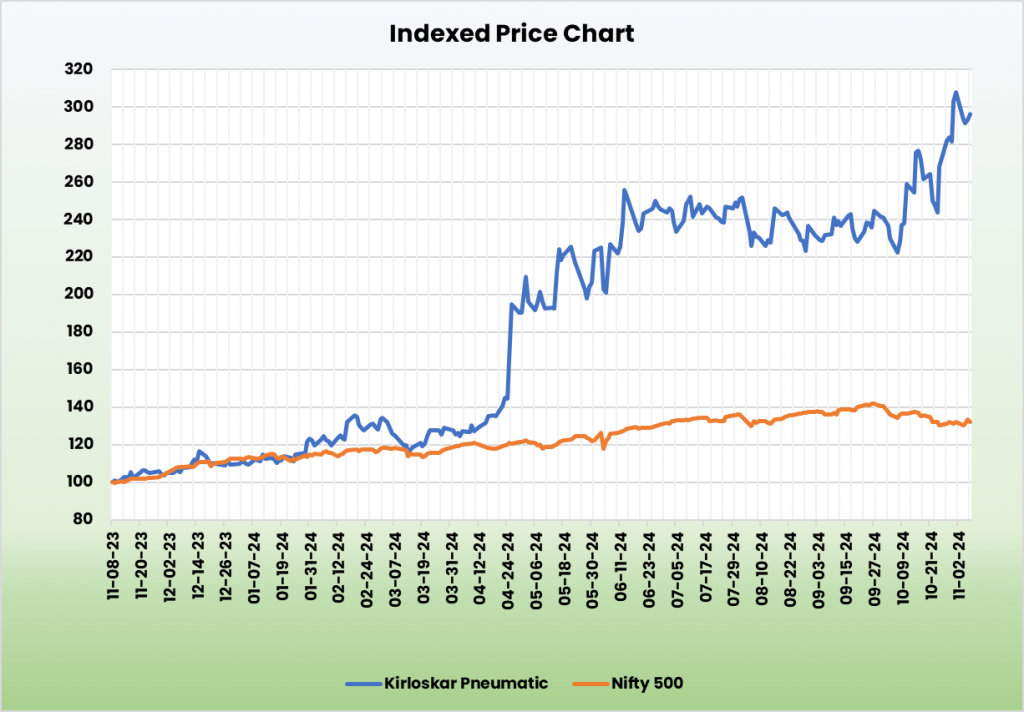

Kirloskar Pneumatic Firm Ltd – Progress Constructed on Manufacturing Excellence

Based in 1958 and headquartered in Pune, Kirloskar Pneumatic Firm Ltd. (KPCL) is a number one supplier of business pneumatic gear, together with air compressors, gasoline compressors, and pneumatic instruments. Backed by The Kirloskar Group, KPCL serves industries resembling oil and gasoline, metal, cement, meals and beverage, railways, protection, and marine. With manufacturing services in Hadapsar, Saswad, and a brand new plant in Nashik (FY24), KPCL has a presence in over 30 nations.

Merchandise and Providers

Kirloskar Pneumatic Firm Ltd. (KPCL) affords a various vary of services and products throughout these principal segments:

- Air Compressors: Reciprocating, screw, and centrifugal air compressors.

- Air Conditioning and Refrigeration: Reciprocating compressors, refrigeration programs, and vapor absorption chillers.

- Course of Fuel Methods: CNG packages and gasoline compression programs.

Subsidiaries: As of FY24, the corporate doesn’t have any subsidiaries.

Progress Methods

- KPCL is buying a majority stake in Methods and Elements India Pvt. Ltd. to spice up its presence within the refrigeration market, significantly within the pharma, chemical, and meals sectors.

- A brand new forging and fabrication facility in Nashik (FY24) enhances KPCL’s in-house manufacturing, aiming to optimize prices and obtain a sustainable aggressive edge with a 6,000 metric tonne capability.

- The Nashik facility’s in-house manufacturing goals to scale back lead instances, enhance effectivity, and decrease prices by streamlining fabrication and forging processes.

- KPCL has partnered with PDC Machines LLC (USA) to produce diaphragm compressors for hydrogen compression, supporting India’s inexperienced hydrogen tasks.

- New product introductions in FY24 embody Tezcatlipoca Centrifugal Compressors, Atmos Aria Screw Compressors, and Jarilo Biogas Compressors, receiving constructive buyer inquiries.

- Sturdy curiosity and order pipelines for Tezcatlipoca and Aria compressors sign development, with additional orders for hydrogen purposes anticipated within the coming quarters.

Monetary Efficiency

Q2FY25

- Income reached Rs.431 crore, up 53% from Rs.282 crore in Q2FY24.

