Be part of Our Telegram channel to remain updated on breaking information protection

Tom Lee’s BitMine is in search of to lift $20 billion via an expanded inventory providing to purchase Ethereum, aiming to change into ETH’s Michael Saylor with the most important company acquisition of the asset up to now.

In response to a submitting on Tuesday, BitMine has expanded its at-the-market (ATM) inventory providing, which permits it to promote shares progressively at prevailing market costs, from about $4.9 billion to $24.5 billion, a fivefold improve, with all proceeds anticipated to go towards ETH purchases.

BitMine inventory surged virtually 6% on the information yesterday and has climbed an extra 4.9% in premarket buying and selling to succeed in $65.29 as of 8:09 a.m. est.

Tom Lee is elevating $20B to purchase extra Ethereum

oh my goodness$BMNR $ETH pic.twitter.com/7g3W5a8N7C

— amit (@amitisinvesting) August 12, 2025

This comes as Ether climbed above the $4,600 stage, its highest since December 2021, because it closed on its earlier excessive of $4,891 that it set in Nov. 2021.

ETH has surged 9.7% prior to now 24 hours to commerce at $4,697 as of 8:21 a.m. EST, in response to CoinGecko. Buying and selling quantity additionally surged 45% to $59.7 billion, showcasing rising curiosity in ETH.

US spot Ethereum ETFs (exchange-traded funds) noticed one other $524.9 million in inflows yesterday after a record-breaking day on Monday.

Tom Lee Units Sights On Unprecedented 5% Ethereum Seize

Underneath Tom Lee, BitMine has grown to change into the most important company holder of Ethereum, hoarding 1.2 million ETH value almost $5 billion.

The legendary Wall Avenue investor and Fundstrat CEO is set to amass 5% of ETH’s whole provide, up from about 0.95% now.

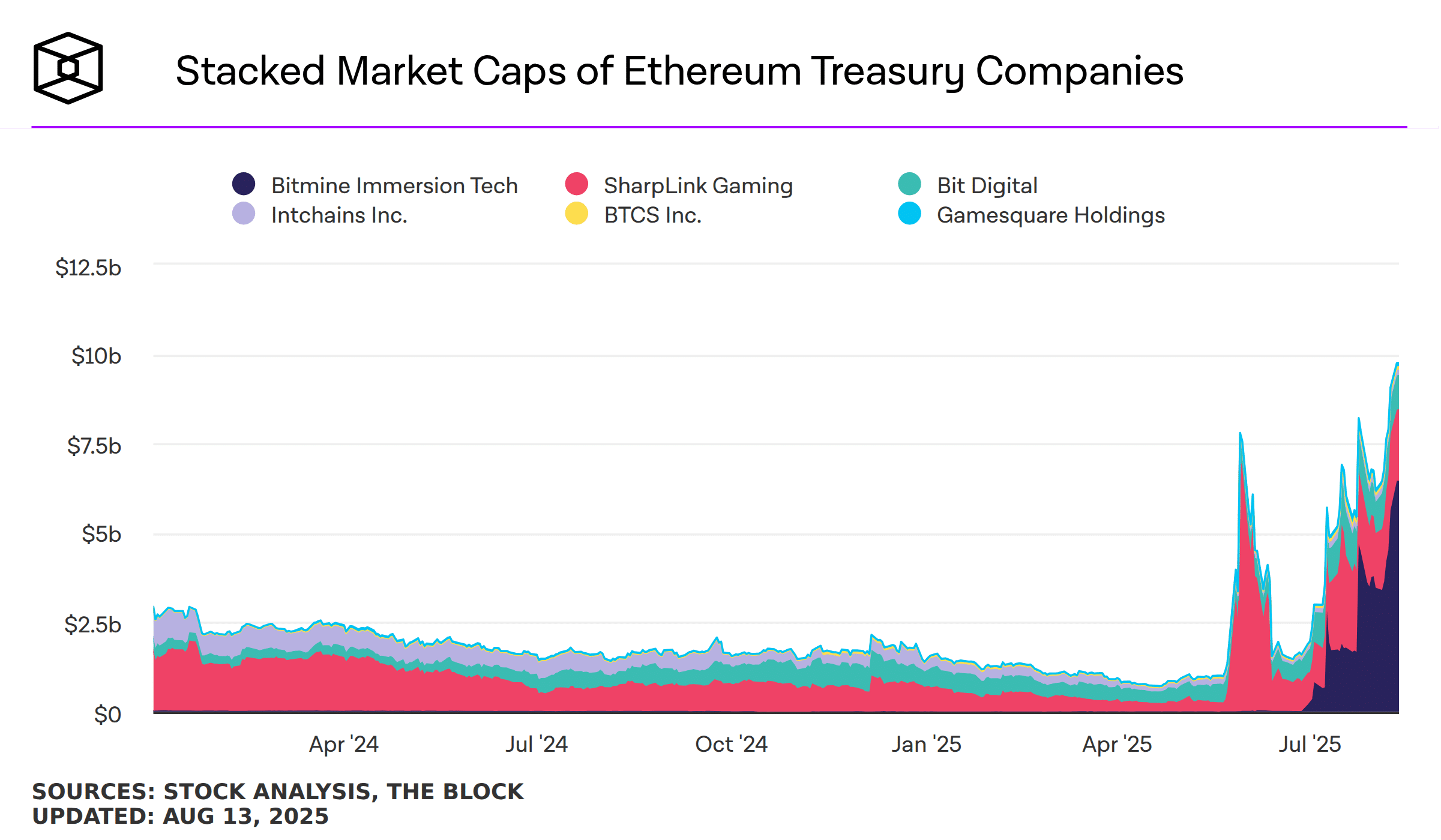

In the meantime, different ETH-focused digital asset treasuries are additionally scaling up, with 2.2 million ETH (1.8% of the ether provide) gathered within the final 2 months.

Most ETH treasuries are taking an lively on-chain strategy, as they goal to deploy capital via staking and DeFi to reinforce returns. They do that whereas supporting community safety and liquidity.

This borrows from Michael Saylor’s Technique playbook, the place the corporate raises funds via fairness and convertible debt issuance to purchase Bitcoin. This has allowed Technique to amass over 628,946 BTC (2.9% of BTC’s provide).

Technique has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/bx0814RI1w

— Michael Saylor (@saylor) August 11, 2025

Nevertheless, the Ethereum treasuries differ from their BTC counterparts of their capability to faucet into Ethereum’s staking and DeFi ecosystem.

The race to amass a bigger share of ETH is now accelerating, as these corporations construct reserves at a good value foundation, in response to knowledge from The Block.

In the meantime, Joseph Lubin’s Sharplink Gaming additionally introduced a $400 million registered direct providing, alongside $200 million in current ATM proceeds able to deploy, which might push its Ethereum holdings previous $3 billion.

Now, the 2 main ETH treasury corporations are exerting important shopping for stress on Ethereum.

Inflows Into ETH ETFs Prolonged To Six Days

The company acquisition of ETH comes at a time when the market can also be experiencing rising inflows for US spot Ethereum ETFs.

These funding autos recorded $523.9 million in each day inflows on Tuesday, following Monday’s record-setting $1.02 billion.

Information from CoinGlass exhibits that six of the 9 ETFs recorded optimistic flows, led by BlackRock’s ETHA with $318.70 million in inflows.

This extends the ETH ETFs’ optimistic streak to 6 consecutive days, attracting $2.33 billion in web inflows. In consequence, spot ETH ETFs now account for $24.84 billion in web property, which is roughly 4.8% of Ethereum’s whole market capitalization.

In response to Nate Geraci, President of NovaDius Wealth, the most recent inflows into ether ETFs mark a notable shift from BTC ETFs that dominated final yr and earlier this yr.

One other half bil into spot eth ETFs…

fifth greatest day since launch.

Now $2.3bil over previous 5 buying and selling days.

Since starting of July, spot eth ETFs have taken in almost $1.5bil greater than spot btc ETFs.

Notable shift.

