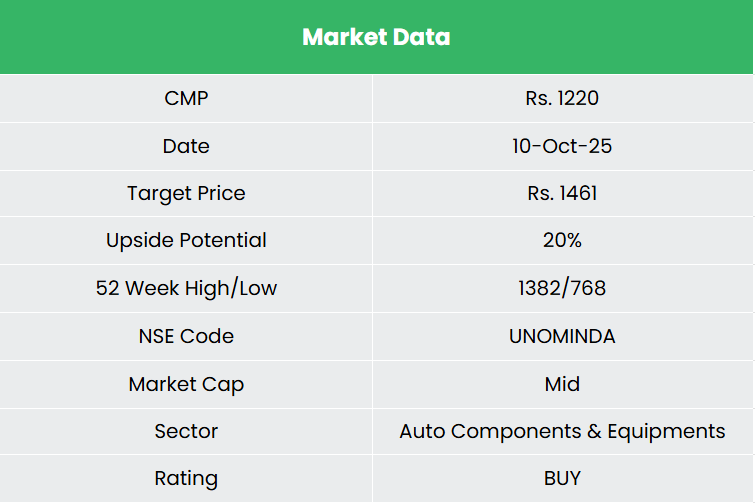

Uno Minda Ltd – Driving the New

Established in 1992 and headquartered in Gurugram, Uno Minda Ltd. is a number one world producer of automotive elements and methods, catering to main OEMs worldwide. It’s considered one of India’s most diversified auto part gamers, with a robust presence throughout a number of product classes equivalent to switches, lighting, acoustics, alloy wheels, die-casting, and seatings. The corporate serves a variety of auto segments, together with passenger vehicles, industrial automobiles, and two – and three-wheelers, throughout each ICE and electrical/hybrid platforms. As of FY25, the corporate operates 28 product strains and has a world manufacturing footprint with 76 vegetation throughout India, Indonesia, Vietnam, Germany, Spain, and Mexico. It additionally has 37 R&D and Engineering Centres in India, Germany, Japan, Taiwan, Korea & Spain.

Merchandise and Companies

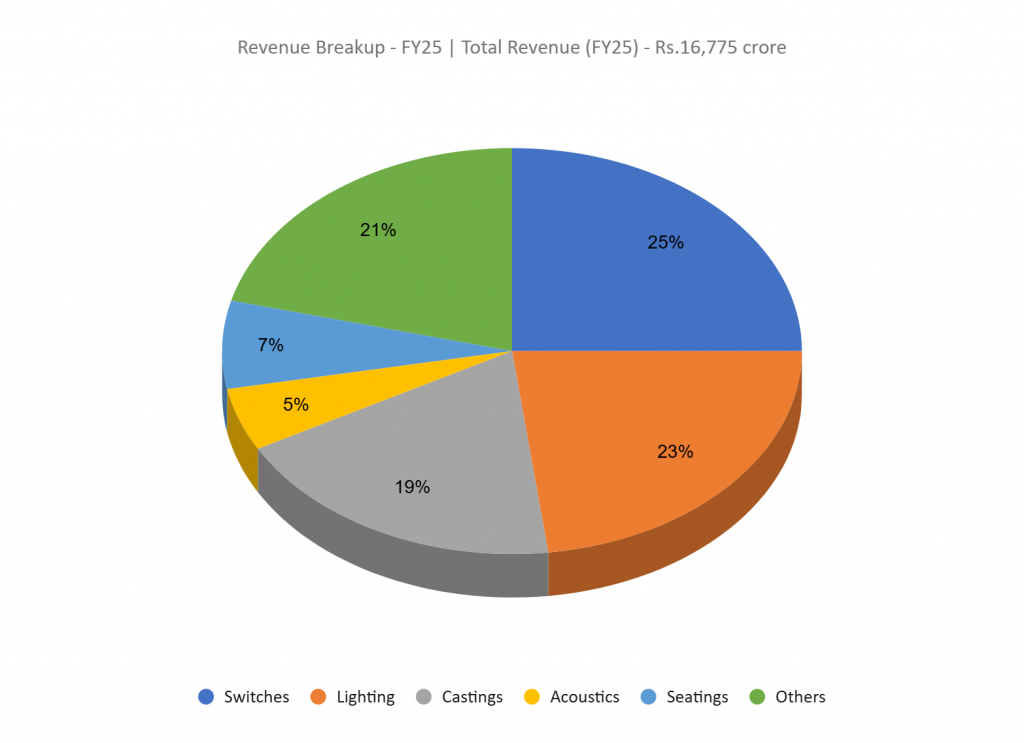

The corporate’s enterprise is unfold throughout well-diversified portfolio of verticals together with lighting, switches, castings, sunroofs, acoustics, seating, wi-fi costs, digital camera, sensors, ADAS, EV elements, controllers, alloy wheel, battery, aftermarket and others.

