India’s fairness benchmarks opened the week on a agency word, extending their upward momentum and shutting comfortably in constructive territory. Each the Nifty 50 and the Sensex maintained energy all through the session, remaining above key technical assist ranges and reflecting wholesome market sentiment. Technical indicators such because the RSI additionally prompt sustained bullishness with out drifting into overbought situations.

Sectoral efficiency additional bolstered the optimistic tone, with all main indices ending greater. Banking, auto, and mid-cap segments led the rally, supported by notable features in choose shares throughout these classes. Whereas home markets superior strongly, broader Asian cues had been blended, with some regional indices going through gentle stress whilst others managed to put up features. Total, the market atmosphere signalled resilience and continued investor confidence firstly of the week.

On this overview, we are going to analyse the important thing technical ranges and pattern instructions for Nifty and BSE Sensex to observe within the upcoming buying and selling periods. All of the charts talked about beneath are primarily based on the 15-minute timeframe.

NIFTY 50 Chart & Value Motion Evaluation

To view different technical studies, click on right here

The Nifty 50 Index opened on a constructive word at 25,948.20 on Monday, up by 38.15 factors from Friday’s closing of 25,910.05. The index opened on a robust word on Monday, hovering close to the important thing degree of 25,950. The index fashioned a range-bound pattern within the morning session and was buying and selling inside the vary of 25,920 and 25,980; nonetheless, within the afternoon session, it continued its upward pattern from its day’s low and settled above the 26,000 degree, ending the session on a Bullish word.

The Nifty index had reached a day’s excessive at 26,024.20 and noticed a day’s low at 25,906.35. Lastly, it had closed at 26,013.45, within the inexperienced, above the 26,000 degree, up 103.40 factors, or 0.40%. Within the brief time period, the Index was above the 13/20 day EMA within the each day time-frame, indicating an uptrend.

The index’s nearest resistance degree is at 26,024.20 (R1), which it has failed to remain above a number of occasions. The upper resistance degree is at 26,104.20 (R2), which is the 52-week excessive for the index. However, the closest assist is now at 25,925.75 (S1), which was a earlier resistance degree however has was assist. If the index falls beneath this, the following assist degree to look at is at 25,757.65 (S2).

Commerce Setup:

| Nifty 50 | |

| Resistance 2 | 26,104.20 |

| Resistance 1 | 26,024.20 |

| Closing Value | 26,013.45 |

| Assist 1 | 25,925.75 |

| Assist 2 | 25,757.65 |

NIFTY 50 Momentum Indicators Evaluation

RSI (Every day): The Nifty 50’s RSI stood at 65.12, which is beneath the overbought zone of 70, indicating bullish sentiment and room to develop greater.

Bollinger Bands (Every day): The index is buying and selling within the higher band of the Bollinger Band vary (Easy Transferring Common). Its place within the higher vary suggests a bullish sentiment, and in Monday’s session, the Index fashioned a bullish candle with minimal wicks on the higher finish and a protracted wick on the decrease finish. The shut is above the open, confirming upward momentum. The index took assist close to 25,906, and 26,024 acted as a resistance degree. A sustained transfer above the center band indicators a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Monday’s buying and selling session had a median quantity of 281.77 Mn.

Derivatives Information: Choices OI signifies robust Put writing at 26,000, adopted by 25,900, establishing a robust assist zone. On the upside, a major Name OI buildup at 26,100 and 26,200 suggests a possible provide of resistance. PCR (Put/Name Ratio) stands at 1.08 (>=1), leaning in the direction of impartial sentiment, and the lengthy Buildup signifies that merchants are coming into their lengthy positions and it’s confirmed when each the value and open curiosity are rising, which indicators a robust bullish outlook, thus total indicating a impartial to bullish outlook for the following buying and selling session.

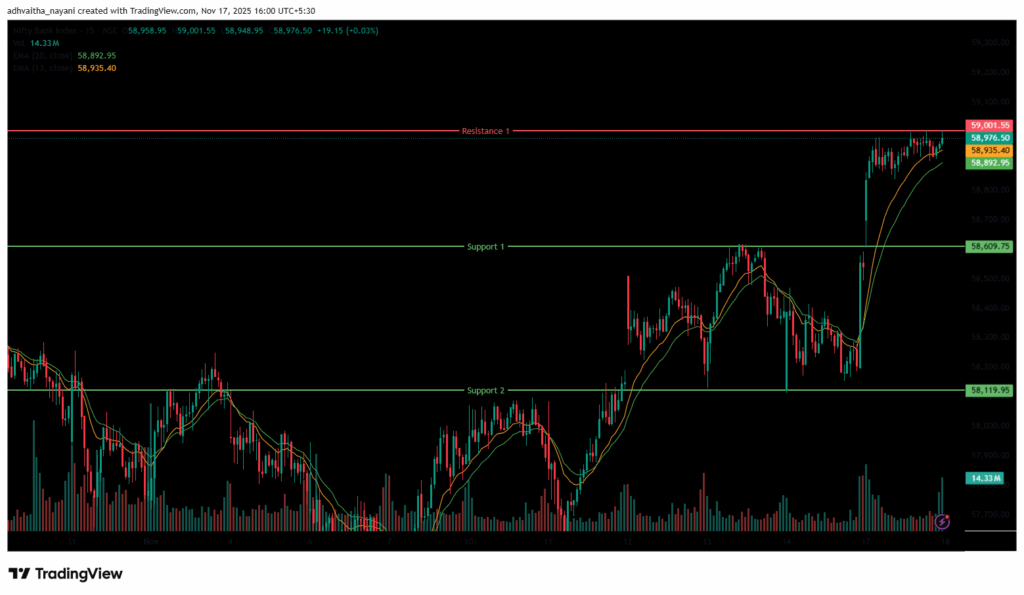

Financial institution Nifty Chart & Value Motion Evaluation

The Financial institution Nifty Index opened on a constructive word at 58,696.30 on Monday, up by 178.75 factors from Friday’s closing of 58,517.55. The index opened on an optimistic word however traded in a range-bound method within the morning session, between the 58,800 and 58,975 ranges. Within the afternoon session, the index continued to commerce close to the 59,000 degree, marking its day excessive at 59,001.55 and buying and selling between the vary of 58,920 and 59,000.

The Financial institution Nifty index had peaked at 59,001.55 and made a day’s low at 58,605.30. Lastly, it had closed in inexperienced at 58,962.70, rising above the 58,950 degree, gaining 445.15 factors or 0.76%. The Relative Energy Index (RSI) stood at 71.41, coming into the overbought zone of 70 within the each day time-frame. Within the brief time period, the Index was above the 13/20 day EMA within the each day time-frame, indicating an uptrend.

The upper resistance degree is at 59,001.55 (R1), which is the 52-week excessive for the index. However, the closest assist is now at 58,609.75 (S1), which was a earlier resistance degree however has was assist. If the index falls beneath this, the following assist degree to look at is at 58,119.95 (S2).

Commerce Setup:

