Be part of Our Telegram channel to remain updated on breaking information protection

Technique, the Bitcoin treasury agency led by Michael Saylor, has purchased an extra $217.4 million value of BTC.

Based on a Sept. 8 8-Ok submitting with the US Securities and Change Fee (SEC), the corporate purchased 638,460 BTC between Sept. 2 and Sept. 7 at a median buy value of $111,196.

Technique’s newest Bitcoin buy was funded by the proceeds from at-the-market gross sales of its Class A typical inventory, MSTR, perpetual Strike most popular inventory, STRK, and perpetual Strife most popular inventory, STRF.

Relentless Dilution, Underperformance

Saylor mentioned on X that Technique’s holdings now stand at 638,460 BTC, or 3% of Bitcoin’s 21 million provide, acquired for $47.17 billion. The common acquisition value for these cash is round $73,880, he added.

Technique has acquired 1,955 BTC for ~$217.4 million at ~$111,196 per bitcoin and has achieved BTC Yield of 25.8% YTD 2025. As of 9/7/2025, we hodl 638,460 $BTC acquired for ~$47.17 billion at ~$73,880 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/QNIuAWRwEW

— Michael Saylor (@saylor) September 8, 2025

Technique is sitting on an unrealized achieve of $25.76 billion.

Whereas Technique’s latest purchase and big paper features may very well be seen as positives for the crypto trade, a number of Technique buyers have shared their frustration with the corporate’s continued BTC accumulation.

One X person questioned the corporate’s shopping for exercise, asking why their MSTR shares are being diluted “to line Technique’s company pockets.” Different customers replied to the remark and advised the disgruntled investor to concentrate on the quantity of BTC per share they maintain as a substitute of the greenback worth of the shares.

In the meantime, one other X person who claims to be a shareholder in Technique mentioned buyers wish to hear Saylor’s ideas on why MSTR is underperforming towards BTC, including that “the dilution is relentless.”

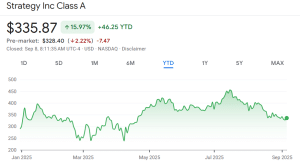

MSTR has recorded a achieve of barely lower than 16% over the past 12 months, in accordance with Google Finance, whereas Bitcoin has soared over 105% throughout the identical interval.

MSTR YTD efficiency (Supply: Google Finance)

BTC slid round 4% in comparison with a 15% slide for MSTR.

Saylor mentioned Technique has achieved a year-to-date (YTD) achieve of 25.8% on its Bitcoin holdings, however person Boris Sixson on X mentioned that he stays dissatisfied.

“Sure, you made a revenue…We, as buyers in $MSTR inventory, made a loss,” he mentioned “What an exquisite world. You get richer. You progress up within the rating of the wealthy… Allow us to take a look at the rising losses, together with as we speak.”

Including to MSTR buyers’ woes is Technique’s latest snub from the S&P 500 index. Though Technique met all the necessities for inclusion within the index, it missed out to firms that included Robinhood (HOOD).

MSTR remains to be listed on the Nasdaq, however Bloomberg estimated that inclusion within the S&P 500 might have led to inflows for MSTR of $16 billion as funds that monitor it could have been compelled to purchase up Technique shares.

Metaplanet And El Salvador Purchase BTC As Sentiment Improves

Technique shouldn’t be the one firm that has purchased Bitcoin as we speak. Japan-based Metaplanet introduced earlier as we speak that it purchased 136 BTC, pushing its whole holdings to twenty,136 BTC value greater than $2.2 billion.

*Metaplanet Acquires Further 136 $BTC, Complete Holdings Attain 20,136 BTC* pic.twitter.com/c41t6bJg1L

— Metaplanet Inc. (@Metaplanet_JP) September 8, 2025

And El Salvador additionally added to its BTC hoard. President Nayib Bukele introduced on X yesterday that El Salvador bought 21 Bitcoins to have fun the fourth anniversary of its Bitcoin Legislation.

The nation now holds 6,313.18 BTC valued at round $701 million, in accordance with the federal government’s blockchain knowledge.

The Bitcoin shopping for from Technique, Metaplanet and El Salvador comes amid enhancing investor sentiment out there.

Within the final 24 hours, the Crypto Concern and Greed Index, a well-liked software to gauge investor sentiment, has risen from a “Concern” studying of 44 to a “Impartial” rating of 51. That’s nonetheless down from a “Greed” studying of 67 a month in the past.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection