Home fairness markets mirrored a agency upward bias on Wednesday, with the benchmark indices recovering from gentle early weak spot to finish comfortably larger. Each the Nifty 50 and the Sensex closed in constructive territory, supported by robust momentum indicators and sustained buying and selling above key transferring averages. Broader market sentiment additionally remained constructive, because the banking and IT-heavy indices contributed to the day’s power, whereas volatility stayed contained and RSI readings signalled wholesome, non-overbought circumstances.

Sector efficiency was blended, with expertise, public-sector banking, and providers shares main the features amid renewed optimism in these segments. Nonetheless, oil & fuel and realty counters confirmed gentle profit-booking after latest advances. Asian market cues had been equally blended, providing neither robust tailwinds nor headwinds, as main indices throughout the area moved in different instructions. General, the market surroundings mirrored regular confidence, supported by sectoral rotation and broad-based participation.

On this overview, we’ll analyse the important thing technical ranges and development instructions for Nifty and BSE Sensex to watch within the upcoming buying and selling periods. All of the charts talked about beneath are based mostly on the 15-minute timeframe.

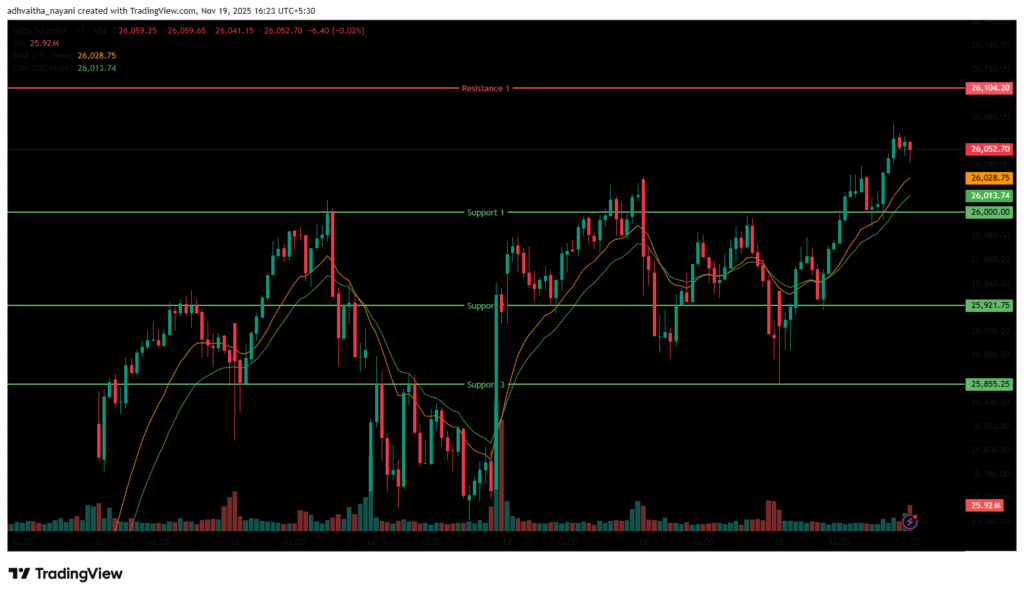

NIFTY 50 Chart & Worth Motion Evaluation

To view different technical experiences, click on right here

The Nifty 50 Index opened on a constructive notice at 25,918.10 on Wednesday, up by 8.05 factors from Tuesday’s closing of 25,910.05. The index opened on a flat-to-positive notice however was dragged all the way down to the 25,856 stage, marking its day low; later, the index recovered from the low and traded above the 26,000 stage. The Index is buying and selling inside the vary of 25,850 and 26,050. Within the afternoon session, the index continued the surge and reached its peak at 26,075 and settled above the 26,050 stage, ending the session in Bullish.

The Nifty index had reached a day’s excessive at 26,074.65 and noticed a day’s low at 25,856.20. Lastly, it had closed at 26,052.65, within the inexperienced, above the 26,050 stage, up 142.60 factors, or 0.55%. Within the quick time period, the Index was above the 13/20 day EMA within the every day time-frame, indicating an uptrend.

The index’s nearest resistance stage is at 26,104.2 (R1), which is the 52-week excessive for the index. Alternatively, the closest help is now at 26,000 (S1) and 25,921.75 (S2), which was a earlier resistance stage however has was help. If the index falls beneath this, the subsequent help stage to observe is at 25,855.25 (S3).