| Financial institution Nifty | |

| Resistance 1 | 59,001.55 |

| Closing Value | 58,962.70 |

| Assist 1 | 58,609.75 |

| Assist 2 | 58,119.95 |

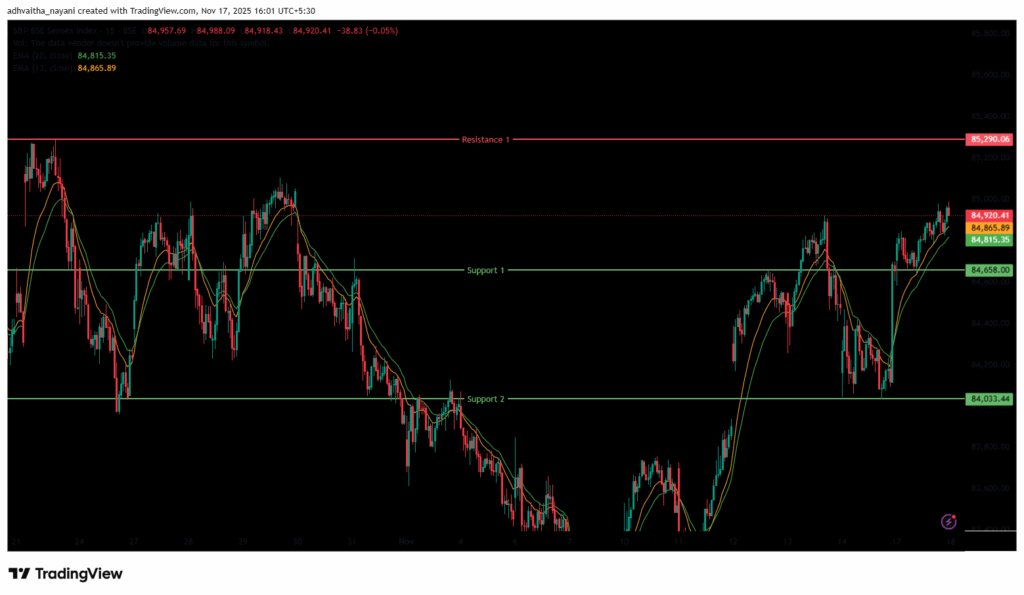

BSE Sensex Chart & Value Motion Evaluation

To view different technical studies, click on right here

The BSE Sensex Index opened on an optimistic word at 84,700.50 on Monday, up by 137.72 factors from Friday’s closing of 84,562.78. The Sensex index opened on a constructive word and continued to commerce in an identical sample because the Nifty 50, and was traded between the vary of 84,700 and 84,850 through the morning session. Within the afternoon session, the index continued to rise and had a day’s excessive at 84,988.09, close to the 85,000 degree. The Index was buying and selling between the vary of 84,800 and 84,980 within the afternoon session.

The BSE Sensex index had peaked at 84,988.09 and made a day’s low at 84,581.08. Lastly, it had closed at 84,950.95 in inexperienced, gaining 388.17 factors or 0.46%. The Relative Energy Index (RSI) stood at 65.87, beneath the overbought zone of 70 within the each day time-frame. Within the brief time period, the Index was above the 13/20 day EMA within the each day time-frame, indicating an uptrend.

The index faces speedy resistance at 85,290.06 (R1), a degree it has struggled to maintain above and the 52-week excessive. On the draw back, assist lies at 84,658 (S1), a former resistance degree which was assist, and the following stronger assist (S2) is at 84,033.44.

Commerce Setup:

| Sensex | |

| Resistance 1 | 84,290.06 |

| Closing Value | 84,950.95 |

| Assist 1 | 84,658.00 |

| Assist 2 | 84,033.44 |

Market Recap on November seventeenth, 2025

On Monday, the Nifty 50 opened greater at 25,948.20, up barely by 38.15 factors from its earlier shut of 25,910.05. The index hit an intraday excessive of 26,024.20 and closed above the 26,000 degree at 26,013.45, up 103.40 factors, or 0.40%. The index closed above all key shifting averages (20/50/100/200-day EMAs) on the each day chart. The BSE Sensex adopted the identical trajectory, opening on a constructive pattern at 84,700.50, up 137.72 factors from the earlier shut of 84,562.78. It closed at 84,950.95, up 388.17 factors, or 0.46%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 65.12 and Sensex at 65.87, beneath the overbought threshold of 70.

On Monday, all indices present a bullish response, with no main indices in unfavorable territory. The Nifty PSU Financial institution index was the most important gainer, rising 1.09% or 91.75 factors, and standing at 8,491.65. Shares reminiscent of Indian Abroad Financial institution rose 3.76%, adopted by Financial institution of Maharashtra and Indian Financial institution, which gained as much as 3.28% on Monday.

The Nifty Auto index was additionally among the many greatest gainers, rising 0.85% or 232.85 factors, and standing at 27,472. Shares reminiscent of Hero MotoCorp Ltd jumped 4.69% on Monday. Whereas different auto shares like TVS Motor Firm Ltd, Tata Motors Ltd, and Eicher Motors Ltd additionally gained as much as 2.63%. The Nifty Midcap 50 index was additionally among the many prime gainers, rising 0.84% or 144.80 factors, and standing at 17,444.

Asian markets had a gentle unfavorable sentiment on Monday. Japan’s Nikkei 225 declined by -116.53 factors or -0.23%, closing at 50,260.00. China’s Shanghai Composite decreased by -18.46 factors, or -0.46%, to three,972.03, whereas Hong Kong’s Hold Seng Index plummeted by -210.46 factors, or -0.80%, to shut at 26,362.00. However, South Korea’s KOSPI continues to rise by 77.68 factors or 1.90%, closing at 4,089.25.

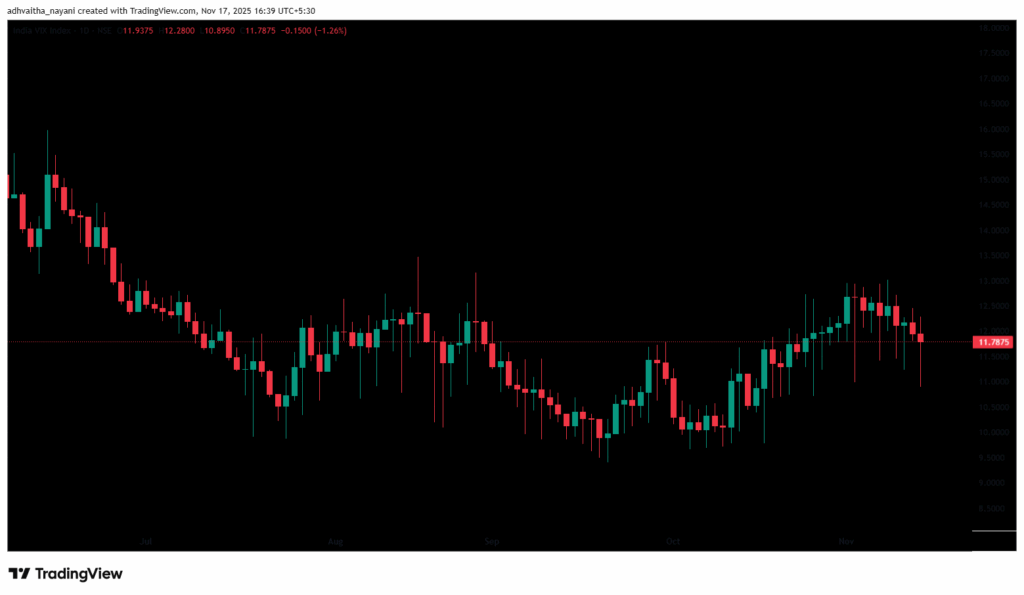

India VIX

The India VIX decreased 0.15 factors or 1.26%, from 11.94 to 11.79 throughout Monday’s session. A lower within the India VIX sometimes signifies lower cost volatility within the inventory market, suggesting a extra secure market atmosphere. Nonetheless, a secure market atmosphere and minimal volatility are anticipated when the India VIX is beneath 15.

Given the continued volatility and blended sentiments, it’s advisable to keep away from aggressive positions and look forward to clear directional strikes above resistance or beneath assist. Merchants ought to contemplate these key assist and resistance ranges when coming into lengthy or brief positions following the value break from these crucial ranges. Moreover, merchants can mix shifting averages to determine extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding specialists/broking homes/ranking companies on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of monetary losses. Buyers should subsequently train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the writer aren’t answerable for any losses triggered because of the choice primarily based on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Non-public Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Registration granted by SEBI and certification from NISM under no circumstances assure efficiency of the middleman or present any assurance of returns to buyers.