Be part of Our Telegram channel to remain updated on breaking information protection

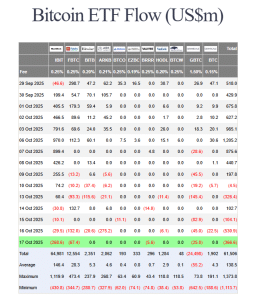

US spot Bitcoin ETFs (exchange-traded funds) recorded $366.6 million in outflows on Friday, extending their dropping streak to a 3rd day as buyers turned risk-off amid renewed issues over stress in credit score markets

The withdrawals adopted $536 million in outflows a day earlier, the biggest single-day internet loss since August, amid weakening urge for food for threat belongings as jitters about US regional banks rippled by means of markets.

That despatched Bitcoin plunging to as little as $103,598.43 previously 24 hours, in keeping with CoinMarketCap. It has since recovered to commerce at $106,586.89 as of 12:41 a.m. EST, nonetheless down over 2%.

The Crypto Concern & Greed Index, a gauge of investor sentiment, has plunged 29 factors from final month to an ”excessive concern” studying of 23.

BlackRock’s IBIT Leads The Spot Bitcoin ETF Outflows

IBIT, the Bitcoin ETF supplied by asset administration large BlackRock, recorded the very best internet each day outflows on the day. Information from Farside Buyers reveals that $268.6 million exited the product within the newest buying and selling session.

IBIT remains to be the chief by way of internet cumulative inflows for the reason that merchandise launched final yr, with $64.981 billion coming into the fund since then.

US Bitcoin ETF flows (Supply: Farside Buyers)

Constancy’s FBTC noticed the second-biggest outflows yesterday of $67.4 million. In the meantime, Valkyrie’s BRRR and Grayscale’s GBTC skilled $5.6 million and $25 million outflows, respectively.

The remaining funds recorded no new flows on the day.

With the most recent internet each day outflows, the funds have now seen over $1 billion outflows over the previous three days.

Michael Saylor Says Volatility Is A Present

As Bitcoin’s value slides, Technique’s Michael Saylor says that volatility within the crypto market “is a present to the devoted.”

Volatility is a present to the devoted.

— Michael Saylor (@saylor) October 17, 2025

Technique is at present the biggest company holder of Bitcoin, with 640,250 BTC on its stability sheet.

The corporate began shopping for BTC in 2020, and ended up pioneering the digital asset treasury (DAT) agency pattern. SaylorTracker knowledge additionally reveals that Technique is sitting on an unrealized revenue of greater than $20.9 billion on its stability sheet, even after the most recent correction in Bitcoin’s value.

In the meantime, analyst Michael van de Poppe commented on the most recent Bitcoin value drop and the correction seen within the total crypto market. In an X put up to his over 811.9K followers, the analyst stated that there’s not a lot to fret about.

There’s not a lot to fret.

The one factor you must do, as an holder of your belongings, is to be affected person.

The 4-year cycle principle is useless. #Bitcoin would by no means be $100k+ if it wasn’t with out the ETFs.

Which means, that we’re nonetheless in the identical form.#Bitcoin breaking apart from…

— Michaël van de Poppe (@CryptoMichNL) October 17, 2025

He advised his 811k followers that there’s ”not a lot to fret” and urged them to only “be affected person.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.