Picture supply: Getty Pictures

One development inventory caught out like a sore thumb after I opened my Shares and Shares ISA watchlist yesterday (23 June). That was Hims & Hers Well being (NYSE: HIMS), which was down virtually 35%, registering it’s worst-ever day.

It is a share I’ve been waiting for some time, however haven’t purchased but. Even after yesterday’s crash, it’s nonetheless up 86% over 12 months.

Might this crash be an opportune time for me to nip in and open a place?

Personalised medication platform

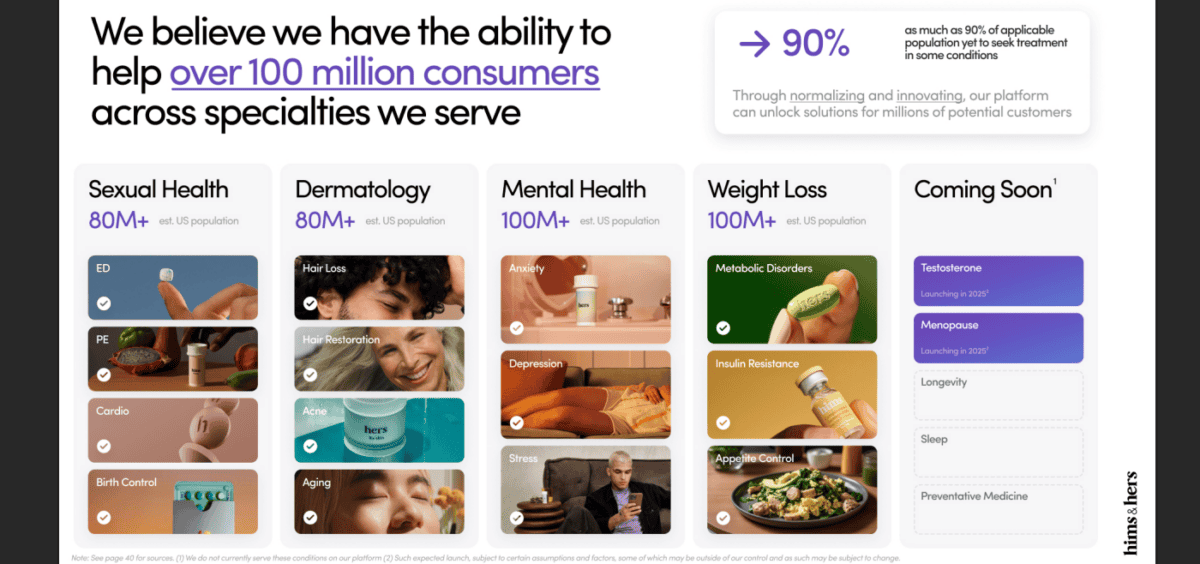

Hims & Hers is a vertically built-in pharmacy and telehealth platform centered on personalised wellness. It presents prescription and over-the-counter therapies for hair loss, psychological well being, skincare, sexual well being, and extra.

In 2024, the agency’s income soared 69% 12 months on 12 months to $1.5bn. Nonetheless, this isn’t a jam-tomorrow development story, as a result of each web revenue and free money movement greater than quadrupled in Q1 of this 12 months. Subscribers grew 38% to 2.4m.

Driving a few of this eye-catching development has been compounded GLP-1 weight-loss medicine, which the agency started promoting on its platform in 2024. In Might, it introduced a partnership with pharmaceutical large Novo Nordisk to promote its blockbuster Wegovy therapy.

Disagreement

Since that announcement, Hims & Hers inventory has been rocketing. Till yesterday that’s, when Novo terminated the collaboration.

In a press release, the agency pulled no punches, accusing Hims of “unlawful mass compounding and misleading advertising“. It used the phrases “knock-off medicine” quite a few instances in relation to “personalised” doses of semaglutide that Hims continues to promote. Semaglutide is the lively ingredient in Wegovy.

Extra significantly, Novo alleges that probably unsafe lively elements are being sourced from overseas suppliers in China, thereby placing sufferers in danger.

Basically then, there are three allegations right here:

- The continued promoting of copycat variations of Wegovy, which Novo says violates laws.

- Misleading advertising of those as ‘personalised’ therapies.

- Semaglutide sourced from unapproved Chinese language suppliers.

In response, Hims’ CEO Andrew Dudum wrote on X: “We refuse to be strong-armed by any pharmaceutical firm’s anticompetitive calls for that infringe on the impartial choice making of suppliers and restrict affected person alternative.”

Dudum mentioned Novo’s administration is “deceptive the general public“, and that the platform will proceed providing entry to completely different weight-loss therapies, together with semaglutide.

My transfer

What to make of all this? Nicely, there might clearly be regulatory compliance threat right here. Lawsuits seem inevitable, and there’s possible not less than some model injury.

In the meantime, Novo will hold promoting Wegovy with two of Hims’ rivals, specifically Ro and LifeMD. So the agency might lose share within the booming weight-loss house, which isn’t ideally suited.

Nonetheless, there’s extra to the platform than simply Wegovy. It was already rising strongly earlier than GLP-1s, and its alternative to mixture demand in some very giant well being classes seems undimmed to me. It’s additionally increasing into Europe through a latest acquisition.

Hims’ disruptive direct-to-consumer platform goals to be cheaper and extra personalised than the standard healthcare mannequin. Due to this fact, I feel shareholders ought to count on additional business resistance, like Uber obtained from taxi corporations.

I’d like administration to reassure traders in regards to the provide chain accusations. Ideally, it will occur when the agency experiences Q2 earnings in August, if not earlier than.

But when the inventory retains falling within the coming days, I’ll open a starter place.