Be part of Our Telegram channel to remain updated on breaking information protection

T. Rowe Value, a fund administration titan with nearly $1.8 trillion in property underneath administration, has filed to launch a crypto ETF (exchange-traded fund) to put money into a basket of main cryptos.

In keeping with the submitting with the US Securities and Trade Fee (SEC), the T. Rowe Value Energetic Crypto ETF will probably be an actively-managed product that may put money into a “diversified basket of commodity crypto property” with the purpose of outperforming the FTSE Crypto US Listed Index.

”Can’t overstate significance of T. Rowe Value submitting for an actively managed crypto ETF out of left discipline,” stated Nate Geraci, president of NovaDius Wealth President. ”T. Rowe is the quintessential legacy asset supervisor, based in 1937.”

Can’t overstate significance of T. Rowe Value submitting for an actively managed crypto ETF out of left discipline…

T. Rowe is the quintessential legacy asset supervisor, based in 1937.

They handle some $1.8tril in property, however simply acquired concerned w/ ETFs in 2020.

Now shifting to crypto. pic.twitter.com/S7XD7GSYxl

— Nate Geraci (@NateGeraci) October 23, 2025

It is going to invest in Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Polkadot (DOT), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Money (BCH), Chainlink (LINK), Stellar Lumen (XLM), and Shiba Inu (SHIB).

T. Rowe Value didn’t specify a administration charge for the product, and the fund stays topic to regulatory approval.

Bloomberg ETF analyst Eric Balchunas stated the transfer by the large TradFi fund supervisor was a ”semi-shock,” however predicted there will probably be a ”land rush” for funds concentrating on diversified baskets of main cryptos.

T. Rowe Value Joins BlackRock, Constancy In Taking Crypto Mainstream

T. Rowe Value’s transfer into crypto ETFs follows related strikes made by asset administration giants together with BlackRock and Constancy.

BlackRock’s US spot Bitcoin ETF (IBIT) has been the best-performing BTC ETF out there since US regulators gave the merchandise the greenlight final 12 months. Knowledge from Farside Buyers exhibits that IBIT has seen $65.165 billion in cumulative inflows since its launch.

IBIT’s internet property stand at over $86.838 billion, in accordance to the product’s net web page.

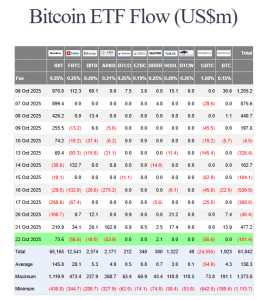

US spot BTC ETF flows (Supply: Farside Buyers)

Crypto ETFs Delayed By Ongoing Authorities Shutdown

The US authorities shutdown is at the moment holding up approvals of crypto ETFs, with the backlog rising to round 155 purposes. Merchandise for SOL and XRP lead the queue.

There’s now 155 crypto ETP filings monitoring 35 totally different digital property. Might simply find yourself seeing over 200 hit mkt in subsequent 12mo. Whole land rush. Right here’s the listing by coin, superb work from @JSeyff pic.twitter.com/dKyiySxn0H

— Eric Balchunas (@EricBalchunas) October 21, 2025

There are a number of merchandise linked to the highest 10 cryptos by market cap, as effectively smaller tokens together with meme cash akin to Official Trump (TRUMP) and Melania (MELANIA), which have been launched by US President Donald Trump’s staff.

There was no indication of when precisely the federal government shutdown will finish, however merchants on the decentralized betting platform Polymarket see a 40% likelihood that it’ll proceed previous Nov. 16.

SEC Approves Generic Itemizing Guidelines For Crypto ETFs

T. Rowe Value’s submitting comes after the Securities and Trade Fee (SEC) permitted generic itemizing requirements for crypto ETFs in September.

Underneath the brand new framework, main exchanges akin to Nasdaq, Cboe BZX Trade and NYSE Arca can listing qualifying commodity-based belief shares with out having to first submit particular person proposed rule adjustments underneath Part 19(b) of the Trade Act.

The permitted generic itemizing requirements for crypto ETFs will streamline the method for eligible merchandise to enter the market. As such, analysts have predicted a wave of recent crypto ETF merchandise will launch quickly.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection