Picture supply: Getty Photos

Not all traders may have the identical view on explicit firms. It’s this variety of opinions that makes a market. When contemplating which FTSE 100 shares to purchase, I all the time suppose analysing the brief positions of hedge funds is a good suggestion.

Right here’s a few UK blue-chips the funds suppose will fall in worth. But regardless of their wealth of collective expertise, they don’t all the time get it proper, and I feel these instituions are overly bearish on certainly one of these firms. Which might I purchase?

Sainsbury’s

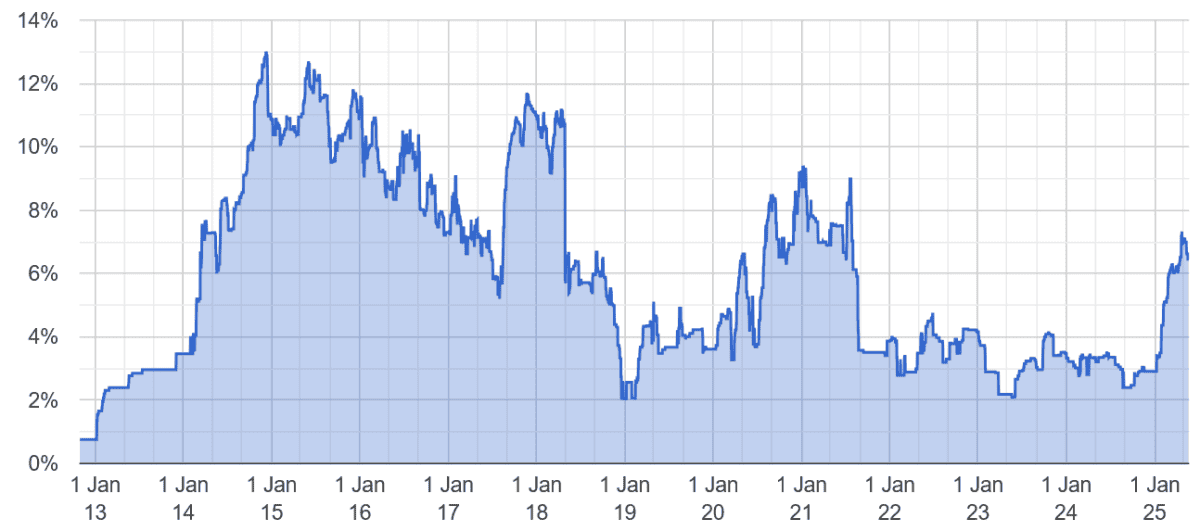

Based on shorttracker.co.uk, Sainsbury’s (LSE:SBRY) is presently essentially the most shorted FTSE share proper now. Some 6.5% of all its shares are presently shorted, with seven completely different funds betting towards the inventory.

Actually, brief curiosity has spiked in latest months. It was sitting round 2.9% at first of the 12 months.

Margins at Britain’s second-largest grocery store stay beneath menace as competitors grows and prices spiral. Sainsbury’s predicts underlying retail working revenue will stagnate at £1bn this 12 months because it eats an additional £140m prices by means of nationwide wage hikes and elevated Nationwide Insurance coverage contributions.

I feel it could wrestle to achieve this goal too, with the nation’s different Massive 4 supermarkets (Tesco, Asda and Morrisons) kicking off a contemporary worth struggle in 2025. And naturally the continued growth from worth specialists Aldi and Lidl poses an ever-present drawback.

The Nectar loyalty scheme — which has round 18m members — is a robust weapon in J Sainsbury’s struggle towards rising competitors. The coupon-and-discount programme helped ship the grocery store’s best market share beneficial properties in a decade final 12 months.

Nonetheless, I nonetheless suppose Sainsbury’s shares may fall sharply. I’m with the hedge funds on this one.

The Berkeley Group

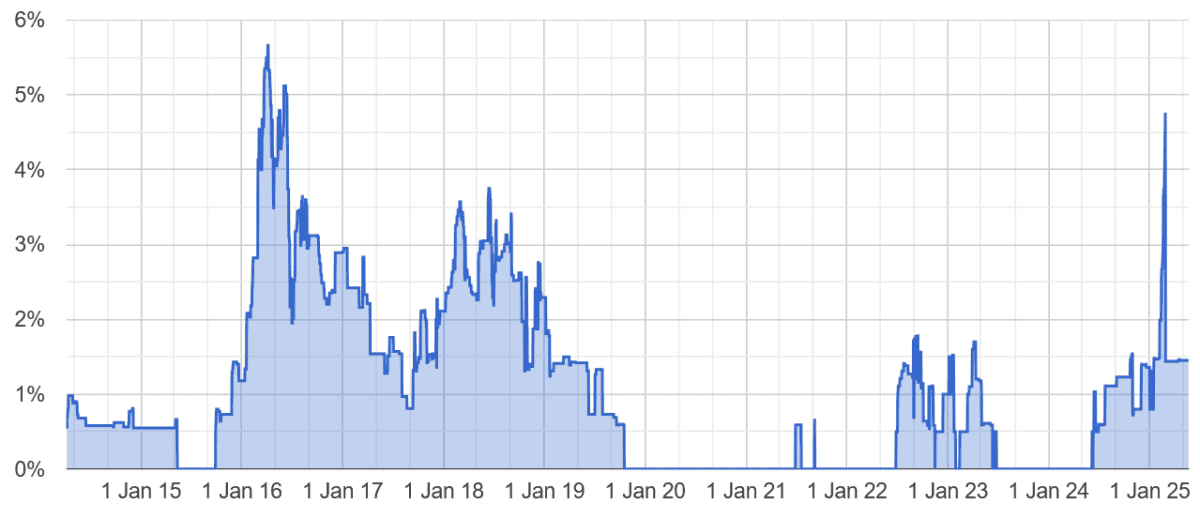

Housebuilder Berkeley (LSE:BKG) can also be one of many Footsie’s most shorted shares at present, albeit at a decrease stage than Sainsbury’s.

Shorttracker.co.uk exhibits round 1.5% of its shares are shorted, up from 1.3% at first of 2025. Two hedge funds presently maintain brief positions within the enterprise.

On the one hand, it’s not onerous to see why. Housebuilders are among the many most cyclical shares on the market, and a dark outlook for the home financial system means Berkeley may wrestle to shift inventory.

But I consider that, on stability, issues are beginning to search for for FTSE 100 firm. Its give attention to the extra prosperous areas of the London and the South East may assist it climate wider financial weak point throughout the broader nation too.

Inflation information has been extra disappointing of late. However the broader development for costs within the UK is down, which means the Financial institution of England ought to proceed chopping charges and making mortgage merchandise extra reasonably priced.

On this entrance, it’s additionally value mentioning the intensifying commerce struggle that’s supporting dwelling gross sales and costs. Newest official information confirmed common home values up £16,000 within the 12 months to March, to £271,000.

Given its strong long-term outlook, I’ll take into account shopping for Berkeley shares after I subsequent have spare money to speculate, regardless of the bearish view of some hedge funds.

&w=150&resize=150,150&ssl=1)