Be a part of Our Telegram channel to remain updated on breaking information protection

S&P World slapped a junk ranking on Michael Saylor’s Technique, citing its heavy reliance on risky Bitcoin and restricted greenback liquidity.

The credit standing company initiated protection of the Bitcoin treasury agency with a B- ranking, six notches beneath funding grade, saying it has “speculative credit score high quality with elevated default danger.”

It pointed to the agency’s concentrated Bitcoin holdings, slender enterprise focus, and weak risk-adjusted capitalization as key weaknesses.

S&P additionally warned of an “inherent forex mismatch,” noting that every one of Technique’s debt is denominated in US {dollars} whereas almost all its property are held in Bitcoin. A pointy drop in BTC’s value, it mentioned, might pressure the corporate to promote holdings at a loss to fulfill obligations, creating potential liquidity stress.

Saylor Lauds ‘First-Ever’ Ranking For A Crypto Treasury Agency

Nonetheless, Saylor took to X to rejoice the event, calling it the “first-ever” ranking for a Bitcoin treasury agency from a “main credit standing company.”

S&P World Rankings has assigned Technique Inc a ‘B-‘ Issuer Credit score Ranking (Outlook Secure) — the first-ever ranking of a Bitcoin Treasury Firm by a serious credit standing company. https://t.co/WLMkFqkkCb

— Michael Saylor (@saylor) October 27, 2025

Others within the business echoed Saylor’s remarks. Amongst them was KindlyMD CEO David Bailey, who predicted that the “market demand for treasury firms is about to blow up” following the ranking.

Rankings are a requirement for a lot of pension funds and different institutional traders to have the ability to put money into company paper.

Technique Shares Climb

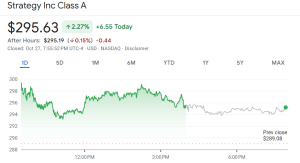

Technique shares climbed greater than 2% yesterday, however have slumped 9% prior to now month and greater than 19% in six months, based on Google Finance.

MSTR value (Supply: Google Finance)

Technique Retains On Shopping for

Technique, which was once an enterprise software program firm, makes use of virtually all of its extra money to buy BTC and develop its reserves. It additionally points convertible debt, most popular inventory, and fairness to lift capital for Bitcoin buys.

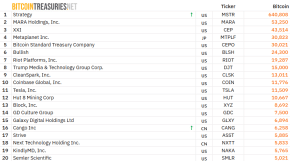

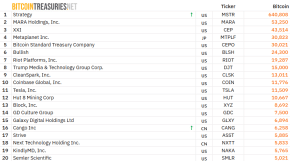

Since Technique began buying Bitcoin again in 2020, the corporate has grow to be the biggest BTC treasury agency globally. Knowledge from Bitcoin Treasuries reveals that Technique has collected 640,808 BTC through the years. At present costs, this values the holdings at roughly $72.97 billion.

Technique can be sitting on an unrealized acquire of over 52%, which equates to greater than $25.53 billion.

Prime 20 company BTC holders (Supply: Bitcoin Treasuries)

Lately, nonetheless, Technique and different digital asset treasury corporations have confronted strain resulting from their declining inventory costs, which has hindered their potential to lift extra capital for added buys.

Regardless of that, Technique has continued to buy Bitcoin at the same time as different crypto treasury corporations hit the brakes.

Technique’s newest Bitcoin purchase was on Oct. 27, when the agency bought one other 390 BTC for round $42.4 million at a median value of $111,117 per coin.

Technique has acquired 390 BTC for ~$43.4 million at ~$111,053 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/26/2025, we hodl 640,808 $BTC acquired for ~$47.44 billion at ~$74,032 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/1d4Pmv8ub2

— Michael Saylor (@saylor) October 27, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection