Lots of younger buyers are sometimes confused if it’s actually price saving small chunks of cash within the begin of their careers?

Lots of buyers don’t save sufficient in the beginning of their profession and marvel if they need to begin saving solely sooner or later when they can save a “respectable” quantity like Rs 10,000 or Rs 50,000 a month?

Immediately I wish to let you understand why small financial savings issues!

The #1 good thing about small financial savings

Does it actually matter in future if you happen to save Rs 2,000 per thirty days for a number of years? Even if you happen to do it for 3 yrs, you’ll simply have Rs 60,000-70,000 with you. It’s not an enormous sum of money.

Lots of people may be capable to put an enormous lump sum in a single go to compensate for the ache of taking the hassle of saving a small sum of cash every month. On prime of it, if you happen to ignore saving a small sum of cash for a number of years, your closing wealth won’t be drastically completely different had you saved small quantities.

What you simply learn above is what lots of buyers take into consideration small saving. It’s a traditional mathematical approach of it.

Nonetheless I typically inform those who it’s not in regards to the quantity, however in regards to the HABIT OF SAVING MONEY.

Domesticate the Behavior of Saving

If you begin your investments and begin investing per thirty days, the larger profit is that you’re forcing your self to take out a bit of your month-to-month revenue and make investments it someplace.

You might be truly creating the HABIT of saving frequently, which isn’t a straightforward factor to realize.

Immediately, lots of buyers are incomes good sum of money and so they even have an honest surplus, however what’s lacking is the behavior of saving. They’ve by no means accomplished it earlier than in life for a few years, and now when all of the sudden they’re having surplus which doubtlessly could be invested, they’re discovering it robust to do this, as a result of they aren’t capable of management themselves with the distraction this world provides them.

Think about two youngsters, certainly one of them at all times saves 5% of his pocket cash and spends the remaining. One other one spends all his pocket cash. This continues for 15 yrs of their life. You may think about what would be the psychology of each the youngsters and the way it will affect their future.

The identical is true for buyers after they begin their profession and incomes life.

Small financial savings compounds and increase your wealth sooner or later

Small financial savings won’t look sufficiently big in the beginning, however over the time frame, they compound nicely and provides to your wealth creation, generally massive and generally small.

So let’s think about that your future saving situation seems like this

[su_table responsive=”yes”]

| Yr | The quantity you’ll save per thirty days |

| First 10 yrs | Rs 2,000 for 3 yrs, then Rs 3,000 for 3 yrs, then Rs 5,000 for 4 yrs |

| Subsequent 25 yrs | Rs 20,000 per thirty days (rising with 8% per yr) |

[/su_table]

Given the situation above, think about two instances

- Case 1: You spend money on first 10 yrs – Small financial savings accomplished

- Case 2: You DONT make investments for first 10 yrs – No small financial savings accomplished

If you happen to add up all the cash which you invested out of your pocket in CASE 1 and Case 2, you will see that out that the distinction is simply 2.4%. Sure, incase 1, you’ll make investments 1.77 cr and incase 2, it will likely be 1.73 cr. Hardly any distinction you’ll say

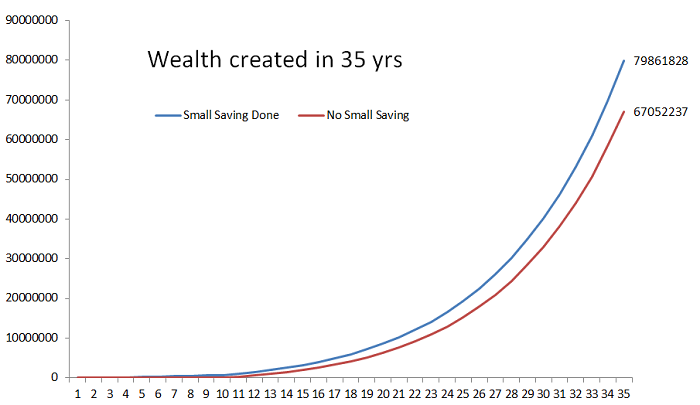

However whenever you discover out the distinction within the wealth created on the finish in each instances, it will likely be a niche of 16%. Within the case of Case 1 you’ll make 7.98 cr, whereas in case 2, you’ll have 16% much less wealth. That’s an honest sum of money.

Beneath you will notice the wealth distinction in each the instances.

The above instance tells us that if somebody just isn’t saving small chunks of cash simply because they really feel it won’t be price it, it’s not the appropriate approach of it, as a result of in the long run it’s going to absolutely assist in boosting the wealth one will create.

Small financial savings additionally enable you in coping with emergencies

One other good thing about saving small quantities in the beginning and never ready for the “proper” time is that one will not less than begin having some quantity for emergencies. In our instance above, if one invests even small quantities for the primary 10 yrs of life, they may have a sizeable quantity of Rs 7.2 lacs not less than.

This isn’t a small quantity. It could actually assist the investor in coping with any type of emergencies. One may even keep away from taking loans for issues like shopping for a automotive, trip or residence home equipment.

If nothing occurs, it’s going to give a pleasant feeling to the investor and increase his confidence that it’s attainable for him to create wealth. Keep in mind to create 1 crore, you might want to create the primary 10 lacs and to do this you want first 1 lac.

It’s important to begin someplace.

Don’t delay your investments, else it’s going to price you later

The extra you delay investing, the extra you’ll have to make investments sooner or later to cowl up the brief fall. Here’s a small instance I wish to share with you

If you happen to make investments Rs 10,000 per thirty days for the following 30 yrs (assuming a 12% return and seven% improve in SIP per yr), it is possible for you to to create 5.36 crore in 30 yrs.

Do you what occurs if you happen to delay by simply 5 yrs? In that case, you’ll create solely Rs 2.78 crore. Sure, Solely 2.78 crore in opposition to 5.36 cr.

And now if you wish to attain the identical corpus of 5.36 cr, you’ll have to begin with the SIP of Rs 19,300

Value of Delay Calculator

Beneath is an easy price of delay calculator the place you possibly can check out completely different situations for your self and see what would be the affect of delaying the investments.

[WP-Coder id=”20″]

Begin Small – It helps you in constructing the behavior of saving

To conclude I’d say, beginning small has its personal profit. It’s going to develop your behavior of financial savings. If you happen to can’t save Rs 2,000 on the wage of Rs 30,000, it will likely be equally robust to avoid wasting Rs. 20,000 on the wage of 1,00,000.

“Investing” is extra about your personal habits & not exterior components.

Do tell us what you are feeling about this text? Are you aware somebody who has been delaying their investments (are you certainly one of them?)