As we speak we are going to focus on an fascinating subject – What number of instances of your annual bills do you want as your retirement corpus to retire comfortably?

For instance, if somebody has an annual bills of Rs 6 lacs per yr, then can they retire with Rs. 1.8 crores (30 instances)? That is the main focus of the article right now!

The present state of “Retirement” Commercials

From final 4-5 yrs, I can see lots of conversations, articles and YouTube movies which discuss retirement and its significance.

There are numerous retirement plans and pension plans additionally launched today which discuss significance of retiring with sufficient cash and a secured method of producing pension when you cease working.

There is no such thing as a doubt that retirement is prime most monetary purpose (and the longest one) for any investor. All of us will most likely have a for much longer retirement life than we think about right now. Our dad and mom even have retired simply few years again (or going to retire quickly).

A 60 yrs previous individual can anticipate to dwell wherever as much as 85 – 105 yrs in future. With altering life fashion, much less dependence of youngsters, rising bills at retirement – planning for retirement has grow to be rather more essential than any time in historical past.

The issue is that we don’t know once we will die. You CANT plan for simply 20 yrs of retirement, as a result of what for those who die at 100 yrs? It’s fairly a tricky factor to foretell when you’ll die, and nearly inconceivable to plan for it.

Therefore the perfect you are able to do is take the worst case, and plan for a really lengthy retirement.

Retirement Planning could be very powerful

Very first thing you must know is, that there are various variables relating to retirement. There are issues like

- Inflation

- Returns

- Taxation

- When will you die

- When will you retire

Whenever you do any retirement calculations, you make some assumptions and also you get a solution.

One massive drawback is that in actuality there might be lots of adjustments in these numbers, and your planning can go for a toss. Therefore it is advisable have a look at issues realistically and plan in such a method that takes care of worst situations.

Subsequent 40 yrs money circulation

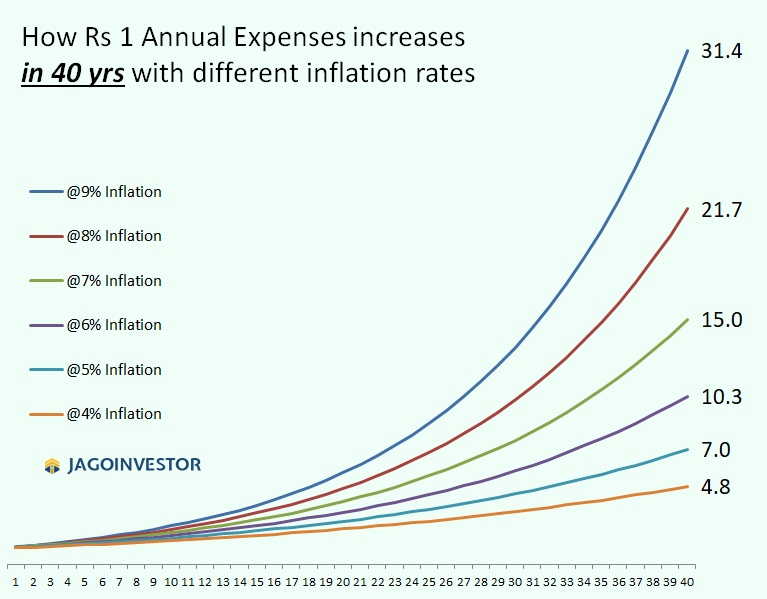

So let me begin with asking how your bills will look into future? If somebody needs to retire right now, how will their subsequent 30-40 yrs of cashflow might seem like.

Assuming that you just wish to retire all through time and your annual bills at retirement is 1 unit. Then how it will change over time?

Are you able to see how drastic the bills can fluctuate in your retirement life resulting from numerous inflation charges? Observe that in actuality, the bills would possibly come down a bit as soon as you might be sufficiently old like 80-90 yrs, however I’ve nonetheless not thought-about it as a result of there might be different sorts of bills like medical prices which is able to shoot up.

Is 30x corpus sufficient for retirement?

Now let’s dive deeper into the primary query and give attention to this text – “Is a corpus of 30 instances yearly bills sufficient to guide a protracted retired life?”