Subsidiaries – As of FY25, the corporate has 30 subsidiaries and 9 associates/joint ventures.

Funding Rationale

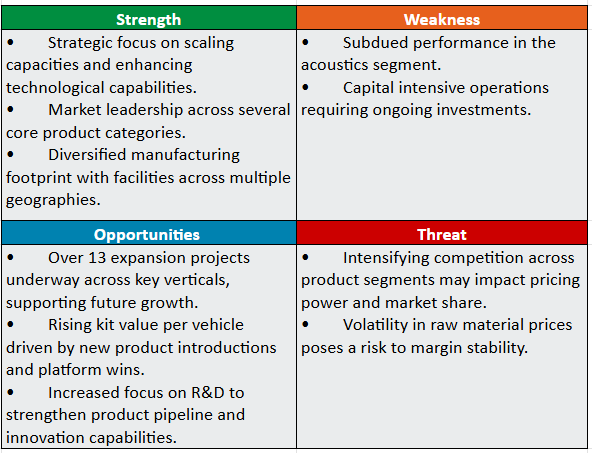

- Speedy enlargement plans – The corporate is enterprise vital capability enlargement initiatives to align with the accelerating demand in electrical automobiles (EVs), premiumization, and superior automotive applied sciences. The corporate, by way of its three way partnership with Inovance Automotive, is establishing a greenfield facility to fabricate high-voltage EV powertrain elements for 4W passenger and industrial electrical automobiles – together with charging management methods, inverters, motors, and e-axles – with an funding of Rs.423 crore, anticipated to be commissioned by Q2FY27. Moreover, it’s establishing a brand new aluminium die-casting plant in Sambhaji Nagar, Maharashtra, aimed toward assembly the rising demand for casting elements in e-2Ws and e-4Ws whereas supporting backward integration for its upcoming 4W-EV powertrain facility. The plant, presently in Section 1, will home a posh 2,500-ton casting setup. Within the alloy wheels phase, Uno Minda is enhancing its two-wheeler alloy wheel capability from 8 million to 9.5 million items p.a. at its Bawal plant, backed by a Rs.200 crore funding and focused for completion by Q2FY27, to serve a newly secured order and rising market demand. Moreover, the corporate has commissioned a brand new digital camera module manufacturing line, turning into the primary in India to localize manufacturing for RPAS/FPAS methods, with a quantity ramp-up anticipated within the coming quarters.

- Phase Efficiency – In Q1FY26, Uno Minda reported robust progress throughout key segments, pushed by rising demand and capability enlargement. The switching phase grew 16% YoY, contributing 25% of income, supported by sturdy 2W exports and new orders from a UK motorbike producer. The lighting phase rose 13% YoY, making up 23% of income, fuelled by demand for superior lighting options and new orders for Dynamic Emblem Projectors; capability constraints at current vegetation are being addressed by a brand new Rs.233 crore facility in Kharkhoda. The casting enterprise, contributing 19% of income, benefited from new alloy wheel capacities. The seating phase grew 18% YoY (7% of income), pushed by buyer diversification and product enlargement, with plans to double enterprise over 5 years. The Acoustics phase (4% of income) confronted demand softness in Europe, whereas the Others phase grew 30% YoY, supported by wi-fi chargers, EV elements, and EVSE house charging options. The Worldwide Enterprise accounted for 11% of general income, highlighting a gradual world footprint.

- Q1FY26 – In Q1FY26, the corporate reported income of Rs.4,420 crore, marking a 16% YoY enhance from Rs.3,818 crore in Q1FY25, pushed by robust efficiency in core segments equivalent to switches, lighting, alloy wheels, and seating methods, together with rising traction in rising areas like sensors, radars, and controllers. Working revenue additionally rose by 16% YoY to Rs.474 crore, up from Rs.408 crore in the identical quarter final 12 months. Web revenue stood at Rs.239 crore, reflecting a 21% YoY progress in comparison with Rs.198 crore in Q1FY25.

