Prime 5 Greatest Shopper Sturdy Shares In India

The worldwide client durables market has proven strong development, propelled by technological developments, rising disposable incomes, and the rising penetration of good units. The market, valued at roughly USD 1.2 trillion in 2023, is anticipated to develop at a CAGR of 5.6% over the subsequent 5 years.

India goes to turn out to be the fourth largest marketplace for client durables by 2030, in response to a report from Indbiz. The patron durables market projected to achieve INR 3.15 lakh crores by 2030, rising at a CAGR of over 10% from 2024 pushed by authorities initiatives underneath “Make in India” and the adoption of energy-efficient home equipment contribute to this upward trajectory.

Greatest Shopper Sturdy Shares In India

India’s client durables sector is characterised by various classes, together with house home equipment, air conditioners, LED lighting, and kitchen gear. City demand is fueled by good properties and IoT-enabled home equipment, whereas rural markets expertise development on account of electrification and improved connectivity.

Firms like LG, Voltas, and Havells play a pivotal function, leveraging innovation and expansive distribution networks to handle evolving client wants. Authorities insurance policies reminiscent of lowered GST charges on sure home equipment and production-linked incentives for native manufacturing additional improve the trade’s prospects.

Shopper Durables Shares

Now allow us to analyze the 5 Greatest client durables shares in India to regulate for funding.

