Picture supply: Getty Photographs

In line with the consensus of analysts protecting the London Inventory Change Group (LSE:LSEG), it’s essentially the most undervalued firm on the FTSE 100.

Now, analysts’ forecasts will be deceptive. Typically there simply aren’t many protecting a inventory and a consensus of two analysts isn’t a lot of a consensus. And a few merely aren’t excellent at their jobs. I lately edited a chunk of funding analysis by an analyst at a significant funding financial institution, and it was an appalling piece of labor in each respect.

There’s additionally a time-lag factor. Typically analysts simply don’t have the time to replace their protection. An organization may report a foul quarter and the share worth falls, however the analysts’ forecast stay the place they have been.

These don’t seem to use right here — though I can’t vouch for the standard of all of the analysts. The inventory’s coated by 17 of them, and with a market-cap of £44.8bn, it’s seemingly the largest firm in most analysts’ protection.

Simply how undervalued?

Nicely, in line with their common forecast the inventory’s undervalued by 43%. That implies the market’s considerably overlooking this firm’s potential.

On a statutory foundation, the inventory’s buying and selling round 43 occasions ahead earnings. And whereas that falls dramatically to 27.2 occasions by 2027, the adjusted figures are much more illuminating.

The present forecast suggests earnings per share of 399p for the yr forward and 442p for 2026. This offers us a price-to-earnings (P/E) ratio of 21.5 occasions for 2025 and 19.3 occasions for 2026. In fact, these figures imply nothing with out context. Why would an investor pay 21.5 occasions earnings for the London Inventory Change Group however might imagine twice about paying greater than 16 occasions for a grocery store chain?

It’s all in regards to the high quality of the enterprise and the potential for sustainable earnings progress. High quality’s usually indicated by model power, market place, and margins.

Within the first half of the yr, the London Inventory Change Group reported an adjusted EBITDA margin of 49.5% — up 100 foundation factors over a yr. In different phrases, each £10 of gross sales is value £4.95 of EBITDA.

Most different companies, particularly on the FTSE 100 which is dominated by mature enterprise like banks and miners, can’t compete with this.

Every thing thought of

Regardless of all the pieces I’ve mentioned above, this isn’t a flawless firm — something however. Traders contemplating the London Inventory Change Group ought to observe that Annual Subscription Worth isn’t notably robust, particularly as some merchandise like Eikon being retired.

Bear in mind, knowledge and analytics are actually the largest enterprise in LSEG, answerable for almost half the group’s whole revenue. That is additionally the place traders are keenly awaiting the fruits of a tie-up with tech big Microsoft. Shedding market share to Bloomberg or FactSet wouldn’t be an actual concern.

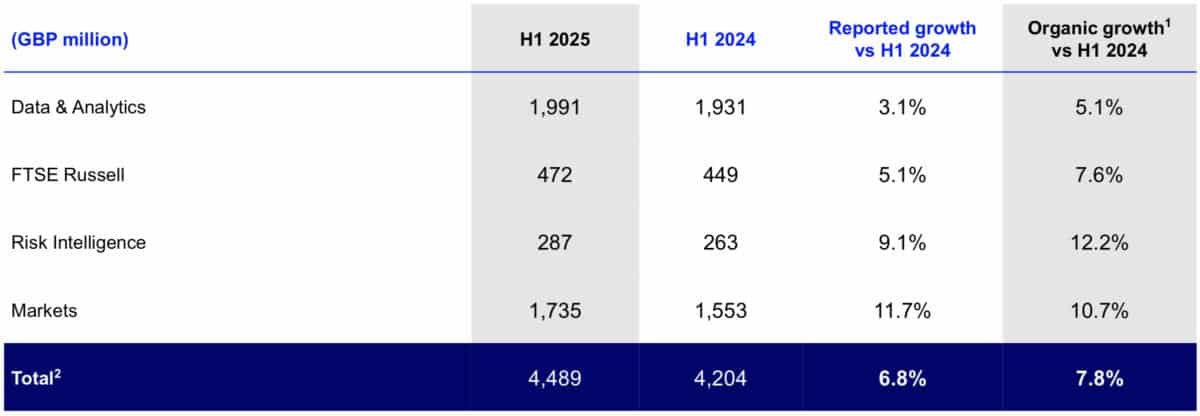

Nevertheless, there are various the explanation why I consider traders ought to think about this inventory. I’ve famous a couple of, together with the margins and the valuation. However the above snippet from the interim outcomes highlights a diversified enterprise with vital progress throughout a number of divisions.