Picture supply: Getty pictures

The big tax advantages that Shares and Shares ISAs present could make them formidable weapons to focus on long-term wealth. Buyers can put the cash safeguarded from HMRC to work, boosting the compounding impact to assist them develop their pension pot sooner.

These tax financial savings have helped Shares and Shares ISAs ship an annual return near 10% over the past decade. But regardless of these advantages, many Britons stay reluctant to make use of them on account of their increased danger profile. The latest panic over rumoured cuts to Money ISA allowances to encourage share investing is proof of this.

Please observe that tax remedy depends upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

However investing on the inventory market doesn’t must contain taking over uncomfortable ranges of danger. And with the poor returns on provide from Money ISAs — the typical annual return since 2015 is simply over 1% — I actually consider utilizing a Shares and Shares ISA too is a no brainer (it’s why I at present use each forms of account to focus on giant returns and handle danger).

Getting private

Buyers can unfold the chance they face by buying exchange-traded funds (ETFs) or funding trusts.

Pooled investments like these can allocate capital throughout a variety of belongings, with buyers selecting the one which finest balances their desired return and tolerance of danger. The Private Belongings Belief (LSE:PNL) is one such automobile I feel is a lovely method for ISA buyers to contemplate constructing wealth.

Greater than a 3rd (36%) of the belief is locked up in shares, its single most represented asset class. Main holdings right here embody UK and US blue-chip shares Unilever, Microsoft, Visa, and Diageo. That additionally provides danger linked to the efficiency of particular person shares (like Diageo, which has been weak not too long ago).

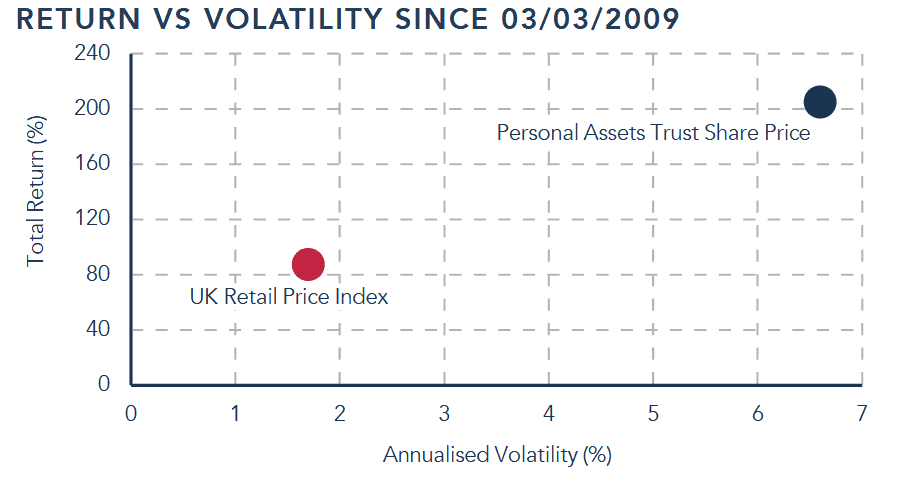

Nonetheless, the remaining is allotted to basic, steady belongings like authorities bonds, valuable metals and money. Because of this, buyers nonetheless get pleasure from relative low ranges of volatility, because the chart under exhibits:

Substantial safe-haven holdings at present embody gold bars (10.6% of the belief), US inflation-protected authorities bonds (26%) and short-dated Gilts (10%).

Since 2015, the fund has delivered a mean annual return of 5.3%. That’s much better than a primary money financial savings account has offered in that point.

Holy moly

Buyers chasing higher returns can obtain this by contemplating trusts with higher allocations to equities. This entails extra danger danger, although automobiles which make investments throughout sectors and areas can nonetheless considerably cut back the hazard to people’ money.

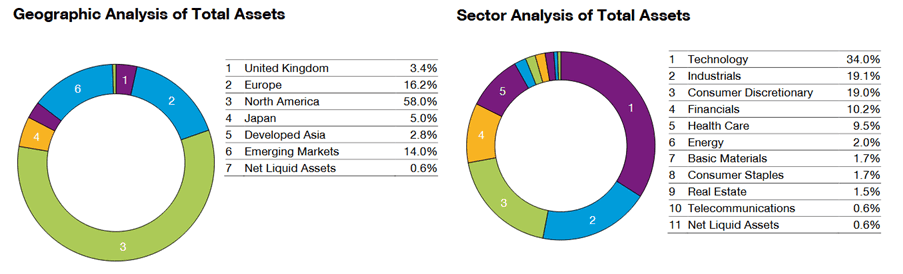

Take the Monks Funding Belief (LSE:MNKS). The typical annual return right here is an excellent 10.3%, achieved throughout scores of various firms (105 at present) spanning the globe:

Main holdings right here embody the ‘Magnificent Seven’ Microsoft, Meta, Amazon and Nvidia. These firms may be unstable throughout financial slowdowns, however over the long run have offered robust returns because the digital financial system has grown.

With administration by monetary providers big Baillie Gifford, buyers

Each trusts expose buyers to dangers corresponding to rising rates of interest and market declines. But as their long-term performances present, they’ll nonetheless be an effective way for cautious buyers to generate long-term wealth and I feel they’re worthy of additional analysis.