Picture supply: Getty Pictures

Situations stay robust for FTSE 100 housebuilder Barratt Redrow (LSE:BTRW) because the UK economic system splutters. Within the first half, it reported an underwhelming 16,565 completions, lacking its goal vary of 16,800-17,200 by a notable distance.

So as to add additional woe, it additionally stays impacted by pricey legacy constructing defects. It booked £248m price of further legacy property liabilities in January-June, largely resulting from fireplace security and structural points at earlier developments.

At 373p per share, the FTSE firm’s now buying and selling at a 32.8% low cost to what’s was 12 months in the past. Regardless of the builder’s issues, I believe this will symbolize a gorgeous dip shopping for alternative.

Certainly, Metropolis analysts consider Barratt’s share worth might rocket virtually 40% through the subsequent 12 months.

Restoration continues

Whereas the agency’s restoration is slower than hoped, it’s nonetheless nonetheless shifting forwards. Its internet non-public reservation fee rose 16.4% between January and June, to 0.64 per outlet per week. Its additionally reported that its ahead order guide had “continued to enhance“: this was up 10.5% and 4.3% on a price and quantity foundation respectively within the first half.

Doubt stays as as to if Barratt can proceed its restoration, however I’m optimistic it could actually. Rates of interest are more likely to proceed falling as inflation recedes, supporting purchaser affordability.

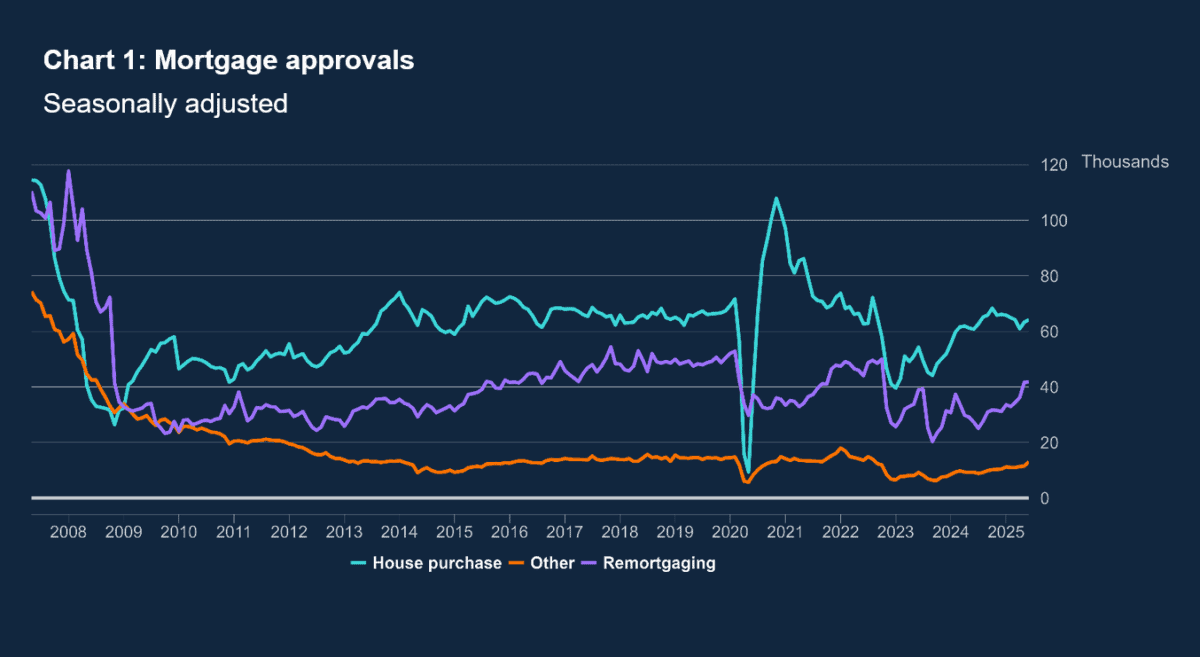

Underlining this assist, newest Financial institution of England information confirmed internet mortgage approvals for home purchases up 1.4% month on month in June.

Future fee cuts may very well be fuelled, too, by enduring financial stagnation, which can offset issues like rising unemployment on Barratt’s gross sales.

Worth share

Metropolis forecasters are in settlement, and anticipate the builder’s earnings to rise sharply over the subsequent two years

A 49% year-on-year rise in annual earnings is tipped for this monetary 12 months (to June 2026). Predicted development stays elevated at 31% for monetary 2027, too.

These forecasts imply Barratt’s shares provide up sturdy worth in my opinion. Its price-to-earnings (P/E) ratio of 12.6 instances for this 12 months drops to 9.6 instances for subsequent 12 months.

In the meantime, its P/E-to-growth (PEG) a number of is a steady 0.3 by the interval. Any sub-1 studying signifies {that a} share is undervalued.

Lastly, dealer consensus additionally suggests sturdy dividend development by the interval. So the corporate’s ahead dividend yields are a wholesome (and quickly growing) 4.5% and 5.4% for monetary 2026 and 2027, respectively.

Close to-40% worth good points

As with many UK shares, sharp financial circumstances stay an issue for the corporate. However on stability, I’m assured Barratt’s backside line can nonetheless steadily enhance, pulling its share increased from right now’s ranges.

The 17 Metropolis analysts who fee the FTSE share all consider the builder will rebound. The consensus worth goal sits at 516.6p for the subsequent 12 months. This means worth upside of 38.5%.

Given the stable long-term outlook for houses demand, Barratt is a share I plan to carry for years. Its merger with Redrow final 12 months provides it terrific scale to use this chance — the UK authorities is focusing on 300,000 new houses every year between now and 2029.