The quick reply is YES, however earlier than I’m going deeper into the reply – let me present you a case research

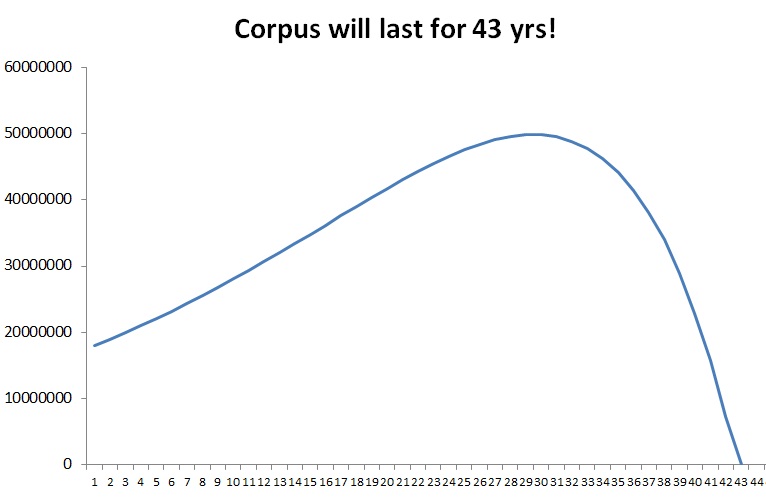

Think about an individual retires with following numbers

- Per 30 days bills within the begin of retirement = Rs 12 lacs (1 lac per 30 days)

- Corpus = 3.6 Cr (30x)

- Inflation Assumed = 7%

- Submit Tax Returns = 9%

How lengthy will the retirement corpus final on this case?

The reply is 43 yrs as per excel calculations. For simplicity goal, for now now we have taken a case the place inflation, returns are all fastened and the individual solely wants the month-to-month bills as per rising inflation and no different withdrawals are achieved until finish. Wherein case, the corpus change can be very clean.

Right here is the way it seems to be like

What in case your assumptions are fallacious by 10% margin?

Many of the calculators simply provide you with a solution like above graph, however doesn’t ask a query – “What if issues go fallacious?”

- What’s the inflation is greater than what you assumed?

- What for those who wanted extra revenue in future than you deliberate?

- What if you weren’t in a position to generate the returns you assumed?

- What for those who had much less corpus than you initially deliberate?

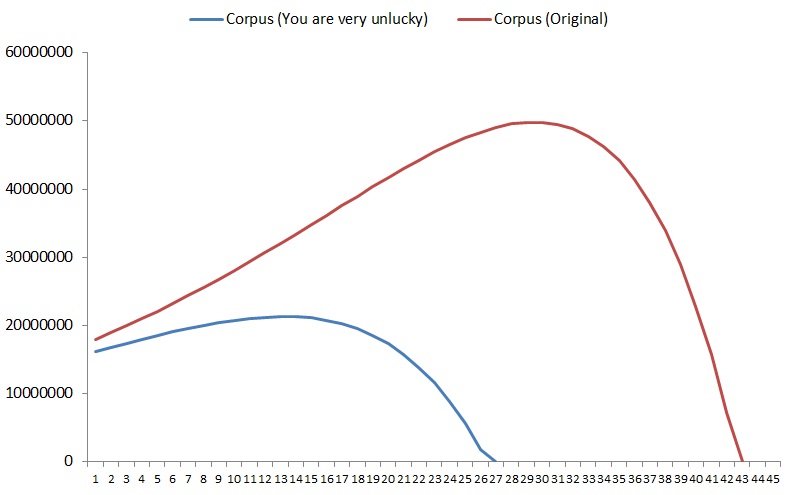

How completely different would be the consequence now if you’re fallacious by 10% margin on all 4 variables?

So, lets see that case too.

- Corpus is 10% much less = 3.24 cr (as a substitute of three.6 cr)

- Month-to-month Bills are 10% extra = 1.1 lacs per 30 days (as a substitute of 1 lacs)

- Inflation is 10% increased than assumed = 7.7% (as a substitute of seven%)

- Returns are 10% decrease than assumed = 8.1% (as a substitute of 9%)

So as a substitute of 43 yrs, how briskly the corpus will end now?

