Picture supply: Getty Photographs

I had by no means come throughout US used automobile gross sales platform Carvana (NYSE: CVNA) till a number of years in the past when somebody advised a narrative about promoting an previous secondhand automobile for greater than they’d purchased it for. That struck me as odd and so I regarded into the expansion inventory and its enterprise mannequin.

Clearly, I used to be not the one one who struggled with the business logic. Between August 2021 and December 2022, Carvana inventory misplaced 99% of its worth.

At that time, I’m positive loads of traders should have questioned if issues have been over. Removed from it. In little over two years, the expansion inventory has soared 6,398%.

What on earth’s occurring with this valuation?

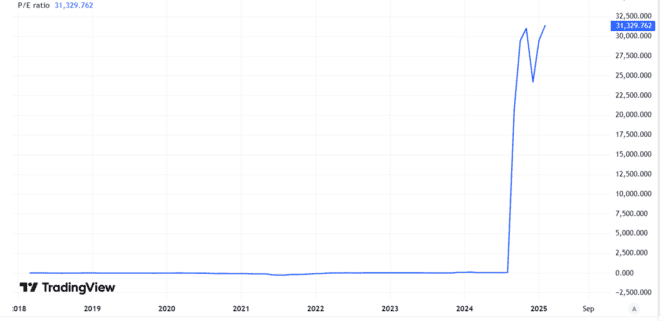

Meaning Carvana is now buying and selling on a price-to-earnings (P/E) ratio of over 28,000. Sure, you learn that appropriately.

Created utilizing TradingView

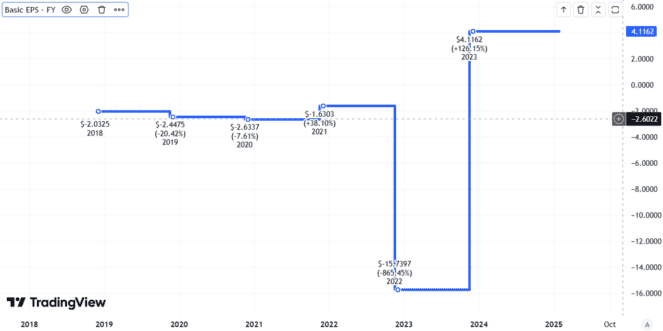

Nonetheless, at the least it made a revenue final yr. That got here after a few years of losses.

Created utilizing TradingView

However… a P/E ratio in tens of 1000’s? Has the US market gone completely mad?

Not essentially. Carvana has a market capitalisation of $55bn. Clearly there’s some critical cash invested right here.

The corporate has developed an revolutionary enterprise mannequin at scale. In its most not too long ago reported quarter, it bought 109,000 automobiles and generated income of $3.7bn.

When the expansion inventory crashed that mirrored various dangers: risky pricing within the second hand automobile market, issues in regards to the high quality of Carvana’s mortgage ebook, its potential to maintain servicing it, and the corporate’s losses at that time.

Now, traders appear to be wanting from the opposite aspect of the lens. Carvana is worthwhile and rising quick. It has economies of scale that in a platform mannequin like this generally is a virtuous circle.

The extra consumers and sellers it serves, the higher it understands the market and the stronger its providing for shoppers turns into. (Though the enterprise mannequin is completely different, this form of platform-based virtuous circle might be seen on this aspect of the pond at Auto Dealer).

I’m not going anyplace close to this

Nevertheless, whereas the 99% crash now seems overdone on reflection, I additionally am sceptical that the 6,398% share worth progress is cheap.

Though Carvana is worthwhile, that’s on an accounting foundation. It was nonetheless lossmaking on the operational degree in its most up-to-date full-year outcomes.

Seeing this purely as a automobile buying and selling platform (just like, say, eBay) misses a big a part of what attracts traders – and likewise what I believe is a key danger.

Carvana’s mannequin is as a lot (or extra) about being a financing firm as it’s about shopping for automobiles, reconditioning them and promoting them on.

That enormous ebook of auto loans issues me. Carvana has been closely reliant on reselling them to 1 purchaser (Ally Monetary). That causes an enormous focus danger, ought to the connection between Carvana and Ally bitter.

Even past that although, US automobile loans traditionally have greater default charges than another forms of borrowing like dwelling mortgages.

In a weak financial system I anticipate used automobile mortgage default charges might develop, making it tougher for Carvana to dump its loans onto Ally (or anybody else) at a lovely worth.

The dangers listed here are properly above my consolation degree, even for a US progress inventory. I’ve no plans to take a position.