Commerce Setup:

| Nifty 50 | |

| Resistance 1 | 26,104.20 |

| Closing Worth | 26,052.65 |

| Assist 1 | 26,000.00 |

| Assist 2 | 25,921.75 |

| Assist 3 | 25,855.25 |

NIFTY 50 Momentum Indicators Evaluation

RSI (Every day): The Nifty 50’s RSI stood at 64.21, which is beneath the overbought zone of 70, indicating bullish sentiment and room to develop larger.

Bollinger Bands (Every day): The index is buying and selling within the higher band of the Bollinger Band vary (Easy Shifting Common). Its place within the higher vary suggests a bullish sentiment and in Wednesday’s session, the Index fashioned a big bullish candle with minimal wicks on each ends and ended on a bullish notice. The index took help close to 25,856, and 26,075 acted as a resistance stage. A sustained transfer above the center band indicators a bullish sentiment, whereas a drop again towards the decrease band might reinforce bearish sentiment.

Quantity Evaluation: Wednesday’s buying and selling session had a mean quantity of 250.11 Mn.

Derivatives Knowledge: Choices OI signifies robust Put writing at 26,000, adopted by 25,900, establishing a robust help zone. On the upside, a major Name OI buildup at 26,100 and 26,200 suggests a possible provide of resistance. PCR (Put/Name Ratio) stands at 1.29 (>1), leaning in the direction of bearish sentiment, and the quick overlaying signifies that merchants who had shorted a inventory (offered borrowed shares) are actually shopping for them again to shut their positions, which indicators a bullish outlook, thus total indicating a blended outlook for the subsequent buying and selling session.

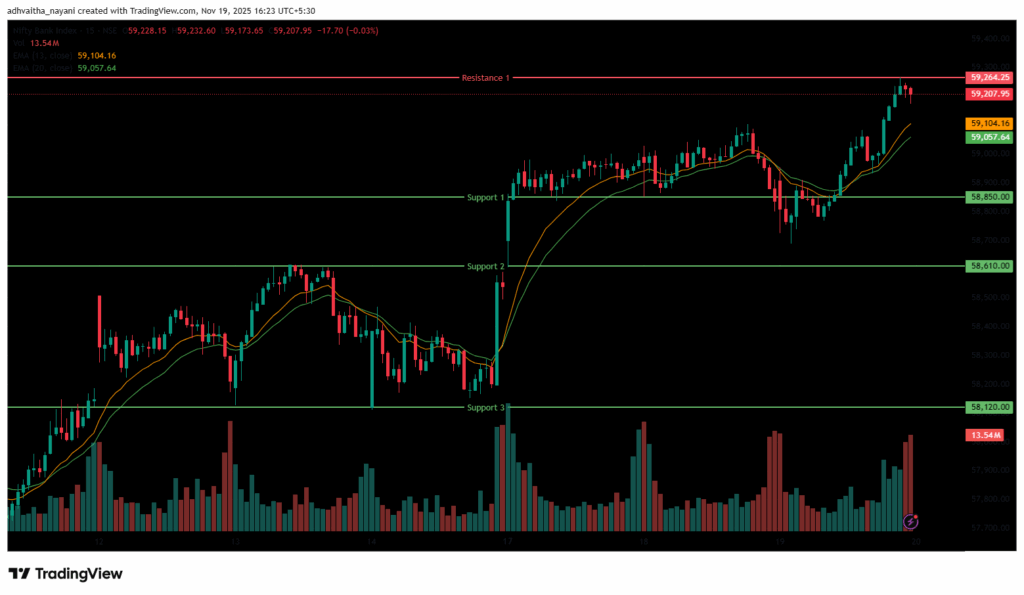

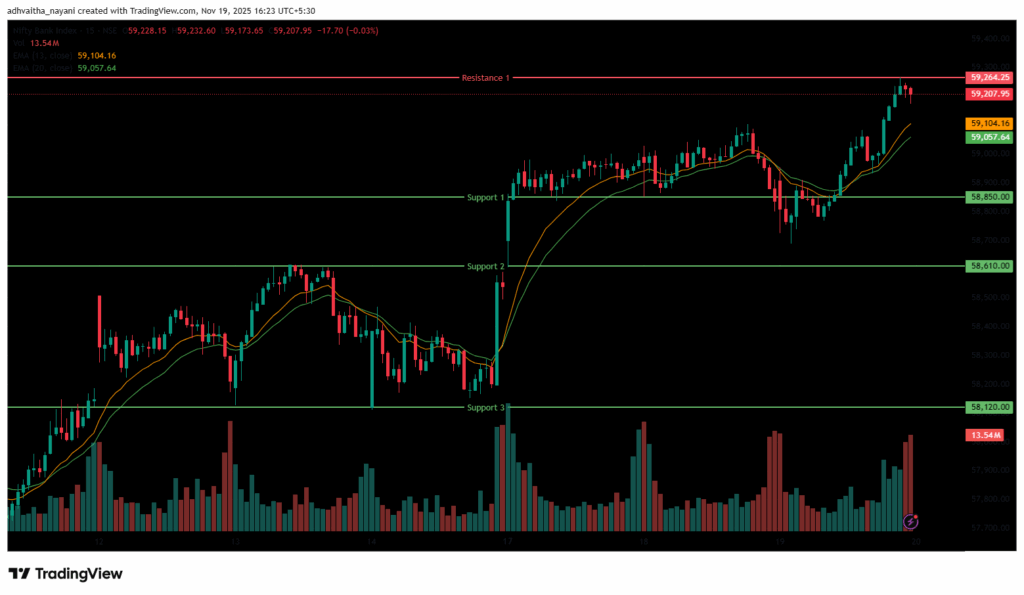

Financial institution Nifty Chart & Worth Motion Evaluation

The Financial institution Nifty Index opened on a flat-to-positive notice at 58,908.15 on Wednesday, up by 8.9 factors from Tuesday’s closing of 58,899.25. The index opened on a flat notice however was dragged all the way down to the 58,688 stage, marking its day low within the morning session, however later recovered from the day’s low and was buying and selling between the 58,650 and 59,050 ranges. Within the afternoon session, the index continued its rally and reached the day’s peak on the 59,264 stage and traded within the vary of 58,900 and 59,300.

The Financial institution Nifty index had peaked at 59,264.25 and made a day’s low at 58,688.55. Lastly, it had closed in inexperienced at 59,216.05, rising above the 59,200 stage, gaining 316.80 factors or 0.54%. The Relative Power Index (RSI) stood at 72.88, above the overbought zone of 70 within the every day time-frame. Within the quick time period, the Index was above the 13/20 day EMA within the every day time-frame, indicating an uptrend.

The upper resistance stage is at 59,264.25 (R1), which is the 52-week excessive for the index. Alternatively, the closest help is now at 58,850 (S1) and 58,610 (S2), which had been earlier resistance ranges however have was help. If the index falls beneath this, the subsequent help stage to observe is at 58,120 (S3).

Commerce Setup:

| Financial institution Nifty | |

| Resistance 1 | 59,264.25 |

| Closing Worth | 59,216.05 |

| Assist 1 | 58,850.00 |

| Assist 2 | 58,610.00 |

| Assist 3 | 58,120.00 |

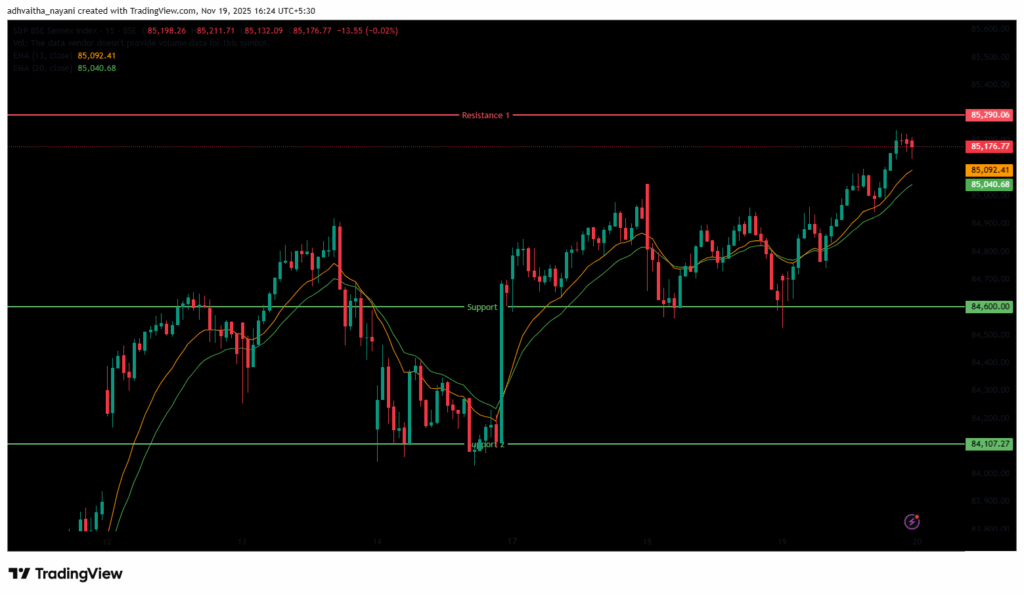

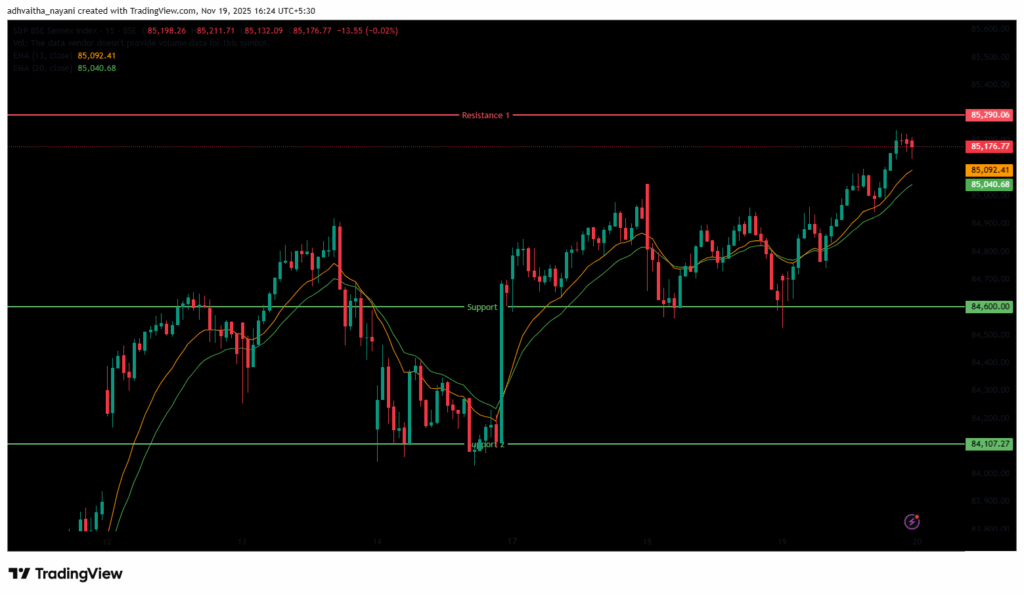

BSE Sensex Chart & Worth Motion Evaluation

To view different technical experiences, click on right here

The BSE Sensex Index opened on a detrimental notice at 84,643.78 on Wednesday, down by 29.24 factors from Tuesday’s closing of 84,673.02. The Sensex index opened on a flat-to-bearish notice and was dragged all the way down to the 84,526 stage, marking its day’s low. It was traded within the vary of 84,500 and 85,100 in the course of the morning session. Within the afternoon session, the index surged as excessive as 85,237, marking its day’s excessive and settling above 85,100. The Index was traded between the vary of 84,900 and 85,250.

The BSE Sensex index had peaked at 85,236.77 and made a day’s low at 84,525.98. Lastly, it had closed at 85,186.47 in inexperienced, gaining 513.45 factors or 0.61%. The Relative Power Index (RSI) stood at 65.98, beneath the overbought zone of 70 within the every day time-frame. Within the quick time period, the Index was above the 13/20 day EMA within the every day time-frame, indicating an uptrend.

The index faces speedy resistance at 85,290.06 (R1), a stage close to its 52-week excessive. On the draw back, help lies at 84,600 (S1) and 84,107.27 (S2), each former resistance ranges.

Commerce Setup:

| Sensex | |

| Resistance 1 | 85,290.06 |

| Closing Worth | 85,186.47 |

| Assist 1 | 84,600.00 |

| Assist 2 | 84,107.27 |

Market Recap on November nineteenth, 2025

On Wednesday, the Nifty 50 opened barely larger at 25,918.10, up by 8.05 factors from its earlier shut of 25,910.05. The index hit an intraday low of 25,856.20 and closed above the 26,000 stage at 26,052.65, up 142.60 factors, or 0.55%. The index closed above all key transferring averages (20/50/100/200-day EMAs) on the every day chart.

The BSE Sensex, although, opened on a detrimental development at 84,643.78, down 29.24 factors from the earlier shut of 84,673.02; it closed within the inexperienced at 85,186.47, up 513.45 factors, or 0.61%. Each indices confirmed excessive momentum, with RSI values for Nifty 50 at 64.21 and Sensex at 65.98, beneath the overbought threshold of 70. The Financial institution Nifty Index additionally closed within the inexperienced at 59,216.05, gaining 316.80 factors or 0.54%.

On Wednesday, the Nifty IT index was the main gainer, rising by 2.97% or 1,069.45 factors, and standing at 37,044.65. Tech shares resembling HCL Applied sciences Ltd gained 4.23%, adopted by Coforge Ltd and Persistent Programs Ltd, which elevated by as much as 4.14% on Wednesday. The Nifty PSU Financial institution index was additionally among the many largest gainers, rising 1.16% or 98.65 factors, and standing at 8,576.40.

Shares resembling Punjab Nationwide Financial institution had been up by 2.19% on Wednesday. Whereas different PSU Banks shares like Financial institution of Baroda, Financial institution of India, and Punjab & Sind Financial institution additionally elevated by as much as 1.68%. The Nifty Service index was additionally among the many high gainers, up by 0.83% or 279.95 factors, and standing at 33,868.35.

Among the many main losers, the Nifty Oil & Fuel Index declined probably the most, dropping -0.35% or -43.10 factors, standing at 12,141.60. Shares together with Mahanagar Fuel Ltd, Bharat Petroleum Company Ltd, Hindustan Petroleum Company Ltd, Indian Oil Company Ltd, fell by as much as 2.38%. The Nifty Realty Index additionally declined on Wednesday by -0.35% or -3.25 factors, closing at 924.05. Actual Property shares, together with Godrej Properties Ltd, DLF Ltd, Anant Raj Ltd, Phoenix Mills Ltd, misplaced as much as -0.95%.

Asian markets had a blended sentiment on Wednesday. Japan’s Nikkei 225 declined by -12.98 factors or -0.03%, closing at 48,690. Whereas, China’s Shanghai Composite elevated by 6.93 factors, or 0.18%, to three,946.74, whereas Hong Kong’s Cling Seng Index fell by -79.03 factors, or -0.31%, to shut at 25,851. South Korea’s KOSPI index fell by -24.11 factors or -0.61%, closing at 3,929.51.

India VIX

The India VIX decreased 0.13 factors or 1.07%, from 12.10 to 11.97 throughout Wednesday’s session. A lower within the India VIX sometimes signifies lower cost volatility within the inventory market, suggesting a extra steady market surroundings. Nonetheless, a steady market surroundings and minimal volatility are anticipated when the India VIX is beneath 15.

Given the continuing volatility and blended sentiments, it’s advisable to keep away from aggressive positions and await clear directional strikes above resistance or beneath help. Merchants ought to think about these key help and resistance ranges when coming into lengthy or quick positions following the worth break from these crucial ranges. Moreover, merchants can mix transferring averages to determine extra correct entry and exit factors.

Disclaimer

The views and funding suggestions expressed by funding consultants/broking homes/score companies on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a threat of monetary losses. Buyers should subsequently train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Personal Restricted or the writer will not be answerable for any losses prompted because of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

About: Commerce Brains Portal is a inventory evaluation platform. Its commerce title is Dailyraven Applied sciences Personal Restricted, and its SEBI-registered analysis analyst registration quantity is INH000015729.

Investments in securities are topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

Registration granted by SEBI and certification from NISM by no means assure efficiency of the middleman or present any assurance of returns to buyers.