Picture supply: Getty Pictures

Ceres Energy (LSE:CWR) is the best-performing inventory within the FTSE 350 over the previous six months — and it’s not even shut. It’s up 519% on this interval and a staggering 699% since early April. It joined the FTSE 250 index final week.

I final wrote about Ceres on the finish of July, after I stated the inventory is likely to be underappreciated at 143p and due to this fact value contemplating. Quick-forward simply three months, the share value is now at 380p!

Zooming additional out, although, the inventory continues to be 76% decrease than a 2021 peak of 1,576p. So, may it have additional to run?

Again in vogue

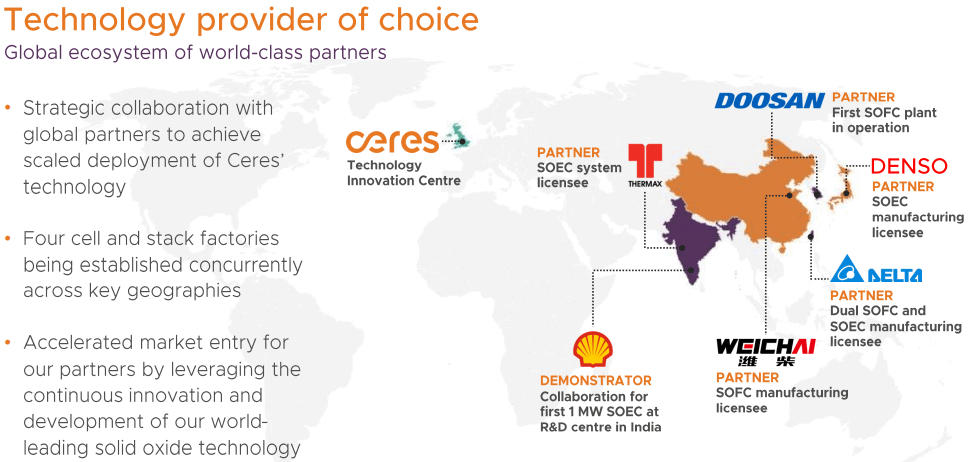

Ceres is a clear power firm that has developed superior strong oxide gasoline cell know-how for hydrogen and electrical energy manufacturing. However moderately than doing the heavy grunt work of producing and distribution, the agency licences its gasoline cell design to companions worldwide.

This capital-light strategy holds the promise of upper profitability at some point. It’s an essential differentiator.

Hydrogen shares are again in vogue after just a few years within the wilderness. Bloom Vitality, which is a market chief in constructing hydrogen gasoline cell techniques, is up 452% yr so far (and greater than 1,000% in 12 months).

The important thing catalyst driving these shares increased is synthetic intelligence (AI). Or, extra particularly, the quite a few knowledge centres which can be being constructed worldwide to assist the explosive progress in power-hungry AI techniques. Gas cell stacks enable the era of cleaner, dependable electrical energy onsite.

Strap in for a turbulent experience

Now, it’s essential to notice that Ceres continues to be someway behind Bloom Vitality, which is near getting into constant profitability. In 2024, Ceres reported a £28.3m internet loss on income of £52m. And analysts don’t count on bottom-line income to materialise earlier than 2028.

Furthermore, whereas six out of the seven brokers masking the inventory (85% of them) charge it a Purchase, the common share value goal amongst them is 276p. That is roughly 27% beneath the present stage.

One other factor value highlighting is that manufacturing licencing offers may end up in lumpy monetary outcomes. In September, Ceres lowered its 2025 gross sales steering to £32m, citing uncertainty over “timing of income recognition“.

Additional to run?

Primarily based on the present £57.4m income forecast for 2026, the inventory’s ahead price-to-sales a number of is round 12.5. So this isn’t an affordable share, as issues stand.

Over the long term although, I believe there’s so much to love right here. The corporate already has wonderful manufacturing partnerships throughout Asia with Doosan Gas Cell in South Korea, Thermax in India, and Japan’s Denso.

In July, Doosan entered mass manufacturing utilizing Ceres’ know-how. And right now (5 November), China’s Weichai Energy (Ceres’ largest shareholder) stated it’ll construct a producing facility to provide cells and stacks to assist energy AI knowledge centres. Income from this can doubtless be booked in 2026.

Wanting forward, I believe the inventory’s run may proceed, and Goldman Sachs agrees. The financial institution has simply hiked its value goal to 480p from 246p, including Ceres to its European conviction record.

Traders ought to count on vital volatility. However I nonetheless suppose the inventory is value contemplating for the long run, particularly on dips.

In keeping with Goldman Sachs, AI will drive a 165% rise in knowledge centre energy demand by 2030.