Greatest knowledge heart in India

At this time India is producing knowledge in terabytes throughout organisations. Whether or not banking, insurance coverage, auto, protection, or agriculture, folks have been utilizing synthetic intelligence to reinforce manufacturing. This creates an enormous quantity of knowledge to be saved. Additional, with the growing use of 5G networks, YouTube, and social networking, the information generated in India is big.

The federal government of India mandated all of the organizations to retailer the information generated from all of the sources inside India. Therefore knowledge heart enterprise in India is anticipated to thrive. The federal government of India additionally framed insurance policies to help this trade with its insurance policies such because the Important Companies Upkeep Act (ESMA), creating Knowledge Centre Facilitation Models (DCFU), creating Knowledge Centre Financial Zones, and making a particular class code for knowledge facilities below the Nationwide Constructing Code of India are all a part of this plan.

Knowledge Middle in India

The Indian knowledge heart actions escalated after the Reserve Financial institution of India directives to localize payment-related knowledge.

The India Knowledge Middle is anticipated to succeed in 17 GW by FY2030 from its present dimension of 1 GW in 2024. This can be a enormous soar of 17 instances inside the subsequent 6 years. Indian firms are increasing domestically and likewise eyeing export or open knowledge heart overseas. For instance, Airtel launched its Nxtra knowledge heart enterprise in Africa.

The information heart market dimension was estimated at USD 4.37 billion in 2023 and is anticipated to succeed in USD 7.66 billion by 2030 at a CAGR of seven.18%. This development is especially pushed by growing web penetration, development in digital knowledge site visitors, rising public cloud companies, and increasing Web of Issues (IoT).

Additionally Learn

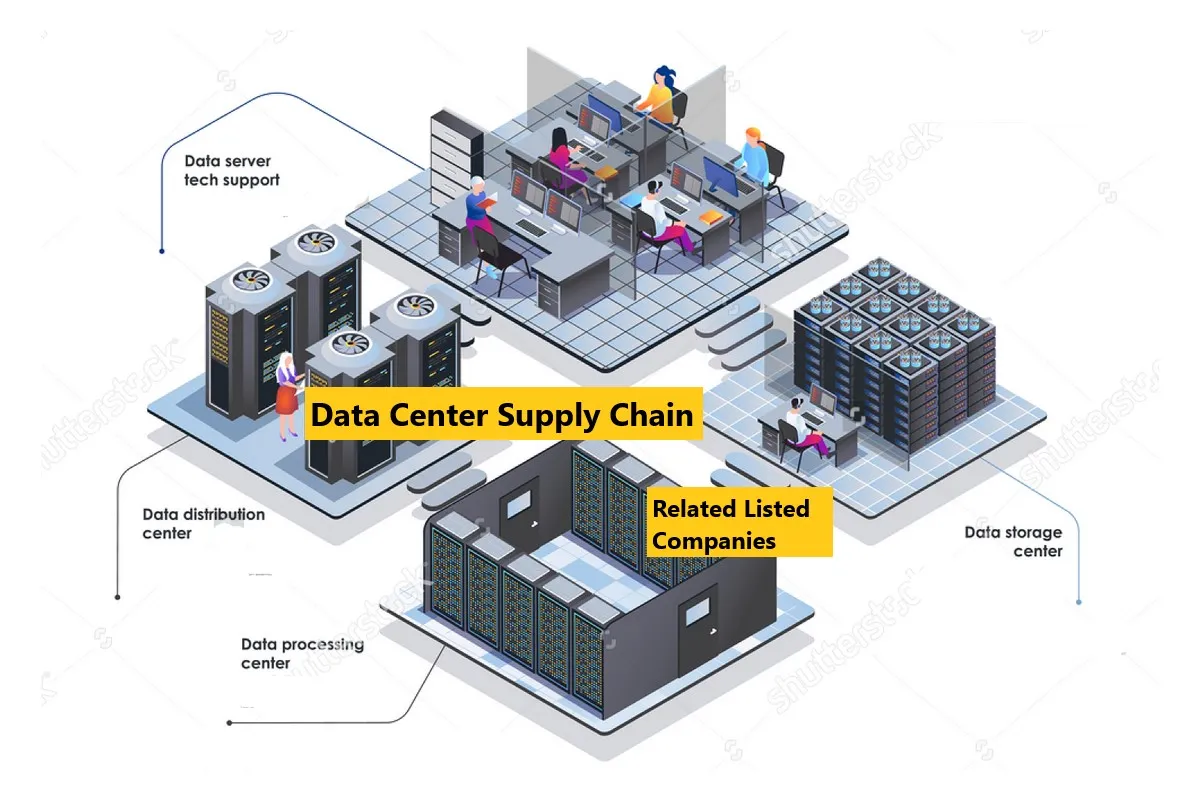

Knowledge Middle Corporations in India

Many international and home firms are making inroads into this rising trade in India. World giants resembling NTT, AWS, and Colt DCS, are aggressively constructing their knowledge heart by partnering with home gamers. Indian conglomerates like Reliance and Adani Teams are additionally aggressively seeking to develop their knowledge heart enterprise in India. Over the past 36-48 months, the information heart trade in India has attracted investments exceeding USD 27 billion.

Chennai is an information centre hub in India as a result of its strategic coastal location that gives submarine cable connectivity. Town has an put in capability of 87 MW, with 156 MW below building and 104 MW deliberate capability.

There are enormous alternatives for the information heart market in India. Allow us to discover out that are the businesses current in India. Allow us to analyze the funding alternatives for buyers in India to take part on this trade whereas investing in knowledge heart shares in India.

Knowledge Middle Shares in India

There is no such thing as a pure participant within the knowledge heart in India. Knowledge heart firms in India are diversified participant. Beneath are a number of knowledge heart India shares to be watch on.

10 Greatest Knowledge Middle Shares in India

I choose beneath 10 greatest knowledge heart shares in India to contemplate investing within the beneath order if you wish to play solely due to knowledge heart. For diversified firms together with knowledge heart participant, Reliance Industries often is the best choice for me for long run funding.

| Firm Identify | Market Cap | Market Cap (Cr) |

|---|---|---|

| Bharti Airtel Ltd | Giant | 8,91,999 |

| HCL Applied sciences Ltd | Giant | 4,25,991 |

| Anant Raj Ltd | Small | 16,483 |

| Amber Enterprises India Ltd | Small | 15,503 |

| Technoe | Small | 16,182 |

| Netweb Applied sciences | Small | 13,917 |

| Tata Communications Ltd | Mid | 52,751 |

| Cummins India Ltd | Mid | 1,07,256 |

| KEC Worldwide Ltd | Small | 22,813 |

| Reliance Industries Ltd | Giant | 21,32,343 |

Different listed firms it’s possible you’ll contemplate for additional evaluation are Adani (Adaniconnex) listed in India, Yotta Infrastructure goes to be listed in Nasdaq. Different large international knowledge heart and hyperscale gamers are Meta, Google, Microsoft, Oracle, IBM, and Alibaba.

My Prime Picks of Knowledge Middle India Shares

Nxtra By Bharti Airtel (Airtel)

Nxtra is a subsidiary of Bharti Airtel Restricted. The corporate is likely one of the largest suppliers of knowledge heart in India. As well as, Nxtra has been related to each the information heart and telecom trade for greater than 2 a long time, which provides an edge to the corporate’s development potential. Backed by one of many world’s largest funding corporations Carlyle Group, the Nxtra knowledge heart is unfold over 120 places.

Nxtra operates each colocation knowledge facilities and hyperscale parks in India and overseas. In India, the corporate has a 21MW hyperscale half in Pune, whereas different 6 hyperscale knowledge facilities are developing in main metros in India resembling Mumbai (58MW), Pune (110 MW), Kolkata (16MW), Hyderabad (40MW), Noida (40MW), and Bengaluru (40MW).

Along with this, Nxtra additionally operates 8 core knowledge facilities throughout states in India resembling Chennai-II (24MW), Mumbai-I (8MW), Pune-I (3MW), Bengaluru-I (5.5MW), Noida-I (4MW), Noida-II (6MW), Manesar-I (8.5 MW), Chennai-I (3.5MW), Chennai-III (1.5MW), Bhubaneswar-I (1.8MW), Mumbai-II (4MW). The corporate additionally operates a 50MW Edge Datacenter.

This is likely one of the core knowledge heart firms in India with sturdy dad and mom like Bharti Airtel. With the expansion of the telecom trade and knowledge heart enterprise, Bharti Airtel will profit essentially the most. Therefore, Bharti Airtel is sweet to speculate at this stage to take part within the knowledge heart development story in India.

HCL Applied sciences (HCL)

HCL Applied sciences shouldn’t be a direct knowledge heart firms in India quite the corporate provides Knowledge Middle Consulting Companies to fulfill the totally different necessities of the information heart firms. The companies embody knowledge heart design companies, session to the modernization of current knowledge heart services, and knowledge heart internet hosting companies. The information heart administration companies embody onsite hand and toes help, community help, reporting, and so forth.

The optionally available knowledge heart administration companies encompass onsite hand and toes help, community help, reporting, instruments for rack ground planning, knowledge heart infrastructure administration companies, and so forth.

At present, HCL Applied sciences has a community of over 250 knowledge heart websites the world over. The corporate.

As well as, HCL Applied sciences is likely one of the IT majors in India with a presence throughout the globe. The corporate is into IT merchandise in addition to software program. HCL Applied sciences presents itself in AI and Generative AI, Cloud, Engineering, and Software program segments of this trade. With the US economic system recovering from gentle recession and the speed minimize cycle imminent, HCL Applied sciences will do higher in comparison with its friends. Keep invested on this firm.

Anant Raj Ltd

Anant Raj Restricted (ARL) is engaged in building and improvement enterprise centered in three main states in India resembling Haryana, Rajasthan, Andhra Pradesh, and Delhi NCR. The corporate began its Knowledge Middle market operations in 1969.

Anant Raj Ltd is planning for 300 MW of knowledge heart by investing Rs 10,000 crore in 4 to 5 years. Anant Raj Cloud, a subsidiary of Anant Raj Ltd, manages the information heart enterprise in Manesar, Rai, and Panchkula in Haryana. The corporate at the moment operates 3MW and can add 3MW extra knowledge facilities this 12 months. Anant Raj Ltd is increasing its Manesar facility by 21MW with a projected funding of Rs 500 crore.

The corporate is likely one of the greatest knowledge heart firms in India together with its core building enterprise. Control this firm for funding.

Amber Enterprises India Ltd (Amber)

Amber Enterprises India is the unique tools producer (OEM) and authentic design producer (ODM) for client sturdy merchandise resembling air conditioners, metallic elements for microwave meeting, washer tub assemblies, case liners for fridges, motors for HVAC merchandise, and printed circuit board. The corporate provides its merchandise to among the large client sturdy gamers resembling Amazon, Provider Media, Daikin, Hitachi, Panasonic, LG, Whirlpool, and Samsung.

Amber Enterprises is well-known for its air conditioner that serves industries resembling protection, industrial, automotive, and railway. Amber Enterprises is likely one of the main air conditioner producers for Telecom and knowledge facilities. It Precision AC, local weather management options for Knowledge Centres. With the expansion in knowledge heart enterprise in India, the demand for its local weather management options will go up.

Amber Enterprises is itself a robust firm on this phase with rising income and PAT over time. That is one in every of my favourite knowledge heart shares in India to regulate.

Techno Electrical (Technoe)

Techno Electrical & Engineering Firm Ltd. (TEECL) is likely one of the largest suppliers of energy infrastructure firms in India. The corporate foray into knowledge heart enterprise within the 12 months 2021. The corporate is planning to speculate USD 1 billion by FY 2030 to ascertain knowledge facilities in India.

TechnoDC, the subsidiary of Techno Electrical, is working an information heart in Chennai. With 20,000 sq. meters of built-up space, the Chennai knowledge heart offers 23.4MW IT capability. This knowledge heart is totally run by renewable vitality.

The corporate can also be planning two extra knowledge facilities in Mumbai, and Kolkata. Mumbai knowledge heart will supply as much as 3 MW capability.

The Kolkata knowledge heart will supply as much as 24 MW capability and will likely be developed on 4-5 Acre land at Bengal Silicon Valley at Kolkata with an funding of USD 164.1 mn.

That is one in every of my favourite knowledge heart shares in India to put money into from a long-term perspective. The corporate has been reporting sturdy income over time.

These 5 knowledge heart firms in India are my greatest picks. Please share your view on different firms. Please share your view within the remark field or getintouch@mind2markets.com. For additional particulars about these firms or their actions, please attain us immediately.

Main Knowledge Middle Corporations in India

| Firm |

| AdaniConneX |

| Nxtra by Airtel |

| ST Telemedia World Knowledge Centres |

| NTT World Knowledge Facilities |

| Internet Werks |

| Sify Applied sciences |

| Yotta Infrastructure |

| CtrlS Datacenters |

Record of knowledge facilities in India

| Record of knowledge facilities in India (These are the pure knowledge heart gamers in India) |

|---|

| Equinix |

| Yotta Knowledge facilities |

| Digital Realty |

| Amazon AWS |

| MOD Mission Important |

| Zenlayer |

| IBM Cloud |

| EdgeConnex |

| Microsoft Azure |

| Oracle |

| Iron Mountain Knowledge Facilities |

| STTelemedia World Knowledge Middle |

| Psychz Networks |

| HostDime |

| Nxtra by Airtel |

| MetaEdge |

| SIfy Applied sciences Restricted |

| CtrlS Datacenters LTD |

| Internet Werks India Pvt Ltd |

| Amaara Networks |

| Netforchoice Knowledge Middle |

Extra From Throughout our Web site

We endeavor that can assist you to grasp totally different facets of an organization earlier than you make investments. Study all firm insights, information evaluation, market intelligence with us. Please attain out to us for any companies on firm evaluation.

To know extra details about firm insights for funding, and enterprise overview of firms for funding, listed below are some steered readings on firm insights for funding – Inexperienced Hydrogen Shares in India, IREDA Share worth Goal, Tata Motors Inventory Worth, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Inventory Worth.