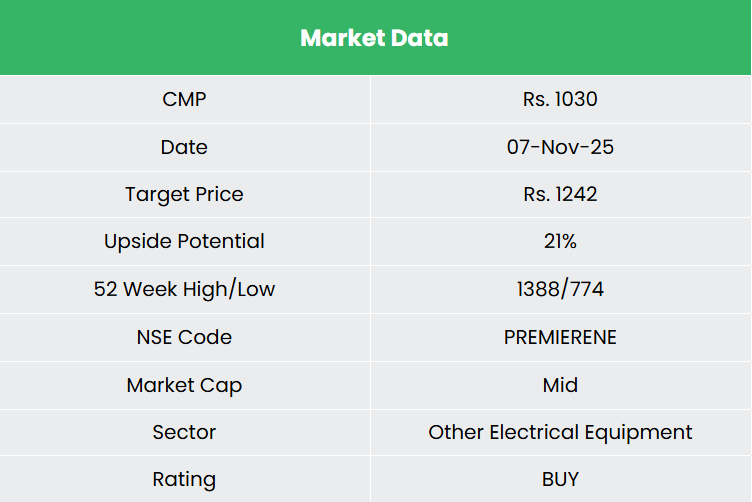

Premier Energies Ltd – Transition to a Brighter Tomorrow

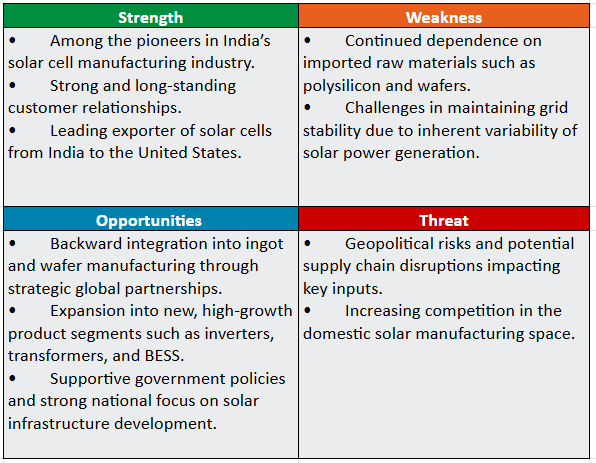

Integrated in 1995 and headquartered in Hyderabad, Premier Energies Ltd is one in every of India’s main renewable vitality producers, specializing in high-efficiency photo voltaic photovoltaic (PV) cells and modules. As of FY25, the corporate has an annual manufacturing capability of three,200 MW for photo voltaic cells and 5,100 MW for modules. Premier Energies has developed an built-in manufacturing ecosystem that covers the complete photo voltaic PV worth chain – from ingots and wafers to cells and modules – supported by three state-of-the-art manufacturing services positioned in Telangana.

Merchandise and Providers

The corporate’s enterprise operations embrace the manufacturing of photo voltaic photovoltaic cells, the manufacturing of photo voltaic modules together with customized made panels for particular functions, the execution of EPC initiatives, unbiased energy manufacturing and O&M companies.

Subsidiaries: As of FY25, the corporate has 8 subsidiary and a pair of affiliate firms.

Funding Rationale

- Entry into New Excessive-Progress Segments: Inverters, Transformers, and BESS – Premier Energies is increasing past its conventional photo voltaic manufacturing base into high-potential adjacencies – inverters, transformers, and battery vitality storage programs (BESS) – strengthening its place as a totally built-in clear vitality participant. Via the acquisition of KSolare Vitality Pvt. Ltd., the corporate positive factors entry to the fast-growing inverter market with a Pune facility able to 500,000 models each year, which can be scaled as much as 1 million models by June 2026. The Transcon acquisition permits entry into the ability transformer section, with whole capability anticipated to rise from 2.5 GVA to 16.75 GVA by April 2026, focusing on higher-margin MV, HV, and EHV classes. Concurrently, the upcoming 12 GWh BESS facility in Pune (6 GWh in FY26 and 6 GWh in FY28) marks a strategic transfer into vitality storage – a crucial enabler of grid stability and renewable integration. Collectively, these ventures broaden the corporate’s portfolio, diversify income streams, and enhance margin resilience.

- Aggressive Capability Enlargement Plans Throughout the Photo voltaic Worth Chain – Aligned with its Mission 2028, the corporate is executing a strong capability growth program throughout the photo voltaic worth chain – extending from ingots and wafers to cells, modules, and aluminium frames. The corporate’s 7 GW photo voltaic cell venture at Naidupeta, Andhra Pradesh (upscaled from 4.8 GW) is progressing on schedule, with phased commissioning focused by June and September 2026, whereas a 5 GW ingot-wafer facility on the identical location will improve backward integration and value effectivity beneath the upcoming ALMM-III coverage framework. In Telangana, Premier is establishing a 5.6 GW TOPCon module manufacturing plant and a 36,000 MT aluminium extrusion and anodizing facility (by way of JV with Nuevosol Vitality) to localize key parts, scale back import dependence, and enhance price competitiveness. All main initiatives are being financed largely via inside accruals, reflecting robust money move self-discipline.

- Q2FY26 – Through the quarter, the corporate generated income of Rs.1,837 crore, a rise of 20% in comparison with the Rs.1,527 crore of Q2FY25. Working revenue elevated from Rs.309 crore of Q2FY25 to Rs.561 crore of Q2FY25, a development of 82%. The corporate reported web revenue of Rs.353 crore, a rise by 71% YoY in comparison with Rs.206 crore of the corresponding interval of the earlier yr. Working revenue margin improved from 20% to 31% and web revenue margin improved from 13% to 19% throughout the interval.

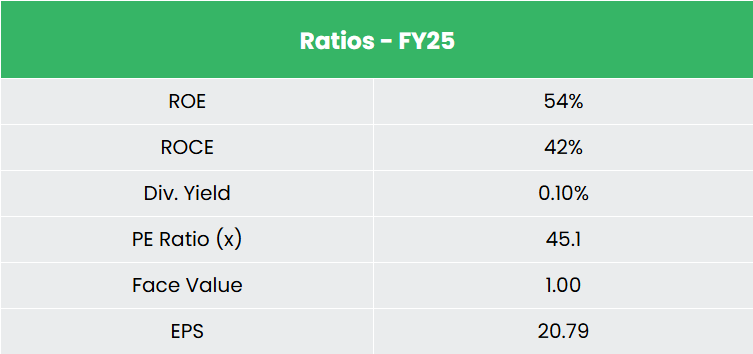

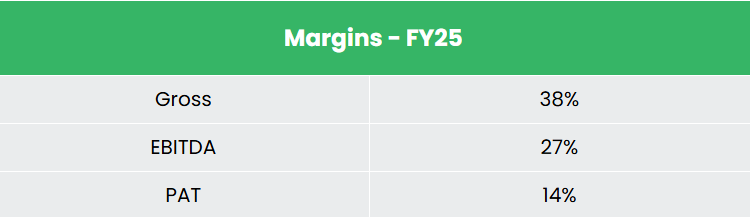

- FY25 – Through the FY, the corporate generated income of Rs.6,652 crore, a rise of 110% in comparison with the FY24 income. Working revenue is at Rs.1,781 crore, up by 273% YoY. The corporate reported web revenue of Rs.937 crore, a rise of 305% YoY.

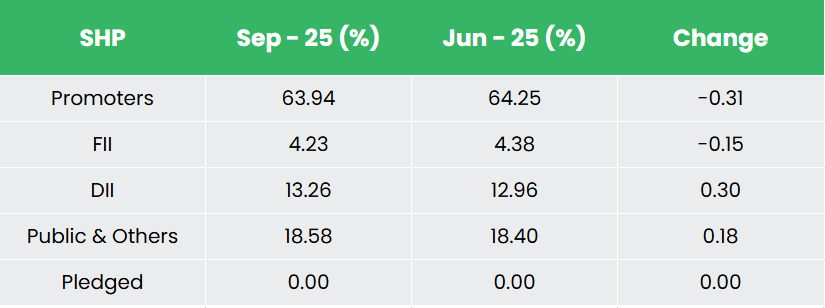

- Monetary Efficiency – The three-year income and web revenue CAGR stands at 106% and 297% respectively between FY23-25. The corporate has a debt-to-equity ratio of 0.47. Common 3-year ROE and ROCE is round 43% and 24% for FY23-25 interval.

