The Union Finances 2025, introduced by the Finance Minister, outlines key measures to drive financial growth, strengthen monetary markets, and create alternatives for traders throughout fairness, debt, and mutual fund markets. Right here’s a complete evaluation of the identical:

Sectoral Highlights of Finances 2025

1. Infrastructure and Capital Expenditure

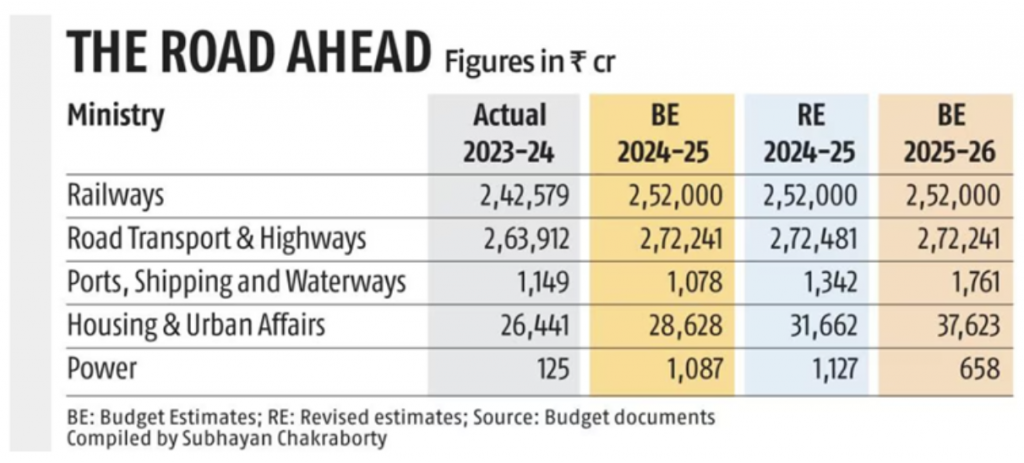

The price range has allotted ₹11.21 trillion, which is a ten% enhance from the ₹10.18 trillion allotted within the earlier price range—for capital expenditure, reflecting a dedication to infrastructure progress via a multiplier impact. As an illustration, elevated spending on ports, delivery, and waterways is anticipated to drive demand in allied industries corresponding to metal and aluminium. The push for public-private partnerships (PPP) will improve personal sector participation in infrastructure initiatives, housing and energy infrastructure. Additional, a concentrate on city mobility initiatives, together with metro rail growth and devoted freight corridors, and the growth of housing schemes just like the Particular Window for Inexpensive and Mid-Earnings Housing (SWAMIH) to advertise reasonably priced housing growth.

Supply: The Enterprise Customary.

Funding Affect

Infrastructure-focused shares and mutual funds – thematic, sectoral and actual property might doubtlessly profit from this price range. Lengthy-term fairness traders might take into account firms engaged in allied sectors. REITs (Actual Property Funding Trusts) may additionally acquire from government-backed housing initiatives.

2. Nationwide Manufacturing Mission as an Extension for ‘Make in India’

Enhancements in production-linked incentives (PLI) throughout electronics, auto elements, and semiconductors; particular incentives for electrical autos (EVs), together with tax breaks and subsidies for producers and consumers; reductions in import duties for uncooked supplies in essential sectors like renewable power and protection; strengthened initiatives for the textile and MSME sectors to spice up native manufacturing and exports; and particular tax advantages for industries adopting superior automation and AI-driven manufacturing processes, together with measures for labor-intensive sectors, will present a big increase to India’s manufacturing business.

Funding Affect

Fairness traders ought to concentrate on manufacturing firms benefiting from authorities incentives. Mutual fund traders can discover sectoral funds in industrial manufacturing and EV expertise. Buyers taking a look at mid and small-cap funds may benefit from elevated MSME assist.

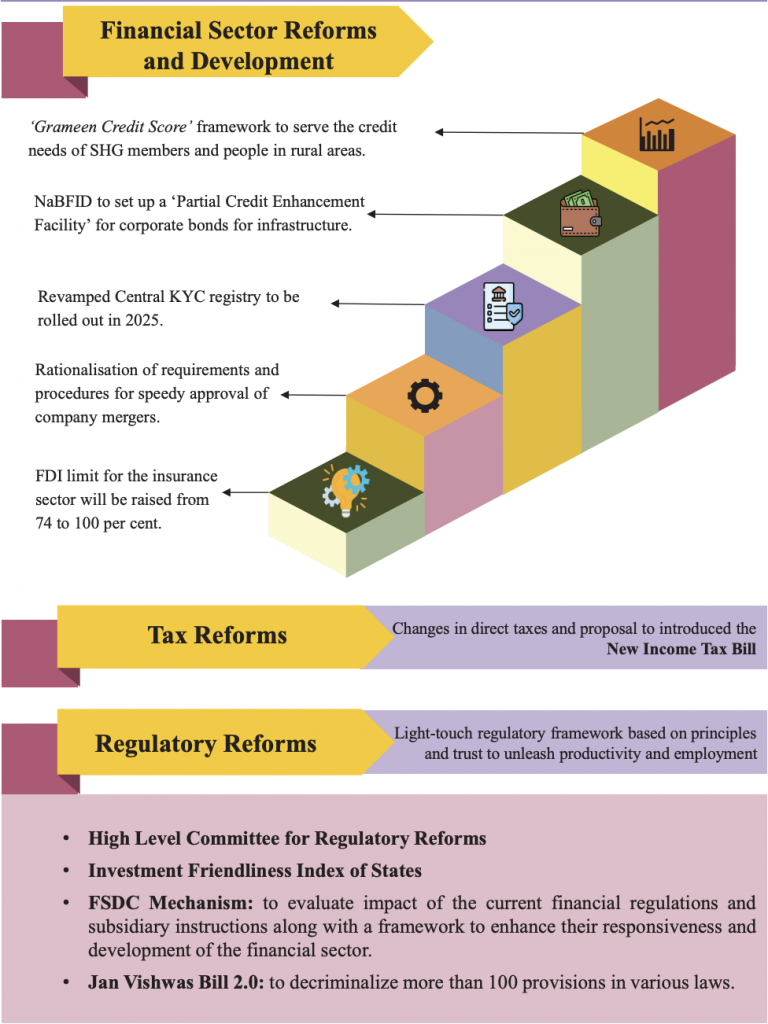

3. Banking and Monetary Providers

The Union Finances 2025 introduces key reforms for the BFSI sector, specializing in regulatory simplification and ease of doing enterprise. A high-level committee will evaluate non-financial sector laws, whereas the Jan Vishwas Invoice 2.0 goals to decriminalise over 100 provisions, lowering compliance burdens. Moreover, the FDI restrict within the insurance coverage sector will enhance from 74% to 100%, attracting overseas investments and fostering sectoral progress.

Funding Affect

Banking and monetary providers sector shares stand to realize. Buyers in debt markets ought to monitor authorities borrowing patterns because it impacts bond yields. Fintech-focused funds may see optimistic momentum from government-driven digital finance initiatives.

4. Renewable Power and Sustainability

The Union Finances 2025 prioritises power sector developments with a powerful concentrate on nuclear energy. The Nuclear Power Mission targets 100 GW capability by 2047, supported by amendments to key legal guidelines for personal sector participation. A ₹20,000 crore R&D initiative will drive small modular reactor (SMR) growth. Moreover, customs obligation exemptions on essential minerals will increase EV and battery manufacturing, whereas a brand new Make in India initiative will assist photo voltaic PV, electrolyser, and grid-scale battery manufacturing.

Funding Affect

Fairness traders might concentrate on renewable power firms. ESG (Environmental, Social, and Governance) mutual funds might appeal to greater inflows. Buyers taking a look at inexperienced bonds can discover long-term sustainable funding choices.

5. Consumption and FMCG Sector

This price range introduces vital revenue tax cuts, elevating the tax exemption restrict to ₹12 lakh, successfully eliminating tax legal responsibility for people incomes as much as this quantity. This transfer is anticipated to extend disposable revenue, thereby boosting consumption throughout numerous sectors. The fast-moving shopper items (FMCG) sector, specifically, anticipates a optimistic impression, as greater shopper spending is prone to drive demand for packaged items. Following the price range announcement, main FMCG shares skilled notable positive factors, reflecting investor optimism in regards to the sector’s progress prospects.

Funding Affect

FMCG and shopper discretionary shares are anticipated to carry out effectively. Buyers in fairness mutual funds might discover worth in diversified consumer-centric portfolios. Buyers in retail-focused REITs might also see advantages from growing shopper spending.

Implications for Totally different Funding Merchandise

1. Fairness Markets

- Constructive Affect: Shares in infrastructure, banking, manufacturing, and EV sectors are poised to learn from budgetary allocations.

- Challenges: Elevated fiscal deficit issues might impression market sentiment within the brief time period.

- Investor Technique: Lengthy-term traders ought to concentrate on progress sectors whereas sustaining a diversified portfolio to mitigate dangers.

- Sectoral Funds: Thematic investments in sustainable power, fintech, and infrastructure might outperform the broader market.

2. Debt Markets

- Fiscal Deficit Goal: The federal government initiatives a fiscal deficit of 4.4% of GDP, signalling a transfer in direction of fiscal consolidation.

- Affect on Bond Yields: Secure rate of interest expectations bode effectively for presidency and company bond markets.

- Inexperienced Bonds: Growing issuance of sovereign inexperienced bonds supplies a brand new alternative for fixed-income traders.

- Investor Technique: Debt fund traders ought to take into account medium to long-term bond funds for secure returns. Buyers taking a look at inexperienced bonds can discover sustainable funding choices.

3. Mutual Funds

- Fairness Mutual Funds might profit from elevated capital expenditure and government-led initiatives in infrastructure and manufacturing. Buyers can discover large-cap funds for stability and mid-cap and small-cap funds for greater progress potential in sectors supported by authorities insurance policies.

- Debt Mutual Funds traders can favor funds with high-quality authorities and company bonds given the concentrate on fiscal prudence. Quick-term bond funds might profit from secure rates of interest, whereas long-term debt funds may see positive factors from fiscal consolidation measures.

- Sectoral and Thematic Funds – Power and banking sector funds may outperform on account of coverage assist. Fintech-focused funds and ESG funds may even see growing inflows as digital banking and sustainability acquire prominence.

- Hybrid and Balanced Benefit Funds – given potential market volatility, traders might test for balanced hybrid funds that dynamically allocate between fairness and debt for risk-adjusted returns.

Wrapping Up

Finances 2025 lays the muse for sustained financial progress with a strategic emphasis on infrastructure, manufacturing, and sustainability. Buyers ought to align their portfolios (search monetary recommendation) with the federal government’s focus areas whereas monitoring macroeconomic traits. A balanced strategy throughout fairness, debt, and mutual funds shall be essential in navigating the evolving monetary panorama within the coming 12 months. The elevated assist for rising sectors corresponding to fintech, renewable power, and e-commerce additional supplies new funding avenues. By staying knowledgeable and adapting to market traits, traders can capitalise on the alternatives created by the price range’s long-term imaginative and prescient. The diversification throughout asset lessons shall be key to optimising threat and return on this evolving monetary panorama.

Considering how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Buyers