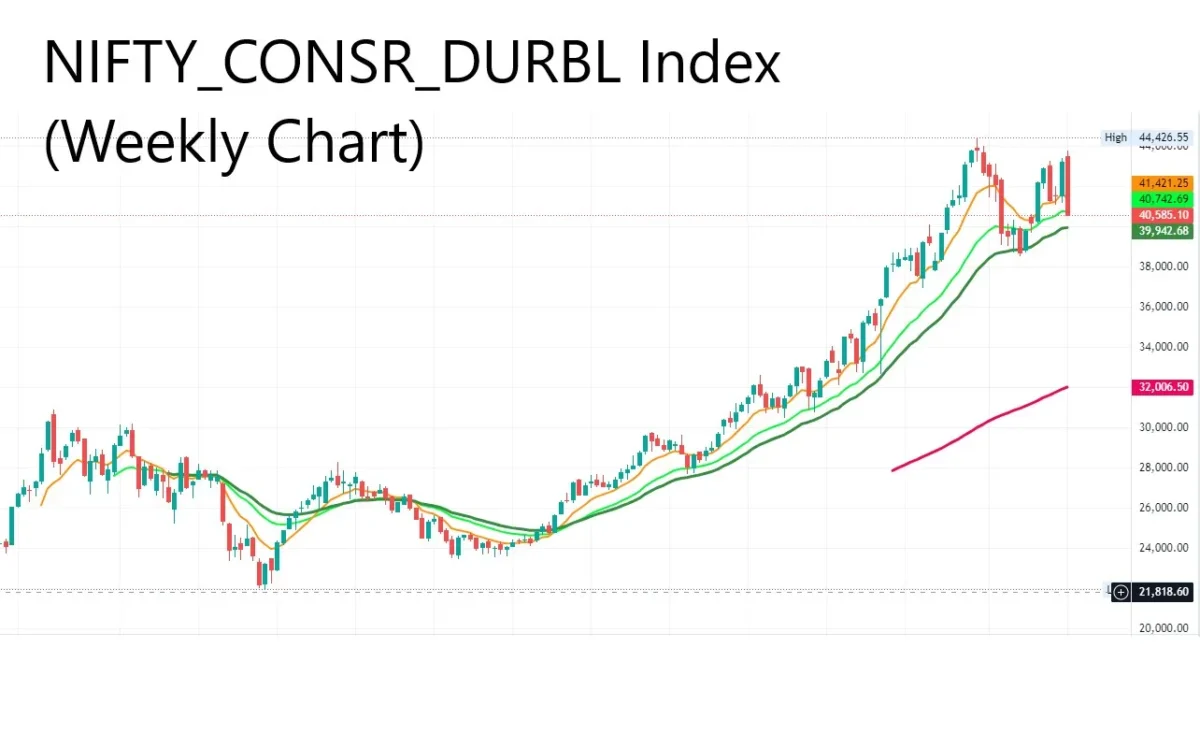

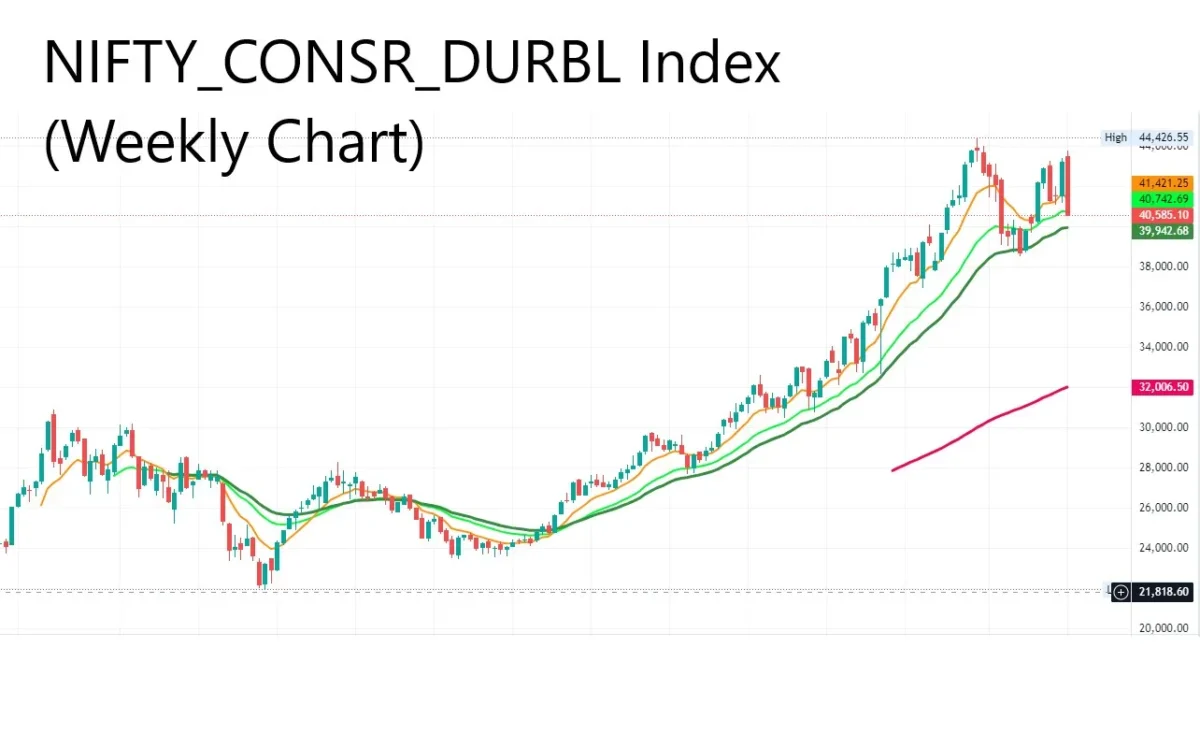

Shopper durables is one sector within the Indian economic system that has been performing persistently over time. For those who take a look at the Nifty Shopper Sturdy Index, month-to-month or weekly chart, you’ll witness the expansion over months with none main drawdowns. This displays the resilience of this sector within the Indian economic system.

Crompton Greaves Shopper Electricals Restricted (CGCEL)

Crompton Greaves Shopper Electricals Restricted (CGCEL) is one among India’s main client electrical firms with a legacy spanning over 85 years. Famend for its market management in followers, residential pumps, and lighting, Crompton has constructed a strong portfolio of energy-efficient, revolutionary, and premium merchandise that cater to evolving client wants.

The corporate operates throughout two main segments: Electrical Shopper Durables (ECD), which incorporates followers, water heaters, and kitchen home equipment, and Lighting, specializing in LED and energy-efficient options. With a robust pan-India distribution community, strategic acquisitions like Butterfly Gandhimathi Home equipment, and a dedication to sustainability and consumer-centric innovation, Crompton continues to boost its market presence and ship long-term worth to stakeholders.

Key tendencies in income, revenue, and money move

- Income Development: Crompton’s consolidated income grew from ₹5,809 crore in FY22 to ₹6,388 crore in FY24, with sustained development throughout ECD and Lighting segments.

- Profitability: PAT in FY24 stood at ₹466 crore, enhancing from ₹476 crore in FY23. EBITDA margins elevated from 11.5% in FY23 to 12.4% in FY24.

- Money Move: Crompton maintained strong money move administration by way of effectivity measures like price optimization and stock management

Phase income of the corporate

- ECD Phase: Accounts for ~85% of income with a robust presence in followers, pumps, and kitchen home equipment.

- Lighting Phase: Contributes ~15% of income, pushed by premiumization and energy-efficient merchandise.

Major drivers of income development

- Product: Development in premium followers, water heaters, and kitchen home equipment; rising contribution from Butterfly Gandhimathi acquisition.

- Geography: Pan-India distribution community with a stronghold in each rural and concrete markets.

- Shopper Conduct: Premiumization and demand for energy-efficient merchandise

Market share

- Market Management: Crompton is #1 in residential pumps and followers and #3 in lighting. Butterfly’s acquisition strengthened its place in kitchen home equipment.

- Aggressive Benefit: Sturdy model fairness, extensive distribution community, and concentrate on consumer-led innovation.

Strategic priorities

- Improve premium product choices in ECD and lighting.

- Growth into massive kitchen home equipment, leveraging the Butterfly model.

- Speed up innovation in energy-efficient and IoT-enabled merchandise.

- Drive price effectivity by way of provide chain optimization and enhanced manufacturing capabilities.

Valuation evaluation

- Crompton’s valuation is supported by constant income development, robust PAT margins, and management in key classes. Its market efficiency and growth methods align effectively with trade development tendencies, making it a lovely funding.

Havells India Restricted

Havells India Restricted, a number one Quick Transferring Electrical Items (FMEG) firm, has advanced right into a family title synonymous with innovation, high quality, and sustainability. With a various portfolio spanning switchgear, cables, lighting, client durables, and the Lloyd model of home equipment, Havells serves over 70 nations globally.

Its in-house manufacturing capabilities, strong R&D, and powerful distribution community allow the corporate to cater to assorted client wants. Havells is strategically targeted on premiumization, rural penetration, and good house options, positioning itself as a key participant within the international client durables market.

Key tendencies in income, revenue, and money move

- Income Development: Havells reported a CAGR of 15% in income over the previous decade, with internet income reaching ₹18,550 crore in FY24 from ₹16,868 crore in FY23.

- Profitability: PAT elevated from ₹1,075 crore in FY23 to ₹1,273 crore in FY24. EBITDA improved from ₹1,603 crore in FY23 to ₹1,845 crore in FY24.

- Money Move: Sturdy money move technology with important reinvestment in capability growth and innovation.

Phase income of the corporate

- Income Combine FY24:

- Cables: 34.1%

- Switchgears: 12.1%

- Lighting & Fixtures: 9.5%

- Electrical Shopper Durables (ECD): 20.4%

- Lloyd Shopper: 18.8%.

Major drivers of income development

- Product Portfolio: Sturdy development in premium and IoT-enabled merchandise throughout ECD, lighting, and Lloyd classes.

- Geographical Attain: Important rural penetration underneath the “Rural Vistaar” initiative, overlaying 3,000+ cities with 42,000+ retail touchpoints.

- Shopper Demand: Elevated adoption of good, energy-efficient, and branded merchandise.

Market share

- Havells is among the many high 3 gamers in most classes, together with residential switchgear, followers, cables, and ACs (by way of Lloyd).

- Aggressive Benefit:

- 90% in-house manufacturing, enabling price management and high quality assurance.

- Huge product portfolio throughout 20 verticals.

- Sturdy distribution community with ~18,000 sellers and 220,000 retailers.

Strategic priorities

- Growth: Continued capability growth, together with Lloyd AC crops in Ghiloth and South India.

- Product Improvement: Give attention to IoT-enabled good house options and energy-efficient home equipment.

- Rural Markets: Strengthening rural presence by way of unique shops and focused product choices.

- Worldwide Markets: Rising export contributions and getting into developed markets with strategic partnerships.

- Lloyd AC Plant Growth: New crops in Sri Metropolis (South India) to double AC manufacturing capability.

- International Markets: Initiatives to broaden into the Center East and North America.

Valuation evaluation

- Havells’ valuation is supported by strong income development, management in FMEG, and a diversified portfolio. Its concentrate on premiumization, rural penetration, and innovation aligns with long-term development alternatives.

Polycab India Restricted

Polycab India Restricted is India’s largest built-in producer of wires and cables and a number one participant within the fast-moving electrical items (FMEG) sector. With a legacy spanning a decade, Polycab dominates the home wire and cable (W&C) market with a 25-26% share and has quickly expanded its FMEG portfolio, attaining a 25% CAGR over eight years.

The corporate is thought for its strong backward integration, superior R&D capabilities, and dedication to sustainability. Via its Challenge LEAP initiative, Polycab is poised to attain ₹200 billion in income by FY26, pushed by innovation, market diversification, and a robust international footprint.

Key tendencies in income, revenue, and money move

- Income Development: Polycab’s income grew considerably, reaching ₹180,394 million in FY24, representing a 28% YoY development.

- Profitability: PAT for FY24 was ₹18,029 million, showcasing robust development with a concentrate on operational effectivity. EBITDA margin stood at 13.8%, indicating wholesome profitability.

- Money Move: Polycab reported ₹21,408 million in internet money, demonstrating strong money technology capabilities.

Phase income of the corporate

- Wires and Cables (W&C): This phase contributed roughly 88% of whole income in FY24, sustaining Polycab’s place because the market chief with a 25-26% share of the organized W&C market.

- FMEG (Quick-Transferring Electrical Items): FMEG income reached ₹12,828 million in FY24, rising at an 8-year CAGR of 25%.

- EPC (Engineering, Procurement, and Development): EPC income was ₹9,642 million in FY24, supported by robust challenge execution.

Major drivers of income development

- Product Portfolio: Growth in premium W&C choices and fast development in FMEG merchandise like followers, switches, and lighting.

- Geographical Attain: A robust Pan-India presence with over 205,000 stores and rising worldwide income (13.8% CAGR over 5 years).

- Demand Drivers: Actual property upcycle, infrastructure improvement, and the adoption of energy-efficient and good merchandise.

Market share

- Polycab dominates the Indian W&C market with a 25-26% organized market share, leveraging backward integration, superior R&D capabilities, and a strong distribution community.

- The aggressive benefit arises from its management in W&C, rising FMEG phase, and sustainable practices reminiscent of renewable vitality integration.

Strategic priorities

- Challenge LEAP: Goal for ₹200 billion in income by FY26 by way of B2B and B2C portfolio optimization.

- Sustainability: Elevated concentrate on renewable vitality, water recycling, and inclusive development.

- International Growth: Strengthening worldwide presence in markets like North America, Australia, and Europe.

- Innovation: Give attention to eco-friendly and good merchandise reminiscent of BLDC followers and inexperienced wires.

Valuation evaluation

- Polycab’s valuation is supported by its management in W&C, fast development in FMEG, robust profitability, and money technology. Its multi-year development technique underneath Challenge LEAP enhances its long-term funding potential.

Information Heart Associated Articles

V-Guard Industries Restricted

V-Guard Industries Restricted is a number one Indian model with a diversified portfolio spanning electronics, electrical, and client durables. Famend for its revolutionary stabilizers, inverters, and water heaters, V-Guard has expanded into kitchen home equipment, photo voltaic options, and modular switches by way of strategic acquisitions.

With a robust distribution community of 100,000+ companions and manufacturing excellence, V-Guard is concentrated on premiumization, sustainability, and leveraging IoT-enabled merchandise to cater to evolving client aspirations. Its balanced geographic presence and dedication to innovation place it as a robust contender in India’s rising client durables market.

Key tendencies in income, revenue, and money move

- Income Development: V-Guard’s income grew considerably, attaining ₹4,857 crore in FY24, a 17.7% enhance from FY23. The Shopper Durables and Electronics segments confirmed robust efficiency.

- Profitability: PAT elevated by 36.2%, reaching ₹257.58 crore in FY24. Gross margins improved by 3.5% year-on-year to 33.6%, pushed by price efficiencies and favorable commodity pricing.

- Money Move: V-Guard generated ₹392.74 crore in money from operations in FY24, indicating strong money move administration.

Phase income of the corporate

- Phase Contribution (FY24):

- Electronics: 24.0%

- Electricals: 40.6%

- Shopper Durables: 29.7%

- Sunflame: 5.7%

- Development was led by Shopper Durables (+13.1%) and Electronics (+17.2%).

Major drivers of income development

- Product Portfolio: Elevated demand for premium and IoT-enabled merchandise like kitchen home equipment, photo voltaic water heaters, and followers.

- Geographic Attain: Growth in non-South markets, contributing 46% of income in FY24, showcasing balanced geographic diversification.

- Shopper Conduct: Rising adoption of good and linked units, supported by rising disposable incomes in India.

Market share

- Market Management: V-Guard is a number one model in stabilizers, inverters, and water heaters, with a rising footprint in kitchen home equipment and modular switches post-acquisitions like Sunflame and Simon Electrical.

- Aggressive Benefits:

- Sturdy model recall and nationwide distribution community with 100,000+ channel companions.

- Strong in-house manufacturing capabilities.

Strategic priorities

- Premiumization: Give attention to IoT-enabled merchandise and premium choices in kitchen home equipment and modular switches.

- Capability Growth: New manufacturing models in Vapi (mixer grinders, stoves) and Hyderabad (batteries) to boost manufacturing capability.

- Sustainability: Initiatives to undertake renewable vitality and develop eco-friendly merchandise.

- Manufacturing Growth: Services in Vapi (kitchen home equipment) and Hyderabad (batteries), together with plans for a brand new TPW fan plant inside 12-18 months.

- Innovation Campus: A state-of-the-art facility in Kochi for R&D, IoT lab, and product design studio.

Valuation evaluation

- V-Guard’s valuation is underpinned by its constant income development, improved profitability, and balanced geographic presence. Strategic acquisitions and premiumization tendencies additional improve its development prospects.

Voltas Restricted

Voltas Restricted, a Tata Group enterprise, is India’s main air con and engineering options supplier with a wealthy legacy spanning seven a long time. The corporate operates throughout three key verticals: Unitary Cooling Merchandise (UCP), Engineering Initiatives, and Engineering Merchandise & Providers.

Famend for its market management in room air conditioners and its revolutionary Voltas Beko vary of house home equipment, Voltas combines technological excellence with sustainability. With an unlimited distribution community and a robust concentrate on customer-centric options, Voltas continues to set benchmarks within the client durables trade.

Key tendencies in income, revenue, and money move

- Income Development: Voltas achieved a consolidated whole revenue of ₹12,734 crores in FY24, a development of 32% in comparison with ₹9,667 crores in FY23.

- Profitability: PAT for FY24 was ₹248 crores, a rise of 82% from ₹136 crores in FY23. EBITDA margins improved from 7.2% in FY23 to eight.4% in FY24.

- Money Move: Sturdy operational money move technology supported by efficient price administration and optimized working capital.

Phase income of the corporate

- Unitary Cooling Merchandise (UCP): Contributed ~77% of whole income, led by robust demand for air conditioners and coolers.

- Engineering Initiatives: Accounts for 14% of income, with important contributions from home and worldwide infrastructure initiatives.

- Engineering Merchandise and Providers: Contributed 9% of income, specializing in mining and development gear.

Major drivers of income development

- Product Portfolio: Growth in good and energy-efficient cooling options and home equipment like IoT-enabled air conditioners and superior washing machines underneath Voltas Beko.

- Geographic Growth: Elevated footprint in tier-2 and tier-3 cities, together with development in worldwide markets like UAE and Saudi Arabia.

- Demand Drivers: Restoration in infrastructure initiatives and rising client demand for premium house home equipment.

Market share

- Market Management: Voltas maintained its market management in room air conditioners with an 18.7% market share in FY24.

- Aggressive Benefits:

- Sturdy model fairness underneath the Tata Group umbrella.

- Strategic three way partnership with Arçelik for client durables (Voltas Beko).

- Intensive distribution community with over 30,000 touchpoints.

Strategic priorities

- Premiumization: Give attention to superior, eco-friendly cooling options and good home equipment.

- Capability Growth: Investments in manufacturing services in Chennai and Waghodia to cater to rising demand.

- Sustainability: Dedication to carbon neutrality and elevated use of renewable vitality in operations.

- International Initiatives: Increasing presence in high-growth areas like Saudi Arabia and UAE.

Valuation evaluation

- Supported by its market management, strong income development, and strategic partnerships, Voltas is well-positioned for sustained development within the client durables market. Its valuation displays robust model fairness and future potential.

Last Phrases on Shopper Durables Shares

Based mostly on the evaluation, Havells India, Polycab India, and Voltas Restricted emerge as robust contenders for funding amongst client durables shares in India. Havells stands out for its diversified portfolio, robust presence in premium FMEG merchandise, and constant income development pushed by rural growth and innovation.

Polycab dominates the wires and cables market, complemented by fast development in its FMEG phase, supported by strong money move and impressive development plans underneath “Challenge LEAP.” Voltas leads in air con and cooling options, leveraging its strategic three way partnership with Arçelik (Voltas Beko) and a robust market share in UCP, supported by increasing manufacturing capabilities.

These firms align effectively with India’s demand for good, energy-efficient merchandise and profit from authorities incentives and strong distribution networks, making them enticing long-term funding choices within the client durables sector.

Different Shopper Durables Shares Listing

- Blue Star Ltd.

- Market Cap: ₹12,000 Cr.

- Overview: Blue Star is a number one air con and industrial refrigeration firm, providing a wide range of cooling merchandise and options.

- Whirlpool of India Ltd.

- Market Cap: ₹10,000 Cr.

- Overview: Whirlpool is a outstanding producer of house home equipment, together with fridges, washing machines, and kitchen home equipment.

- Bajaj Electricals Ltd.

- Market Cap: ₹6,000 Cr.

- Overview: Bajaj Electricals gives a various vary of merchandise, together with lighting, followers, and residential home equipment.

- TTK Status Ltd.

- Market Cap: ₹5,000 Cr.

- Overview: TTK Status is a number one kitchen home equipment firm, recognized for its stress cookers, cookware, and kitchen devices.

- LG Electronics India

- IPO Standing: Filed for IPO in December 2024.

- Particulars: The Indian arm of South Korea’s LG Electronics plans to boost roughly ₹15,237 crore ($1.80 billion) by way of the IPO, with the mother or father firm promoting 101.8 million shares. This transfer goals to capitalize on the rising demand for client durables in India