Picture supply: Getty Pictures

Discovering what hedge funds are shorting may be an effective way for buyers to keep away from potential traps. I’m at the moment scanning which FTSE 100 and FTSE 250 shares these establishments are betting towards as I proceed constructing my portfolio.

Nonetheless, hedge funds don’t at all times get it proper. Right here’s one UK share I believe they’re proper to be bearish on, and one other I’m actively contemplating shopping for for my Shares and Shares ISA.

Ocado Group

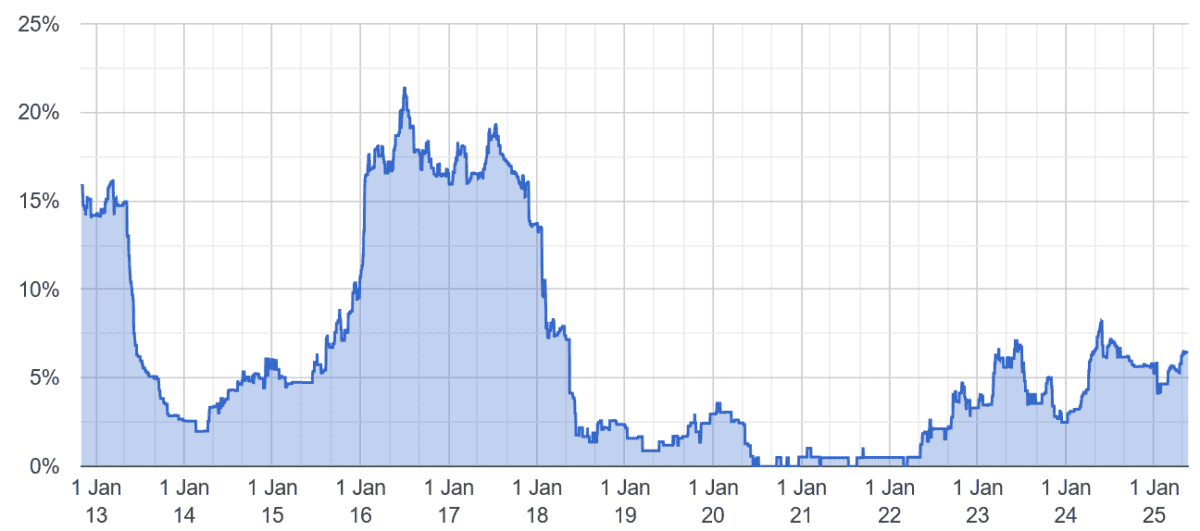

Based on shorttracker.co.uk, Ocado Group‘s (LSE:OCDO) probably the most shorted share on the UK’s second-tier share index at this time. Some 6.5% of all its shares are held in brief positions, with eight separate funds taking a pessimistic view of its prospects.

Quick curiosity in Ocado shares has picked up barely for the reason that begin of the yr too. On the London Inventory Change, solely uranium provider Yellow Cake (6.6%) has a higher proportion of its shares in brief positions.

This will likely, given sustained power at Ocado’s grocery division, come as a shock to some buyers. Ocado’s been the fastest-growing retailer for 11 straight months, and within the 12 weeks to twenty April gross sales jumped 11.8%. That’s in response to Kantar Worldpanel.

The net grocer could wrestle to keep up its spectacular momentum as its rivals roll out new value initiatives. Nonetheless, the most important hazard to Ocado’s shares is the prospect of additional underperformance at its know-how division.

Demand for its robotics and automation methods continues to disappoint as supermarkets reduce plans for brand spanking new buyer fulfilment centres. In-store procuring has returned with a bang for the reason that finish of the pandemic. And so the economics of opening massive, automated centres don’t stack up in addition to they as soon as appeared.

I believe Ocado’s share value might carry on plummeting.

ITV

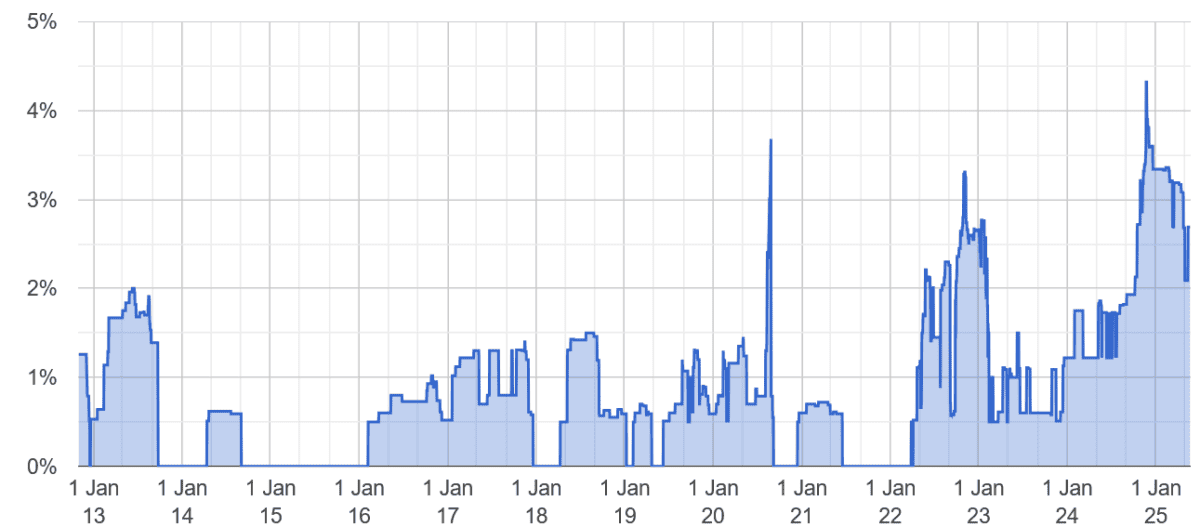

Broadcaster ITV (LSE:ITV) has attracted much less brief curiosity than Ocado. However with 2.7% of its shares held in brief positions, it’s nonetheless one of many FTSE 250’s most shorted, with 4 funds betting towards the corporate.

This bearishness displays fears that ITV will wrestle because the UK financial system flatlines and shoppers pare again spending, impacting promoting gross sales. With an absence of main sporting occasions in 2025, the broadcaster has predicted sharp falls in advert revenues this yr (together with a 14% drop within the present quarter).

Regardless of the specter of a protracted promoting slowdown, I nonetheless assume ITV has a vibrant future. That is thanks largely to its starring position within the streaming revolution.

First off, the business broadcaster is making robust progress of its personal right here with its ITVX platform. Regardless of fierce competitors from the likes of Netflix, streaming hours proceed to climb — these have been up 12% between January and March which, in flip, pushed digital advert revenues 15% greater.

Secondly, ITV’s large manufacturing division means it’s benefitting from demand for brand spanking new content material from different streaming firms. Exterior revenues at ITV Studios rocketed 20% through the first quarter because it delivered programming to international rivals.

Whereas some hedge funds may not fancy the corporate, I’ll contemplate including ITV shares to my portfolio when I’ve spare cash to speculate.