On Wednesday, Indian fairness markets opened on a optimistic word and sustained their upward momentum all through the session, closing with stable positive aspects. Benchmark indices mirrored bullish sentiment, supported by broad-based shopping for throughout sectors and beneficial world cues. Technical indicators remained sturdy, with each the Nifty 50 and BSE Sensex staying above key shifting averages, suggesting ongoing assist for the present pattern. Market momentum was average, indicating power with out getting into overbought territory.

Sectorally, most indices ended within the inexperienced, with realty, PSU banks, and capital markets main the rally. Optimism round a possible U.S. Federal Reserve price reduce later this month boosted investor sentiment. Nevertheless, the media sector was the lone laggard, witnessing gentle declines. World markets additionally mirrored this optimistic tone, with key Asian indices closing larger and U.S. futures buying and selling within the inexperienced by night, reinforcing the upbeat temper within the home market.

On this overview, we’ll analyse the important thing technical ranges and pattern instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling periods. All of the charts talked about under are based mostly on the 5-minute timeframe.

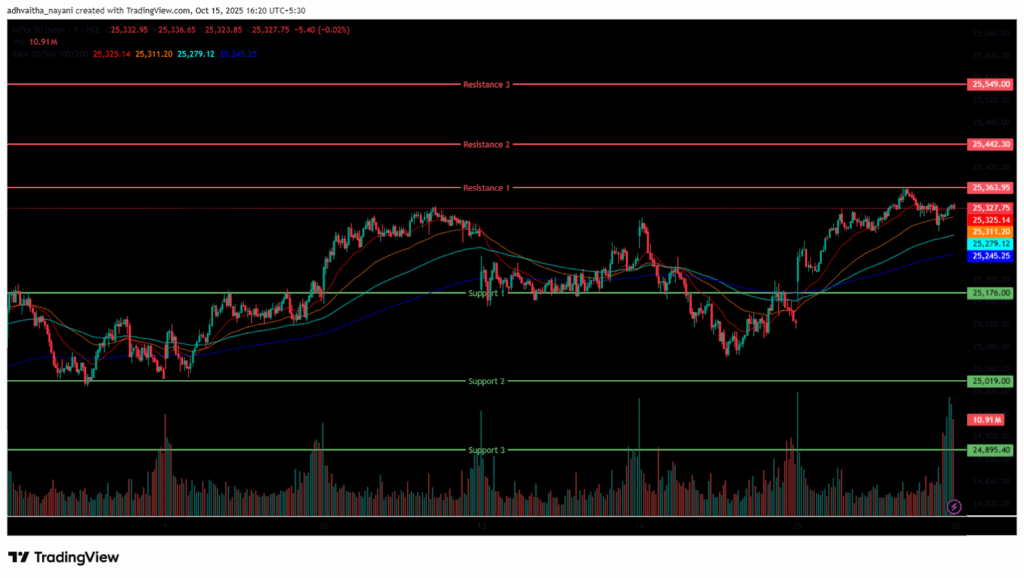

Nifty 50

(On this evaluation, we’ve used 20/50/100/200 EMAs, the place 20 EMA (Pink), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical studies, click on right here

The Nifty 50 Index opened on a optimistic word at 25,181.95 on Wednesday, up by 36.45 factors from Tuesday’s closing of 25,145.50. With a bullish begin to the day, the index had a extremely unstable morning session, buying and selling within the 25,150 to 25,350 vary. Moreover, the Index stood above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame throughout the morning session.

Additional, the index continued its momentum and surged as excessive as 25,365, marking its day’s excessive within the afternoon session and was traded within the vary of 25,250 and 25,350. Throughout the afternoon session, the Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The Nifty’s rapid resistance ranges are R1 (25,364), R2 (25,442), and R3 (25,549), whereas rapid assist ranges are S1 (25,176), S2 (25,019), and S3 (24,895).

The Nifty index had reached a day’s excessive at 25,365.15 and noticed a day’s low at 25,159.35. Lastly, it had closed at 25,323.55, in inexperienced above the 25,300 stage, gaining 178.05 factors, or 0.71%. The Nifty 50 closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

Momentum Indicators

RSI (Each day): The Nifty 50’s RSI stood at 60.49, which is properly under the overbought zone of 70, indicating a bullish sentiment and nonetheless has room to develop larger.

Bollinger Bands (Each day): The index is buying and selling within the higher band of the Bollinger Band vary above the center band (Easy Transferring Common). Its place within the higher vary signifies a bullish sentiment, and the Index took assist at 25,150 and pulled again to the 25,300 stage. A sustained transfer above the center band alerts a bullish sentiment, whereas a drop again towards the decrease band could reinforce bearish sentiment.

Quantity Evaluation: Wednesday’s buying and selling session had common volumes, which stood at 289.93 Mn.

Derivatives Information: Choices OI signifies sturdy Put writing at 25,300, adopted by 25,200, establishing it as a agency assist zone. On the upside, a major Name OI buildup at 25,400 and 25,500 suggests a possible resistance provide. PCR (Put/Name Ratio) stands at 1.2379 (>1), leaning in direction of bearish sentiment and the Lengthy Buildup alerts a powerful bullish sign, with an total combined outlook for the following buying and selling session.

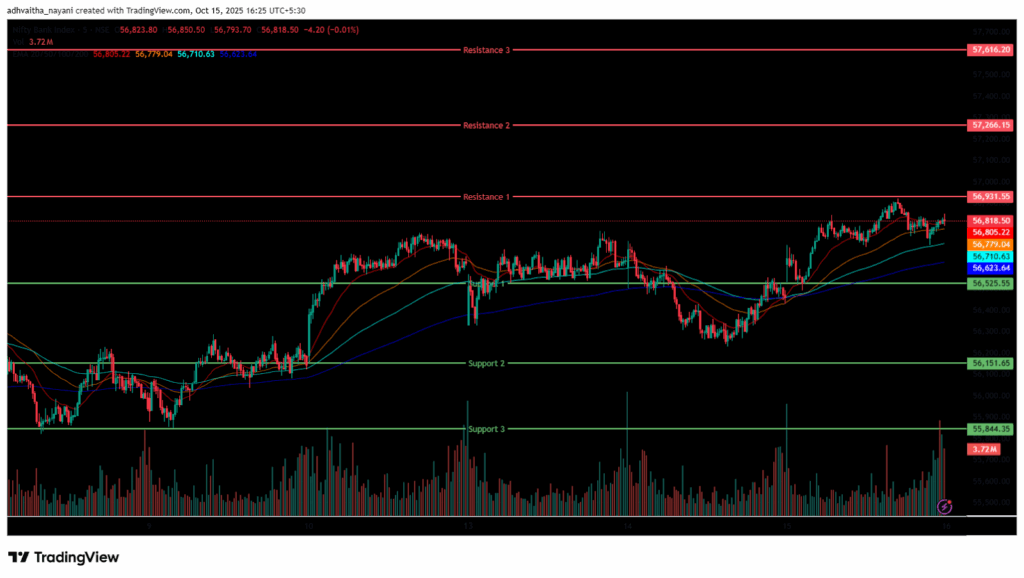

Financial institution Nifty

(On this evaluation, we’ve used 20/50/100/200 EMAs, the place 20 EMA (Pink), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

The Financial institution Nifty Index additionally began the session on a optimistic word at 56,528.95 on Wednesday, up by 32.5 factors from Tuesday’s closing of 56,496.45. The index was buying and selling between the vary of 56,450 and 56,850 within the morning session, indicating excessive volatility. As well as, the index was buying and selling above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. Within the afternoon session, the Index continued its upward momentum and surged as excessive as 56,922, marking its day’s excessive.

Additional, the Index was buying and selling within the vary of 56,700 and 56,950, and resulted in inexperienced above its opening stage. Throughout the afternoon session, Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame. The Financial institution Nifty’s rapid resistance ranges are R1 (56,932), R2 (57,266), and R3 (57,616), whereas its rapid assist ranges are S1 (56,526), S2 (56,152), and S3 (55,844).

