Put up Covid-19 hit lockdowns, India has seen a surge in demat accounts being opened.

Round 114 million demat accounts had been opened in 2023 alone which is round 2.8 instances of 2020 quantity. Such has been the craze of the bull market we’re witnessing.

Because of this, there was an unprecedented improve within the variety of merchants providing suggestions for undisclosed charges. Add to that, there are such a lot of YouTube movies the place individuals realizing little or no about finance and the way inventory markets function have now develop into in a single day monetary influencers. An excessive amount of irrelevant data is now floating round for no purpose in any respect.

Briefly, the drama round inventory markets is growing.

Give it some thought.

Inventory costs of a number of railways and infrastructure firms have multiplied within the final couple of years with completely no change of their earnings or their fundamentals. Whereas a top quality financial institution like HDFC Financial institution which has been holding the ship regular has misplaced round 18% in January 2024 alone.

So now you get individuals on YouTube and tv making an attempt to justify every thing.

- If the market goes up, there’s sufficient justification.

- If the market crashes, there’s sufficient justification.

So what ought to an investor do in such a situation?

It’s easy, simply maintain shopping for!

In the long term, inventory markets are a web constructive indicator for wealth creation. They can’t develop into zero. It’s not of their nature.

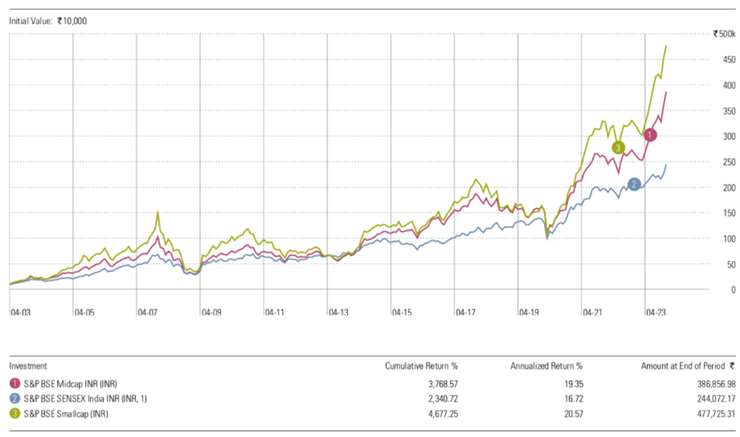

Examine this chart out

It’s a easy chart of Sensex, Mid cap and Small cap index efficiency over the past 20 years.

You don’t want to enter large particulars to know that in the long run, markets maintain going up. Now we have seen the autumn out of the 2008-09 debacle, the 2013 disaster of India being a Fragile 5 nation and the Covid-19 meltdown.

But, the costs maintain going upwards.

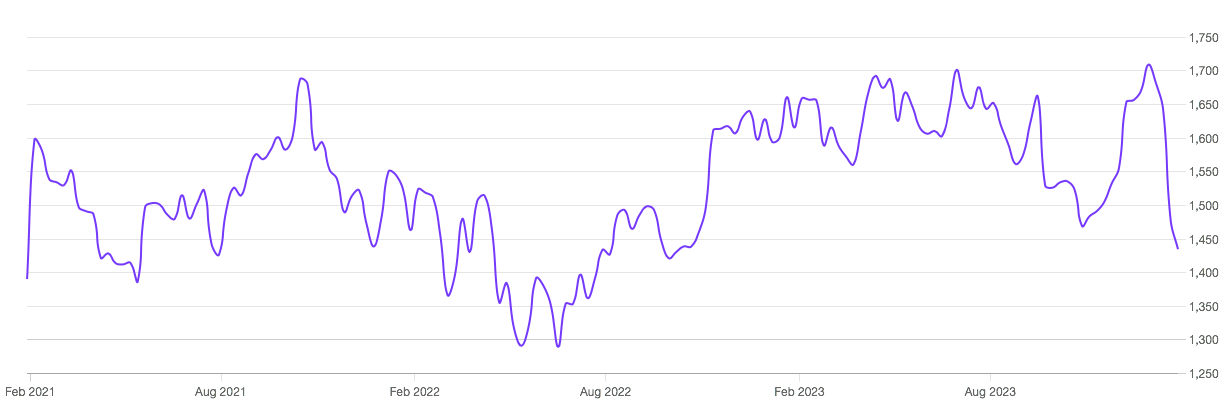

Take HDFC Financial institution for instance.

Over the past couple of weeks, there was a substantial quantity of debate round this inventory. A variety of the children who had been born alongside the Financial institution’s launch date are declaring that this Financial institution’s future is over.

I consider a few of these kids mindlessly remark by way of Telegram and YouTube, their careers are in grave hazard.

As a result of if you happen to take a 3 yr horizon, then HDFC Financial institution’s inventory has not gone anyplace.

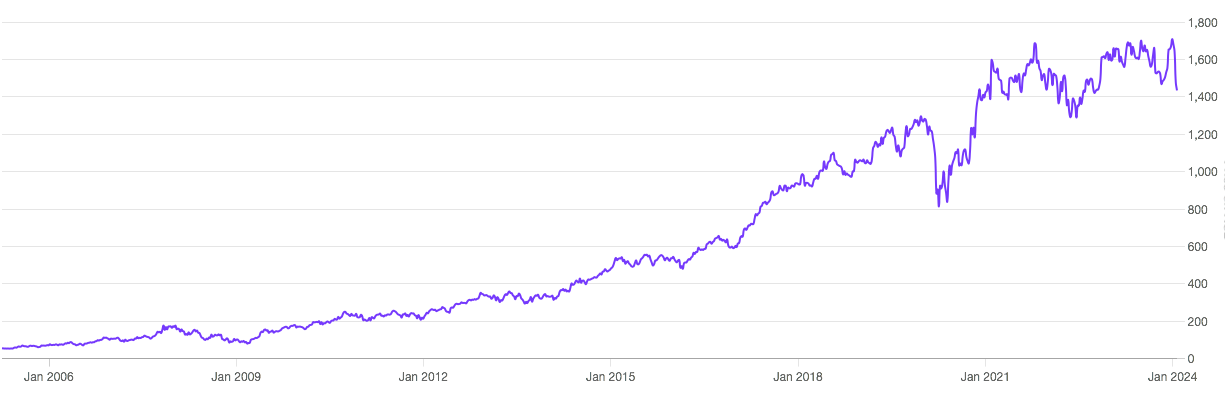

However if you happen to take a look at the final 2 a long time, then the story is totally completely different.

It’s been a large wealth-compounding machine for traders. I’ve written my very own story of proudly owning the inventory which is up 30x now. (learn right here)

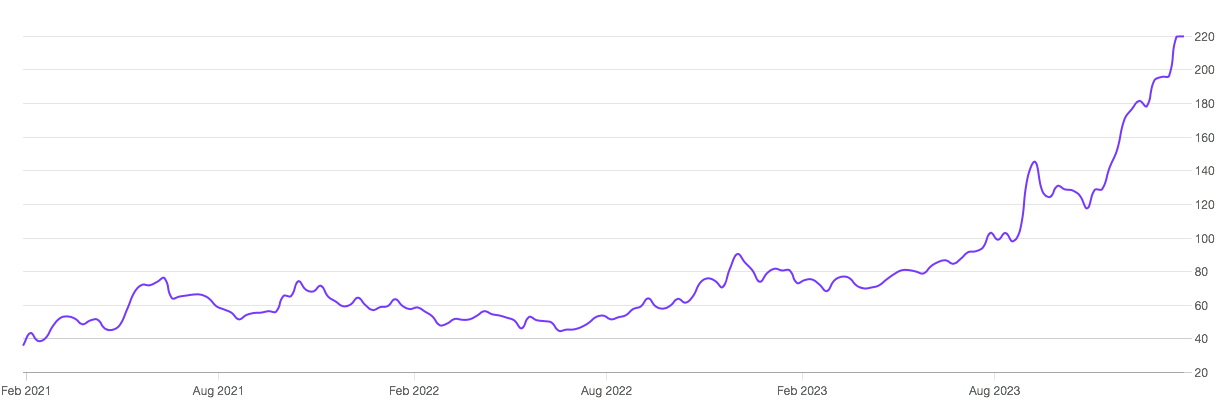

Now let’s take one other instance: Bharat Heavy Electricals Ltd. (BHEL)

Within the final 3 years, it has develop into a darling of the inventory market. Some individuals need to personal it and a few persons are questioning what stopped them from proudly owning the inventory.

Let’s see the charts.

This chart makes your coronary heart soften by lacking out on the inventory.

Simply take a look at the chart, if you happen to had owned it for a similar interval as you’d have owned HDFC Financial institution.

It might have been your worst nightmare of a inventory within the portfolio.

Conform to disagree?

In order an investor, you’d have made cash if you happen to had merely invested together with your mutual fund or a portfolio supervisor whose one of many high holdings has been HDFC Financial institution and never BHEL.

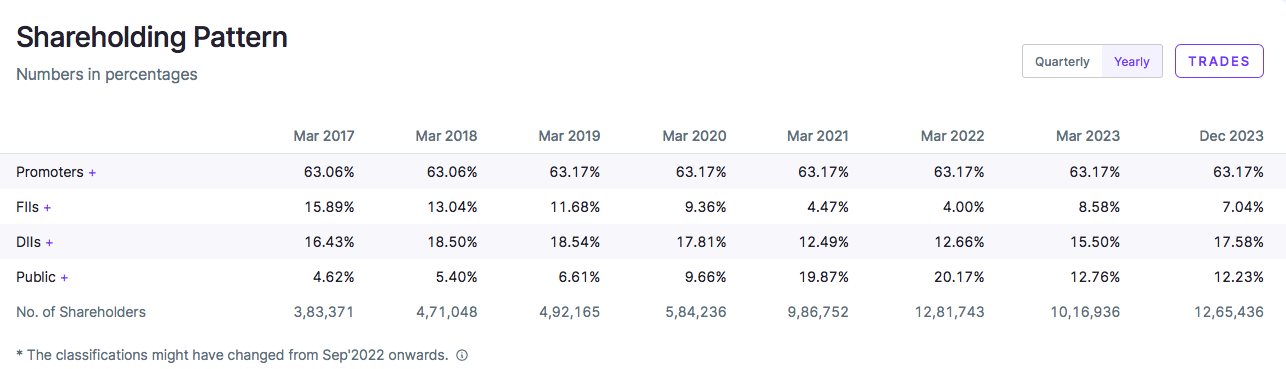

The shareholding sample of each firms give a transparent perception.

HDFC Financial institution

BHEL

BHEL has had a really low possession from institutional traders (FII +DII) with 25% at finest vs HDFC Financial institution with an possession of 82% as of Dec 2023.

But, we frequently get swayed by making a fast buck. So we are likely to make a mistake of timing the market. This by no means works. Because of this, in 2024 itself we’re going to see too many individuals closing their social media outlets or being monetary influencers.

One wonderful day they’d vanish into skinny air leaving your buying and selling capital within the pink zone.

So what do you have to do if you happen to don’t want to be in pink?

So all that you must do is swap off from the markets and maintain investing during. When you don’t want your cash for the subsequent 15-20 years, then why hassle about what’s taking place as we speak.

Simply go away it to the consultants.

Conclusion

With the knowledge movement growing with every day, it’s onerous to know what’s sign and what’s noise. It’s even tougher when you could have a full-time job or a enterprise to run. Such stress tends to take a toll on our household lives too.

A few of us would possibly even be pondering of constructing a fast buck on this bull run in order that we will retire early. That may be an enormous pitfall too. As a result of you are attempting to make quick cash with out understanding the very nature of the beast.

So it’s finest to go away it to the consultants to navigate the bulls and the bears, whilst you take trip on the seashores of the Bahamas. On the finish of the day, what’s the usage of cash if we can’t spend it.

This text is written by Jinay Savla, Jagoinvestor