- EBITDA surged 194% to Rs.94 crore, in comparison with Rs.32 crore in Q2FY24.

- Web revenue elevated 240% to Rs.68 crore, from Rs.20 crore within the prior yr.

- EBITDA margin improved considerably from 11% to 22% YoY.

- Web revenue margin expanded from 7% to 16% YoY.

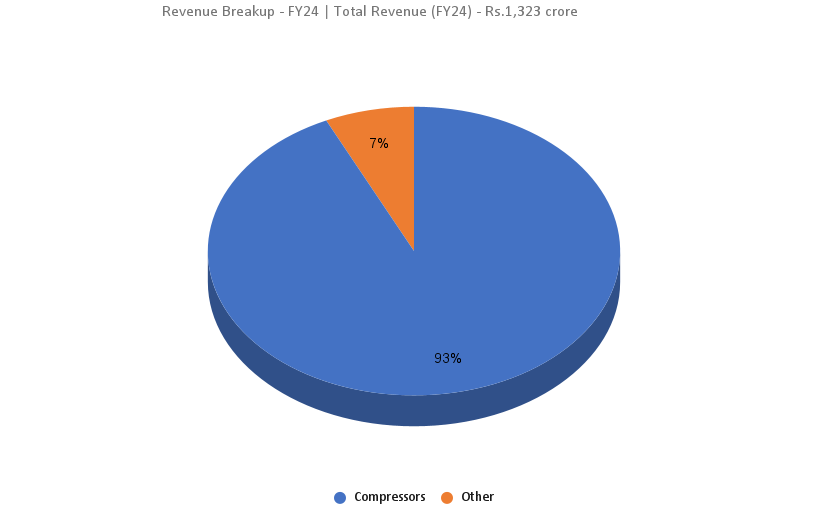

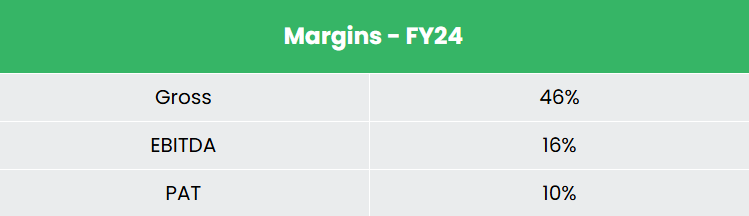

FY24

- Income: Rs.1,323 crore, up 7% YoY.

- Working Revenue: Rs.213 crore, marking a 27% YoY enhance.

- Web Revenue: Rs.133 crore, up 22% YoY.

- Mental Property: 25 IP filings and grants had been achieved in the course of the yr.

Monetary Efficiency (FY21-24)

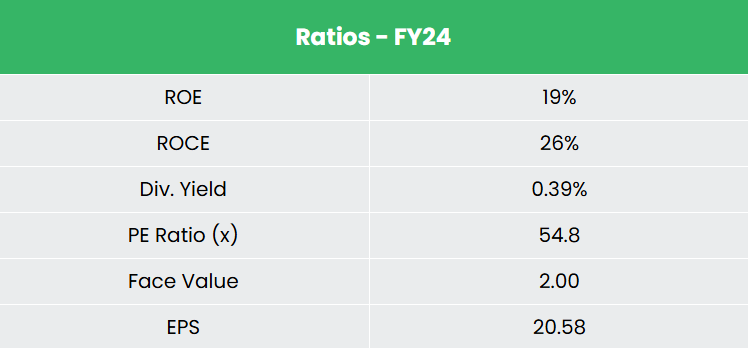

- Income and Web Revenue CAGR: 17% and 30% over FY 21-24.

- 3-12 months Common ROE: ~15%.

- 3-12 months Common ROCE: ~20%.

- Stability Sheet: Sturdy, with zero debt within the capital construction.

Business outlook

- Manufacturing Progress: Manufacturing is rising as a serious development driver in India, bolstered by sectors like automotive, engineering, chemical substances, prescribed drugs, and client durables.

- Electrical Gear Market: Anticipated to succeed in $33.74 billion by 2025, with a CAGR of 9%.

- Compressor Business Enlargement: Set for sturdy development, pushed by rising demand throughout numerous industrial sectors in India and globally.

- Key Progress Drivers: Elevated industrialization, emphasis on energy-efficient options, and adoption of superior applied sciences.

Progress Drivers

- Rising Demand for Air Conditioning: Elevated demand throughout residential, company, and industrial sectors is fueling compressor market development.

- Vacuum Packaging Enlargement: The expansion of the vacuum packaging market can also be supporting compressor demand.

- International Market Progress: The worldwide air compressor market is projected to develop at a CAGR of 4%, whereas the economic refrigeration sector is predicted to develop at 4.5% CAGR from 2021 to 2026.

