibleness to regulate tonnage based mostly on undertaking complexity.

Capex

- Capex for FY25 stands at ₹55 Cr. deliberate for Andhra Section II and North India capability improve/upgrades by March or April 2025.

- The corporate added 20,000 tons of capability in Andhra Pradesh in September 2024 with the present utilizable capability now stands at 127,000 tons. It plans for additional capability upgrades in Andhra and North India with a goal of reaching 2,000 crore annual capability by FY26.

Outlook

- The corporate achieved a 17.6% quantity progress in Q2FY25, surpassing income progress on account of softening metal costs. Whole income elevated by 8.5% YoY to ₹323 crore in Q2FY25.

- The corporate’s EBITDA grew by 32% YoY in Q2FY25 whereas PAT elevated by 36% YoY.

- The corporate anticipates income progress of round 10% in FY25, pushed by respectable quantity progress. Whereas it initiatives income progress of 10-15% in FY26, supported by an increasing buyer base and capability.

- Capex of Section-1 of the fifth Pre-Engineered Constructing (PEB) manufacturing unit in Athivaram, Andhra Pradesh is ramping up efficiently. Additionally, the Ongoing Enlargement of Andhra Pradesh and Kichha capability expansions are on monitor.

- The corporate has acquired land Acquisition in Gujarat for Increasing operational base and it’s aimed toward boosting manufacturing capabilities to satisfy the rising demand for high-quality PEB options.

- The corporate’s new services strengthen geographic attain and reinforce dedication to innovation, high quality, and sustainability.

- Interarch Constructing Merchandise maintains a debt-free stability sheet with web money constructive backed by environment friendly working capital administration.

- The corporate is focusing on to double income over the subsequent 3-4 years. Whereas, It’s also specializing in constructing a trusted buyer base and sustaining management within the PEB sector.

(L) Strengths & Weaknesses

Strengths

(i) Established place within the PEB trade

Interarch Constructing Merchandise is without doubt one of the prime gamers within the Indian PEB trade. Robust market place with established clients corresponding to Grasim Industries , Asian Paints Ltd , Godrej & Boyce Manufacturing Co. Ltd , ITC Ltd and CEAT Ltd, ought to proceed to help enterprise. The corporate has services in North and South India, which helps it keep geographical diversification in orders in addition to cater to purchasers spreads throughout pan India.

(ii) Snug monetary threat profile

Working capital cycle of the corporate stays snug with gross present belongings of round 24 days as on March 31, 2024, owing to wholesome receivables cycle of round 48 days and stock interval of 65 days. Given the environment friendly working capital administration, TOL/TNW ratio has remained at round 1 time over the previous 5 fiscals.

Weaknesses

(i) Susceptibility to cyclicality within the end-user trade and uncooked materials costs

Built-in Constructing Merchandise is a comparatively mid-sized participant with average web value of round Rs 600 crore as of March 31, 2024, restricts the flexibility to bid for high-value initiatives. The enterprise is vulnerable to financial cycles and capex plans of its purchasers. Working margins have been fluctuating over time largely on account of excessive mounted prices and the corporate’s incapacity to go the rise in uncooked materials costs to its clients.

Drop us your question at – information@pawealth.in or Go to pawealth.in

References: Annual Experiences, Information Publications, Investor Shows, Company Bulletins, Administration Discussions, Analyst Meets and Administration Interviews, Business Publications.

Disclaimer: The report solely represents the private opinions and views of the writer. No a part of the report ought to be thought of a advice for purchasing/promoting any inventory. Thus, the report & references talked about are just for the knowledge of the readers in regards to the trade acknowledged.

Most profitable inventory advisors in India | Ludhiana Inventory Market Ideas | Inventory Market Specialists in Ludhiana | Prime inventory advisors in India | Finest Inventory Advisors in Gurugram | Funding Consultants in Ludhiana | Prime Inventory Brokers in Gurugram | Finest inventory advisors in India | Ludhiana Inventory Advisors SEBI | Inventory Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | Prime inventory advisors in India | Prime inventory advisory companies in India | Finest Inventory Advisors in Bangalore