— Nate Geraci (@NateGeraci) August 13, 2025

Ethereum Value Indicators Breakout Momentum Past ATH

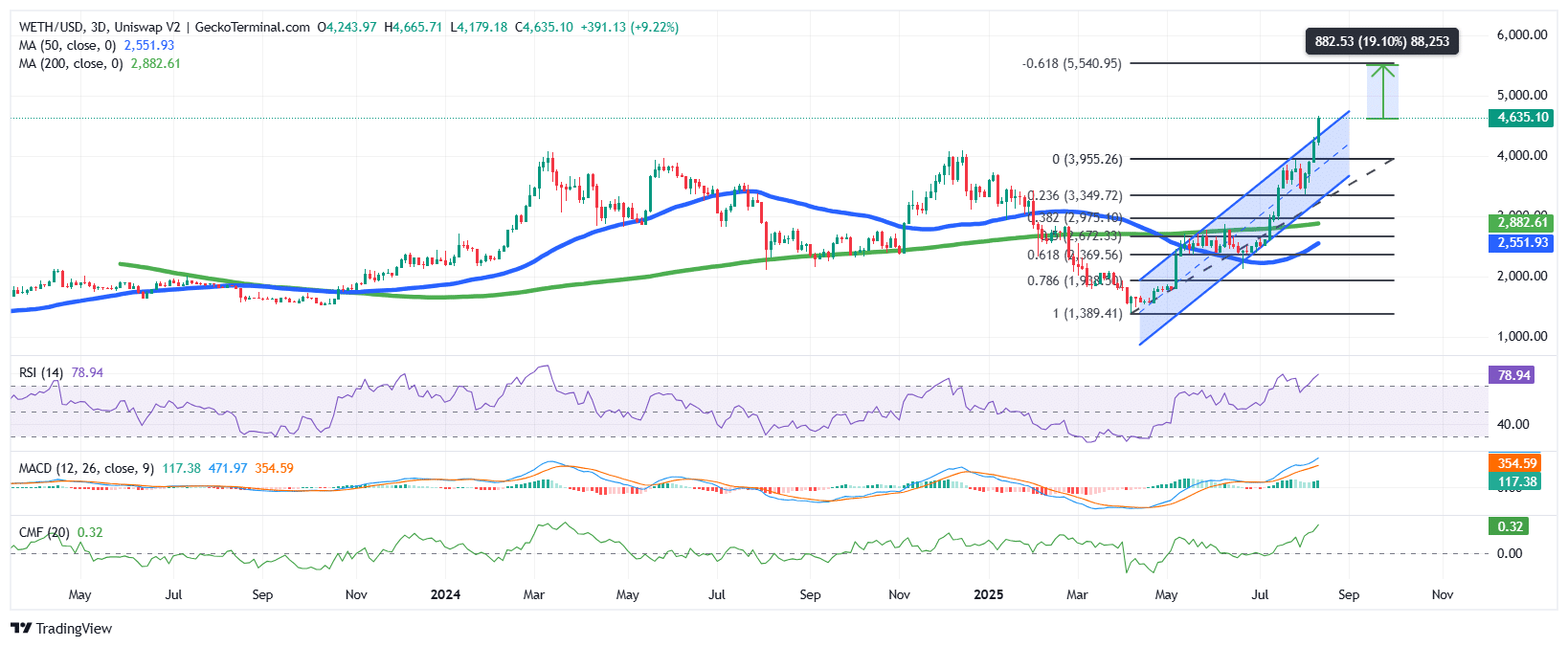

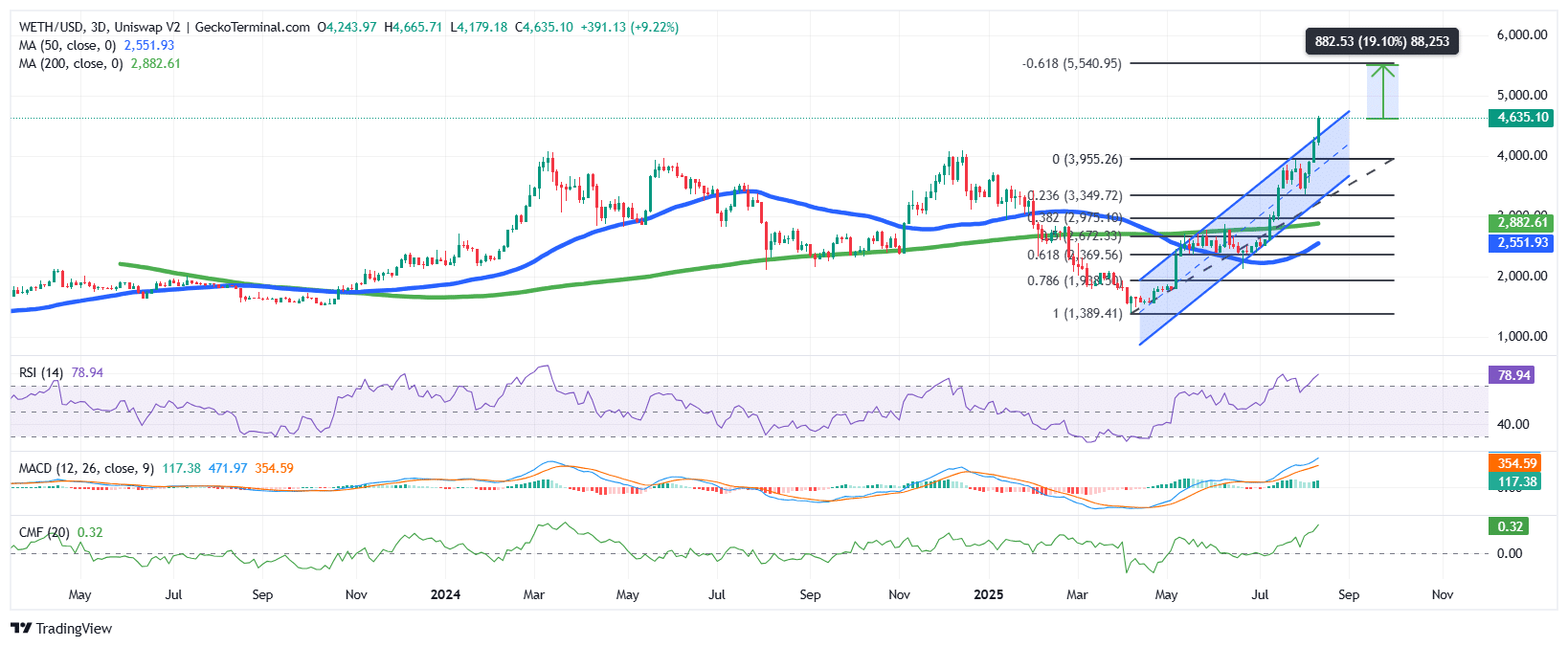

The ETH worth on the 3-day timeframe exhibits that the asset is on a robust bullish development.

It’s buying and selling effectively above each the 50-day and 200-day Easy Shifting Averages (SMAs). The worth of ETH has additionally damaged out of a rising channel sample to the upside, signaling robust momentum.

In the meantime, Fibonacci retracement ranges point out ETH has surpassed the 0% retracement at $3,955, which acted as a long-term resistance stage, in response to GeckoTerminal knowledge.

The Relative Power Index (RSI) additionally helps the crypto house sentiments, which exhibits that merchants are actively shopping for ETH.

Furthermore, the Shifting Common Convergence Divergence (MACD) stays firmly bullish, with the blue MACD line effectively above the orange sign line, confirming upward momentum.

ETH/USD seems poised to check the $5,500 stage within the coming weeks, which might surpass its ATH.

The Chaikin Cash Move (CMF), which sits at 0.32, displays robust shopping for stress and optimistic capital inflows into the asset.

Nevertheless, warning is warranted, because the RSI studying at 78 exhibits overbought situations, that means consumers might quickly be exhausted. On this state of affairs, the consolidation stage and the earlier resistance stage at $3,955 might act as assist.

The broader Ethereum development stays bullish, and the likelihood of reaching new highs stays robust if present momentum holds and company acquisitions improve.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection