The market sentiment on Friday mirrored a cautious but resilient tone as each the Nifty 50 and the Sensex opened decrease however managed to get better most of their intraday losses by the shut. Regardless of the weak begin, each indices stayed above their key transferring averages, signalling that broader market power stays intact whilst short-term volatility persists. Merchants adopted a wait-and-watch method amid combined international cues and continued international fund outflows, with momentum indicators hovering round impartial ranges. This instructed that whereas the market lacked sturdy bullish conviction, promoting strain was additionally restricted, indicating consolidation fairly than panic.

Throughout sectors, the temper was combined. The Nifty Metallic and PSU Financial institution indices emerged as vivid spots, supported by shopping for in choose metallic and public sector banking shares, hinting at rotational curiosity amongst traders. Then again, the Infrastructure, Shopper Durables, and IT indices witnessed revenue reserving, reflecting considerations over international demand and company earnings. The Nifty FMCG index additionally softened, including to the subdued tone. World sentiment, weighed down by declines in main Asian indices and weak U.S. futures, bolstered a cautious outlook. Total, the week ended with the Nifty 50 and Sensex each posting delicate declines, reflecting consolidation amid uncertainty and a cautious international atmosphere.

On this overview, we’ll analyse the important thing technical ranges and development instructions for Nifty and BSE Sensex to observe within the upcoming buying and selling classes. All of the charts talked about under are primarily based on the 5-minute timeframe.

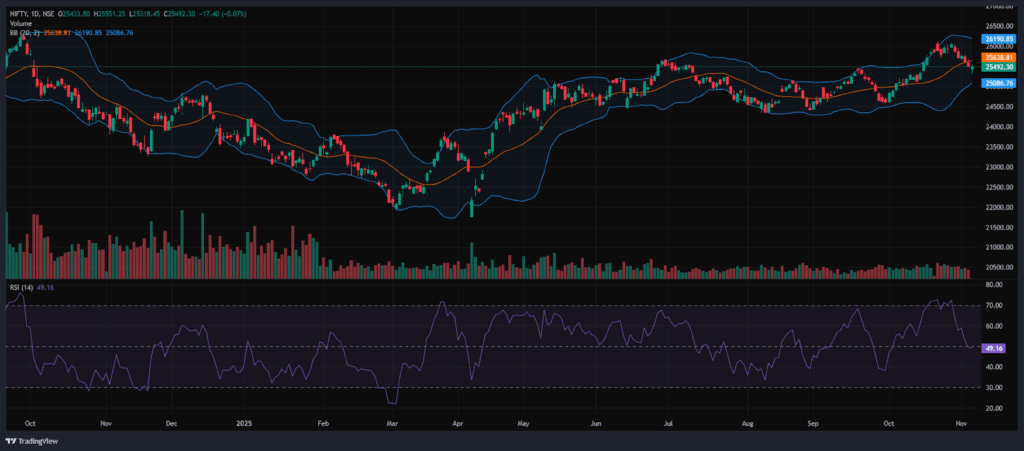

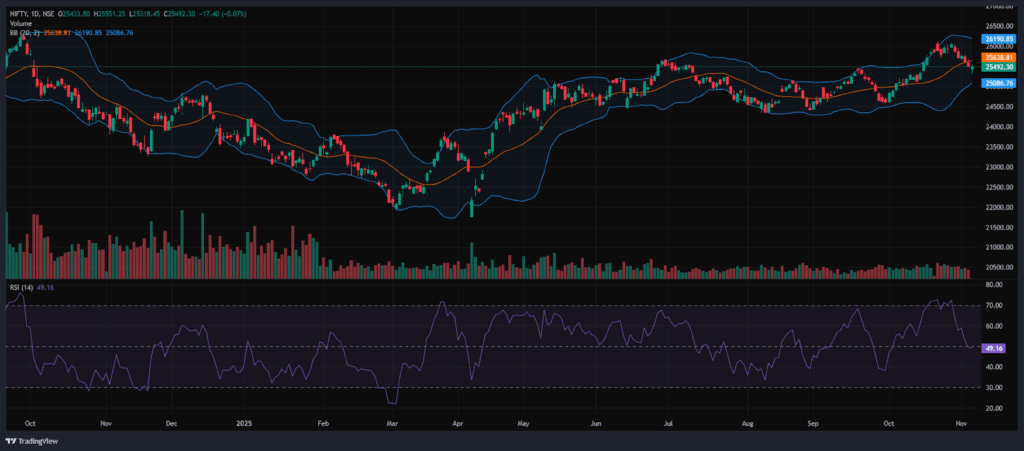

NIFTY 50 Chart & Value Motion Evaluation

(On this evaluation, we’ve got used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

The Nifty 50 Index opened on a unfavorable observe at 25,433.80 on Friday, down by 75.9 factors from Thursday’s closing of 25,509.70. The index opened on a bearish observe and was dragged right down to the 25,318.45 degree. However later recovered from the day’s low and traded inside the 25,300-25,500 vary. It traded under the EMAs of fifty/100/200 however above the 20-day EMA within the 15-minute chart. Within the afternoon session, the index additional moved upwards and hit an intraday excessive of 25,551.25 and settled close to the 25,500 degree. Total, the Index traded inside a 25,450-25,550 vary all through the afternoon session. In the course of the afternoon session, the Nifty 50 closed under the 50/100/200 EMAs however above the 20-day EMA within the 15-minute timeframe.

The Nifty’s instant resistance ranges are R1 (25,554), R2 (25,642), and R3 (25,761), whereas instant assist ranges are S1 (25,455), S2 (25,388) and S3 (25,317).

The Nifty index had reached a day’s excessive at 25,551.25 and noticed a day’s low at 25,318.45. Lastly, it had closed at 25,492.30, within the pink and under the 25,500 degree, down 17.4 factors, or 0.068%. The Nifty 50 closed above the EMAs of fifty/100/200 however under the 20-day EMA within the each day timeframe.

NIFTY 50 Momentum Indicators Evaluation

RSI (Each day): The Nifty 50’s RSI stood at 49.16, which is under the overbought zone of 70, close to the assist zone of 40-50.

Bollinger Bands (Each day): The index is buying and selling within the decrease band of the Bollinger Band vary (Easy Shifting Common). Its place within the decrease vary suggests a bearish sentiment, however within the each day timeframe on Friday session, the Index fashioned a Hammer candle, which signifies a bullish reversal sign. The index took assist close to 25,318, and 25,551 acted as a resistance degree. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Friday’s buying and selling session had a mean quantity of 305.61 Mn.

Derivatives Knowledge: Choices OI signifies sturdy Put writing at 25,400, adopted by 25,300, establishing it as a agency assist zone. On the upside, a major Name OI buildup at 25,500 and 25,600 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 0.89 (<1), leaning in direction of bullish sentiment, however the lengthy Buildup signifies a Sturdy Bullish outlook, thus indicating a bullish outlook for the subsequent buying and selling session.

Financial institution Nifty Chart & Value Motion Evaluation

(On this evaluation, we’ve got used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

The Financial institution Nifty Index began the session on a unfavorable observe at 57,391.40 on Friday, down by 162.85 factors from Thursday’s closing of 57,554.25. The index began on a Bearish observe, and dragged right down to the 57,150 degree. However later, it moved upwards and was buying and selling inside the 57,150-57,850 vary and was buying and selling above the EMAs of 20/50/100 however remained under the 200-day EMA within the 15-minute timeframe within the morning session. Within the afternoon session, the Index hit an intraday excessive at 58,001.35 and settled above the 57,900 degree. Additional, the Index was buying and selling within the vary of 57,750-58,000, and ended with positive aspects in inexperienced. In the course of the afternoon session, Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the 15-minute timeframe.

The Financial institution Nifty’s instant resistance ranges are R1 (57,999), R2 (58,253) and R3 (58,577), whereas instant assist ranges are S1 (57,769), S2 (57,490), and S3 (57,155).

The Financial institution Nifty index had peaked at 58,001.35 and made a day’s low at 57,157.85. Lastly, it had closed in inexperienced at 57,876.80, rising above the 57,850 degree, gaining 322.55 factors or 0.56%. The Relative Power Index (RSI) stood at 60.03, under the overbought zone of 70 within the each day timeframe, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the each day timeframe.

BSE Sensex Chart & Value Motion Evaluation

(On this evaluation, we’ve got used 20/50/100/200 EMAs, the place 20 EMA (Crimson), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

The BSE Sensex Index opened on a unfavorable observe at 83,150.15 on Friday, down by 160.86 factors from Thursday’s closing of 83,311.01. The index began its session on a bearish observe, however later, it moved upwards and was buying and selling inside the 82,650-83,200 vary. It traded under the EMAs of fifty/100/200 however above the 20-day EMA within the 15-minute timeframe within the morning session. Within the afternoon session, the Index additional climbed and touched 83,390.11, marking its day’s excessive and settled above 83,200. The Index was buying and selling within the 83,000-83,400 vary, following a bearish development and closed under the EMAs of fifty/100/200 however above the 20-day EMA within the 15-minute timeframe.

The BSE Sensex instant resistance ranges are R1 (83,393), R2 (83,841) and R3 (84,289), whereas instant assist ranges are S1 (83,065), S2 (82,665), and S3 (82,153).

The BSE Sensex index had peaked at 83,390.11 and made a day’s low at 82,670.95. Lastly, it had closed at 83,216.28 in pink, dropping 94.73 factors or 0.11%. The Relative Power Index (RSI) stood at 49.46, under the overbought zone of 70 within the each day timeframe, and the BSE Sensex closed above the EMAs of fifty/100/200 however under the 20-day EMA within the each day timeframe.