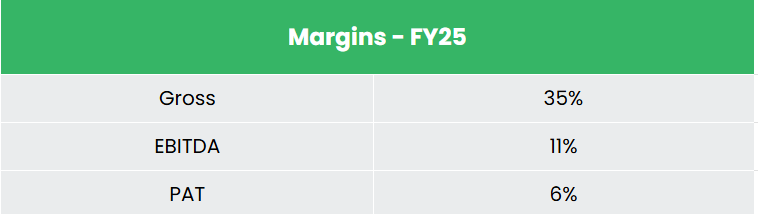

- FY25 – Through the FY, the corporate generated income of Rs.16,775 crore, a rise of 20% in comparison with the FY24 income. Working revenue is at Rs.1,874 crore, up by 18% YoY. The corporate reported internet revenue of Rs.936 crore, a rise of 9% YoY.

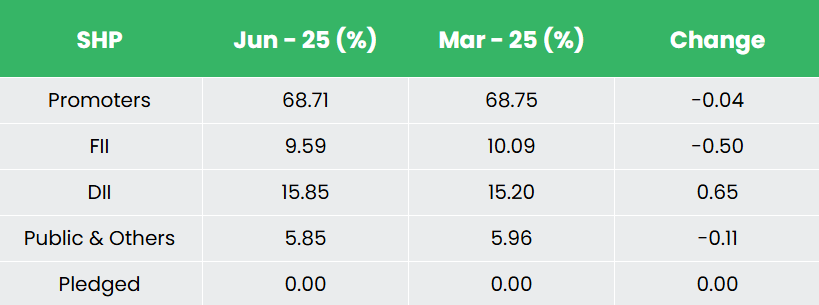

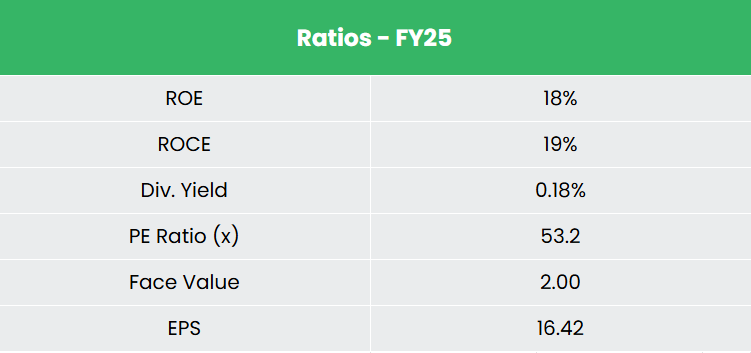

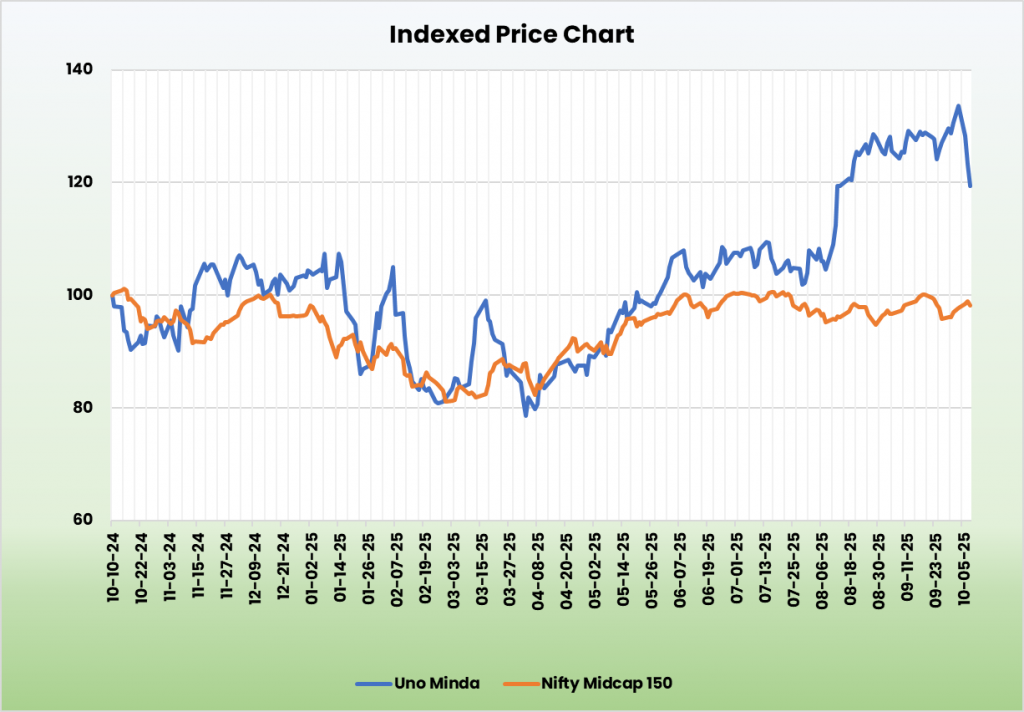

- Monetary Efficiency – Uno Minda has generated a income and internet revenue CAGR of 26% and 39% over the interval of three years (FY23-25). Common 3-year ROE & ROCE is round 18% and 19% for FY23-25 interval. The corporate has robust stability sheet with a sturdy debt-to-equity ratio of 0.43.

Business

India has emerged because the world’s third-largest car market by each worth and quantity, underpinned by rising incomes, infrastructure growth, and supportive authorities insurance policies. The auto part trade is quickly increasing, with exports projected to succeed in Rs.8.5 lakh crore (US$ 100 billion) by 2030. India’s strategic proximity to key markets like ASEAN, Europe, Japan, and Korea is strengthening its place as a world auto part sourcing hub. The 2W phase, pushed by a rising center class, continues to guide home demand. This has spurred progress in unique tools and part manufacturing, enhancing India’s capabilities and world competitiveness. The electrical car (EV) market can also be set to witness vital progress, with a projected worth of US$ 206 billion by 2030. The federal government’s push for 30% electrical mobility by 2030 additional reinforces the sector’s long-term potential, positioning India as a key participant within the world automotive worth chain.

Development Drivers

- 100% FDI permitted underneath the automated path to the car sector.

- The discount within the tax burden within the 2025-26 Union Price range is predicted to spice up spending among the many increasing center class inhabitants.

- Allocation of ~Rs.7,400 crore (74% enhance YoY) for the EV sector within the Union Price range 2025-26.

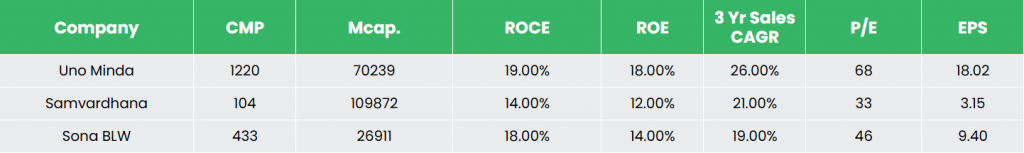

Peer Evaluation

Rivals: Samvardhana Motherson Worldwide Ltd, Sona BLW Precision Forgings Ltd, and so on.

As in contrast with the above rivals, with a gradual income progress, Uno Minda has secure profitability and sturdy earnings potential, indicating the corporate’s monetary stability and its effectivity to generate revenue from the invested capital.

Outlook

Uno Minda has designed a disciplined, demand-driven enlargement technique, with the vast majority of capability additions backed by secured or near-confirmed buyer orders, guaranteeing robust utilization and income visibility. The corporate’s broad-based progress throughout key segments like switching, lighting, casting, and seating displays its alignment with structural trade tendencies equivalent to electrification and premiumization. Its deal with innovation – introducing merchandise like sunroofs, EV elements, and next-generation sensors opens new progress avenues. With a sturdy FY26 capex plan of Rs.1,300 crore for progress and Rs.350-400 crore for sustaining operations, alongside a secure EBITDA margin steerage of round 11%, the corporate’s constant income and revenue progress strengthen its monetary flexibility.

Valuations

With its proactive enlargement initiatives, beneficial automotive market demand, and powerful trade experience, we imagine Uno Minda is nicely poised to ship sustained and sturdy progress going ahead. We suggest a BUY score within the inventory with the goal worth (TP) of Rs.1,461, 57x FY27E EPS. We additionally encourage sustaining a stop-loss at 20% from the entry worth to handle potential draw back threat successfully.

SWOT Evaluation

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please be aware that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles you might like

Put up Views:

41