Be part of Our Telegram channel to remain updated on breaking information protection

US President Donald Trump’s nominee for Commodity Futures Buying and selling Fee (CFTC) Chair Brian Quintenz has accused Gemini co-founders Tyler and Cameron Winklevoss of undermining his affirmation.

Quintenz was initially anticipated to fly by means of Senate affirmation with assist from the broader crypto and monetary industries. This all appeared to vary when the Gemini co-founders wrote a letter to Trump that pressed him to rethink. The White Home subsequently halted a vote for unspecified causes.

Believing that the President might have been misled, Quintenz took to X to share a personal change that passed off between himself and the Winklevoss twins days earlier than they despatched the letter to Trump.

Tyler Winklevoss Requested How Quintenz Would ‘Align With President Trump’

“I’ve by no means been inclined to launch non-public messages,” he wrote on X. “However in mild of my assist for the President and perception that he may need been misled, I’ve posted right here the messages that embody the questions Tyler Winklevoss requested me pertaining to their prior litigation with the CFTC.”

I’ve by no means been inclined to launch non-public messages. However in mild of my assist for the President and perception that he may need been misled, I’ve posted right here the messages that embody the questions Tyler Winklevoss requested me pertaining to their prior litigation with the CFTC.

— Brian Quintenz (@BrianQuintenz) September 10, 2025

The texts shared on X included a letter that Gemini despatched to the CFTC’s inside watchdog relating to a $5 million settlement between the change and the company.

That settlement, which was struck within the last days of former President Joe Biden’s Administration, associated to allegations that Gemini made deceptive statements to the CFTC a few crypto funding product.

Within the letter, the Winklevoss twins criticized the company, and accused the CFTC of participating in “7 years of lawfare trophy looking.”

Tyler Winklevoss then requested Quintenz how he plans to “align with President Trump and the Administration’s mandate to finish the lawfare and make amends for it.”

“Our grievance raises severe questions and issues in regards to the tradition of the company that you’re about to chair and its general health on the eve of it being contemplated as a serious regulator for the crypto trade,” he wrote within the messages shared by Quintenz.

“Cultural reform, which incorporates rectifying what occurred to us, needs to be the best precedence,” he added.

Quintenz replied by saying that he was disillusioned that the CFTC’s enforcement division had pursued the lawsuit in opposition to Gemini “so aggressively.”

Quintenz Promised Truthful Assessment If He Turned CFTC Chair

He added that he would undertake “a good and cheap evaluation of the matter” if and when he’s appointed because the company’s new Chair.

Quintenz then stated that the matter between Gemini and the CFTC needs to be dealt with by a “totally confirmed chair,” earlier than warning the Winklevoss twins to tread rigorously in the event that they had been already involved with somebody at the moment employed by the CFTC.

Tyler Winklevoss requested if Gemini ought to have waited till Quintenz was confirmed as the brand new CFTC Chair by the Senate earlier than submitting their grievance. Quintenz replied by saying “any determination or response to your grievance needs to be made by and given the complete weight of the confirmed chair.”

In his X put up, Quintenz stated that the textual content message “make it clear what they had been after” from him, and likewise present what he “refused to vow.”

“It’s my understanding that after this change they contacted the President and requested that my affirmation be paused for causes apart from what’s mirrored in these texts,” he wrote.

Lawmakers Weigh Granting CFTC Energy Over Crypto Market As Gemini Prepares For Public Itemizing

Quintenz is a former CFTC commissioner who has labored for Andreessen Horowitz’s crypto fund. He’s additionally on the board of the prediction market startup Kalshi.

His latest X put up comes as lawmakers weigh giving the CFTC new energy over the crypto market. Over time, the company has overseen the buying and selling of futures contracts tied to corn, oil, and monetary indexes.

It additionally at the moment regulates derivatives merchandise tied to cryptos like Bitcoin (BTC) and Ethereum (ETH). If the pending laws is accredited by the Senate, the CFTC’s jurisdiction will likely be expanded to additionally embody these digital belongings themselves.

Quintenz’s put up additionally comes as Gemini prepares to go public later this week with an OP that goals to lift $433 million.

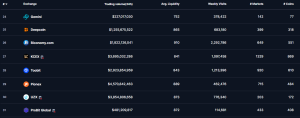

Gemini is at the moment ranked because the Twenty fourth-biggest crypto change when it comes to buying and selling quantity, based on CoinMarketCap knowledge.

Gemini ranked because the Twenty fourth-biggest change (Supply: CoinMarketCap)

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection