It’s a foggy and chilly winter morning in Punjab, a terrace full of vibrant kites ready to soar within the sky. Two cousins, Guddu and Gagan, are on the terrace, every holding ‘manjha’ , a spool of kite thread, ready for the fog to be cleared in order that they might get pleasure from flying kites. In the mean time, they’re having fun with the ‘Maghi’ (Makar Sankranti) delicacies equivalent to groundnuts, ‘gajak’, ’tilgud’, and popcorn served with scorching tea.

Whereas ready for the clear sky, they get right into a dialog like this:

Guddu: (sipping tea) This fog is so cussed! I hoped we’d be flying our kites by now.

Gagan: (laughs) Yeah, similar right here. Makar Sankranti with out flying kites doesn’t really feel proper. However I suppose we now have to attend. The fog ought to clear quickly.

Guddu: True. Within the meantime, keep in mind final week you had been asking about mutual funds? Let me clarify it to you whereas we wait. Belief me, kite flying steps will make it simpler to grasp.

Gagan: () Actually? Alright then, I’d love to listen to it.

Guddu: Okay, consider kite flying as investing in mutual funds. Step one to flying a kite is choosing the proper kite and thread, proper? Equally, step one in mutual fund investing is choosing the proper fund based mostly in your monetary objectives.

Gagan: (nodding) Is smart. So, I’ve to select a kite that fits the wind and a mutual fund that fits my objectives. Proper?

Guddu: Completely, appropriate!

Gagan: That’s fascinating; what’s subsequent?

Guddu: The second step in kite flying is making certain the thread is robust and the knots are tied correctly. In mutual funds, this implies understanding the fund’s danger and making certain your cash is invested in a well-managed fund.

Gagan: Oh! Danger, bought it. Such as you wouldn’t need a weak thread, you don’t need to put money into a poorly managed fund.

Guddu: Precisely! Now, while you begin flying a kite, you let it out slowly, balancing the strain between the wind and the thread. In mutual funds, that is like beginning small with a SIP (Systematic Funding Plan). You make investments small quantities usually as an alternative of placing in a big sum directly.

Gagan: Oh, so SIP is like feeding out the thread slowly, maintaining management whereas adjusting to the wind or market.

Guddu: Exactly! And similar to you information your kite greater by pulling the thread strategically, you might want to monitor your mutual fund investments usually. You’ll be able to alter your investments if wanted, relying on how the market performs.

Gagan: What about when the kite goes off-balance or begins descending? How does that slot in?

Guddu: Nice query! When the kite descends, you pull again the thread and stabilise it. Equally, markets might be risky. As a substitute of panicking, it’s best to keep affected person/invested and make knowledgeable selections to stabilise your portfolio.

Gagan: Hmm, persistence and technique, similar to flying a kite.

Guddu: Precisely! And the ultimate half – when the kite reaches its peak, you don’t reduce the thread, proper? You let it glide steadily and really feel content material. In mutual funds, this implies staying invested for the long run to reap the most effective rewards.

Gagan: (smiling) I get it now. Kite flying and mutual fund investing each want planning, persistence, and technique.

Guddu: Completely. Oh look, the fog is beginning to clear. Able to put your kite and your new data to the check?

Gagan: (laughs) Let’s do it! And possibly after this, I’ll begin my SIP too.

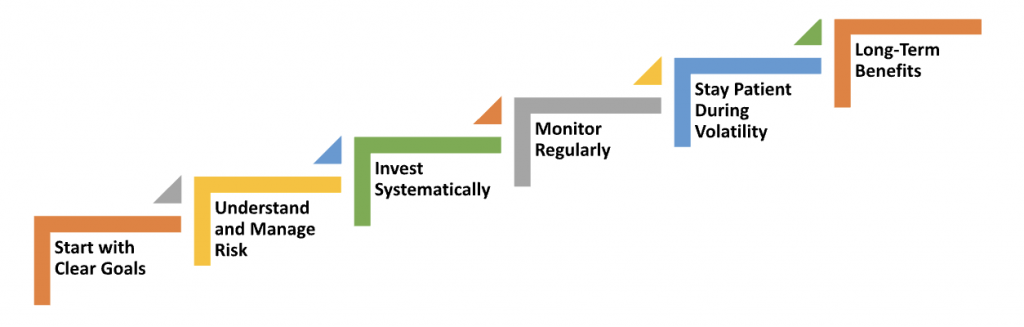

Allow us to now perceive what are the important thing takeaways for us from Guddu and Gagan’s dialog:

1. Clear Targets

Like choosing the proper kite and thread, deciding on a mutual fund aligned together with your monetary objectives is the prerequisite of investing.

2. Danger

Assess the danger degree of the mutual fund, the way in which you make sure the thread and knots are settled for flying the kite.

3. Investing

Systematic Funding Plans (SIPs) may very well be an environment friendly and constant alternative with small investments, very like releasing kite thread slowly and steadily.

4. Monitoring

Preserving the observe of your investments and making the required changes by way of quantity, frequency and many others. may very well be appropriate for the funding, much like guiding your kite because it faces adjustments within the wind.

5. Behaviour

As market fluctuations are inevitable, staying calm and invested; like dealing with a dipping kite, may very well be applicable funding behaviour.

6. Advantages

Within the method you let your kite glide steadily at its peak, staying invested in mutual funds for the long run could enable you to reap higher returns with the assistance of compounding and development.

Other than understanding the idea of mutual funds, we should additionally know the regulatory significance of the identical, described as follows:

Mutual Fund Investments have varied advantages, a few of them are as follows:

1. Diversification

Mutual funds put money into a wide range of belongings, spreading danger throughout sectors and devices. Chances are you’ll select a scheme as per your monetary purpose from the assorted mutual fund scheme classes as outlined by SEBI.

2. Skilled Administration

Fund managers with experience deal with investments, making certain higher decision-making than particular person buyers would possibly obtain.

3. Flexibility

Choices like Systematic Funding Plan (SIP), Systematic Withdrawal Plan (SWP), Systematic Switch Plan (STP) and lump-sum investments cater to buyers with completely different monetary objectives and capacities.

4. Liquidity

Most mutual funds permit simple redemption of items, making certain entry to funds when wanted, for instance the liquid funds.

5. Tax Effectivity

Sure mutual funds, like ELSS (Fairness-Linked Financial savings Schemes), provide tax advantages beneath Part 80C of the Previous Regime of the Revenue Tax Act.

6. Wealth Creation

Lengthy-term investments in mutual funds can yield important returns by compounding and market development.

Wrapping Up

When investing in mutual funds, like kite flying, select the proper “kite,” that means the proper fund that fits your monetary objectives, and in addition choose a secure “thread,” that means the funding kind or plan that matches your danger urge for food. Professional steerage, simply as you information your kite in altering winds, may also help you keep affected person throughout market fluctuations and search stability on your long-term investments.

Keen on how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Buyers