FD is without doubt one of the hottest funding possibility in India as a result of its quite a few benefits like security, mounted curiosity incomes and straightforward to grasp product. And now you’ll be able to simply get a mortgage towards your FD even should you don’t have a credit score rating or meet any earnings incomes eligibility standards to use for a mortgage.

So, One of many principal benefit of holding a Mounted Deposit (FD) is that you could safe a mortgage quantity beneath your FD quantity, with out truly breaking it!

Eligibility standards, paperwork required and the right way to apply?

So as to apply for Mortgage towards FD, you’ll have to strategy your financial institution supervisor, fill the specified kind and submit the vital paperwork. Many banks comparable to PNB, HDFC and so on… are providing on-line facility for mortgage towards FD.

Eligibility standards for taking the mortgage towards FD –

- You must have a 12 months previous energetic mounted deposit with the financial institution.

- Applicant must be at the least 21 years previous

- Applicant needs to be resident citizen of India

- Particular person, sole proprietorship, societies, HUFs and so on are eligible.

Paperwork required for taking the mortgage towards FD –

- Software kind

- Mounted Deposit receipts

- A cancelled cheque could be required if the mortgage is being taken from monetary establishments aside from banks

- Duly signed settlement letter

- Passport dimension images

- Legitimate picture identification proof

Allow us to see a video to grasp it extra clearly –

Pursuits charged on the mortgage quantity

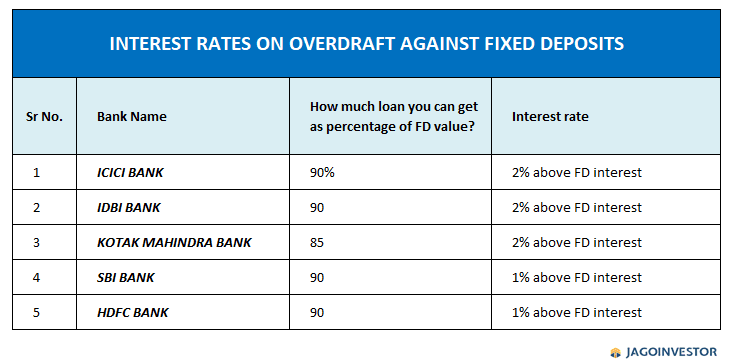

The rates of interest charged for FD loans as in comparison with conventional mortgage rates of interest are very much less. It’s typically round 2% to three% greater than the FD rate of interest.

Instance – Ram is having a FD price Rs 10,00000. He’s incomes an rate of interest of 6.5% on his FD; if he applies for mortgage towards FD then right here he can be charged an rate of interest of 8% to eight.5% on the mortgage. The curiosity charged right here is far lower than the common mortgage rate of interest that often ranges from 9% to fifteen% (varies from banks to banks).

Under is an indicative chart of various banks with rates of interest on overdraft of FD

Is pre-payment of mortgage towards FD allowed? If sure, how a lot is the penalty charged?

Sure, pre-payment of mortgage is allowed with no penalty costs. If you’re considering of taking mortgage towards your FD, and you already know that after few days or few months you can also make pre-payment of the prevailing mortgage then you may be at revenue as a result of pre-payment can be allowed that too with no penalty costs.

How lengthy may be the mortgage tenure?

The mortgage tenure towards mounted deposits will depend on the tenure of the mounted deposit. The tenure of mortgage is not going to be greater than the time period of mounted deposit. In a lot of the instances tenure of mortgage is 3 years.

Instance – Sham desires to avail a mortgage on his mounted deposit (whose maturity is in 5 years). He can avail the mortgage solely after completion of 1 12 months of FD. If he takes mortgage then he must repay the mortgage inside the subsequent 4 years, earlier than the maturity of the mounted deposits.

Mortgage towards FD vs Breaking the FD

The pure query right here one will ask is, why not break the FD itself and use the cash? Why one ought to apply for the mortgage??? Allow us to see the distinction between the each after which one can take the choice.

Distinction Between Mortgage towards FD and Breaking of FD

[su_table responsive=”yes” alternate=”no”]

| Options | Mortgage Towards FD | Breaking of FD |

| Ease of getting cash | Cash can be obtained after process of mortgage sanction is over | Cash is obtained instantly both in money or Financial institution |

| Curiosity Charge | Curiosity on mortgage quantity needs to be paid | No must pay curiosity |

| Sanctioned quantity | Limitation on quantity obtained (As much as 90% of FD) | You get the complete quantity you invested thus far |

[/su_table]

You may see within the desk above, all factors favour breaking of Mounted deposits, however one motive why you’ll be able to consider taking the mortgage towards FD is-

The human tendency, that you just repay the mortgage in EMI kind simply reasonably than once more creating the FD. In the event you break the FD and use the cash, there isn’t any compulsion so that you can once more get monetary savings and create the FD and it would occur that you’ll not have wealth at later level.

Nonetheless, should you take a mortgage towards FD, then the FD exists and you’ll have a look at the mortgage reimbursement as your main goal and compelled to pay again the cash.

Another reason of taking mortgage towards FD is, IF you’re requested for a monetary assist by some relative or buddy and should you select to get mortgage for them towards the FD. Then, they are going to be extra severe in reimbursement of EMI as a result of then they are going to be realizing it properly that you’ve facilitate them a mortgage which needs to be repaid on time. So, it’s going to turn into compulsory for them to repay.

And in the identical situation should you break FD and provides the cash as mortgage, its a transaction between you and your buddy/relative and there’s a tendency of all human beings to not return the cash on time and turn into very informal about it, if it’s not authorized obligation over some one.

That was all in regards to the mortgage towards FD .. Do be happy to ask any doubts within the remark part.