Picture supply: Getty Pictures

My Shares and Shares ISA could also be jam-packed with dividend-paying FTSE 100 shares however that doesn’t imply that I draw back from investing in out-and-out development companies too. After enduring a few torrid years, I see one standout compelling development story within the years forward.

China uninvestable

Driving the narrative behind the poor share worth efficiency of Prudential (LSE: PRU) is that China had change into uninvestable. The delayed leisure of Covid journey restrictions between the Chinese language Mainland and Hong Kong undoubtedly damage the Asian powerhouse financial system.

On high of that the nation’s bubble in actual property has been unwinding. This damage home imports of commodities important for a booming financial system.

Given that almost half of all its insurance coverage income are derived from China and Hong Kong, its little shock that the share worth has been falling. It’s down over 40% in two years.

Covid blues

The sturdy FY24 outcomes launched on Thursday (20 March) spotlight that the dump had been fully overdone. New enterprise revenue was up 11% to $3.1bn. However I consider that is just the start.

The markets by which the corporate operates are a number of the quickest rising on the planet. In each China and India, GDP is anticipated to develop by 5% in 2025.

A rising center class is more and more anticipating entry to what Western customers take as a right. Specifically, insurance coverage and financial savings merchandise.

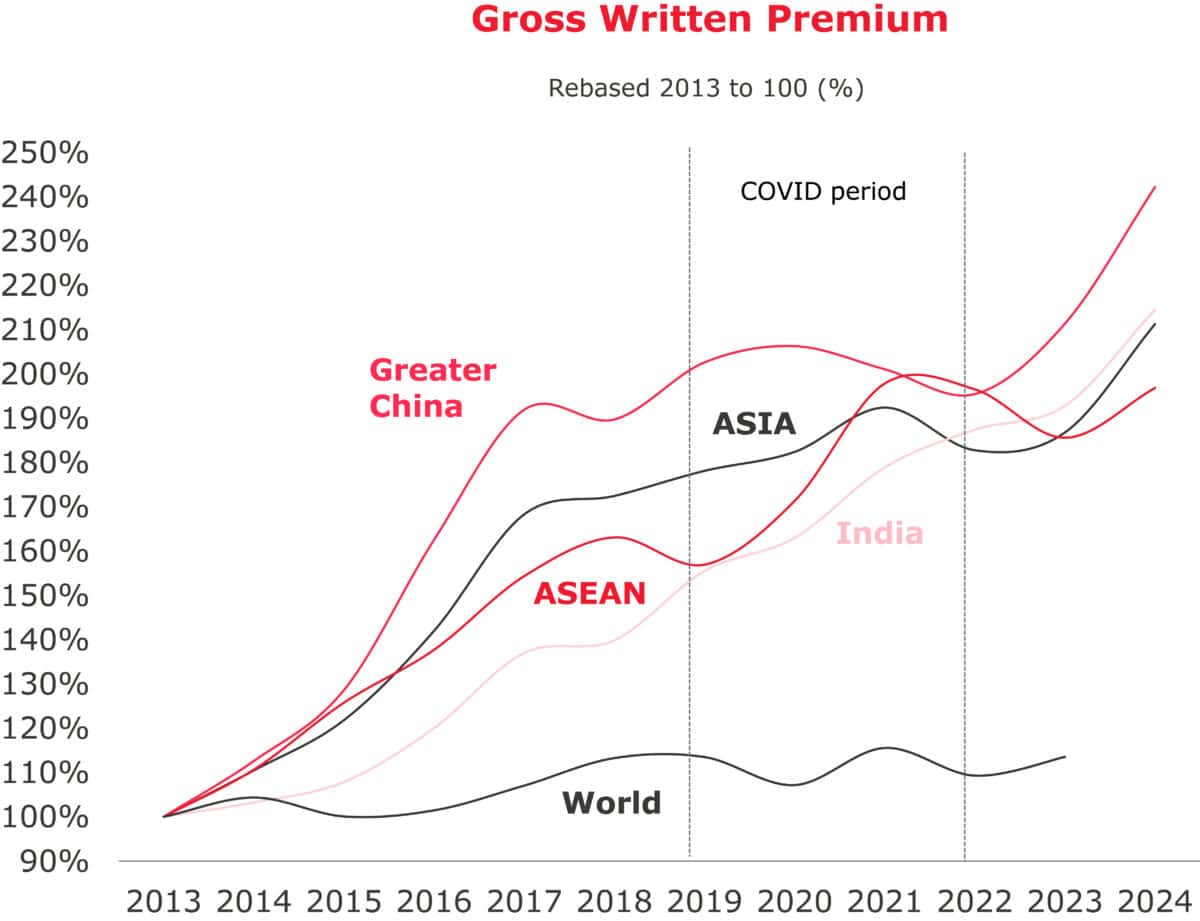

Occasions might have been robust for such customers throughout Covid. Nevertheless, the next chart highlights that gross written premiums in its core markets has now absolutely recovered.

Supply: Prudential presentation

Structural development drivers

The chance introduced to it within the coming years is actually gargantuan. Out to 2033, the entire addressable market in Asian life insurance coverage gross written premiums is predicted to double to $1.6trn.

The drivers for this development are diversified. By 2040, 28% of China’s inhabitants can be over 60. Wealth creation throughout Asia is growing too. At present, the area accounts for 30% of complete world wealth creation. Third, are low insurance coverage penetration charges. The hole in insurance coverage protection is estimated at a whopping $119trn in Asia.

I consider that it’s properly positioned to seize a big slice of this burgeoning market. Key for the enterprise is it rising cohort of brokers.

Promoting insurance-related merchandise is in the beginning a individuals enterprise. Prudential has been working arduous to recruit high quality brokers and prepare them in promoting their merchandise. Lots of its brokers at the moment are members of the celebrated Million Greenback Spherical Desk community.

Dangers

In fact, there are many dangers right here. All insurance coverage companies face ongoing credit score and liquidity dangers. Unsure rate of interest trajectories and growing protectionism insurance policies may have an effect on underlying development drivers. That is significantly acute in China the place considerations concerning the long-term well being of its property sector received’t go away.

However once I have a look at the larger image right here, I believe it makes for one of the crucial compelling development tales within the FTSE 100. The hike in its dividend per share by 13% in FY24 highlights to me that administration could be very bullish too.

Past its rising dividend, it’s additionally in the midst of executing a $2bn share buyback programme. With all this, it’s little surprise I’ve been hoovering up Prudential shares currently whereas they continue to be low-cost.