Picture supply: Getty Photographs

My particular person shares portfolio primarily consists of high-quality, blue-chip progress shares with clear aggressive benefits. I’m speaking about names like Apple, Amazon, and Rightmove.

Nevertheless, I’m not afraid to take small positions in high-risk, high-return progress firms in an effort to generate explosive beneficial properties. I name these my ‘moonshot’ progress shares.

Just lately, I used to be doing a little analysis into the autonomous driving and humanoid robotics industries and came upon a comparatively unknown enterprise that I believed seemed actually fascinating. So, I purchased a couple of shares for my portfolio.

This inventory is actually dangerous. However I feel it may have extra potential than another in my portfolio.

A worldwide chief in area of interest expertise

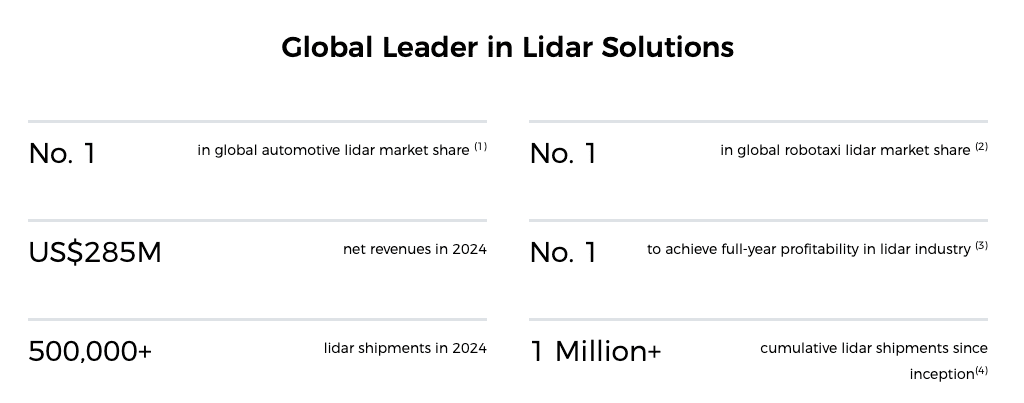

The inventory I purchased was Hesai Group (NASDAQ: HSAI). A Chinese language firm that’s listed on each the Nasdaq and the Hong Kong Inventory Trade, it’s a world chief in LiDAR (Gentle Detection and Ranging) expertise.

LiDAR is a distant sensing tech that emits fast laser pulses to create exact, high-resolution 3D maps of the atmosphere. At this time, it’s utilized by most autonomous driving firms together with Waymo, Apollo, and Zoox.

In 2024, Hesai had a 33% market share of the worldwide LiDAR market by income (61% market share in autonomous ‘Stage 4’ driving). In the meantime, it additionally had extra international LiDAR printed patent functions than another firm.

Out of my consolation zone

Now, that is very completely different from my regular kind of funding. It’s honest to say that it’s out of my consolation zone.

For a begin, it’s a Chinese language ADR (American Depositary Receipt). I are likely to avoid these because of geopolitical dangers (the opportunity of a US delisting, excessive tariffs, and many others) and transparency points.

Secondly, it’s onerous to know if the corporate has a real aggressive benefit. Whereas it has substantial market share, it has a couple of rivals together with the likes of Luminar and Ouster.

Huge potential

As I mentioned above although, I see big potential. There are two the reason why.

For a begin, Hesai appears to be like rather well positioned to profit from the shift to self-driving autos. Presently, it has partnerships with a spread of robotaxi firms together with Apollo, Pony.ai, DiDi, and WeRide. It additionally has partnerships with many common carmakers providing Superior Driver-Help Methods (ADAS) and exploring self-driving tech. Names right here embrace Mercedes-Benz, Toyota, and Li Auto. Because the self-driving trade grows, I anticipate LiDAR expertise to be in excessive demand.

Secondly, it appears to be like effectively positioned to profit from the humanoid robotic revolution. That’s as a result of most of those robots use LiDAR for notion too (together with cameras). Now, this trade continues to be nascent at present. Nevertheless, specialists see big progress forward. In response to Morgan Stanley, it could possibly be value $5trn by 2050. That’s excellent news for Hesai, which already has partnerships with a number of humanoid builders.

It’s value noting that the corporate is already rising at a fast clip. In Q2, it made whole LiDAR shipments of 352,095 models, a rise of 307% 12 months on 12 months. This resulted in a 54% improve in income. It additionally led to a swing from losses to revenue.

I’ll level out that I anticipate this inventory to be a wild experience. It may crash spectacularly. With a market cap of round $4bn and a price-to-sales ratio of 8.5, nonetheless, I just like the set-up. I’m excited in regards to the potential.