Be a part of Our Telegram channel to remain updated on breaking information protection

Shares within the healthcare-turned-Bitcoin treasury firm KindlyMD plummeted over 55% after CEO David Bailey urged short-term merchants to promote if they’re solely on the lookout for fast earnings.

“For these shareholders who’ve come on the lookout for a commerce, I encourage you to exit,” Bailey wrote in a letter to shareholders. ”We view this second as a crucial alternative for us to determine our base of aligned shareholders who’re dedicated to our long-term imaginative and prescient.”

KindlyMD share value (Supply: Google Finance)

That steep drop has taken the corporate’s share value plunge to greater than 89% previously month, its lowest since February. Buying and selling volumes have spiked to a file excessive.

Wow. Intense quantity. Grateful for all of the messages of assist. As we speak is a day of transition. We’re upgrading our shareholder base from brief time period merchants to long run traders. Courageous the storm.

To the ₿ullievers go the spoils.

— David Bailey🇵🇷 $1.0mm/btc is the ground (@DavidFBailey) September 15, 2025

KindlyMD Needs Shareholders That Are Aligned With Lengthy-Time period Imaginative and prescient

Because the inception of KindlyMD’s Bitcoin technique, the corporate has raised $742 million, established a 5,700-plus token BTC treasury, “constructed a seasoned management staff,” and launched a $5 billion at-the market (ATM) program “in partnership with eight main monetary establishments,” Bailey mentioned within the shareholders letter.

KindlyMD has additionally closed its first funding in a Dutch BTC treasury firm known as Treasury, dedicated to a $30 million funding into Japan-based BTC treasury agency Metaplanet, and secured an possibility to amass Bitcoin Journal proprietor BTC Inc.

“The inspiration we construct over the subsequent few weeks and months will propel our technique ahead, for people who wish to be a part of it,” Bailey wrote. “This transition might characterize some extent of uncertainty for traders, and we stay up for rising on the opposite aspect with alignment and conviction amongst our backers.”

The one approach out is thru. We’ll get this over with as shortly as potential. What’s crucial is constructing an aligned shareholder base.

— David Bailey🇵🇷 $1.0mm/btc is the ground (@DavidFBailey) September 15, 2025

Bailey Believes In Bitcoin’s Lengthy-Time period Energy

KindlyMD’s share value woes began across the similar time the Nasdaq-listed firm merged with Nakamoto Holdings to create a Bitcoin-native holding firm.

Following the merger, KindlyMD stays the general public father or mother firm and nonetheless trades beneath the ticker “NAKA,” however Nakamoto has develop into a wholly-owned subsidiary that may function the Bitcoin treasury enterprise beneath the Nakamoto model.

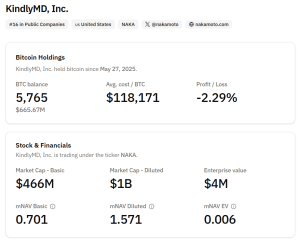

KindlyMD is at present ranked because the Sixteenth-largest company holder of Bitcoin globally, with 5,765 BTC on its stability sheet, knowledge from Bitcoin Treasuries exhibits.

Overview of KindlyMD’s BTC holdings (Supply: Bitcoin Treasuries)

In latest weeks, the Bitcoin treasury house has come beneath stress as premiums for these corporations proceed to compress. That is one thing that Bailey pointed to in his letter to shareholders, and added that he’s decided to endure the present bearish panorama.

“After greater than 13 years of constructing by way of Bitcoin’s cycles, together with 4 bear markets with 70%+ drawdowns, we all know resilience and self-discipline separate those that endure from those that fade,” he mentioned.

“We consider in Bitcoin’s long-term energy as the worldwide reserve asset, and we consider that its progress trajectory by way of public markets is inevitable for international adoption,” he added.

Bailey added that “Bitcoin has moved firmly into the mainstream of finance.”

“What was as soon as dismissed as a fringe experiment has develop into a trillion-dollar asset, held by establishments, sovereigns, public corporations, and thousands and thousands of people worldwide,” he wrote.

The KindlyMD CEO additionally predicted that each class of traders throughout each main capital market “will acknowledge the necessity for publicity.”

Over the previous week, Bitcoin has climbed 2%, in accordance with CoinMarketCap, after a minor uptick within the final 24 hours.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection