Picture supply: Getty Photographs

Sainsbury‘s (LSE:SBRY) shares have been on a curler coaster over the past yr. They’re up 11% after rising strongly since mid-April, however their efficiency nonetheless lags that of Tesco since mid-2024.

Shares of the FTSE 100 rival have risen 33% in worth over the interval.

Nonetheless, after a stable buying and selling replace on Monday (2 July) — during which Sainsbury’s mentioned gross sales proceed to outperform the broader market — might we be about to see a turning level for the UK’s second-largest grocery store and its share worth?

Worth forecasts

Analysts with scores on Sainsbury’s broadly count on the retailer’s share worth to proceed rising at a good clip. Nonetheless, they’re not anticipating it to rise on the kind of tempo Tesco’s has been over the past yr.

Sainsbury’s share worth forecast

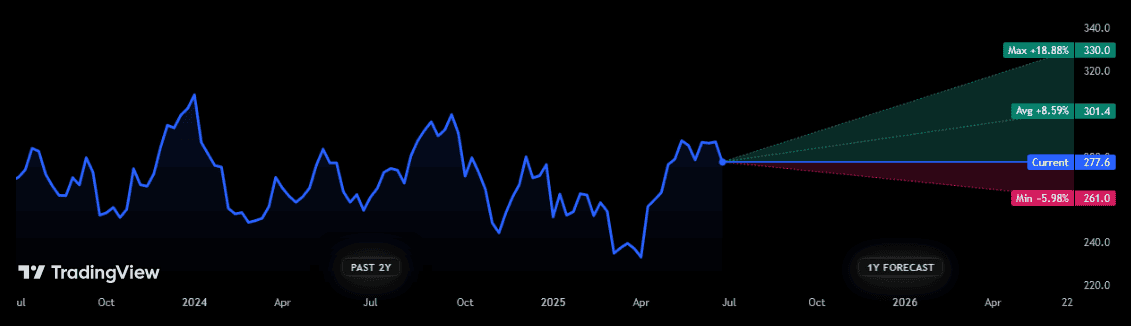

There are presently 11 brokers with scores on Sainsbury’s at this time. And the consensus amongst them is for the Footsie inventory to rise virtually 9% from present ranges of 277.6p.

As with most shares, there’s quite a lot of opinions inside this cluster. On this case, one particularly bullish forecaster thinks the retailer will soar 19% from present ranges. However on the opposite facet of the fence, a bearish analyst reckons it is going to drop round 6%.

Dividend forecasts

By way of dividends, analysts are (on the entire) equally optimistic that issues right here will progress over the following 12 months and past.

They predict:

- An bizarre dividend of 14.1p per share within the 12 months to March 2026. That’s up 4% yr on yr.

- A full-year dividend of 15.1p in monetary 2027, up 7%.

That is on prime of the retailer’s plans to pay £250m out in particular dividends later this yr, following the sale of Sainsbury’s Financial institution final summer time.

As with share worth forecasts, dividend estimates are by no means set in stone. However I feel there’s a great probability that the Sainsbury’s payout will be capable to hit the Metropolis’s projections.

On the draw back, dividend cowl is simply 1.5 instances for the following two fiscal years. As an investor, I search for predicted dividends to be coated no less than 2 instances by anticipated earnings.

But the grocery store’s sturdy monetary foundations might give it room to pay these anticipated dividends, even when income are blown astray. Its web debt-to-EBITDA (earnings earlier than curiosity, tax, depreciation, and amortisation) ratio was 2.5 instances as of March.

That’s on the backside of a goal vary of two.4 to three instances.

Time to purchase Sainsbury’s?

Give latest buying and selling momentum, I wouldn’t be stunned to see Sainsbury’s hit present share worth and dividend estimates.

Like-for-like gross sales rose 4.9% within the 16 weeks to 21 June, it mentioned yesterday. This meant its markets share was on the highest in a decade, with gross sales boosted by worth initiatives like its ‘Aldi Worth Match’ programme that covers 800 merchandise.

Whereas these numbers are stable, they’re not sufficient to persuade me to speculate. Certain, gross sales are spectacular at this time, however income figures weren’t launched to permit traders to think about the influence of this heavy discounting on income.

There’s a hazard, too, that the retailer must proceed slashing costs to continue to grow gross sales on the expense of margins. The much-anticipated grocery store worth struggle hasn’t damaged out simply but nevertheless it’s probably solely a matter of time.

And the stress to chop worth labels might be right here to remain, too, as robust financial circumstances hit shopper spending and low cost chains broaden. I’d reasonably discover much less dangerous UK shares to purchase.