The Financial institution Nifty index had peaked at 56,922.70 and made a day’s low at 56,491.85. Lastly, it had closed in inexperienced at 56,799.90, closing above the 56,750 stage, gaining 303.45 factors or 0.54%. The Relative Energy Index (RSI) stood at 67.48, properly under the overbought zone of 70 within the each day time-frame, and Financial institution Nifty closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

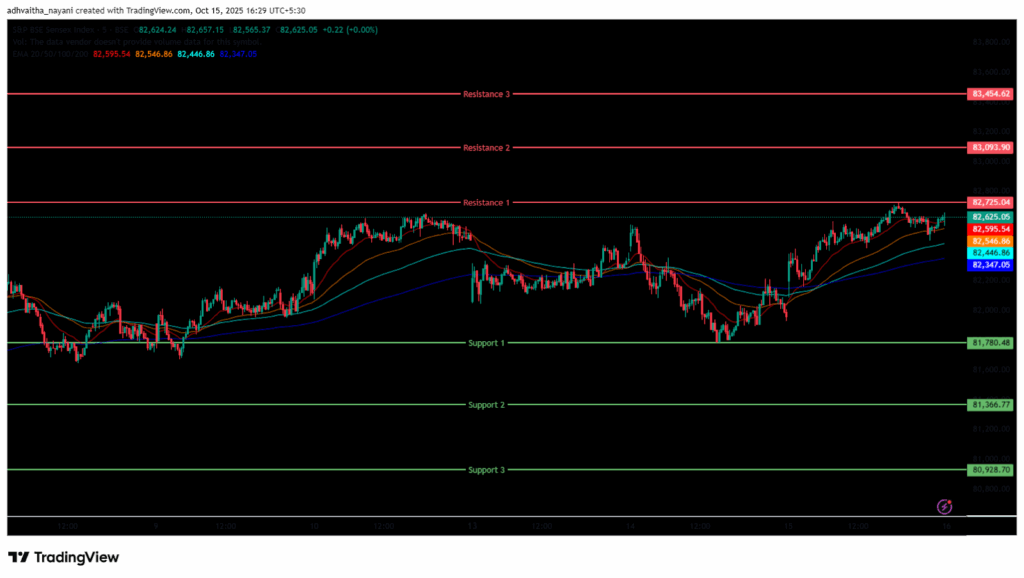

Sensex

(On this evaluation, we’ve used 20/50/100/200 EMAs, the place 20 EMA (Pink), 50 EMA (Orange), 100 EMA (Mild Blue), and 200 EMA (Darkish Blue)).

To view different technical studies, click on right here

The BSE Sensex Index additionally opened on a optimistic word at 82,197.25 on Wednesday, up by 167.27 factors from Tuesday’s closing of 82,029.98. The index began its session on a bullish word and was buying and selling within the 82,250 and 82,550 vary all through the morning session, and was above all 4 EMAs of 20/50/100/200 within the 15-minute time-frame.

Within the afternoon session, the Index continued to rise and was buying and selling round 82,550 and 82,650, sustaining its total bullish pattern and shutting above the EMAs of 20/50/100/200 within the 15-minute time-frame. The BSE Sensex rapid resistance ranges are R1 (82,725), R2 (83,094), and R3 (83,455), whereas rapid assist ranges are S1 (81,780), S2 (81,367), and S3 (80,929).

The BSE Sensex index had peaked at 82,727.02 and made a day’s low at 82,084.37. Lastly, it had closed at 82,605.4 in inexperienced, gaining 575.45 factors or 0.70%. The Relative Energy Index (RSI) stood at 60.12 (under the overbought zone of 70) within the each day time-frame, and the BSE Sensex closed above all 4 EMAs of 20/50/100/200 within the each day time-frame.

India VIX

The India VIX decreased by 0.62 factors or 5.60%, from 11.16 to 10.53 throughout Wednesday’s session. A lower within the India VIX usually signifies cheaper price volatility within the inventory market, suggesting a extra secure market atmosphere. Nevertheless, a secure market atmosphere and minimal volatility are anticipated when the India VIX is under 15.

Market Recap on the fifteenth of October 2025

On Wednesday, the Nifty 50 opened on a optimistic word at 25,181.95, up 36.45 factors from its earlier shut of 25,145.5. The index hit an intraday excessive of 25,365.15, crossing above the 25,350 stage, earlier than closing at 25,323.55, up 178.05 factors, or 0.71%. The index remained above all key shifting averages (20/50/100/200-day EMAs) on the each day chart, indicating some technical assist. The BSE Sensex mirrored the Nifty’s pattern, opening at 82,197.25, up 167.27 factors from the earlier shut of 82,029.98.

It adopted the same sample, closing at 82,605.43, a acquire of 575.45 factors, or 0.70%. Each indices confirmed average momentum, with RSI values for Nifty 50 at 60.49 and Sensex at 60.12, under the overbought threshold of 70. All the most important indices remained optimistic on Wednesday. The Financial institution Nifty Index resulted in optimistic territory, rising 303.45 factors, or 0.54%, to 56,799.9. The rise was primarily as a result of optimistic cues from world markets amid expectations of a US Federal Reserve price reduce later this month. Moreover, hopes for an early US-India commerce deal amid China tensions boosted market sentiment on Wednesday.

Many of the indices resulted in inexperienced on Wednesday. The Nifty Realty Index was the most important gainer, gaining 3%, or 27.05 factors, to 915.4. Shares like Sobha Ltd, Brigade Enterprises Ltd, Status Estates Initiatives and Signature World noticed positive aspects of as much as 4.7%. The Nifty PSU Financial institution Index additionally posted positive aspects, advancing 1.7%, or 126.6 factors, to 7,723.1. Key shares like Financial institution of Maharashtra, Indian Abroad Financial institution, and Punjab & Sind Financial institution have been up by 7.6%.

The Nifty Capital Market Index adopted the optimistic pattern, closing at 4,644.85, up 1.4%, or 66 factors. Shares like HDFC AMC Ltd gained 3%, whereas different capital market shares equivalent to 360 One Wam Ltd, Nippon Life India AMC and Motilal Oswal Monetary Companies noticed positive aspects of as much as 3%. Nifty Media was the one loser for at present, declining 0.5% or -8 factors, closing at 1,539.25. Media shares equivalent to DB Corp Ltd, Ideas Music Ltd, and Solar TV Community dropped as much as -8.4%.

Asian markets adopted a optimistic sentiment as properly. Japan’s Nikkei 225 gained 1.76%, rising 825.35 factors, to shut at 47,672.67. Hong Kong’s Cling Seng rose by 1.84%, closing at 25,910.6, whereas China’s Shanghai Composite elevated 1.22%, to three,912.21. Equally, South Korea’s KOSPI Index rose 2.68%, ending at 3,657.28, and the Shenzhen Element Index was additionally up 1.73%, closing at 13,118.75. At 5 p.m. IST, U.S. Dow Jones Futures have been up 0.4%, at 46,686, a drop of 186 factors.

Commerce Setup Abstract

The Nifty 50 opened on a optimistic word at 25,181.95 on Wednesday and ended the session within the inexperienced above the 25,300 stage at 25,323.55. A break under 25,176 might set off additional promoting in direction of 25,019, whereas breaking the following resistance stage of 25,363.9 might set off bullishness in direction of the 25,442 stage.

Financial institution Nifty additionally began the session on a optimistic word at 56,528.95 and ended the session within the inexperienced at 56,799.9, on the 56,800 stage. A break under 56,526 might set off additional promoting in direction of 56,152, whereas breaking the following resistance stage of 56,932 might set off bullishness in direction of the 57,266 stage.

Sensex additionally opened on a optimistic word at 82,197.25 and likewise ended the session within the inexperienced at 82,605.43, close to the 82,600 stage. A break under 81,780 might set off additional promoting in direction of 81,367, whereas breaking the following resistance stage of 82,725 could lead on in direction of the 83,094 stage.

Given the continuing volatility and combined sentiments, it’s advisable to keep away from aggressive positions and watch for clear directional strikes above resistance or under assist. Merchants ought to think about these key assist and resistance ranges when getting into lengthy or brief positions following the value break from these important ranges. Moreover, merchants can mix shifting averages to establish extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding specialists/broking homes/score businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of economic losses. Traders should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Personal Restricted or the creator should not answerable for any losses induced because of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce identify is Dailyraven Applied sciences Personal Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Registration granted by SEBI and certification from NISM by no means assure efficiency of the middleman or present any assurance of returns to traders.