Be part of Our Telegram channel to remain updated on breaking information protection

Kraken and Backed Finance have expanded their tokenized inventory product xStocks to the Tron blockchain, exhibiting the rising demand for turning real-world property like shares into digital tokens.

As a part of the rollout, Backed will subject xStocks as TRC-20 tokens on TRON, with every token absolutely backed 1:1 by the underlying asset. This integration will convey tokenized equities to TRON’s giant ecosystem, giving builders and customers wider entry to real-world asset buying and selling.

Since its launch in late June 2025, xStocks has recorded over $2.5 billion in mixed buying and selling quantity on centralized and decentralized exchanges, Kraken mentioned.

Wall Avenue’s going on-chain ⛓️

Kraken is launching tokenized shares & ETFs with @BackedFi‘s new @xStocksFi, plus increasing MiFID-regulated derivatives within the EU 🇪🇺

Subsequent-gen markets are right here. We’re already constructing them 🧱

All on this week’s #KrakenIn60 👇 pic.twitter.com/o0joLZ7qa1

— Kraken (@krakenfx) Could 23, 2025

In keeping with a TronDAO spokesperson, the rising curiosity in RWAs exhibits rising belief in layer-1 blockchains like Tron. He added that Tron will preserve constructing the infrastructure wanted for long-term adoption and real-world monetary use instances.

TRON founder Justin Solar mentioned TRON makes tokenized shares extra accessible, whereas Kraken’s Arjun Sethi famous that xStocks are absolutely backed and verifiable on-chain. As well as, Backed’s Adam Levi added that TRON’s success with stablecoins now extends to tokenized equities.

TRON Now An Even Stronger Bridge Between TradFi And Blockchain

TRON’s quick, low-cost community and international attain make it a really perfect residence for the mission. Quickly, Kraken customers in supported areas will be capable of deposit and withdraw xStocks straight via TRON, making it simpler and extra handy to entry tokenized property.

This integration makes TRON a fair stronger bridge between conventional finance and blockchain. With tokenized shares now becoming a member of stablecoins and different real-world property, TRON gives one of the full platforms for constructing monetary apps on-chain.

It’s a giant step for tokenized markets. TRON’s quick and international community offers individuals in every single place to entry property that after had been restricted. TRON DAO believes tokenized shares needs to be open, straightforward to make use of, and work throughout totally different networks, giving customers extra freedom.

This modification removes middlemen, permits 24/7 entry, and helps create a fairer and extra clear monetary system.

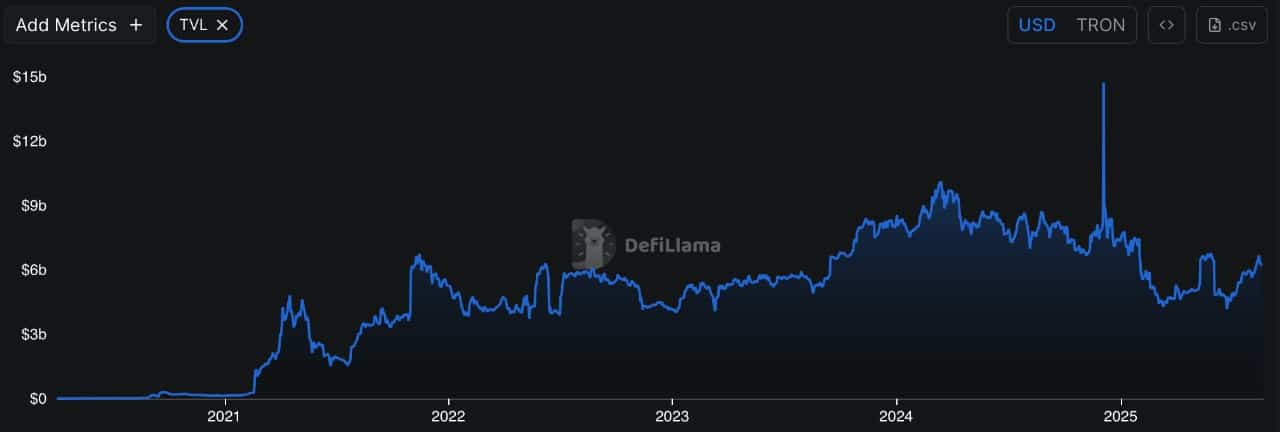

TRON’s decentralized finance (DeFi) community is bouncing again after a giant drop earlier in 2025, knowledge from DeFiLlama exhibits.

Tron TVL over time. Supply: DefiLlama

In 2021, TRON’s whole worth locked (TVL) grew shortly, transferring previous $6 billion. The community confronted ups and downs in 2022 and 2023, however managed to maintain regular progress. By 2024, TRON hit new highs with TVL above $9 billion, exhibiting sturdy demand from customers and buyers.

Issues modified at first of 2025 when TVL fell sharply, reaching its lowest level since mid-2022. This raised considerations concerning the well being of the DeFi market on TRON.

Nonetheless, TVL has began climbing once more and is now above $6 billion once more. The restoration is linked to increased stablecoin exercise and TRON’s rising use in funds.

Ethereum Leads DeFi As RWA Tokenization Pushes Market To $26.4B

Ethereum continues to steer DeFi with $89 billion in whole worth locked (TVL), making up about 60% of all blockchain exercise. On July 29, eToro mentioned it is going to tokenize 100 well-liked U.S. shares on Ethereum. A month earlier, Robinhood launched a layer-2 blockchain in Europe for buying and selling U.S. property.

Actual-world asset (RWA) tokenization is gaining momentum this 12 months as extra establishments put property like US Treasurys, personal credit score, and shares on-chain. Knowledge from RWA.xyz exhibits the market reached $26.4 billion final week, up from $15.6 billion at first of the 12 months.

A Binance Analysis report famous that tokenized shares are approaching a “key progress stage,” just like DeFi’s early years. Nansen CEO Alex Svanevik added that the largest alternative lies in personal markets, the place inefficiencies are bigger than in public markets.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection