Picture supply: Rolls-Royce plc

It has been a outstanding few years for shareholders in Rolls-Royce (LSE: RR). In the course of the depths of the pandemic, the aeronautical engineer was on its knees. Rolls-Royce shares offered for pennies apiece as lately as 2022.

Now although, the Rolls-Royce share worth is over £7. It’s up 585% over the previous 5 years. With that form of momentum, may the shares presumably go any larger – and ought I to purchase some for my portfolio?

Some potential boosters for enterprise progress

I do see some floor for optimism in relation to the potential ongoing progress of Rolls-Royce’s enterprise, each on the high line (income) and backside line (earnings).

Demand for plane engine gross sales and servicing stays excessive. The identical is true for energy methods and the defence enterprise. Final yr noticed underlying income progress in these areas of 24%, 11% and 13% respectively.

Whereas the civil aviation quantity stands out – particularly as it’s the largest enterprise – all of these progress figures are robust. With ongoing excessive demand, I reckon revenues may develop this yr too.

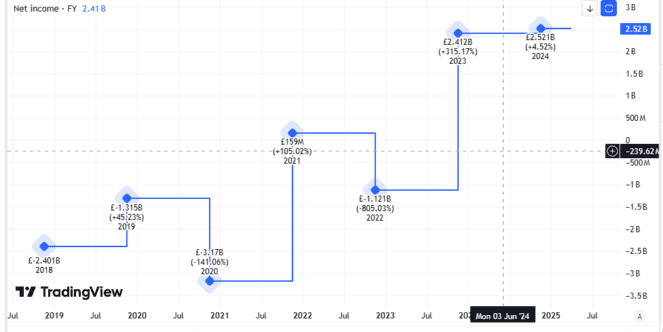

In the meantime, the corporate’s web earnings grew final yr, however not by as dramatic an quantity as some buyers could have hoped.

Created utilizing TradingView

Which will counsel that among the straightforward wins for the corporate have already been achieved in relation to reducing prices. Nonetheless, this yr the corporate has upgraded its medium-term targets, which had been already formidable by the corporate’s latest historic customary. It’s now aiming for £3.6bn–£3.9bn of underlying working revenue by 2028 and an underlying working margin of 15-17%.

I’m nervous concerning the share worth

However that’s removed from assured. Present commerce disputes threaten demand for brand new engine gross sales. Sharp swings in some key currencies may additionally have an effect (destructive or constructive) when they’re reported again into Rolls’ reporting forex of sterling.

On high of that there are ongoing dangers that concern me concerning the aviation business as they are often signficiant however fall largely outdoors the management both of airways or engine makers. One other pandemic, giant terrorist occasion or battle may all of a sudden ship passenger demand right into a headspin. That may probably be unhealthy for revenues and earnings

With the appropriate margin of security within the share worth, that may not trouble me. All shares carry dangers, in spite of everything: the sensible investor merely goals to cost them correctly.

However a rising share worth has been pushing Rolls-Royce’s price-to-earnings ratio upwards. It now stands at 24.

Created utilizing TradingView

That’s too excessive for my consolation in relation to having a margin of security.

Each investor is completely different, after all. I can effectively think about that if investor enthusiasm stays excessive or the corporate proclaims additional excellent news, the share worth could transfer up from right here.

From a long-term investing perspective although, the present share worth shouldn’t be enticing to me and I cannot be investing.