- Authorities Initiatives: Applications like Digital India and Make in India, together with favorable FDI insurance policies and PLI schemes, are simplifying the setup of producing items in India.

Aggressive Benefit

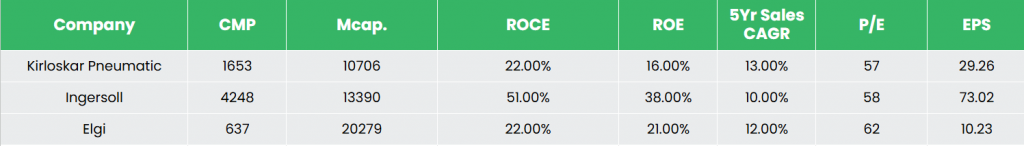

KPCL stands out as a essentially sturdy firm, showcasing constant income development and strong returns on invested capital. Competing with trade gamers like Ingersoll-Rand (India) Ltd and Elgi Equipments Ltd, KPCL has solidified its place by way of regular monetary well being and strategic investments.

Outlook

- Sturdy Operational Efficiency: The corporate continues to ship strong, margin-accretive outcomes.

- Order Guide: As of October 1, 2024, the order e book stands at Rs.1,780 crore, positioning the corporate for substantial development pushed by market share and trade demand.

- Margin Progress: Enhancements within the product combine and packaged gross sales have boosted margins, although a normalization of margins is predicted within the second half of FY25.

- FY25 Income Steering: The corporate goals for Rs.2,000 crore in income with an EBITDA margin steering of 18-20%.

- Mental Property: Over 20 IP purposes had been filed in H1FY24, reflecting the corporate’s give attention to innovation.

- In-Home Manufacturing & IP Growth: These methods are anticipated to reinforce price effectivity, drive development, and maintain margin enhancements.

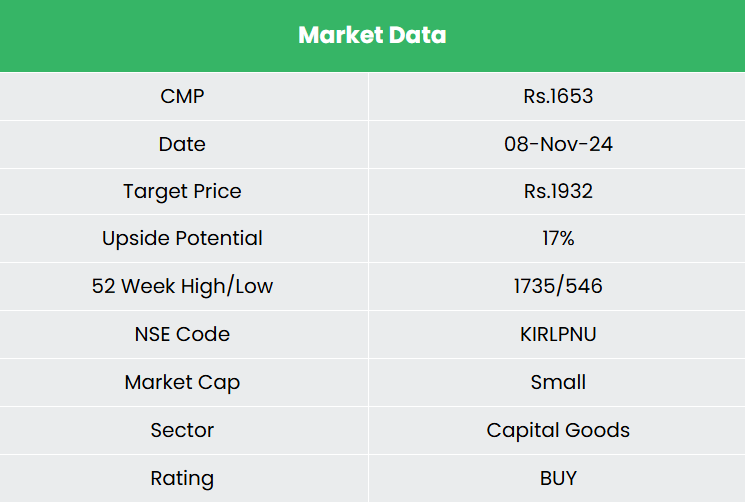

Valuation

Positioned for strong development by way of strategic initiatives, Kirloskar Pneumatic is increasing its product portfolio, tapping into new segments, and enhancing in-house manufacturing capabilities. These strikes bolster its long-term development prospects. We suggest a BUY ranking with a goal value of ₹1,932, representing 46x FY26E EPS.

Dangers

- Competitor Danger: Rising competitors within the trade might put stress on the corporate’s revenue margins.

- New Product Launch: Delays in launching new merchandise may influence the corporate’s market share and development potential.

Be aware: Please word that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

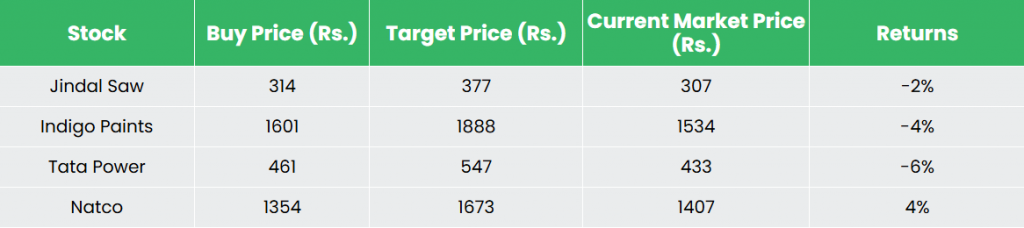

Recap of our earlier suggestions (As on 08 November 2024)

Jindal Noticed Ltd

Indigo Paints Ltd

Tata Energy Firm Ltd

Natco Pharma Ltd

Different articles it’s possible you’ll like

Publish Views:

117