Business

India’s vitality demand is anticipated to rise quicker than another nation within the coming a long time, propelled by its huge inhabitants and accelerating financial development. To fulfill this surge sustainably, the nation is more and more counting on low-carbon and renewable vitality sources. With its pledge to generate 50% of its electrical energy from renewables by 2030 and obtain net-zero emissions by 2070, India has set a serious international local weather benchmark. As of FY25, India ranks fourth globally in photo voltaic, wind, and whole renewable vitality capability, sustaining its place from FY24. The nation’s vitality panorama has undergone a structural transition, shifting steadily from typical fossil fuels towards sustainable options. Backed by bold targets, coverage help, and a transparent imaginative and prescient outlined at COP26 to realize 500 GW of non-fossil gasoline capability by 2030, the renewable vitality sector is unlocking immense development alternatives. This transformation positions India as a pivotal participant within the international shift towards clear and sustainable vitality.

Progress Drivers

- Within the Union Finances 2025-26, the federal government boosted its flagship rooftop photo voltaic initiative, PM Surya Ghar: Muft Bijli Yojana, by allocating Rs. 20,000 crore (US$ 2.33 billion) an 80% enhance to fast-track the deployment of rooftop photo voltaic initiatives.

- Different initiatives by the federal government comparable to PM-KUSUM, CPSU scheme in addition to DCR (Home Content material Requirement) and AMM (Authorised Checklist of Fashions and Producers) necessities.

- 100% FDI has been allowed beneath the automated route for renewable vitality era and distribution initiatives.

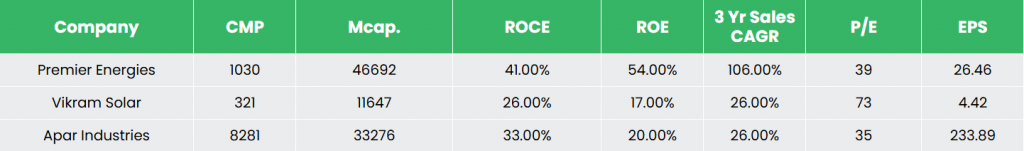

Peer Evaluation

Opponents: Vikram Photo voltaic Ltd, Apar Industries Ltd, and so forth.

In contrast with the above friends, Premier Energies seems pretty valued, backed by superior profitability and powerful income development, making it one of many strongest performers within the sector.

Outlook

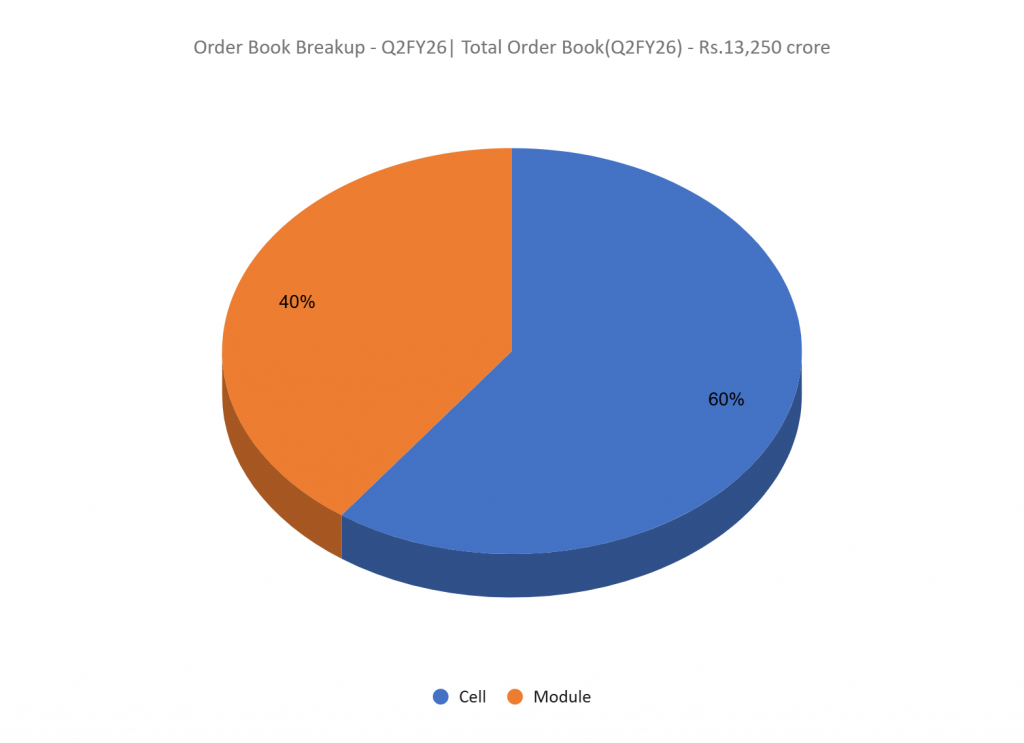

The corporate is poised for robust development, supported by its bold Mission 2028 roadmap to realize 10 GW of totally built-in ingot, wafer, cell, and module capability. The corporate targets increasing cell and module capacities, underpinned by a deliberate capex of Rs.12,500 crore over the following three years. With a strong order guide of 9,114 MW valued at Rs.13,250 million as of 30 September 2025, Premier Energies has robust income visibility and execution momentum. The strategic give attention to scaling high-efficiency TOPCon expertise, deeper backward integration, and entry into value-accretive segments comparable to BESS and inverters positions the corporate to maintain superior development and profitability in India’s quickly increasing renewable vitality panorama.

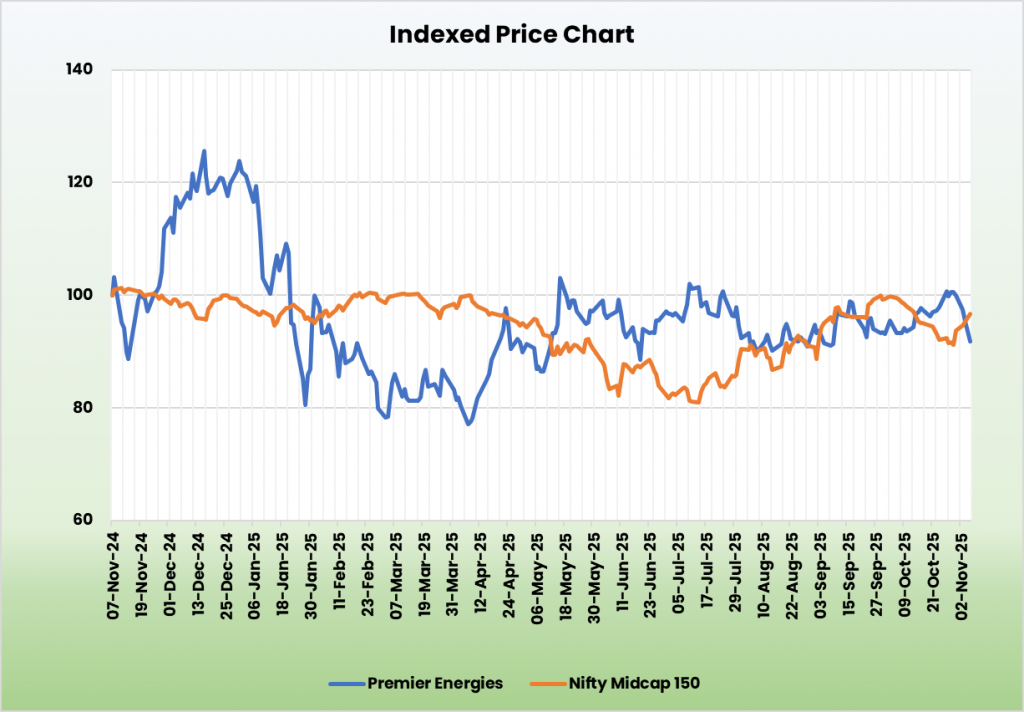

Valuations

We consider Premier’s totally built-in enterprise mannequin underscores the administration’s give attention to long-term operational effectivity, margin growth, and sustainable worth creation. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs.1,242, 42x FY27E EPS. We additionally encourage sustaining a stop-loss at 20% from the entry worth to handle potential draw back danger successfully.

SWOT Evaluation

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM by no means assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles it’s possible you’ll like

Publish Views:

37