The reply now adjustments to 27 yrs

Sure, from 43 yrs .. it now adjustments to 27 yrs, which is 16 yrs earlier.

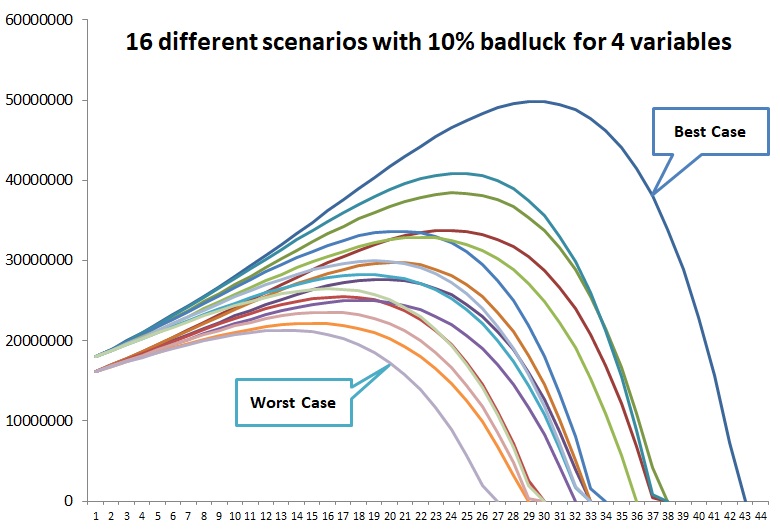

Nonetheless in actual life, both all 4 issues can go fallacious by some margin, or simply 1 or 2 or 3 issues might go fallacious.. so there are numerous situations right here..

- Nothing goes fallacious

- One variable goes fallacious

- Two variable goes fallacious

- Three variables goes fallacious

- All 4 variables go fallacious

This in complete makes 16 completely different mixture.. We have now seen the perfect case (when nothing goes fallacious) and worst case (when all 4 variables go fallacious) ..

However once we see all 16 variables collectively .. it seems to be like under

Observe that these calculations above are assuming an inflation of seven% and post-tax returns of 9%. When you take decrease returns or increased inflation, then the outcomes can be completely different ..

Testing the information for 250 iterations

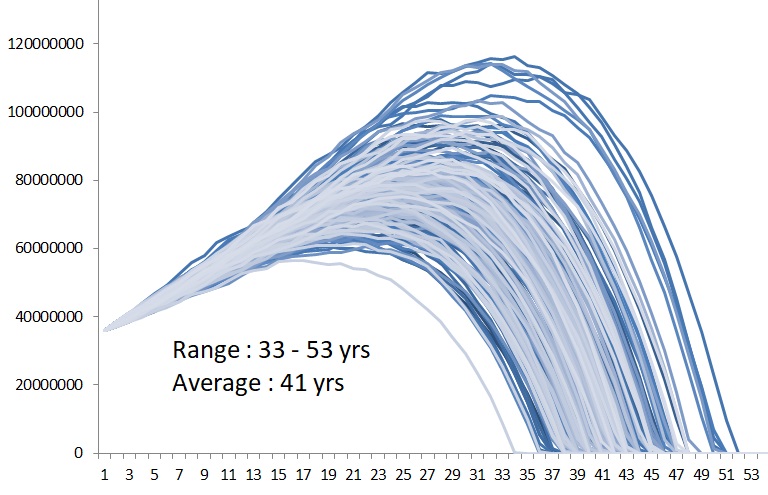

I assumed that Inflation and Returns will come down slowly over long run as we transfer in the direction of a extra developed financial system. We’d attain to a 2-4% inflation (beginning with 7% right now) and 4-6% returns submit tax (beginning with 9% right now). I added a variation in calculations and plotted 250 variations of the identical chart and right here is the outcomes.

As you’ll be able to see from above graph, the outcomes can fluctuate rather a lot relying on inflation and returns mixture. On a median the corpus lasts for 41 yrs.

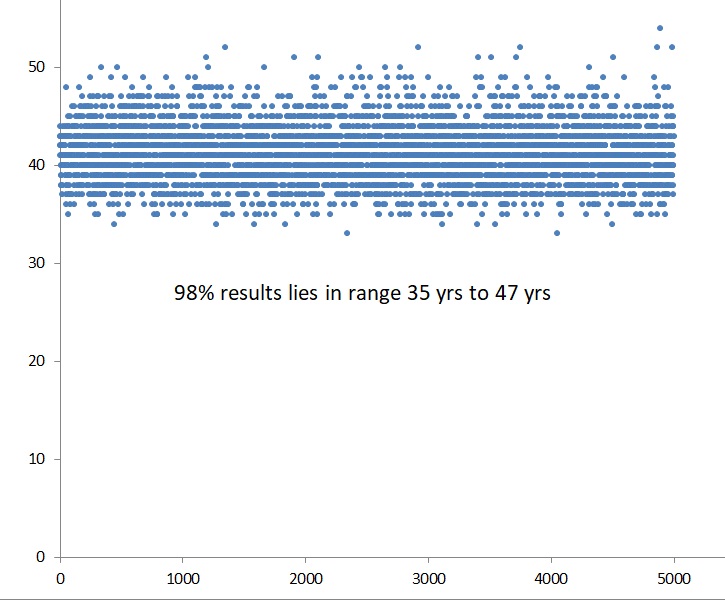

I additionally took 5000 iterations to see how lengthy the cash finishes and right here is the plot.

What we noticed was that 98% of the instances the cash lasted in vary of 35 yrs to 47 yrs, which is a good sufficient planning, however the assumption is that each one our assumptions about inflation and returns maintain true.

Investing in Fastened Deposits for Earnings Era

A variety of buyers are extraordinarily conservative and don’t wish to put money into something apart from financial institution fastened deposits. We all know that financial institution fastened deposits are extremely safe, however on the identical time – they’re extraordinarily inefficient in taxation and likewise present under inflation returns.

However let’s take a look at that case as nicely.

Let’s assume that an individual is placing all their cash in fastened deposits solely. Wherein case the returns might be taken as 4% submit tax (30% tax deducted from 5.5% returns)

Beneath I’ve proven how lengthy the retirement cash will final when an individual has 60x, 50x, 40x, 30x, 20x and 10x corpus. I’ve achieved 250 situations and plotted them to see how the corpus ends.

As you’ll be able to see, when the returns are decrease – you want rather more than 30x corpus if you wish to final it for a really long run.

With simply 30x, it is going to final for simply 22 -24 yrs. The frustration of seeing your cash ending if you are nonetheless don’t see your demise coming your method is perhaps very horrible expertise.

So conclude, Sure 30x corpus is nice sufficient to retire, however the assumption is that you’ll not be dipping into that corpus to withdraw any massive quantities like for purchasing home, or to your youngsters’ training or any massive medical emergencies.

Higher to have these issues separate than your 30x corpus.

What if my corpus is lower than 30x?

It’s going to be a problem if you’re retiring with much less corpus like 20x or 10x or 15x. Wherein case, you’ll have to just remember to even have some first rate fairness publicity to bump up your returns in order that your corpus can last more. We at Jagoinvestor are engaged on numerous methods which can be utilized to guarantee that the corpus last more utilizing an fairness publicity and producing an everyday stream of revenue for our shoppers.

Do let me know what your ideas about this text are.

Additionally, if you’re within the subject of retirement planning and wish to take heed to an off-the-cuff however very detailed speak on this subject, do take heed to my speak with P V Subramanyam the place now we have mentioned numerous points about retirement

Disclaimer : Observe that these calculations are extremely advanced at instances and there are many issues which contribute to the calculation. I don’t declare to have achieved issues completely from statistical viewpoint. This text is simply a primary calculation with some excessive stage assumptions. Do speak to your monetary advisor earlier than creating your retirement technique.

![Simply launched: December’s higher-risk, high-reward inventory suggestion [PREMIUM PICKS] Simply launched: December’s higher-risk, high-reward inventory suggestion [PREMIUM PICKS]](https://i0.wp.com/www.fool.co.uk/wp-content/uploads/2023/05/Fire-1200x675.jpg?w=150&resize=150,150&ssl=1)