Market Recap on November seventh, 2025

On Friday, the Nifty 50 opened decrease at 25,433.80, down -75.90 factors from its earlier shut of 25,509.70. The index hit an intraday low of 25,318.45 and closed at 25,492.30, down -17.40 factors, or -0.07%. The index went under the 20-day EMA and touched the 50-day EMA through the day however closed above key transferring averages (50/100/200-day EMAs) on the each day chart. The BSE Sensex mirrored the Nifty’s development, opening at 83,150.15, down -160.86 factors from the earlier shut of 83,311.01. It adopted the same sample, closing at 83,216.28, a fall of -94.73 factors, or -0.11%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 49.16 and Sensex at 49.46, under the overbought threshold of 70.

On Friday, indices present a combined response. The Nifty Metallic index was the main gainer, rising 1.41% or 144.90 factors, and standing at 10,426.80. Shares corresponding to Hindustan Copper Ltd rose 3.26%, adopted by Adani Enterprises Ltd and Jindal Metal Ltd, which gained as much as 2.38% on Friday. The Nifty PSU financial institution index was additionally among the many greatest gainers, rising 0.87% or 71.75 factors, and standing at 8,352.15. Shares corresponding to Financial institution of Maharashtra Ltd jumped 3.83% on Friday. Whereas different PSU financial institution shares like Financial institution of India, Punjab & Sind Financial institution, and Indian Abroad Financial institution additionally gained as much as 3.15%.

On the Sectoral Losers, the Nifty Infrastructure Index was the most important loser, falling -1.00%, or -95.20 factors, to 9,393.60. Infra shares like Bharti Airtel Ltd, Suzlon Vitality Ltd, Godrej Properties Ltd, and Interglobe Aviation Ltd noticed declines of as much as -4.47%. The Nifty Shopper Durables Index additionally fell on Friday, dropping -274 factors or -0.72%, ending at 37,617.25. Amber Enterprises Ltd fell probably the most, declining by -7.73% after posting a internet loss in Q2 FY26, adopted by PG Electroplast Ltd, Cera Sanitaryware Ltd, and V-Guard Industries Ltd, falling as much as -3.96%. The Nifty IT Index adopted the decline, dropping -0.62% or -220 factors, to shut at 35,117.6. Tech shares, together with Tech Mahindra Ltd, Oracle Monetary Providers Software program Ltd, LTIMindtree Ltd, and Wipro Ltd, fell as much as 1.90%. The Nifty FMCG Index additionally fell on Friday’s commerce, ending at 55,437.2, down -274.5 or -0.49%.

Asian markets had an general bearish sentiment on Friday. Japan’s Nikkei 225 declined by 743.68 factors or 1.48%, closing at 50,140. Whereas China’s Shanghai Composite fell by -10.20 factors, or -0.26%, to three,997.56, equally, Hong Kong’s Dangle Seng Index additionally declined by -250.9 factors, or -0.96%, to shut at 26,235. Singapore’s Straits Instances Index, nevertheless, elevated by 7.25 factors or 0.16%, ending at 4,492.24, however South Korea’s KOSPI decreased by -72.69 factors or -1.84%, closing at 3,953.76. At 4:49 p.m. IST, U.S. Dow Jones Futures had been decrease, down -0.14%, at 46,838.86, dropping -73.44 factors.

This week, the broad indices Nifty 50 and Sensex declined by -0.89% and -0.86% respectively. Ongoing international capital outflows and a cautious international outlook continued to overwhelm the markets.

India VIX

The India VIX elevated 0.15 factors or 1.21%, from 12.41 to 12.56 throughout Friday’s session. A rise within the India VIX usually signifies greater value volatility within the inventory market, suggesting a much less secure market atmosphere. Nevertheless, a secure market atmosphere and minimal volatility are anticipated when the India VIX is under 15.

Commerce Setup Abstract:

The Nifty 50 opened on a unfavorable observe at 25,434 on Friday and ended the session within the pink under the 25,500 degree at 25,492.30. A break under 25,455 might set off additional promoting in direction of 25,388, whereas breaking the subsequent resistance degree of 25,554 might set off bullishness in direction of the 25,642 degree.

The Financial institution Nifty additionally began the session on a unfavorable observe at 57,391 however ended the session within the inexperienced at 57,877, above the 57,850 degree. A break under 57,769 might set off additional promoting in direction of 57,490, whereas breaking the subsequent resistance degree of 57,999 might set off bullishness in direction of the 58,253 degree.

The Sensex opened on a unfavorable observe at 83,150 and ended the session within the pink at 83,216, under the 83,250 degree. A break under 83,065 might set off additional promoting in direction of 82,665, whereas breaking the subsequent resistance degree of 83,393 might set off bullishness in direction of the 83,841 degree.

Given the continuing volatility and combined sentiments, it’s advisable to keep away from aggressive positions and look ahead to clear directional strikes above resistance or under assist. Merchants ought to think about these key assist and resistance ranges when coming into lengthy or brief positions following the worth break from these essential ranges. Moreover, merchants can mix transferring averages to determine extra correct entry and exit factors.